Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On May 1, 20x8, Grant Ltd. was formed by the sole shareholder investing 14,032 into the business. At December 31st, 20x9, the company had

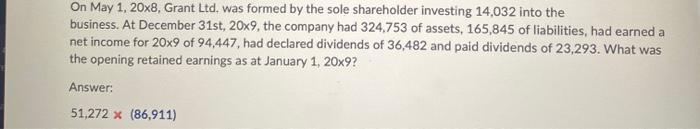

On May 1, 20x8, Grant Ltd. was formed by the sole shareholder investing 14,032 into the business. At December 31st, 20x9, the company had 324,753 of assets, 165,845 of liabilities, had earned a net income for 20x9 of 94,447, had declared dividends of 36,482 and paid dividends of 23,293. What was the opening retained earnings as at January 1, 20x9? Answer: 51,272 x (86,911) On May 1, 20x8, Grant Ltd. was formed by the sole shareholder investing 14,032 into the business. At December 31st, 20x9, the company had 324,753 of assets, 165,845 of liabilities, had earned a net income for 20x9 of 94,447, had declared dividends of 36,482 and paid dividends of 23,293. What was the opening retained earnings as at January 1, 20x9? Answer: 51,272 x (86,911)

Step by Step Solution

★★★★★

3.30 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To find the opening retained earnings as of January 1 20x9 we can use the following formula Opening ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started