Answered step by step

Verified Expert Solution

Question

1 Approved Answer

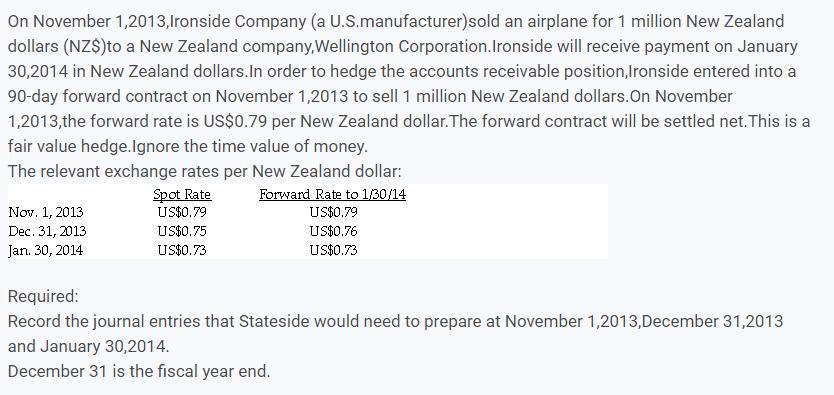

On November 1,2013, Ironside Company (a U.S.manufacturer)sold an airplane for 1 million New Zealand dollars (NZ$)to a New Zealand company, Wellington Corporation. Ironside will

On November 1,2013, Ironside Company (a U.S.manufacturer)sold an airplane for 1 million New Zealand dollars (NZ$)to a New Zealand company, Wellington Corporation. Ironside will receive payment on January 30,2014 in New Zealand dollars. In order to hedge the accounts receivable position,Ironside entered into a 90-day forward contract on November 1,2013 to sell 1 million New Zealand dollars. On November 1,2013,the forward rate is US$0.79 per New Zealand dollar. The forward contract will be settled net. This is a fair value hedge.Ignore the time value of money. The relevant exchange rates per New Zealand dollar: Spot Rate Forward Rate to 1/30/14 Nov. 1, 2013 US$0.79 US$0.79 Dec. 31, 2013 US$0.75 JS$0.76 Jan. 30, 2014 US$0.73 US$0.73 Required: Record the journal entries that Stateside would need to prepare at November 1,2013, December 31,2013 and January 30,2014. December 31 is the fiscal year end.

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries Date Account Debit Credit 2013 Nov Cash 624100 Accounts R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e11f221edf_181192.pdf

180 KBs PDF File

635e11f221edf_181192.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started