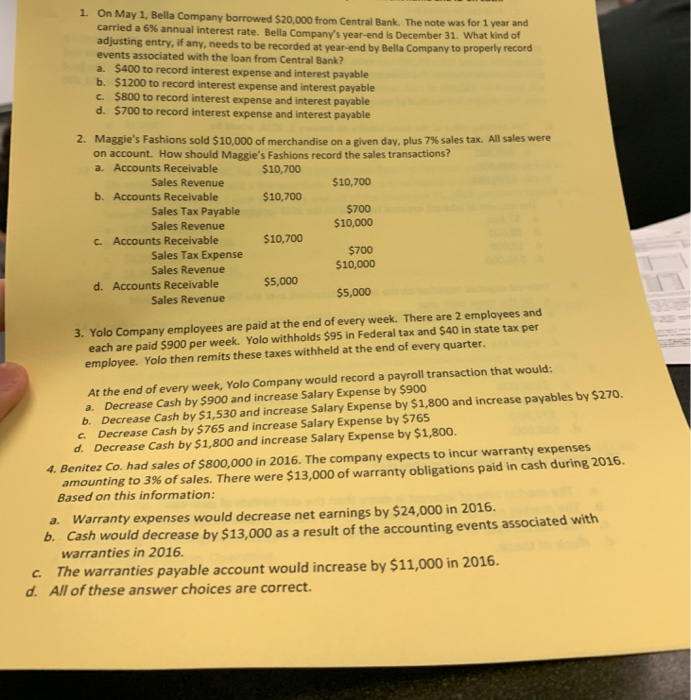

On May 1, Bella Company borrowed $20,000 from Central Bank The note was for 1 year and carried a 6% annual interest rate. Bella Company's year-end is December 31. adjusting entry, if any, needs to be recorded at year-end by Bella Company to events associated with the loan from Central Bank? a. $400 to record interest expense and interest payable b. $1200 to record interest expense and interest payable c. $800 to record interest expense and interest payable d. $700 to record interest expense and interest payable 1. What kind of properly record 2. Maggie's Fashions sold $10,000 of merchandise on a given day, plus 7% sales tax. All sales were on account. How should Maggie's Fashions record the sales transactions? a. Accounts Receivable $10,700 Sales Revenue $10,700 b. Accounts Receivable $10,700 Sales Tax Payable Sales Revenue $700 $10,000 c. Accounts Receivable $10,700 Sales Tax Expense Sales Revenue $700 $10,000 d. Accounts Receivable $5,000 $5,000 Sales Revenue 3. Yolo Company employees are paid at the end of every week. There are 2 employees and Yolo withholds $95 in Federal tax and $40 in state tax per each are paid $900 per week. employee. Yolo then remits these taxes withheld at the end of every quarter. At the end of every week, Yolo Company would record a payroll transaction that would: Decrease Cash by $900 and increase Salary Expense by $900 a. b. Decrease Cash by $1,530 and increase Salary Expense by $1,800 and increase payables by $270. c. Decrease Cash by $765 and increase Salary Expense by $765 d. Decrease Cash by $1,800 and increase Salary Expense by $1,800 amounting to 3% of sales. There were $13,000 of warranty obligations paid in cash during 2016. Based on this information: 4. Benitez Co. had sales of $800,000 in 2016. The company expects to incur warranty expenses a. Warranty expenses would decrease net earnings by $24,000 in 2016. b. Cash would decrease by $13,000 as a result of the accounting events associated with warranties in 2016. The warranties payable account would increase by $11,000 in 2016. c. d. All of these answer choices are correct