Answered step by step

Verified Expert Solution

Question

1 Approved Answer

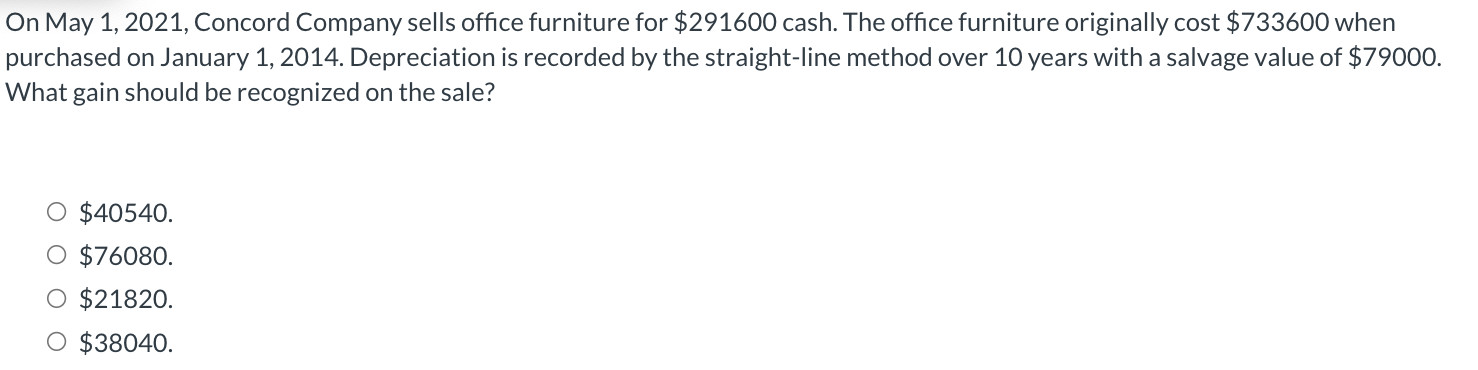

On May 1,2021 , Concord Company sells office furniture for $291600 cash. The office furniture originally cost $733600 when purchased on January 1, 2014. Depreciation

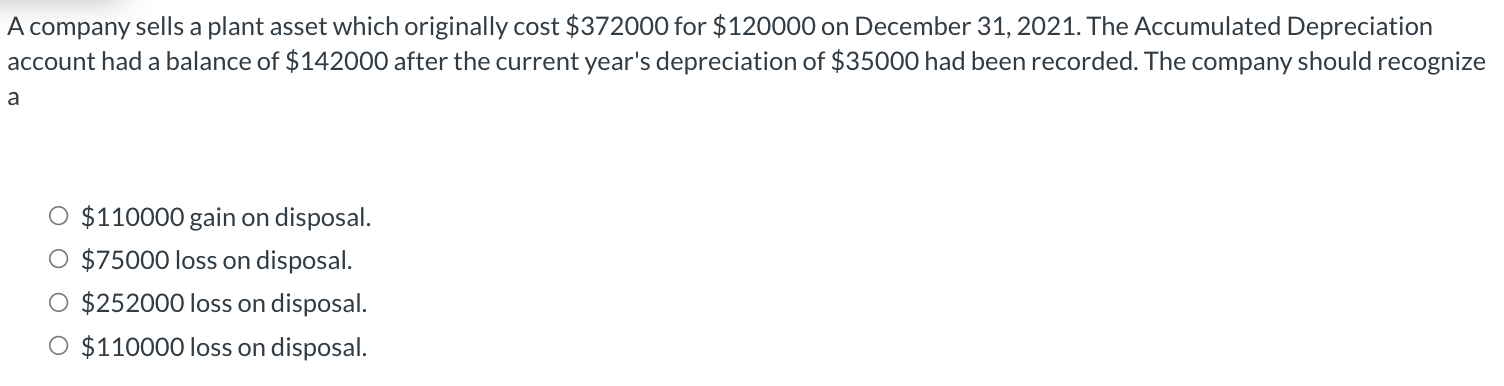

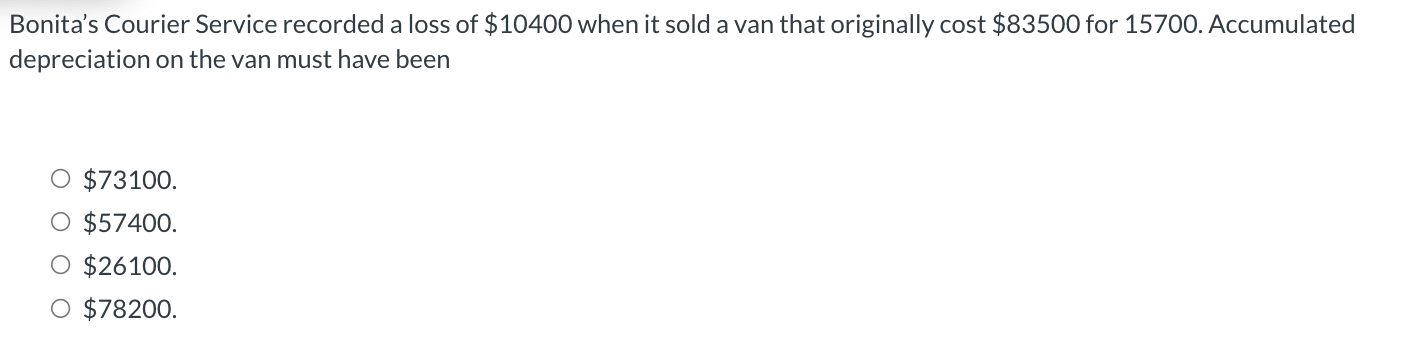

On May 1,2021 , Concord Company sells office furniture for $291600 cash. The office furniture originally cost $733600 when purchased on January 1, 2014. Depreciation is recorded by the straight-line method over 10 years with a salvage value of $79000. What gain should be recognized on the sale? $40540.$76080.$21820.$38040. A company sells a plant asset which originally cost $372000 for $120000 on December 31,2021 . The Accumulated Depreciation account had a balance of $142000 after the current year's depreciation of $35000 had been recorded. The company should recognize a $110000 gain on disposal. $75000 loss on disposal. $252000 loss on disposal. $110000 loss on disposal. Bonita's Courier Service recorded a loss of $10400 when it sold a van that originally cost $83500 for 15700 . Accumulated depreciation on the van must have been $73100.$57400.$26100.$78200

On May 1,2021 , Concord Company sells office furniture for $291600 cash. The office furniture originally cost $733600 when purchased on January 1, 2014. Depreciation is recorded by the straight-line method over 10 years with a salvage value of $79000. What gain should be recognized on the sale? $40540.$76080.$21820.$38040. A company sells a plant asset which originally cost $372000 for $120000 on December 31,2021 . The Accumulated Depreciation account had a balance of $142000 after the current year's depreciation of $35000 had been recorded. The company should recognize a $110000 gain on disposal. $75000 loss on disposal. $252000 loss on disposal. $110000 loss on disposal. Bonita's Courier Service recorded a loss of $10400 when it sold a van that originally cost $83500 for 15700 . Accumulated depreciation on the van must have been $73100.$57400.$26100.$78200 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started