On May 8, 2020, AbbVie, Inc., acquired Allergan plc for $64 billion. The footnote relat- ing to this acquisition, which AbbVie included in its June 30, 2020 SEC Form 10-Q, is pre- sented after the following questions. Use this information to answer the following questions:

a. AbbVie describes its assignment of fair value as being preliminary. Briefly describe the procedure under GAAP for companies to use provisional amounts and the process by which those estimates can be adjusted.

b. Prepare the journal entry that AbbVie made for the acquisition of Allergan's common stock.

C. Describe the process by which AbbVie determined the assignment of fair value to Goodwill in the amount of $27,044 million.

d. How much did AbbVie assign to identifiable intangible assets? Briefly describe the valuation approach used to determine the fair values of the identifiable intangible assets. What significant assumptions are inherent in the estimation of intangible asset fair values?

e. For the three months ended June 30, 2020 AbbVie reported consolidated revenues of $10,425 million and a net loss of $738 million. For what period of time is Allergan's performance included in AbbVie's revenues and expenses for the three months ended June 30, 2020? How much did Allergan contribute to AbbVie's revenues and net losses for the three months ended June 30, 2020? What would AbbVie's revenues and net income be without the effect of Allergan?

f. How much in acquisition-related costs did AbbVie incur during the three months ended June 30, 2020. How were these costs recognized in the financial statements?

g. Describe the entry that AbbVie makes in the consolidation process to remove the Equity Investment account from the parent-company balance sheet in preparation of the consolidated balance sheet.

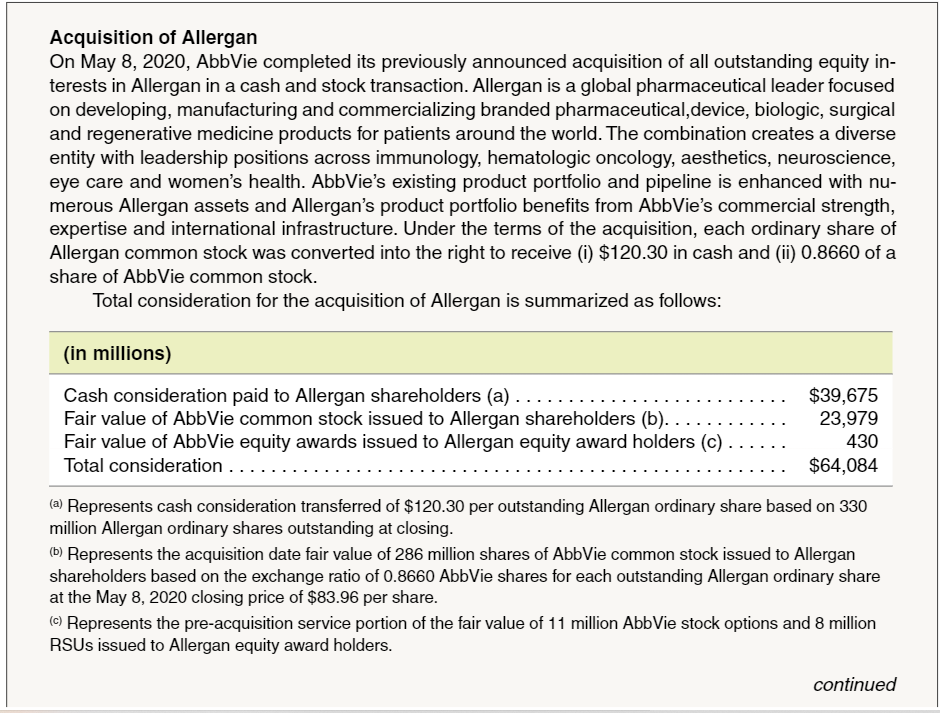

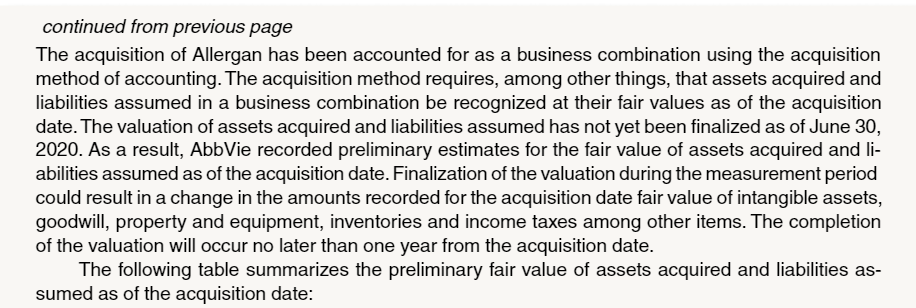

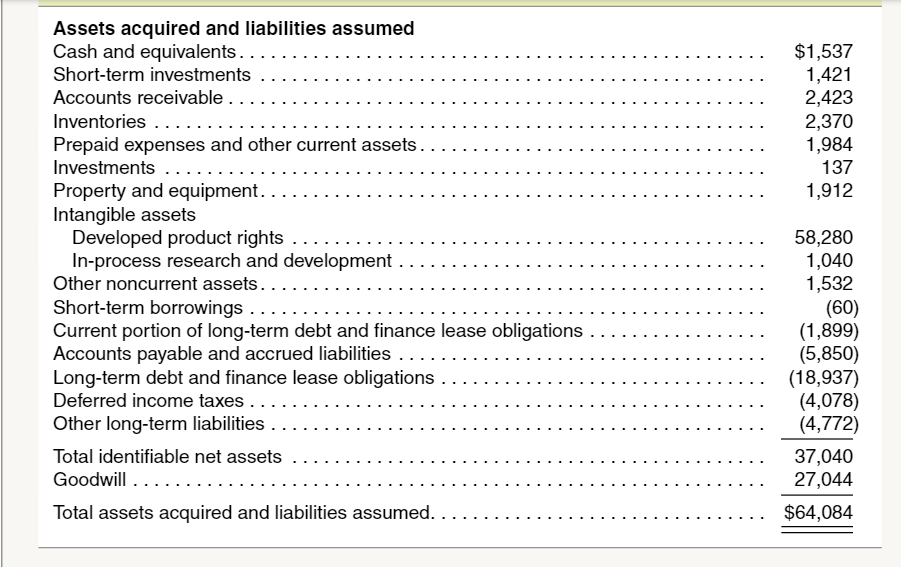

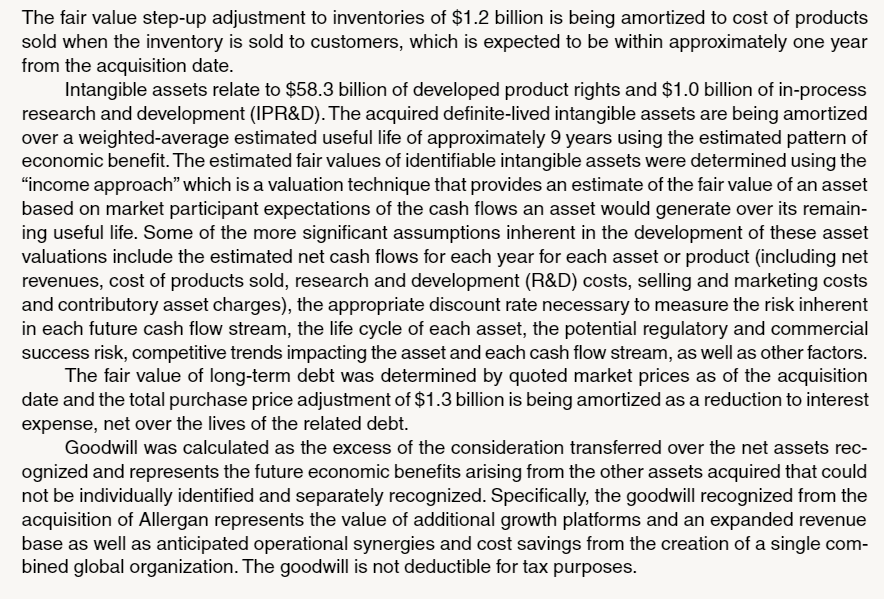

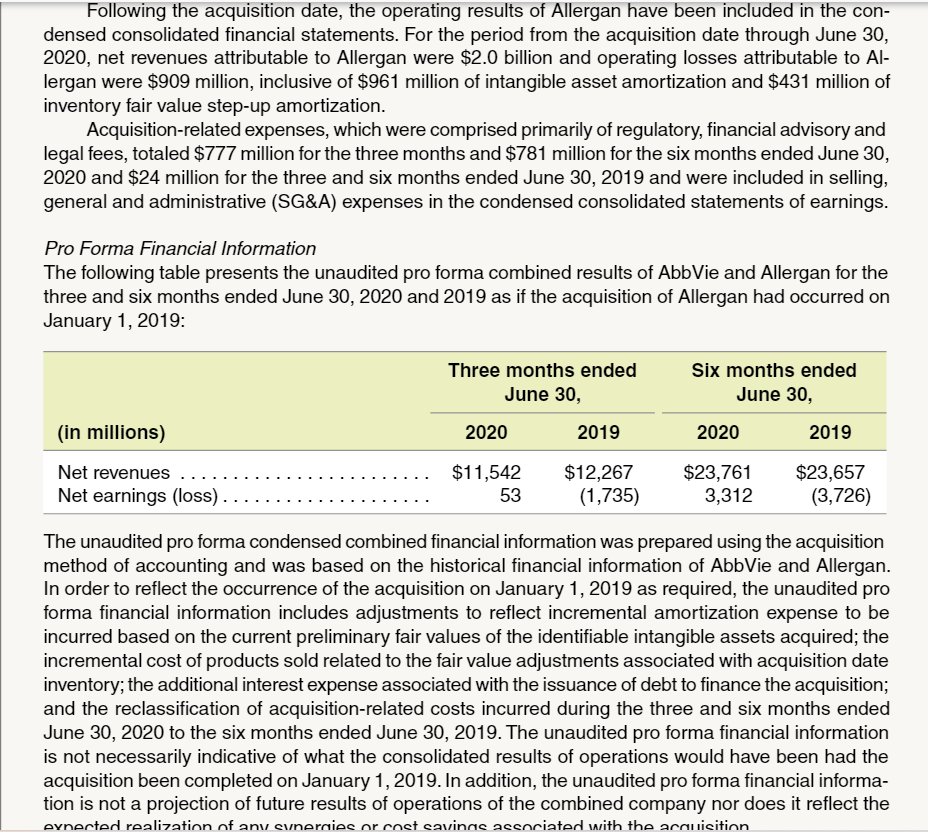

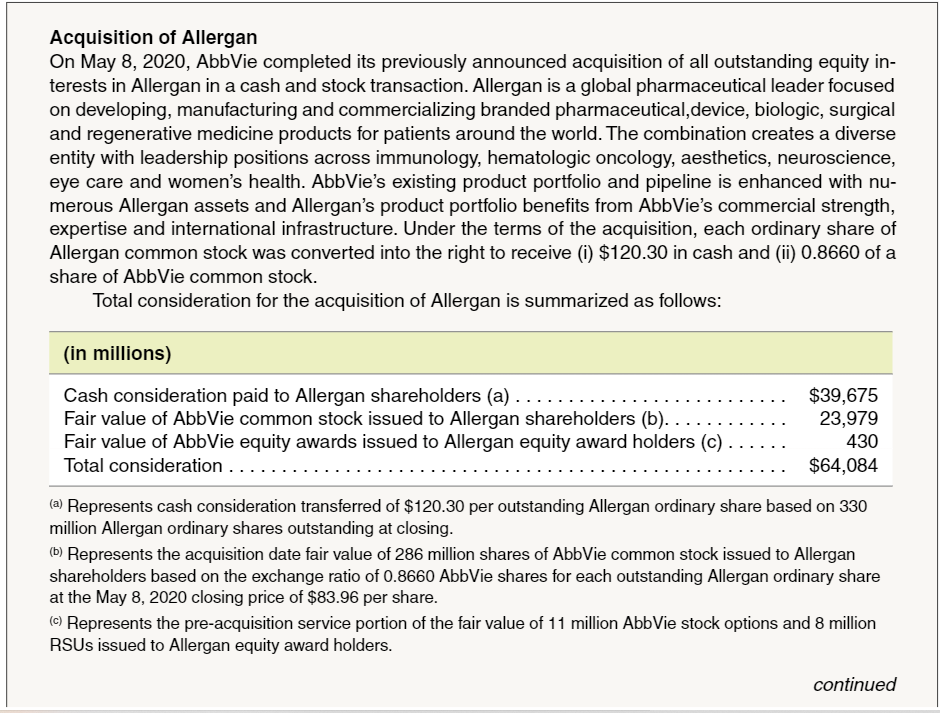

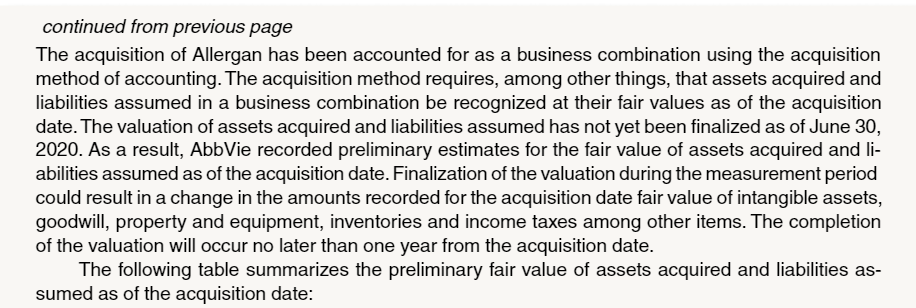

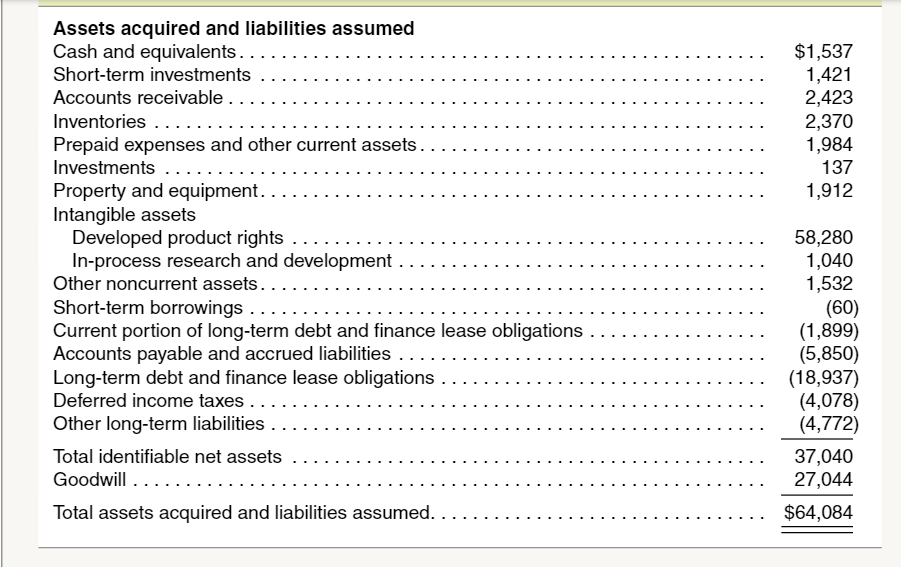

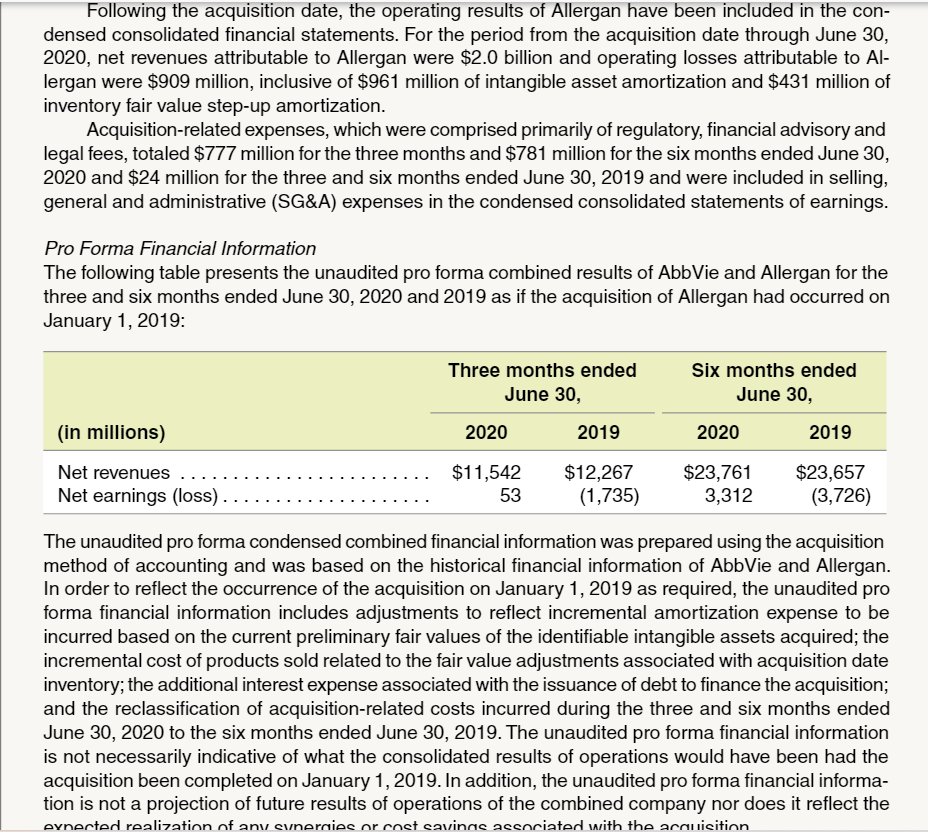

Acquisition of Allergan On May 8, 2020, AbbVie completed its previously announced acquisition of all outstanding equity interests in Allergan in a cash and stock transaction. Allergan is a global pharmaceutical leader focused on developing, manufacturing and commercializing branded pharmaceutical,device, biologic, surgical and regenerative medicine products for patients around the world. The combination creates a diverse entity with leadership positions across immunology, hematologic oncology, aesthetics, neuroscience, eye care and women's health. AbbVie's existing product portfolio and pipeline is enhanced with numerous Allergan assets and Allergan's product portfolio benefits from AbbVie's commercial strength, expertise and international infrastructure. Under the terms of the acquisition, each ordinary share of Allergan common stock was converted into the right to receive (i) $120.30 in cash and (ii) 0.8660 of a share of AbbVie common stock. Total consideration for the acquisition of Allergan is summarized as follows: (a) Represents cash consideration transferred of $120.30 per outstanding Allergan ordinary share based on 330 million Allergan ordinary shares outstanding at closing. (b) Represents the acquisition date fair value of 286 million shares of AbbVie common stock issued to Allergan shareholders based on the exchange ratio of 0.8660 AbbVie shares for each outstanding Allergan ordinary share at the May 8, 2020 closing price of $83.96 per share. (c) Represents the pre-acquisition service portion of the fair value of 11 million AbbVie stock options and 8 million RSUs issued to Allergan equity award holders. continued from previous page The acquisition of Allergan has been accounted for as a business combination using the acquisition method of accounting. The acquisition method requires, among other things, that assets acquired and liabilities assumed in a business combination be recognized at their fair values as of the acquisition date. The valuation of assets acquired and liabilities assumed has not yet been finalized as of June 30 , 2020. As a result, AbbVie recorded preliminary estimates for the fair value of assets acquired and liabilities assumed as of the acquisition date. Finalization of the valuation during the measurement period could result in a change in the amounts recorded for the acquisition date fair value of intangible assets, goodwill, property and equipment, inventories and income taxes among other items. The completion of the valuation will occur no later than one year from the acquisition date. The following table summarizes the preliminary fair value of assets acquired and liabilities assumed as of the acquisition date: Assets acquired and liabilities assumed Cash and equivalents. Short-term investments Accounts receivable. Inventories ... Prepaid expenses and other current assets. Investments ... Property and equipment. Intangible assets Developed product rights . 58,280 In-process research and development Other noncurrent assets. Short-term borrowings . Current portion of long-term debt and finance lease obligations . Accounts payable and accrued liabilities . Long-term debt and finance lease obligations ... Deferred income taxes... Other long-term liabilities . Total identifiable net assets Goodwill . Total assets acquired and liabilities assumed. (60) The fair value step-up adjustment to inventories of $1.2 billion is being amortized to cost of products sold when the inventory is sold to customers, which is expected to be within approximately one year from the acquisition date. Intangible assets relate to $58.3 billion of developed product rights and $1.0 billion of in-process research and development (IPR\&D). The acquired definite-lived intangible assets are being amortized over a weighted-average estimated useful life of approximately 9 years using the estimated pattern of economic benefit. The estimated fair values of identifiable intangible assets were determined using the "income approach" which is a valuation technique that provides an estimate of the fair value of an asset based on market participant expectations of the cash flows an asset would generate over its remaining useful life. Some of the more significant assumptions inherent in the development of these asset valuations include the estimated net cash flows for each year for each asset or product (including net revenues, cost of products sold, research and development (R\&D) costs, selling and marketing costs and contributory asset charges), the appropriate discount rate necessary to measure the risk inherent in each future cash flow stream, the life cycle of each asset, the potential regulatory and commercial success risk, competitive trends impacting the asset and each cash flow stream, as well as other factors. The fair value of long-term debt was determined by quoted market prices as of the acquisition date and the total purchase price adjustment of $1.3 billion is being amortized as a reduction to interest expense, net over the lives of the related debt. Goodwill was calculated as the excess of the consideration transferred over the net assets recognized and represents the future economic benefits arising from the other assets acquired that could not be individually identified and separately recognized. Specifically, the goodwill recognized from the acquisition of Allergan represents the value of additional growth platforms and an expanded revenue base as well as anticipated operational synergies and cost savings from the creation of a single combined global organization. The goodwill is not deductible for tax purposes. Following the acquisition date, the operating results of Allergan have been included in the condensed consolidated financial statements. For the period from the acquisition date through June 30 , 2020 , net revenues attributable to Allergan were $2.0 billion and operating losses attributable to Allergan were $909 million, inclusive of $961 million of intangible asset amortization and $431 million of inventory fair value step-up amortization. Acquisition-related expenses, which were comprised primarily of regulatory, financial advisory and legal fees, totaled $777 million for the three months and $781 million for the six months ended June 30 , 2020 and $24 million for the three and six months ended June 30, 2019 and were included in selling, general and administrative (SG\&A) expenses in the condensed consolidated statements of earnings. Pro Forma Financial Information The following table presents the unaudited pro forma combined results of AbbVie and Allergan for the three and six months ended June 30, 2020 and 2019 as if the acquisition of Allergan had occurred on January 1, 2019: The unaudited pro forma condensed combined financial information was prepared using the acquisition method of accounting and was based on the historical financial information of AbbVie and Allergan. In order to reflect the occurrence of the acquisition on January 1, 2019 as required, the unaudited pro forma financial information includes adjustments to reflect incremental amortization expense to be incurred based on the current preliminary fair values of the identifiable intangible assets acquired; the incremental cost of products sold related to the fair value adjustments associated with acquisition date inventory; the additional interest expense associated with the issuance of debt to finance the acquisition; and the reclassification of acquisition-related costs incurred during the three and six months ended June 30, 2020 to the six months ended June 30, 2019. The unaudited pro forma financial information is not necessarily indicative of what the consolidated results of operations would have been had the acquisition been completed on January 1, 2019. In addition, the unaudited pro forma financial information is not a projection of future results of operations of the combined company nor does it reflect the Acquisition of Allergan On May 8, 2020, AbbVie completed its previously announced acquisition of all outstanding equity interests in Allergan in a cash and stock transaction. Allergan is a global pharmaceutical leader focused on developing, manufacturing and commercializing branded pharmaceutical,device, biologic, surgical and regenerative medicine products for patients around the world. The combination creates a diverse entity with leadership positions across immunology, hematologic oncology, aesthetics, neuroscience, eye care and women's health. AbbVie's existing product portfolio and pipeline is enhanced with numerous Allergan assets and Allergan's product portfolio benefits from AbbVie's commercial strength, expertise and international infrastructure. Under the terms of the acquisition, each ordinary share of Allergan common stock was converted into the right to receive (i) $120.30 in cash and (ii) 0.8660 of a share of AbbVie common stock. Total consideration for the acquisition of Allergan is summarized as follows: (a) Represents cash consideration transferred of $120.30 per outstanding Allergan ordinary share based on 330 million Allergan ordinary shares outstanding at closing. (b) Represents the acquisition date fair value of 286 million shares of AbbVie common stock issued to Allergan shareholders based on the exchange ratio of 0.8660 AbbVie shares for each outstanding Allergan ordinary share at the May 8, 2020 closing price of $83.96 per share. (c) Represents the pre-acquisition service portion of the fair value of 11 million AbbVie stock options and 8 million RSUs issued to Allergan equity award holders. continued from previous page The acquisition of Allergan has been accounted for as a business combination using the acquisition method of accounting. The acquisition method requires, among other things, that assets acquired and liabilities assumed in a business combination be recognized at their fair values as of the acquisition date. The valuation of assets acquired and liabilities assumed has not yet been finalized as of June 30 , 2020. As a result, AbbVie recorded preliminary estimates for the fair value of assets acquired and liabilities assumed as of the acquisition date. Finalization of the valuation during the measurement period could result in a change in the amounts recorded for the acquisition date fair value of intangible assets, goodwill, property and equipment, inventories and income taxes among other items. The completion of the valuation will occur no later than one year from the acquisition date. The following table summarizes the preliminary fair value of assets acquired and liabilities assumed as of the acquisition date: Assets acquired and liabilities assumed Cash and equivalents. Short-term investments Accounts receivable. Inventories ... Prepaid expenses and other current assets. Investments ... Property and equipment. Intangible assets Developed product rights . 58,280 In-process research and development Other noncurrent assets. Short-term borrowings . Current portion of long-term debt and finance lease obligations . Accounts payable and accrued liabilities . Long-term debt and finance lease obligations ... Deferred income taxes... Other long-term liabilities . Total identifiable net assets Goodwill . Total assets acquired and liabilities assumed. (60) The fair value step-up adjustment to inventories of $1.2 billion is being amortized to cost of products sold when the inventory is sold to customers, which is expected to be within approximately one year from the acquisition date. Intangible assets relate to $58.3 billion of developed product rights and $1.0 billion of in-process research and development (IPR\&D). The acquired definite-lived intangible assets are being amortized over a weighted-average estimated useful life of approximately 9 years using the estimated pattern of economic benefit. The estimated fair values of identifiable intangible assets were determined using the "income approach" which is a valuation technique that provides an estimate of the fair value of an asset based on market participant expectations of the cash flows an asset would generate over its remaining useful life. Some of the more significant assumptions inherent in the development of these asset valuations include the estimated net cash flows for each year for each asset or product (including net revenues, cost of products sold, research and development (R\&D) costs, selling and marketing costs and contributory asset charges), the appropriate discount rate necessary to measure the risk inherent in each future cash flow stream, the life cycle of each asset, the potential regulatory and commercial success risk, competitive trends impacting the asset and each cash flow stream, as well as other factors. The fair value of long-term debt was determined by quoted market prices as of the acquisition date and the total purchase price adjustment of $1.3 billion is being amortized as a reduction to interest expense, net over the lives of the related debt. Goodwill was calculated as the excess of the consideration transferred over the net assets recognized and represents the future economic benefits arising from the other assets acquired that could not be individually identified and separately recognized. Specifically, the goodwill recognized from the acquisition of Allergan represents the value of additional growth platforms and an expanded revenue base as well as anticipated operational synergies and cost savings from the creation of a single combined global organization. The goodwill is not deductible for tax purposes. Following the acquisition date, the operating results of Allergan have been included in the condensed consolidated financial statements. For the period from the acquisition date through June 30 , 2020 , net revenues attributable to Allergan were $2.0 billion and operating losses attributable to Allergan were $909 million, inclusive of $961 million of intangible asset amortization and $431 million of inventory fair value step-up amortization. Acquisition-related expenses, which were comprised primarily of regulatory, financial advisory and legal fees, totaled $777 million for the three months and $781 million for the six months ended June 30 , 2020 and $24 million for the three and six months ended June 30, 2019 and were included in selling, general and administrative (SG\&A) expenses in the condensed consolidated statements of earnings. Pro Forma Financial Information The following table presents the unaudited pro forma combined results of AbbVie and Allergan for the three and six months ended June 30, 2020 and 2019 as if the acquisition of Allergan had occurred on January 1, 2019: The unaudited pro forma condensed combined financial information was prepared using the acquisition method of accounting and was based on the historical financial information of AbbVie and Allergan. In order to reflect the occurrence of the acquisition on January 1, 2019 as required, the unaudited pro forma financial information includes adjustments to reflect incremental amortization expense to be incurred based on the current preliminary fair values of the identifiable intangible assets acquired; the incremental cost of products sold related to the fair value adjustments associated with acquisition date inventory; the additional interest expense associated with the issuance of debt to finance the acquisition; and the reclassification of acquisition-related costs incurred during the three and six months ended June 30, 2020 to the six months ended June 30, 2019. The unaudited pro forma financial information is not necessarily indicative of what the consolidated results of operations would have been had the acquisition been completed on January 1, 2019. In addition, the unaudited pro forma financial information is not a projection of future results of operations of the combined company nor does it reflect the