Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On May 4, 2XX2, an investor company owns 30% of the outstanding common stock of an investee and can exercise significant influence over the

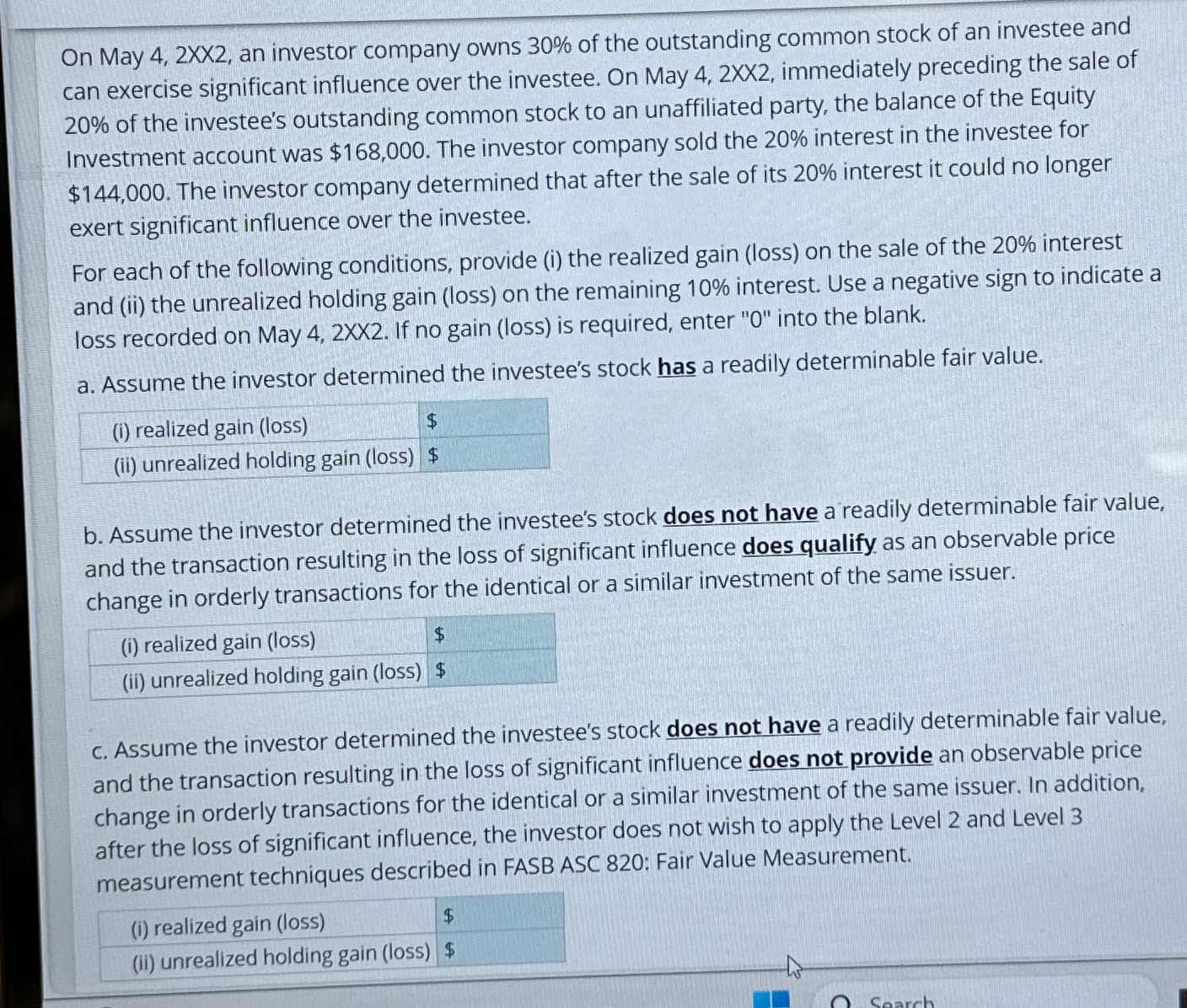

On May 4, 2XX2, an investor company owns 30% of the outstanding common stock of an investee and can exercise significant influence over the investee. On May 4, 2XX2, immediately preceding the sale of 20% of the investee's outstanding common stock to an unaffiliated party, the balance of the Equity Investment account was $168,000. The investor company sold the 20% interest in the investee for $144,000. The investor company determined that after the sale of its 20% interest it could no longer exert significant influence over the investee. For each of the following conditions, provide (i) the realized gain (loss) on the sale of the 20% interest and (ii) the unrealized holding gain (loss) on the remaining 10% interest. Use a negative sign to indicate a loss recorded on May 4, 2XX2. If no gain (loss) is required, enter "0" into the blank. a. Assume the investor determined the investee's stock has a readily determinable fair value. (i) realized gain (loss) $ (ii) unrealized holding gain (loss) $ b. Assume the investor determined the investee's stock does not have a readily determinable fair value, and the transaction resulting in the loss of significant influence does qualify as an observable price change in orderly transactions for the identical or a similar investment of the same issuer. (i) realized gain (loss) $ (ii) unrealized holding gain (loss) $ c. Assume the investor determined the investee's stock does not have a readily determinable fair value, and the transaction resulting in the loss of significant influence does not provide an observable price change in orderly transactions for the identical or a similar investment of the same issuer. In addition, after the loss of significant influence, the investor does not wish to apply the Level 2 and Level 3 measurement techniques described in FASB ASC 820: Fair Value Measurement. $ (i) realized gain (loss) (ii) unrealized holding gain (loss) $ Search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started