Answered step by step

Verified Expert Solution

Question

1 Approved Answer

on May 20 of the current year, Tracey sells a building to Judy for 540,000. Traceys basis in the building is 290,000. This area has

on May 20 of the current year, Tracey sells a building to Judy for 540,000. Tracey’s basis in the building is 290,000.

This area has a real property tax year that ends on June 30. The taxes are payable by September 1 of that year. On September 1, Judy pays the annual property taxes of 8,500.

Both Tracey and Judy are calendar-year cash method taxpayers. The closing agreement does not seperatley account for the property taxes. Disregard any leap year

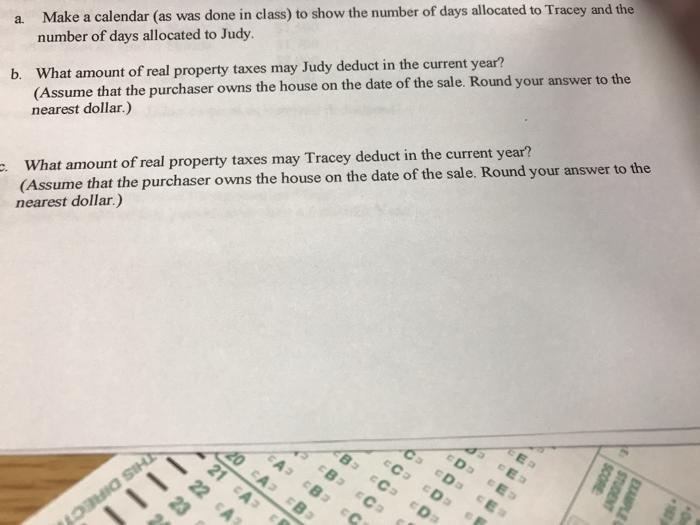

a. Make a calendar (as was done in class) to show the number of days allocated to Tracey and the number of days allocated to Judy. b. What amount of real property taxes may Judy deduct in the current year? (Assume that the purchaser owns the house on the date of the sale. Round your answer to the nearest dollar.) What amount of real property taxes may Tracey deduct in the current year? (Assume that the purchaser owns the house on the date nearest dollar.) 2 HOME SH JIIN 20 CA 21 CA 22 A3 CA3 CB B CC B CC of the sale. Round your answer to the CC Ca Ca Sa EDD Du EDD CD= E R E CES 16 SCORE STUDENT EXAMPLE 160 +On

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

ans a Tracey owns the buidling from July 1 to May 20 as i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started