Answered step by step

Verified Expert Solution

Question

1 Approved Answer

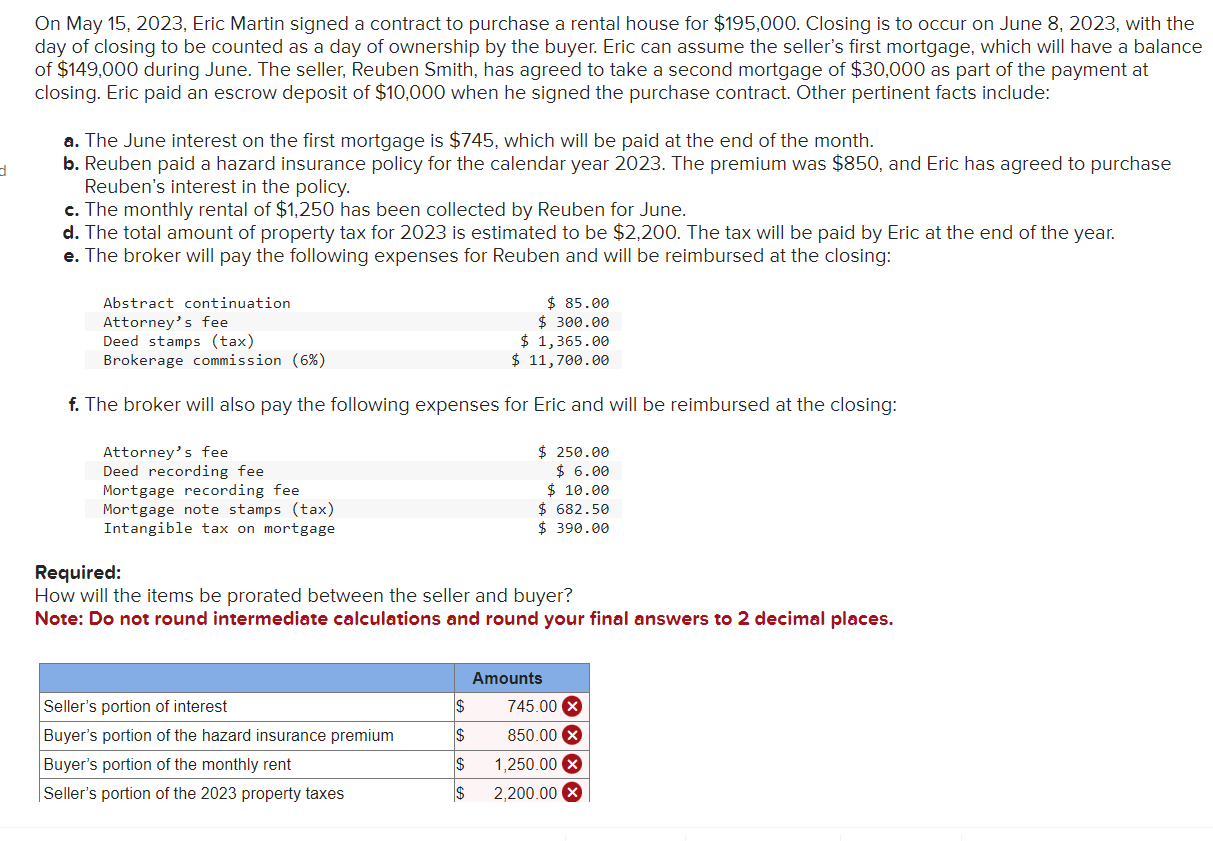

On May 1 5 , 2 0 2 3 , Eric Martin signed a contract to purchase a rental house for $ 1 9 5

On May Eric Martin signed a contract to purchase a rental house for $ Closing is to occur on June with the day of closing to be counted as a day of ownership by the buyer. Eric can assume the sellers first mortgage, which will have a balance of $ during June. The seller, Reuben Smith, has agreed to take a second mortgage of $ as part of the payment at closing. Eric paid an escrow deposit of $ when he signed the purchase contract. Other pertinent facts include:On May Eric Martin signed a contract to purchase a rental house for $ Closing is to occur on June with the

day of closing to be counted as a day of ownership by the buyer. Eric can assume the seller's first mortgage, which will have a balance

of $ during June. The seller, Reuben Smith, has agreed to take a second mortgage of $ as part of the payment at

closing. Eric paid an escrow deposit of $ when he signed the purchase contract. Other pertinent facts include:

a The June interest on the first mortgage is $ which will be paid at the end of the month.

b Reuben paid a hazard insurance policy for the calendar year The premium was $ and Eric has agreed to purchase

Reuben's interest in the policy.

c The monthly rental of $ has been collected by Reuben for June.

d The total amount of property tax for is estimated to be $ The tax will be paid by Eric at the end of the year.

e The broker will pay the following expenses for Reuben and will be reimbursed at the closing:

f The broker will also pay the following expenses for Eric and will be reimbursed at the closing:

Required:

How will the items be prorated between the seller and buyer?

Note: Do not round intermediate calculations and round your final answers to decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started