Answered step by step

Verified Expert Solution

Question

1 Approved Answer

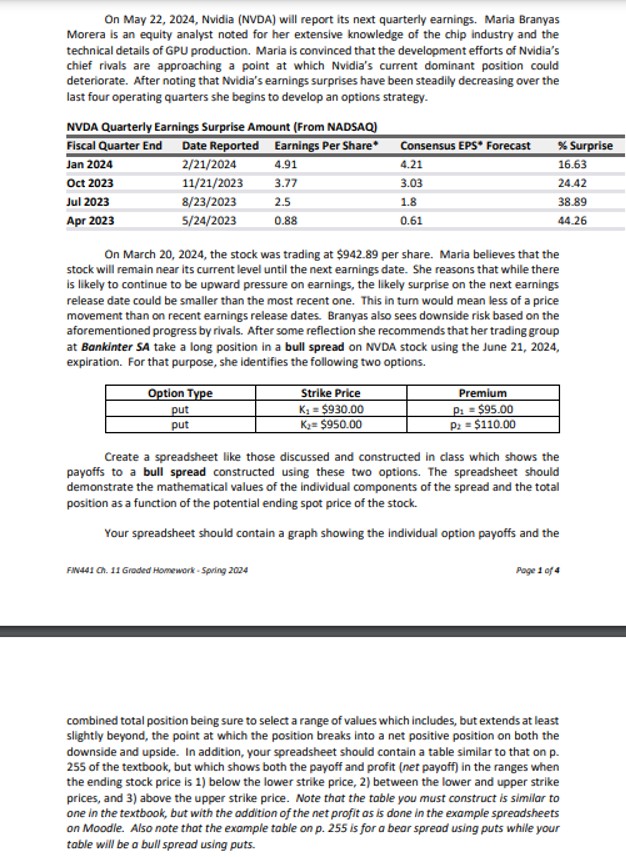

On May 2 2 , 2 0 2 4 , Nvidia ( NVDA ) will report its next quarterly earnings. Maria Branyas Morera is an

On May Nvidia NVDA will report its next quarterly earnings. Maria Branyas

Morera is an equity analyst noted for her extensive knowledge of the chip industry and the

technical details of GPU production. Maria is convinced that the development efforts of Nvidia's

chief rivals are approaching a point at which Nvidia's current dominant position could

deteriorate. After noting that Nvidia's earnings surprises have been steadily decreasing over the

last four operating quarters she begins to develop an options strategy.

NVDA Quarterly Earnings Surprise Amount From NADSAQ

On March the stock was trading at $ per share. Maria believes that the

stock will remain near its current level until the next earnings date. She reasons that while there

is likely to continue to be upward pressure on earnings, the likely surprise on the next earnings

release date could be smaller than the most recent one. This in tum would mean less of a price

movement than on recent earnings release dates. Branyas also sees downside risk based on the

aforementioned progress by rivals. After some reflection she recommends that her trading group

at Bankinter SA take a long position in a bull spread on NVDA stock using the June

expiration. For that purpose, she identifies the following two options.

Create a spreadsheet like those discussed and constructed in class which shows the

payoffs to a bull spread constructed using these two options. The spreadsheet should

demonstrate the mathematical values of the individual components of the spread and the total

position as a function of the potential ending spot price of the stock.

Your spreadsheet should contain a graph showing the individual option payoffs and the

combined total position being sure to select a range of values which includes, but extends at least

slightly beyond, the point at which the position breaks into a net positive position on both the

downside and upside. In addition, your spreadsheet should contain a table similar to that on

of the textbook, but which shows both the payoff and profit net payoff in the ranges when

the ending stock price is below the lower strike price, between the lower and upper strike

prices, and above the upper strike price. Note that the table you must construct is similar to

one in the textbook, but with the addition of the net profit as is done in the example spreadsheets

on Moodle. Also note thot the example table on p is for a bear spread using puts while your

table will be a bull spread using puts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started