Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On May 20, Jessica goes to the local Ford dealership with an interest in acquiring a new Ford Explorer. After taking a test drive, Jessica

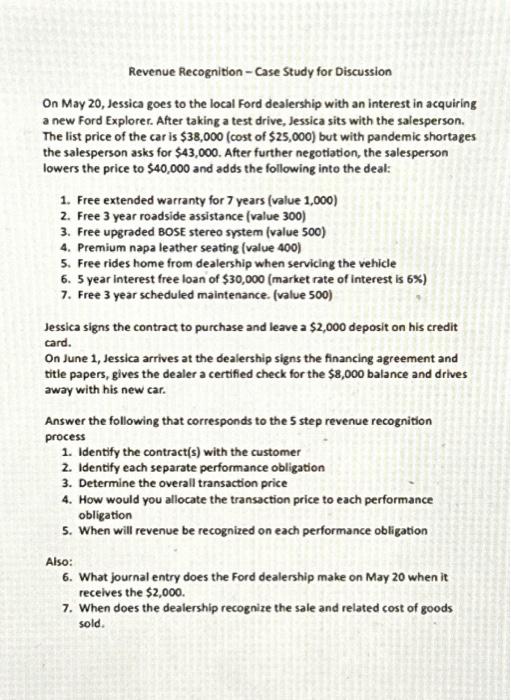

On May 20, Jessica goes to the local Ford dealership with an interest in acquiring a new Ford Explorer. After taking a test drive, Jessica sits with the salesperson. The list price of the car is $38,000 (cost of $25,000) but with pandemic shortages the salesperson asks for $43,000. After further negotiation, the salesperson lowers the price to $40,000 and adds the following into the deal: 1. Free extended warranty for 7 years (value 1,000) 2. Free 3 year roadside assistance (value 300) 3. Free upgraded BOSE stereo system (value 500) 4. Premium napa leather seating (value 400) 5. Free rides home from dealership when servicing the vehicle 6. 5 year interest free loan of $30,000 (market rate of interest is 6%) 7. Free 3 year scheduled maintenance. (value 500) Jessica signs the contract to purchase and leave a $2,000 deposit on his credit card. On June 1, Jessica arrives at the dealership signs the financing agreement and title papers, gives the dealer a certified check for the $8,000 balance and drives away with his new car. Answer the following that corresponds to the 5 step revenue recognition process 1. Identify the contract(s) with the customer 2. Identify each separate performance obligation 3. Determine the overall transaction price 4. How would you allocate the transaction price to each performance obligation 5. When will revenue be recognized on each performance obligation Also: 6. What journal entry does the Ford dealership make on May 20 when it receives the $2,000. 7. When does the dealership recognize the sale and related cost of goods sold.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started