Answered step by step

Verified Expert Solution

Question

1 Approved Answer

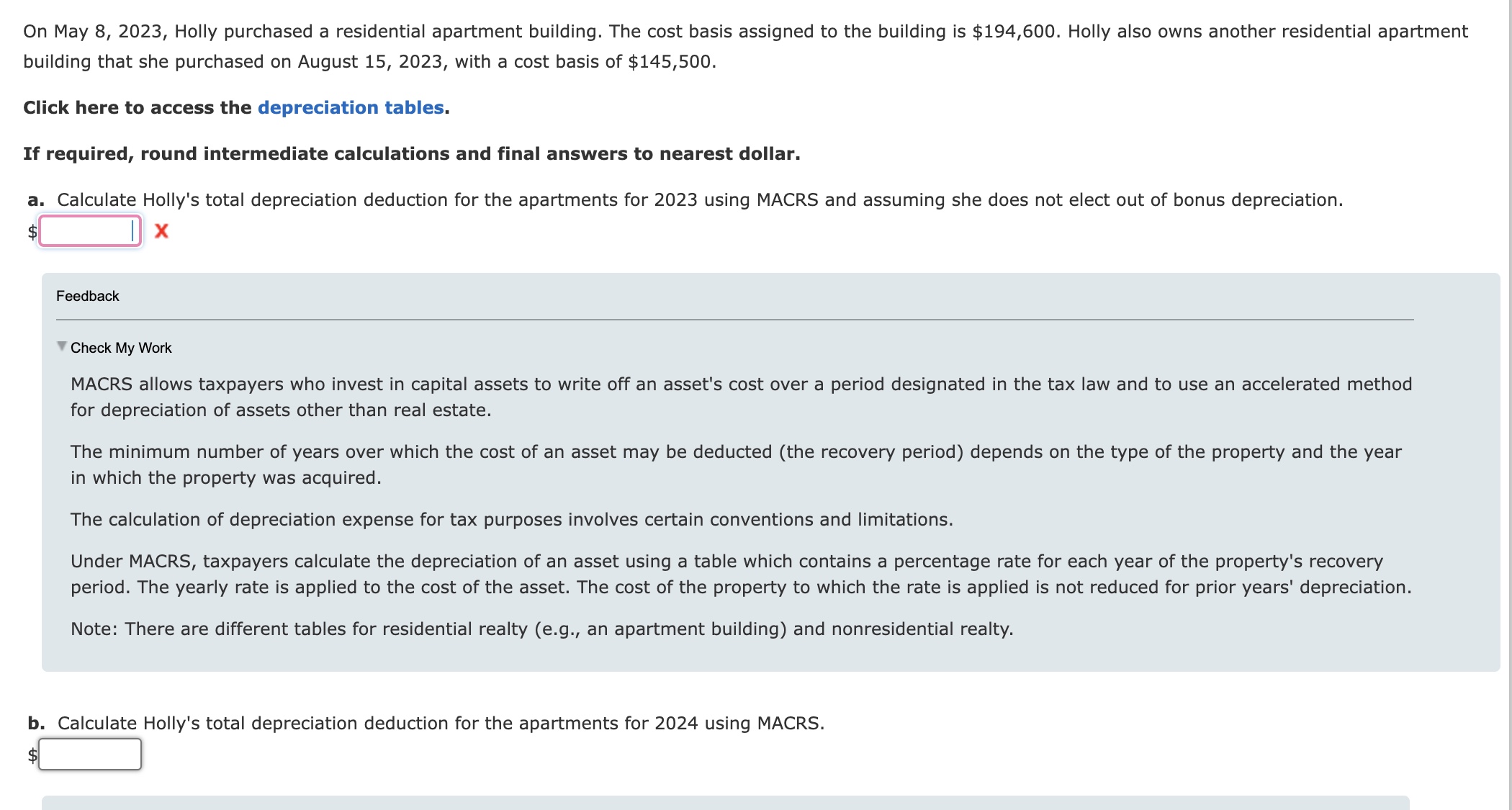

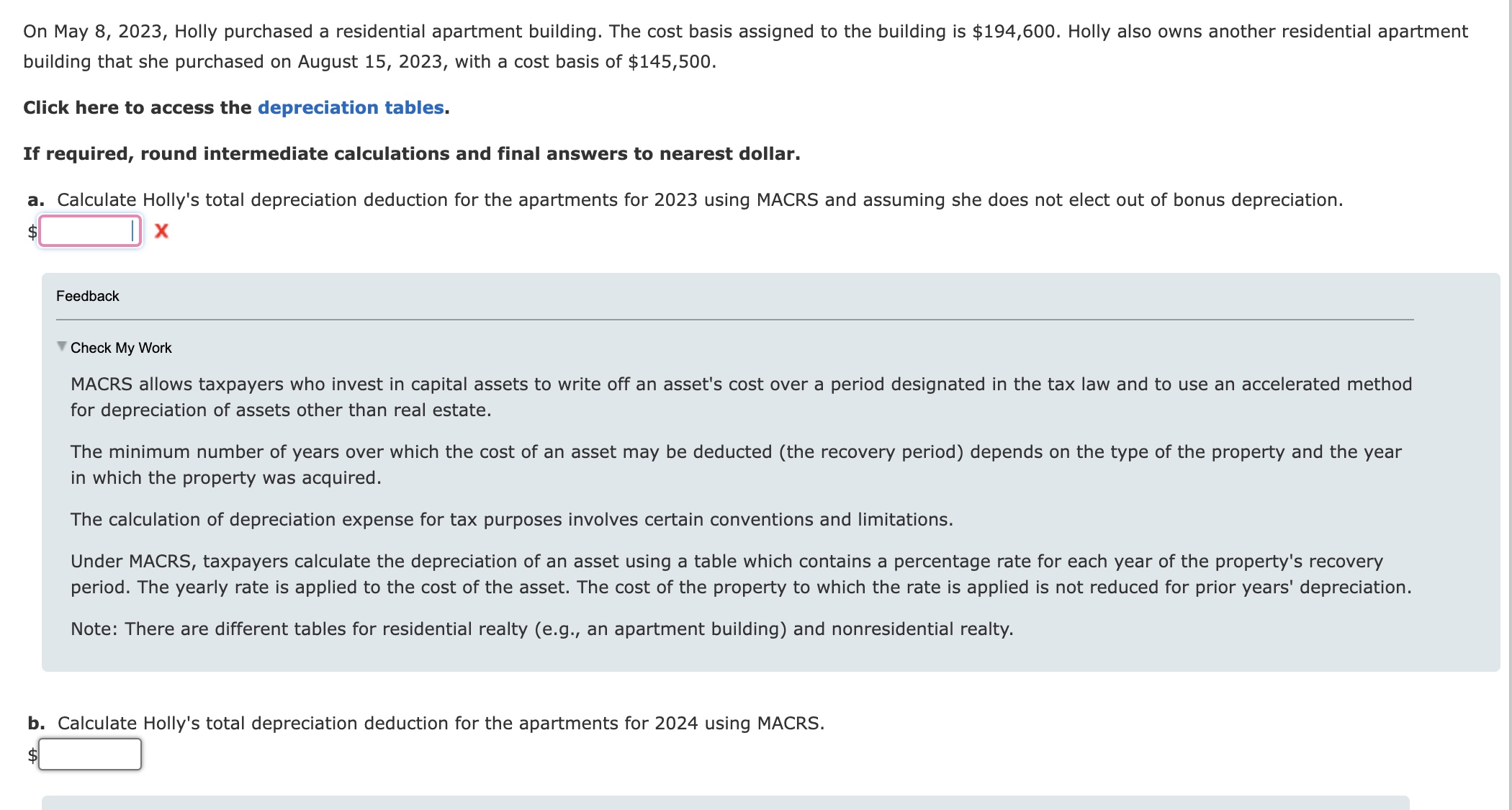

On May 8 , 2 0 2 3 , Holly purchased a residential apartment building. The cost basis assigned to the building is $ 1

On May Holly purchased a residential apartment building. The cost basis assigned to the building is $ Holly also owns another residential apartment

building that she purchased on August with a cost basis of $

Click here to access the depreciation tables.

If required, round intermediate calculations and final answers to nearest dollar.

a Calculate Holly's total depreciation deduction for the apartments for using MACRS and assuming she does not elect out of bonus depreciation.

$

Check My Work

MACRS allows taxpayers who invest in capital assets to write off an asset's cost over a period designated in the tax law and to use an accelerated method

for depreciation of assets other than real estate.

The minimum number of years over which the cost of an asset may be deducted the recovery period depends on the type of the property and the year

in which the property was acquired.

The calculation of depreciation expense for tax purposes involves certain conventions and limitations

Under MACRS, taxpayers calculate the depreciation of an asset using a table which contains a percentage rate for each year of the property's recovery

period. The yearly rate is applied to the cost of the asset. The cost of the property to which the rate is applied is not reduced for prior years' depreciation.

Note: There are different tables for residential realty eg an apartment building and nonresidential realty.

b Calculate Holly's total depreciation deduction for the apartments for using MACRS.

s

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started