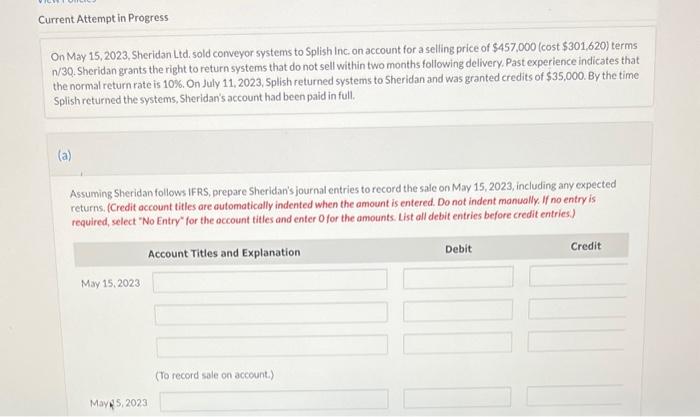

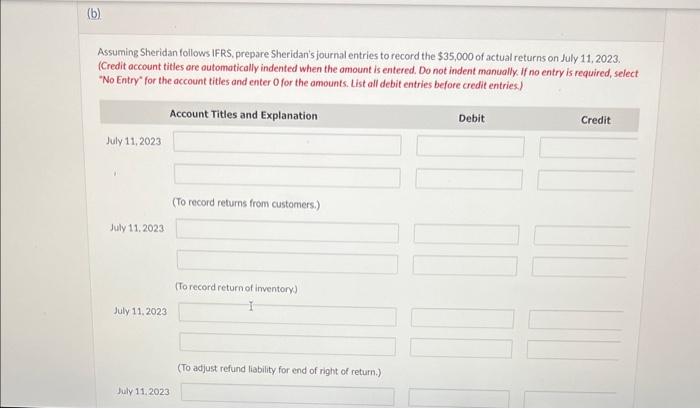

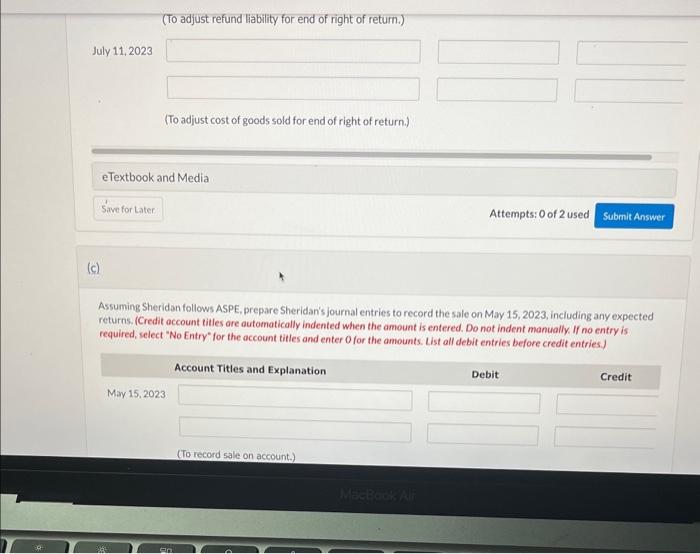

On May 15, 2023, Sheridan Ltd. sold conveyor systems to Splish Inc. on account for a selling price of $457,000 (cost $301,620) terms n/30. Sheridan grants the right to return systems that do not sell within two months following delivery. Past experience indicates that the normal return rate is 10%. On July 11,2023 , Splish returned systems to Sheridan and was granted credits of $35,000. By the time Splish returned the systems, Sheridan's account had been paid in full. (a) Assuming Sheridan follows IFRS, prepare Sheridan's journal entries to record the sale on May 15, 2023, including any expected returns. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts. List all debit entries before credit entries.) Assuming Sheridan follows IFRS, prepare Sheridan's journal entries to record the $35,000 of actual returns on July 11,2023. (Credit account titles are outomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries) (To adjust refund liability for end of right of retum.) uly 11,2023 (To adjust cost of goods sold for end of right of return.) Assuming Sheridan follows ASPE, prepare Sheridan's journal entries to record the sale on Maxy 15, 2023, including any expected returns. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) (To record sale on account.) May 15,2023 (To accrue for sales returns.) May 15,2023 (To record cost of noods sold.) Assuming Sheridan follows ASPE, prepare Sheridan's journal entries to record the $35,000 of actual returns on July 11,2023. (Credit occount titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) (To adjust allowance for sales returns and allowance for the end of right of return.) July 11, 2023 (To adjust cost of goods sold for end of right of return.) eTextbook and Media Save for Later Attempts: 0 of 2 used Subrnit Answer On May 15, 2023, Sheridan Ltd. sold conveyor systems to Splish Inc. on account for a selling price of $457,000 (cost $301,620) terms n/30. Sheridan grants the right to return systems that do not sell within two months following delivery. Past experience indicates that the normal return rate is 10%. On July 11,2023 , Splish returned systems to Sheridan and was granted credits of $35,000. By the time Splish returned the systems, Sheridan's account had been paid in full. (a) Assuming Sheridan follows IFRS, prepare Sheridan's journal entries to record the sale on May 15, 2023, including any expected returns. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts. List all debit entries before credit entries.) Assuming Sheridan follows IFRS, prepare Sheridan's journal entries to record the $35,000 of actual returns on July 11,2023. (Credit account titles are outomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries) (To adjust refund liability for end of right of retum.) uly 11,2023 (To adjust cost of goods sold for end of right of return.) Assuming Sheridan follows ASPE, prepare Sheridan's journal entries to record the sale on Maxy 15, 2023, including any expected returns. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) (To record sale on account.) May 15,2023 (To accrue for sales returns.) May 15,2023 (To record cost of noods sold.) Assuming Sheridan follows ASPE, prepare Sheridan's journal entries to record the $35,000 of actual returns on July 11,2023. (Credit occount titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) (To adjust allowance for sales returns and allowance for the end of right of return.) July 11, 2023 (To adjust cost of goods sold for end of right of return.) eTextbook and Media Save for Later Attempts: 0 of 2 used Subrnit