Question

On May 1, 2025, Crane Company purchased factory equipment for $739700. The asset's useful life in hours is estimated to be 190000. The estimated

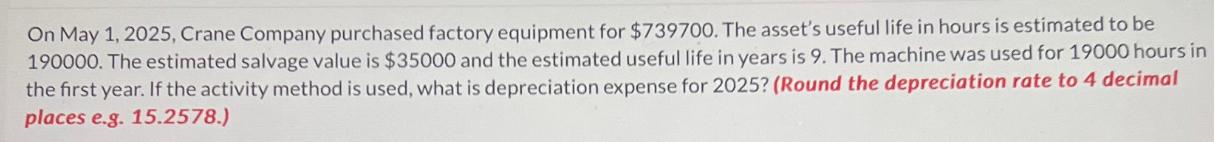

On May 1, 2025, Crane Company purchased factory equipment for $739700. The asset's useful life in hours is estimated to be 190000. The estimated salvage value is $35000 and the estimated useful life in years is 9. The machine was used for 19000 hours in the first year. If the activity method is used, what is depreciation expense for 2025? (Round the depreciation rate to 4 decimal places e.g. 15.2578.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the depreciation expense for 2025 using the activity method we need to determine the de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Reporting and Analysis

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

1st edition

1111822360, 978-1337116619, 1337116610, 978-1111822378, 1111822379, 978-1111822361

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App