On May 28, 2021, Cullumber Services purchased equipment for $100,800, giving the supplier a 1-year note at 6% (due at maturity) for $79,700, and paid

On May 28, 2021, Cullumber Services purchased equipment for $100,800, giving the supplier a 1-year note at 6% (due at maturity) for $79,700, and paid the balance with cash. Cullumber also paid Wu Engineering $9,000 cash for installing the equipment on May 30. The equipments useful life was estimated to be five years, with an $17,400 residual value. The straight-line method of depreciation is used for equipment and Cullumber has a calendar year end. On October 4, 2023, the equipment was destroyed in an accident. Cullumber received $61,980 cash as insurance proceeds for the equipment.

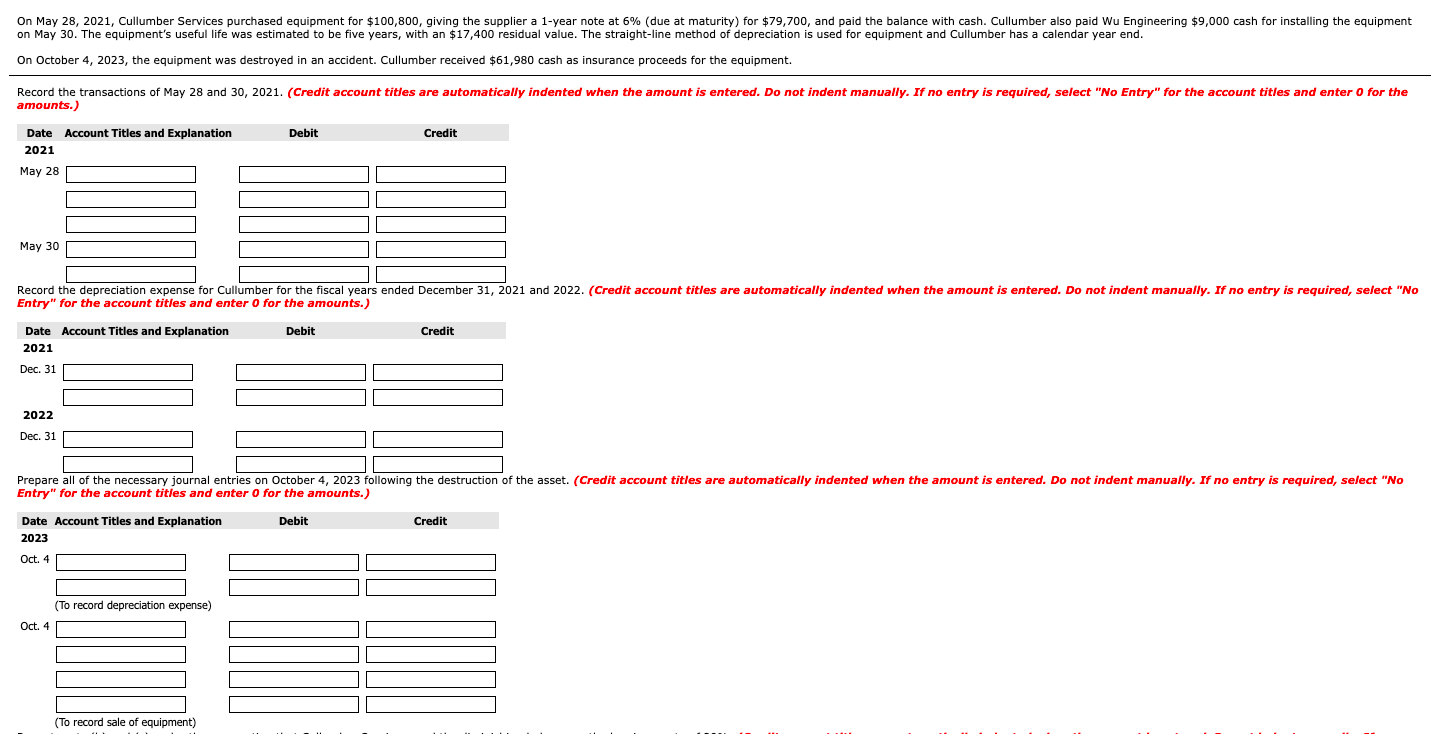

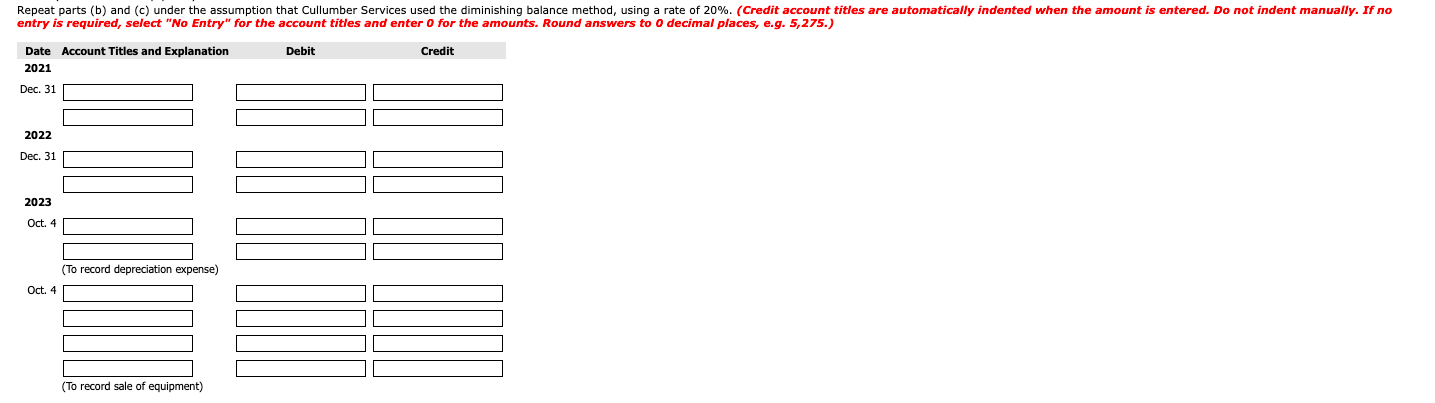

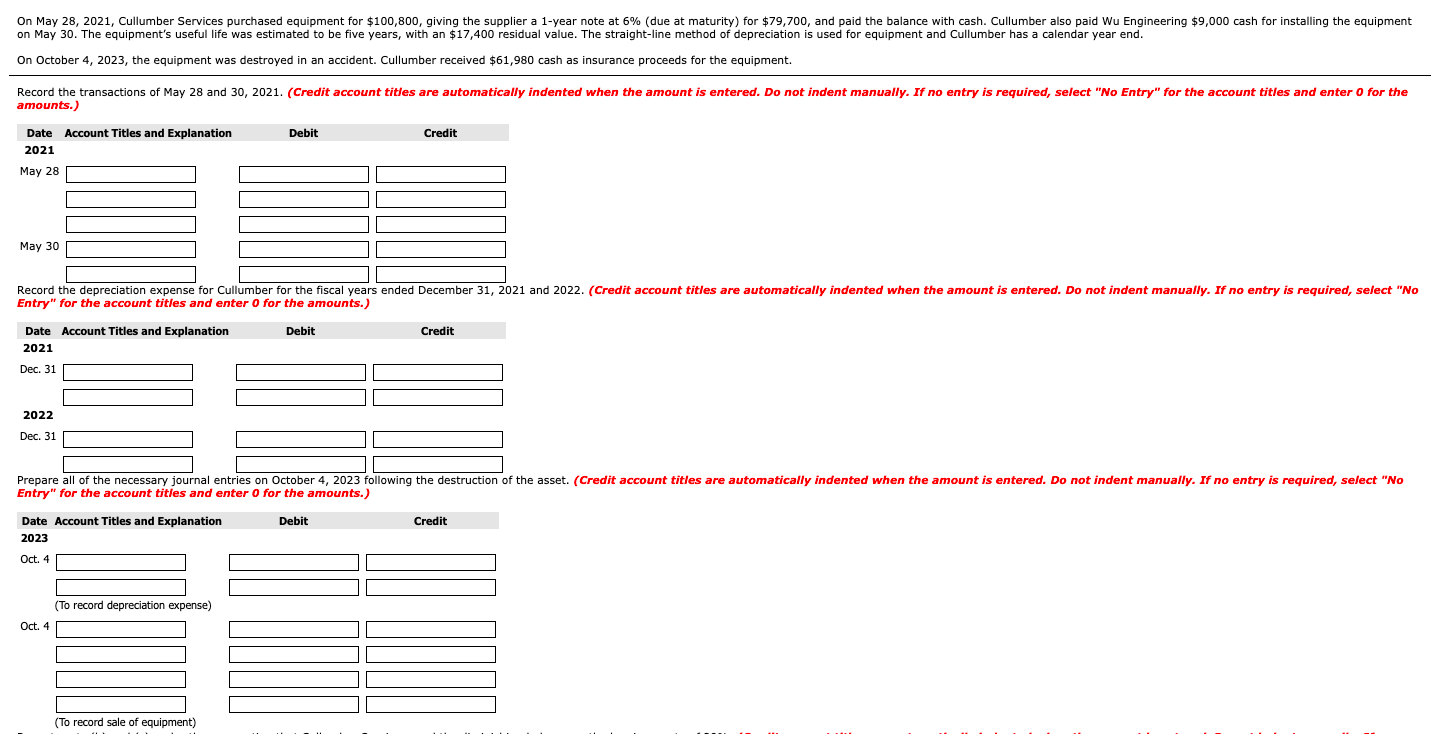

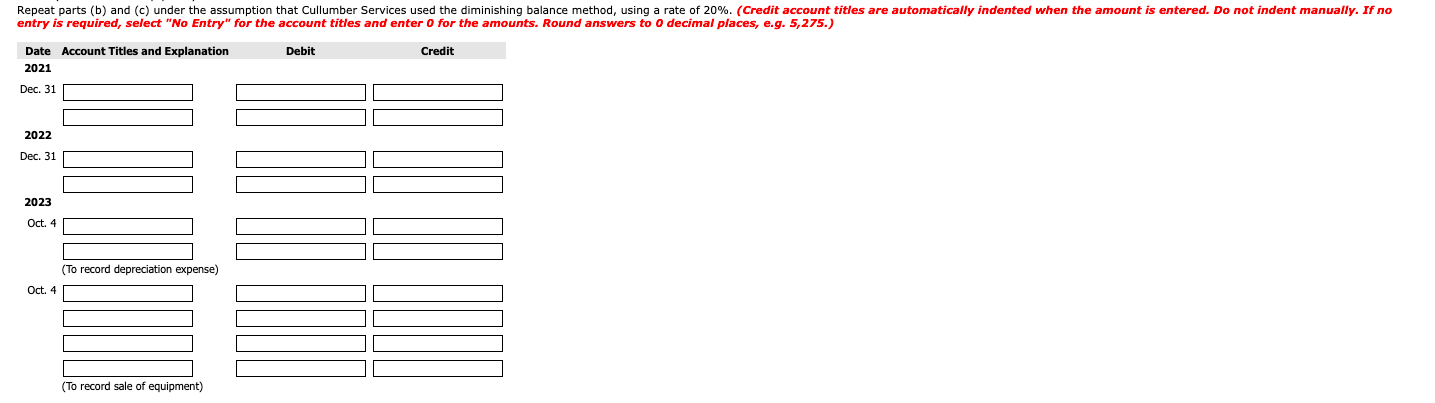

On May 28, 2021, Cullumber Services purchased equipment for $100,800, giving the supplier a 1-year note at 6% (due at maturity) for $79,700, and paid the balance with cash. Cullumber also paid Wu Engineering $9,000 cash for installing the equipment on May 30. The equipment's useful life was estimated to be five years, with an $17,400 residual value. The straight-line method of depreciation is used for equipment and Cullumber has a calendar year end. On October 4, 2023, the equipment was destroyed in an accident. Cullumber received $61,980 cash as insurance proceeds for the equipment. Record the transactions of May 28 and 30, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Debit Credit Date Account Titles and Explanation 2021 May 28 May 30 Record the depreciation expense for Cullumber for the fiscal years ended December 31, 2021 and 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Debit Credit Date Account Titles and Explanation 2021 Dec. 31 2022 Dec. 31 Prepare all of the necessary journal entries on October 4, 2023 following the destruction of the asset. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Debit Credit Date Account Titles and Explanation 2023 Oct. 4 (To record depreciation expense) Oct. 4 (To record sale of equipment) Repeat parts (b) and (c) under the assumption that Cullumber Services used the diminishing balance method, using a rate of 20%. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to o decimal places, e.g. 5,275.) Debit Credit Date Account Titles and Explanation 2021 Dec. 31 2022 Dec. 31 2023 Oct. 4 (To record depreciation expense) Oct. 4 (To record sale of equipment)