Answered step by step

Verified Expert Solution

Question

1 Approved Answer

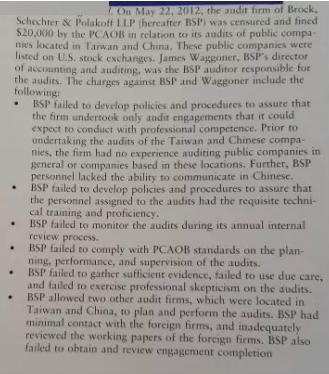

On May 22, 2012, the audit firm of Brock, Schechter & Polakoff LLP (hereafter BSP) was censured and fined $20,000 by the PCAOB in

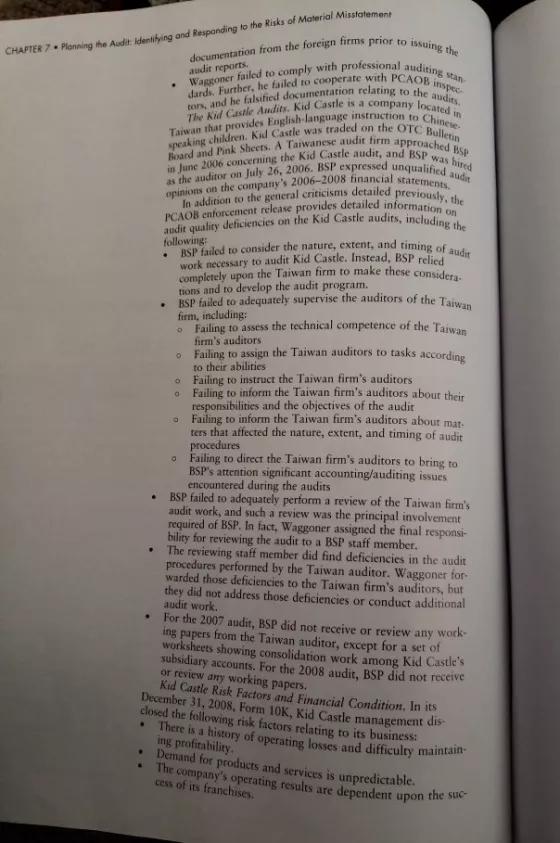

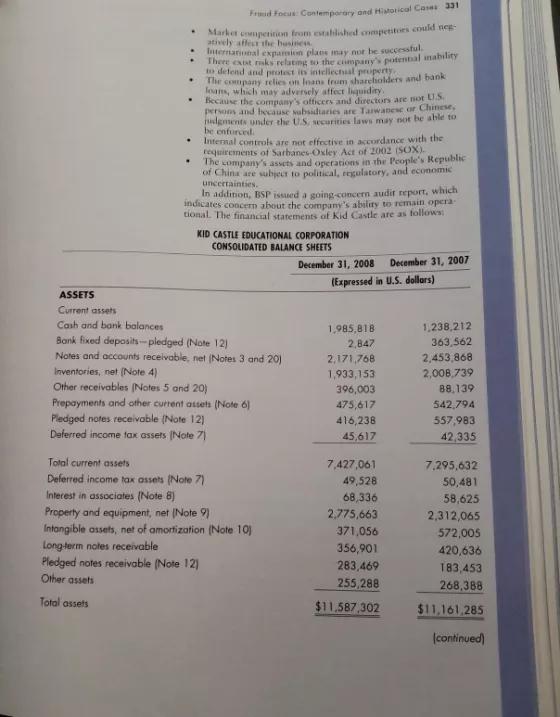

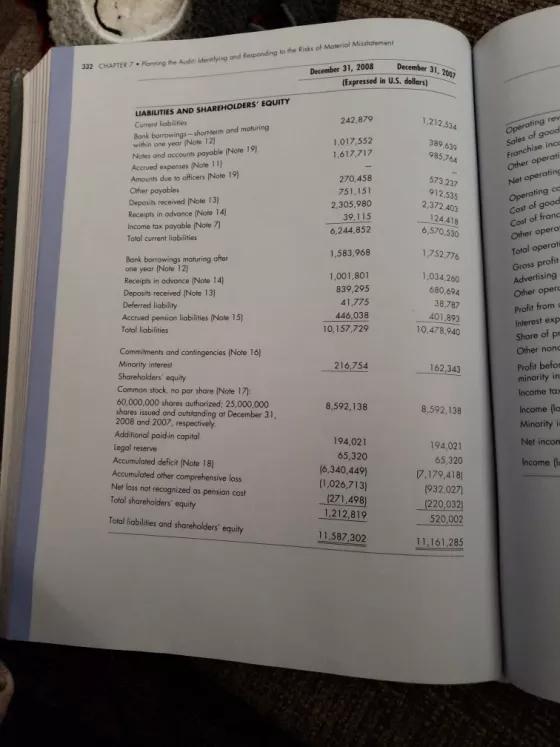

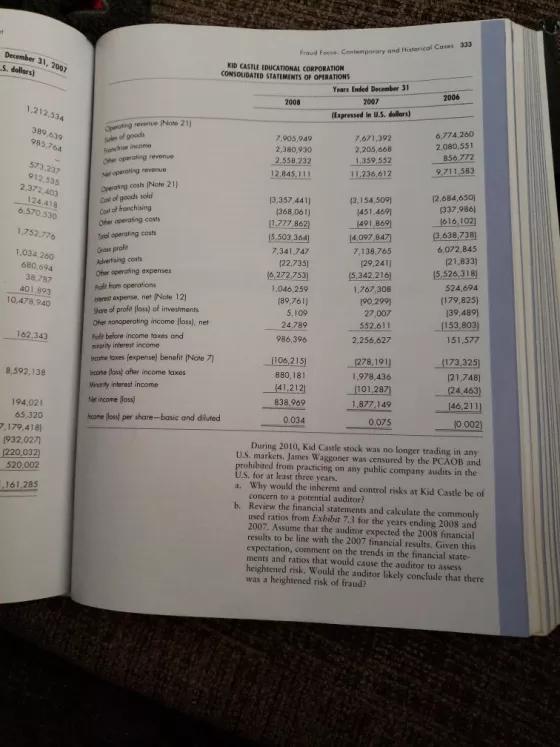

On May 22, 2012, the audit firm of Brock, Schechter & Polakoff LLP (hereafter BSP) was censured and fined $20,000 by the PCAOB in relation to its audits of public compa- nies located in Taiwan and China. These public companies were listed on U.S. stock exchanges. James Waggoner, BSP's director of accounting and auditing, was the BSP auditor responsible for the audits. The charges against BSP and Waggoner include the following: BSP failed to develop policies and procedures to assure that the firm undertook only audit engagements that it could expect to conduct with professional competence. Prior to undertaking the audits of the Taiwan and Chinese compa- nies, the firm had no experience auditing public companies in general or companies based in these locations. Further, BSP personnel lacked the ability to communicate in Chinese. BSP failed to develop policies and procedures to assure that the personnel assigned to the audits had the requisite techni- cal training and proficiency. BSP failed to monitor the audits during its annual internal review process. BSP failed to comply with PCAOB standards on the plan- ning, performance, and supervision of the audits. BSP failed to gather sufficient evidence, failed to use due care, and failed to exercise professional skepticism on the audits. BSP allowed two other audit firms, which were located in Taiwan and China, to plan and perform the audits. BSP had minimal contact with the foreign firms, and inadequately reviewed the working papers of the foreign firms. BSP also failed to obtain and review engagement completion CHAPTER 7 Planning the Audit Identifying and Responding to the Risks of Material Misstatement documentation from the foreign firms prior to issuing the audit reports. Waggoner failed to comply with professional auditing stan tors, and he falsified documentation relating to the audits, dards. Further, he failed to cooperate with PCAOB inspec The Kid Castle Audits, Kid Castle is a company located in Taiwan that provides English-language instruction to Chinese- Board and Pink Sheets. A Taiwanese audit firm approached BSP speaking children. Kid Castle was traded on the OTC Bulletin in June 2006 concerning the Kid Castle audit, and BSP was hired as the auditor on July 26, 2006. BSP expressed unqualified audi opinions on the company's 2006-2008 financial statements. In addition to the general criticisms detailed previously, the PCAOB enforcement release provides detailed information on audit quality deficiencies on the Kid Castle audits, including the following: BSP failed to consider the nature, extent, and timing of audi work necessary to audit Kid Castle. Instead, BSP relied completely upon the Taiwan firm to make these considera tions and to develop the audit program. BSP failed to adequately supervise the auditors of the Taiwan . . . . . . firm, including: Failing to assess the technical competence of the Taiwan firm's auditors o o Failing to assign the Taiwan auditors to tasks according to their abilities Failing to instruct the Taiwan firm's auditors Failing inform the Taiwan firm's auditors about their responsibilities and the objectives of the audit Failing to inform the Taiwan firm's auditors about mat- ters that affected the nature, extent, and timing of audit procedures Failing to direct the Taiwan firm's auditors to bring to BSP's attention significant accounting/auditing issues encountered during the audits BSP failed to adequately perform a review of the Taiwan firm's audit work, and such a review was the principal involvement required of BSP. In fact, Waggoner assigned the final responsi- bility for reviewing the audit to a BSP staff member. The reviewing staff member did find deficiencies in the audit procedures performed by the Taiwan auditor. Waggoner for- warded those deficiencies to the Taiwan firm's auditors, but they did not address those deficiencies or conduct additional audit work. For the 2007 audit, BSP did not receive or review any work- ing papers from the Taiwan auditor, except for a set of worksheets showing consolidation work among Kid Castle's subsidiary accounts. For the 2008 audit, BSP did not receive or review any working papers. Kid Castle Risk Factors and Financial Condition. In its December 31, 2008, Form 10K, Kid Castle management dis- closed the following risk factors relating to its business: . There is a history of operating losses and difficulty maintain- ing profitability. Demand for products and services is unpredictable. . The company's operating results are dependent upon the suc- cess of its franchises. . . . . . Fraud Focus: Contemporary and Historical Cases 331 Market competition from established competitors could neg atively affect the business. International expansion plans may not be successful. There exit risks relating to the company's potential inability to defend and protect its intellectual property. The company relies on loans from shareholders and bank loans, which may adversely affect liquidity. Because the company's officers and directors are not U.S. persons and because subsidiaries are Taiwanese or Chinese, udgments under the US, securities laws may not be able to be enforced. Internal controls are not effective in accordance with the requirements of Sarbanes-Oxley Act of 2002 (SOX). The company's assets and operations in the People's Republic of China are subject to political, regulatory, and economic uncertainties. In addition, BSP issued a going-concern audit report, which indicates concern about the company's ability to remain opera tional. The financial statements of Kid Castle are as follows: KID CASTLE EDUCATIONAL CORPORATION CONSOLIDATED BALANCE SHEETS Total current assets Deferred income tax assets (Note 7) Interest in associates (Note 8) ASSETS Current assets Cash and bank balances Bank fixed deposits-pledged (Note 12) Notes and accounts receivable, net (Notes 3 and 20) Inventories, net (Note 4) Other receivables (Notes 5 and 20) Prepayments and other current assets (Note 6) Pledged notes receivable (Note 12) Deferred income tax assets (Note 7) Property and equipment, net (Note 9) Intangible assets, net of amortization (Note 10) Long-term notes receivable Pledged notes receivable (Note 12) Other assets Total assets December 31, 2008 December 31, 2007 (Expressed in U.S. dollars) 1,985,818 2,847 2,171,768 1,933,153 396,003 475,617 416,238 45,617 7,427,061 49,528 68,336 2,775,663 371,056 356,901 283,469 255,288 $11,587,302 1,238,212 363,562 2,453,868 2,008,739 88,139 542,794 557,983 42,335 7,295,632 50,481 58,625 2,312,065 572,005 420,636 183,453 268,388 $11,161,285 (continued) 332 CHAPTER 7 ing the Auditing and Responding to the Risks of Moal Mint December 31, 2008 LIABILITIES AND SHAREHOLDERS' EQUITY Cured labilities Bank borrowings-shomen and maturing within one year Now 12 Notes and accounts payable (Note 19) Accrued expenses Note 11) Amounts due to officers Note 19) Other payables Deposit received Note 13) Receipts in advance (Note 14 Income tax payable (Note 7) Total current liabilities Bank borowings maturing ofter one year (Note 12) Receipts in odvonce (Note 14) Deposits received (Note 13) Deferred liability i Accrued pension liabilities (Note 15) Total liabilities Commitments and contingencies (Note 16) Minority interest Shareholders equity Common stock, no por share Note 17 60,000,000 shores authorized; 25,000,000 shares issued and outstanding at December 31, 2008 and 2007, respectively Additional paid in capital Legal reserve Accumulated deficit (Note 18 Accumulated other comprehensive loss Net loss not recognized as pension cost Totol shareholders equity Total liabilities and shareholders equity (Expressed in U.S. dollars) 242,879 1,017,552 1,617,717 270,458 751 151 2,305,980 39,115 6,244.852 1,583,968 1,001,801 839,295 41,775 446,038 10,157,729 216,754 8,592,138 194,021 65,320 December 31, 2007 (6,340,449) (1,026,713) (271,498) 1,212,819 11.587,302 1,212,534 389.639 573 237 912,535 2,372.400 124.418 6,570,530 1752.776 1,034,260 680,694 38,787 401,893 10,478,940 162,343 8,592,138 194,021 65,320 7.179,418 (932.027) (220,032) 520,002 11,161,285 Operating rev Sales of good Franchise inco Other operati Net operating Operating ce Cost of good Cost of franc Other operas Total operats Gross profit Advertising Other operc Profit from Interest expe Shore of pe Other nonc Profit befom minority ins Income tax Income (las Minority in Net incor Income December 31, 2007 S. dollars) 1,212,534 389.639 983,764 573,3237 912,535 2,372,400 124.418 6.570.530 1.753.776 1,034 200 680.694 401,993 10,478,940 162,343 8,592,138 194,021 65,320 7,179,4181 1932,0271 (220.032) 520,002 161.285 greue Note 211 of goods operating rev Operating cosh Note 21) of goods soll Coat franchising Oferperating costs vel operating costs G prode Adang costs Oher operating expenses hom operations bere expense, net Note 121 Share of profe loss) of investments Ofer nonoperating income loss), net fut before income taxes and srity interest income toxes (expense) benefit (Note 7 con los after income taxes Vity interest income income foss) one loss) per share-basic and diluted Fraud Contemporary and fastenical Come 333 KID CASTLE EDUCATIONAL CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS 2008 7,905,949 2,380,930 2.558 232 12.845,111 13,357 441) (368.061) (1.777 862) (5.503 364) 7,341,747 (22.735) (6,272-753) 1,046,259 (89,761) 5,109 24.789 986,396 (106,215) 880, 181 (41,212) 838,969 0.034 Years Ended December 31 2007 Expressed in U.S. dollars) 7,671,392 2,205,668 1.359.552 11,236,612 (3,154,509) 1451.4691 (491 869) 14.097 647) 7,136,765 (29,241) (5.342.216) 1,767,306 (90,299) 27,007 552.611 2,256,627 (278,191) 1,978,436 [101 287) 1,877,149 0,075 2006 6,774 260 2.080,551 856 772 9,711 583 12,684,650) (337,986) (616,102) (3.638,738) 6.072.845 (21,833) (5.526.318) 524,694 (179,825) 139,489) (153,803) 151,577 (173,325) (21,748) (24.463) 146,211) (0.002) During 2010, Kid Castle stock was no longer trading in any U.S. markets. James Waggoner was censured by the PCAOB and prohibited from practicing on any public company audits in the U.S. for at least three years. a. Why would the inherent and control risks at Kid Castle be of concern to a potential auditor? b. Review the financial statements and calculate the commonly used ratios from Exhibit 7.1 for the years ending 2008 and 2007. Assume that the auditor expected the 2008 financial results to be line with the 2007 financial results. Given this expectation, comment on the trends in the financial state- ments and ratios that would cause the auditor to assess heightened risk. Would the anditor likely conclude that there was a heightened risk of fraud? Audit: Identifying and Responding to the Risks of Material Misstatement c. Based on your answers to (a) and (b), for what accounts would you recommend that the auditor plan to conduct more substantive audit procedures? d. The 10-K discloses the fact that BSP earned total audit fees in 2007 and 2008 of $121,026 and $150,000, respectively. Comment on the motivations of BSP and Waggoner to accept the foreign audits and how those motivations might have. affected Waggoner's lack of ethics and how those motiva- tions might have affected his professional skepticism. Presum- ably, BSP had to pay the Taiwanese and Chinese audit firms a portion of the audit fee, and based on the allegations in the i PCAOB enforcement release, BSP did virtually no audit work. Comment on your thoughts about the appropriateness of hiring a foreign audit firm to conduct the majority of audit work on an engagement and on BSP's actions (or lack thereof) in this regard. e. Use the framework for making quality professional decisions from Chapter 4 to identify those steps in the framework where Waggoner went wrong and describe what he should have done differently. f. Describe the risks that an audit firm faces when it attempts to audit a company in a foreign country. For additional information on the PCAOB enforcement releases relating to this case, see PCAOB Release Nos. 105- 2012-002 and 105-2012-003. DERAL SAVINGS AND LOAN

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Since BSP has not performed its duties adequately There are charges against BSP and Waggoner ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started