Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On November 1, 2000 Ira Keyes and Mary Yellen formed Comparative Advantage, Ltd., to sell high-end consulting services to people trying to make their

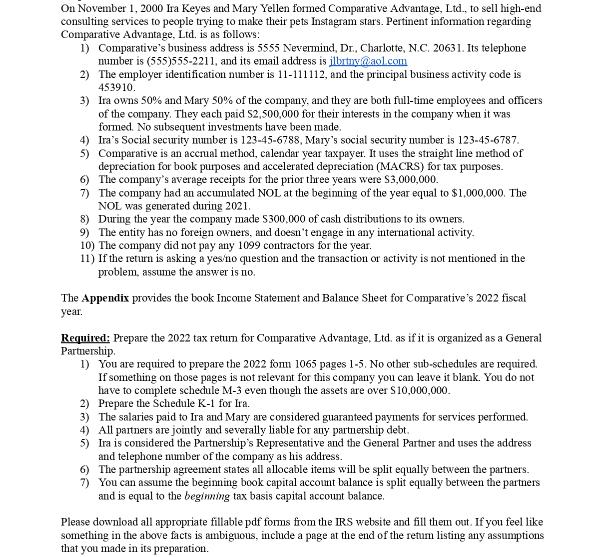

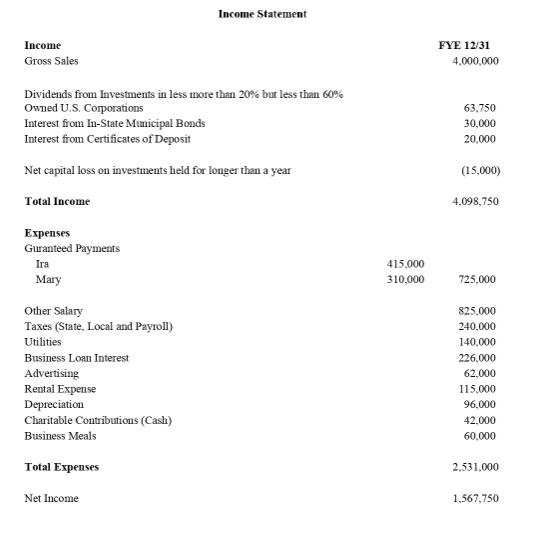

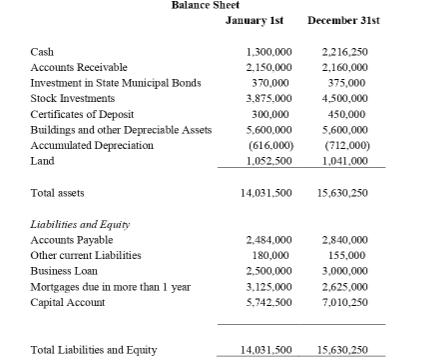

On November 1, 2000 Ira Keyes and Mary Yellen formed Comparative Advantage, Ltd., to sell high-end consulting services to people trying to make their pets Instagram stars. Pertinent information regarding Comparative Advantage, Ltd. is as follows: 1) Comparative's business address is 5555 Nevermind, Dr., Charlotte, N.C. 20631. Its telephone number is (555)555-2211, and its email address is jlbrtny@aol.com 2) The employer identification number is 11-111112, and the principal business activity code is 453910. 3) Ira owns 50% and Mary 50% of the company, and they are both full-time employees and officers of the company. They each paid 52,500,000 for their interests in the company when it was formed. No subsequent investments have been made. 4) Ira's Social security number is 123-45-6788, Mary's social security number is 123-45-6787. 5) Comparative is an accrual method, calendar year taxpayer. It uses the straight line method of depreciation for book purposes and accelerated depreciation (MACRS) for tax purposes. 6) The company's average receipts for the prior three years were $3,000,000. 7) The company had an accumulated NOL at the beginning of the year equal to $1,000,000. The NOL was generated during 2021. 8) During the year the company made $300,000 of cash distributions to its owners. 9) The entity has no foreign owners, and doesn't engage in any international activity. 10) The company did not pay any 1099 contractors for the year. 11) If the return is asking a yes/no question and the transaction or activity is not mentioned in the problem, assume the answer is no. The Appendix provides the book Income Statement and Balance Sheet for Comparative's 2022 fiscal year. Required: Prepare the 2022 tax return for Comparative Advantage, Ltd. as if it is organized as a General Partnership. 1) You are required to prepare the 2022 form 1065 pages 1-5. No other sub-schedules are required. If something on those pages is not relevant for this company you can leave it blank. You do not have to complete schedule M-3 even though the assets are over $10,000,000. 2) Prepare the Schedule K-1 for Ira. 3) The salaries paid to Ira and Mary are considered guaranteed payments for services performed. 4) All partners are jointly and severally liable for any partnership debt. 5) Ira is considered the Partnership's Representative and the General Partner and uses the address and telephone number of the company as his address. 6) The partnership agreement states all allocable items will be split equally between the partners. 7) You can assume the beginning book capital account balance is split equally between the partners and is equal to the beginning tax basis capital account balance. Please download all appropriate fillable pdf forms from the IRS website and fill them out. If you feel like something in the above facts is ambiguous, include a page at the end of the retum listing any assumptions that you made in its preparation. Income Gross Sales Dividends from Investments in less more than 20% but less than 60% Owned U.S. Corporations Interest from In-State Municipal Bonds Interest from Certificates of Deposit Net capital loss on investments held for longer than a year Total Income Expenses Guranteed Payments Ira Mary Other Salary Taxes (State, Local and Payroll) Utilities Business Loan Interest Advertising Rental Expense Depreciation Charitable Contributions (Cash) Business Meals Total Expenses Income Statement Net Income 415,000 310,000 FYE 12/31 4,000,000 63,750 30,000 20,000 (15,000) 4,098,750 725,000 825,000 240,000 140,000 226,000 62,000 115,000 96,000 42,000 60,000 2,531,000 1,567,750 Cash Accounts Receivable Investment in State Municipal Bonds Stock Investments Certificates of Deposit Buildings and other Depreciable Assets Accumulated Depreciation Land Total assets Balance Sheet Liabilities and Equity Accounts Payable Other current Liabilities Business Loan Mortgages due in more than 1 year Capital Account Total Liabilities and Equity January 1st 1,300,000 2,150,000 370,000 3.875,000 300,000 5,600,000 (616,000) 1,052,500 14,031,500 December 31st 14.031,500 2,216,250 2,160,000 375,000 4,500,000 450,000 5,600,000 (712,000) 1,041,000 15,630,250 2,484,000 2,840,000 180,000 155,000 2,500,000 3,000,000 3,125,000 2,625,000 5,742.500 7,010,250 15.630,250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided information a summary for the 2022 tax return for Comparative Advantage Ltd as if it is organized as a General Partnership would ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started