Question

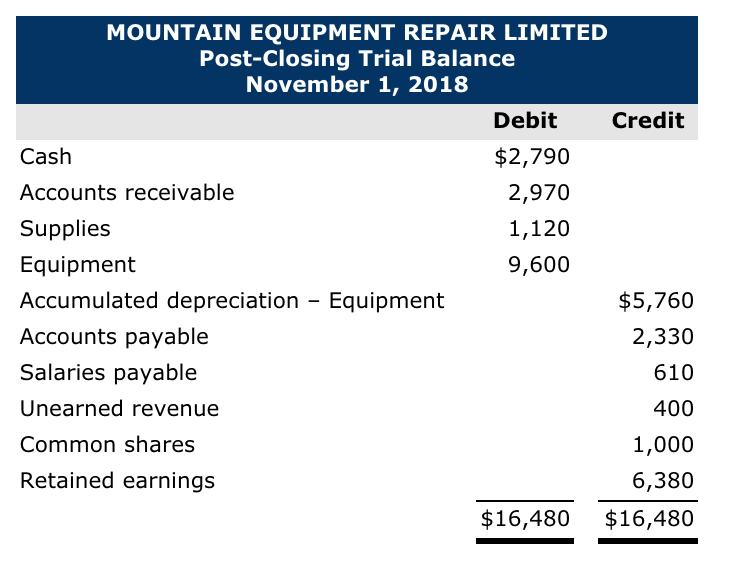

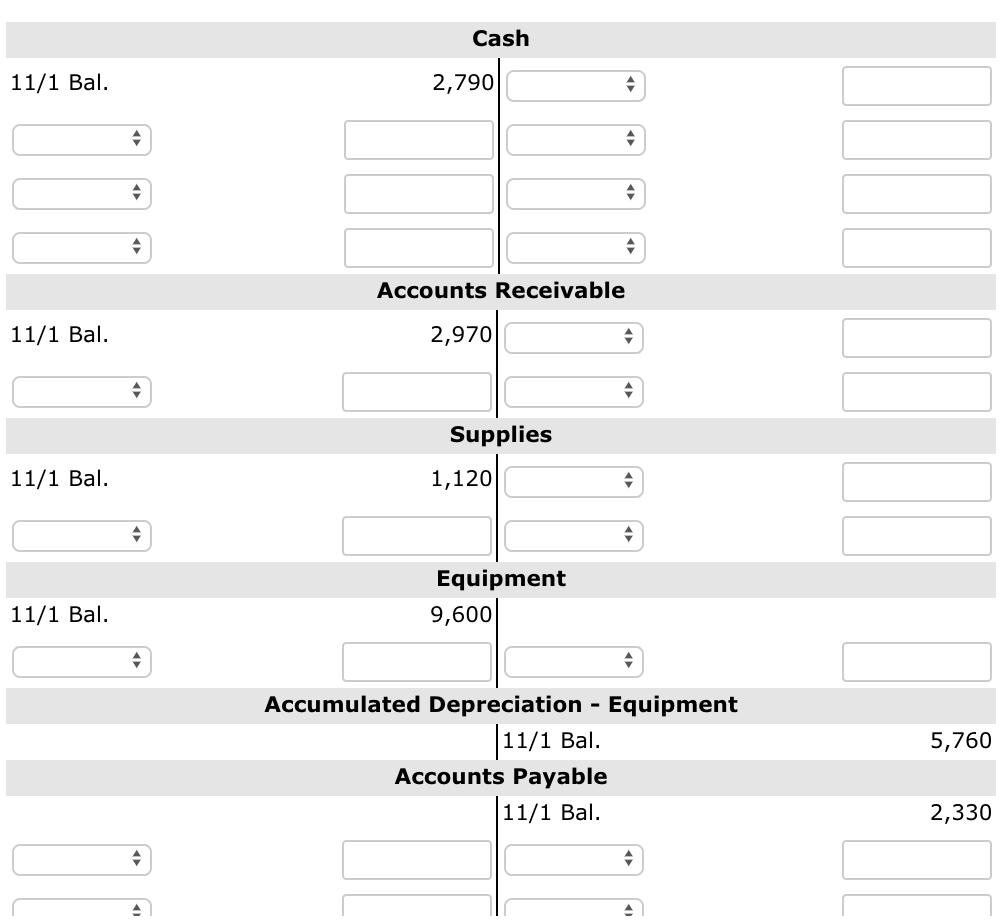

On November 1, 2018, the following were the account balances of Mountain Equipment Repair Limited. Mountains year-end is October 31 and it records adjusting entries

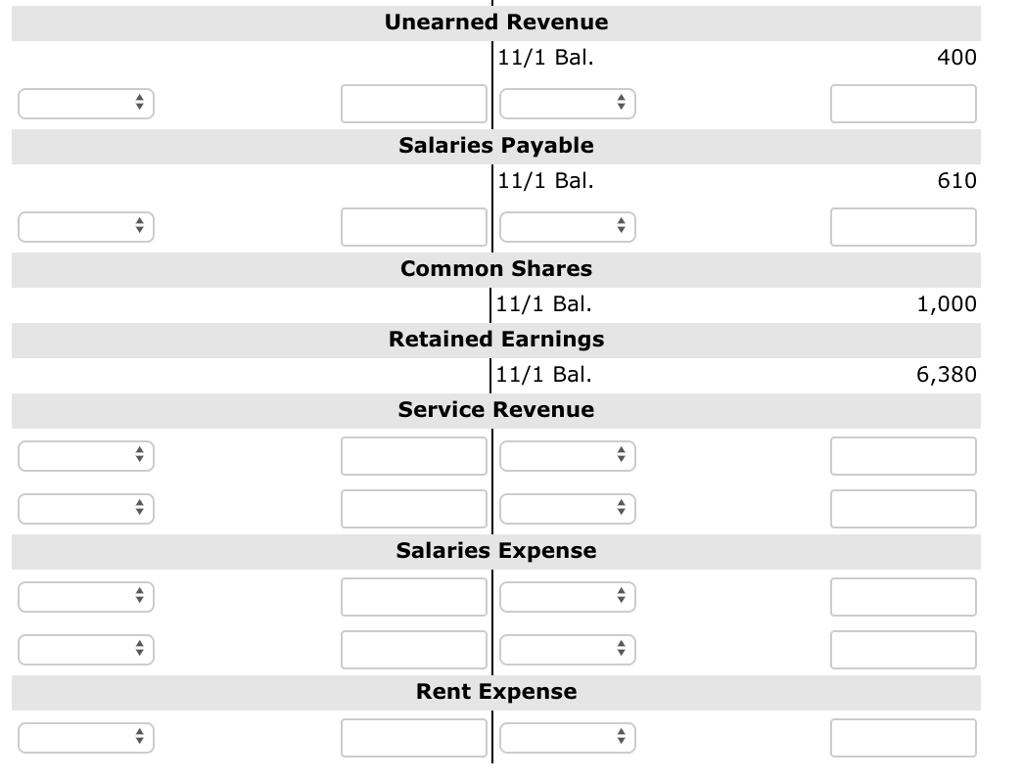

On November 1, 2018, the following were the account balances of Mountain Equipment Repair Limited. Mountain’s year-end is October 31 and it records adjusting entries monthly.

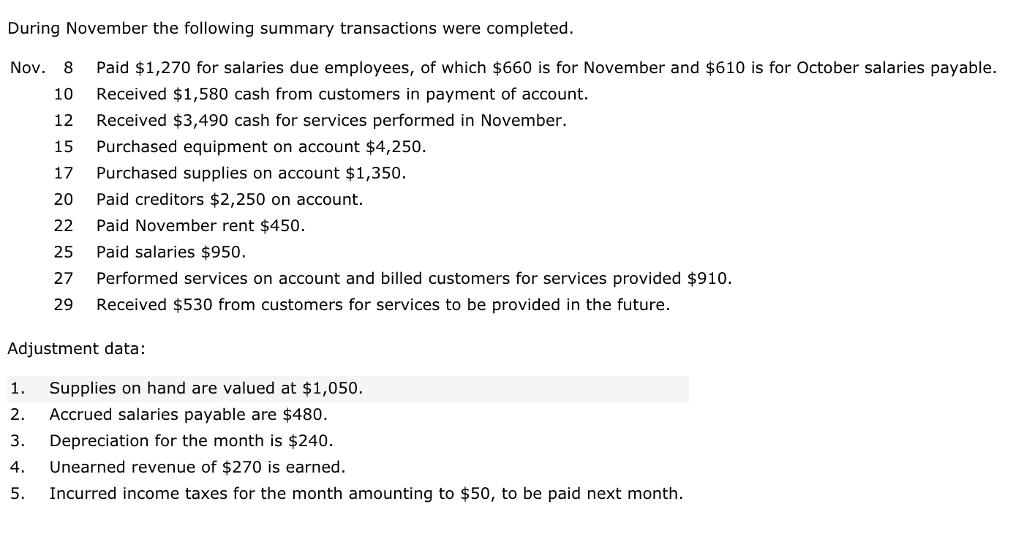

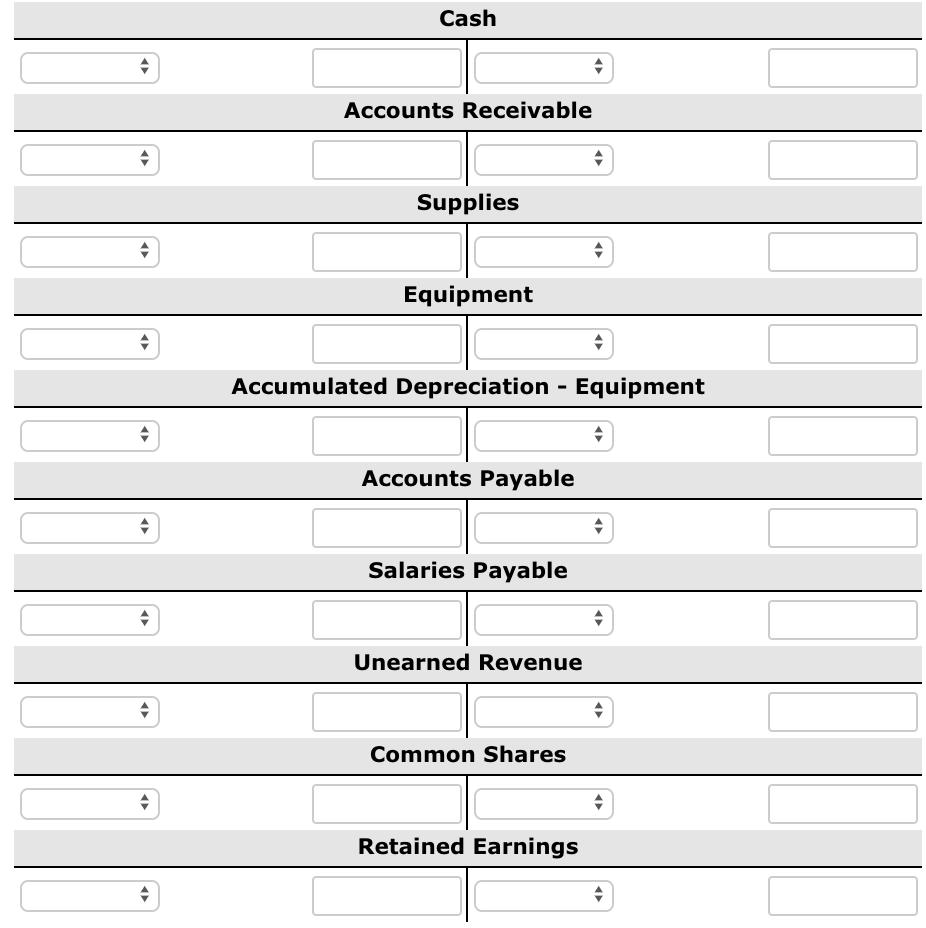

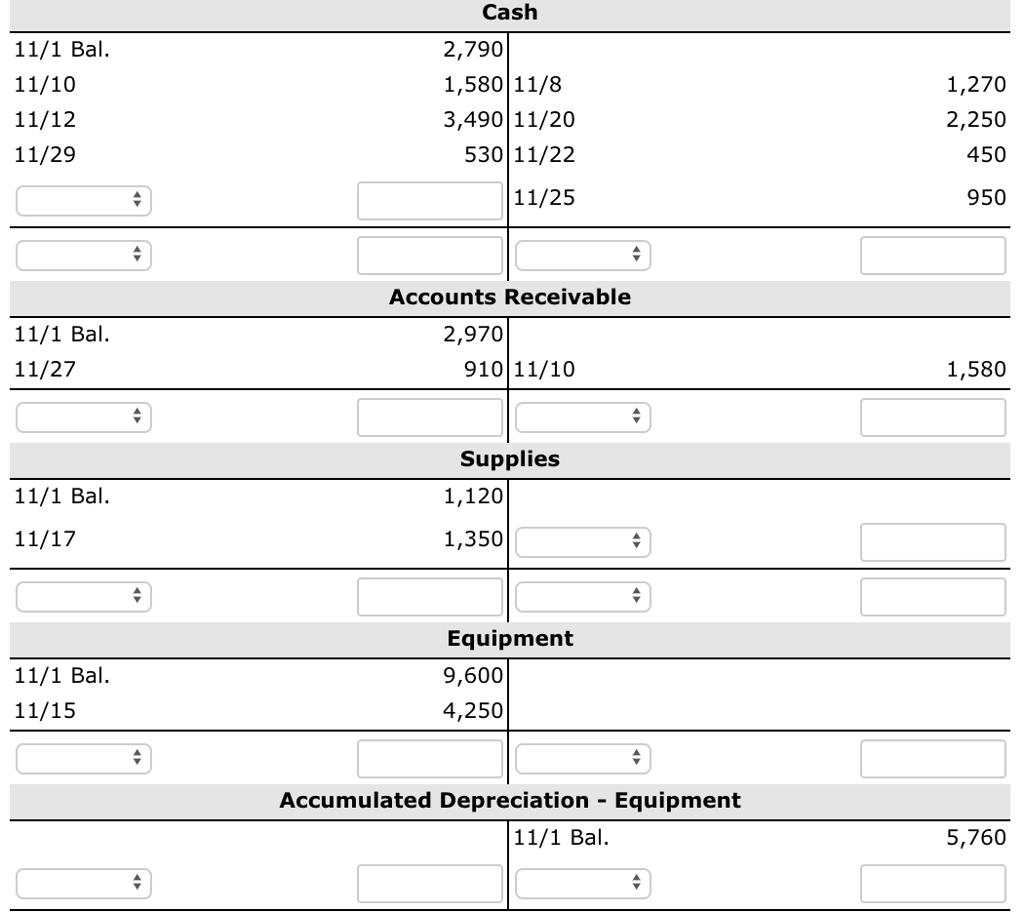

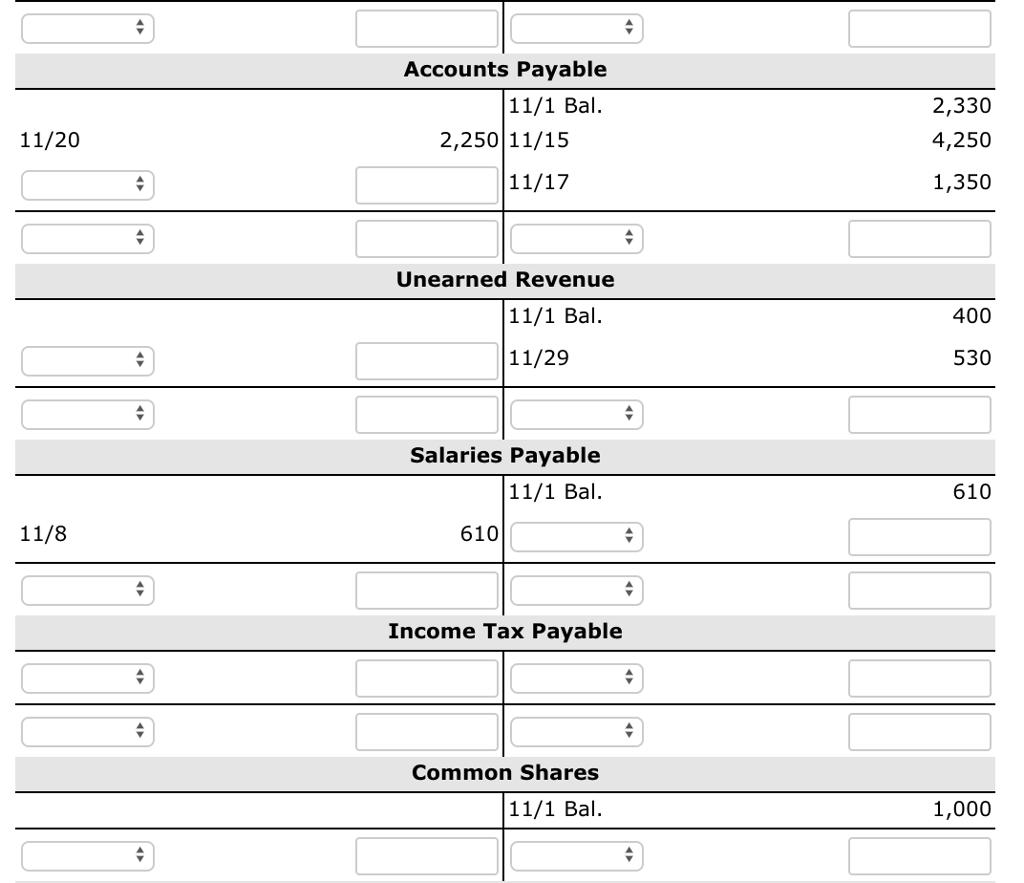

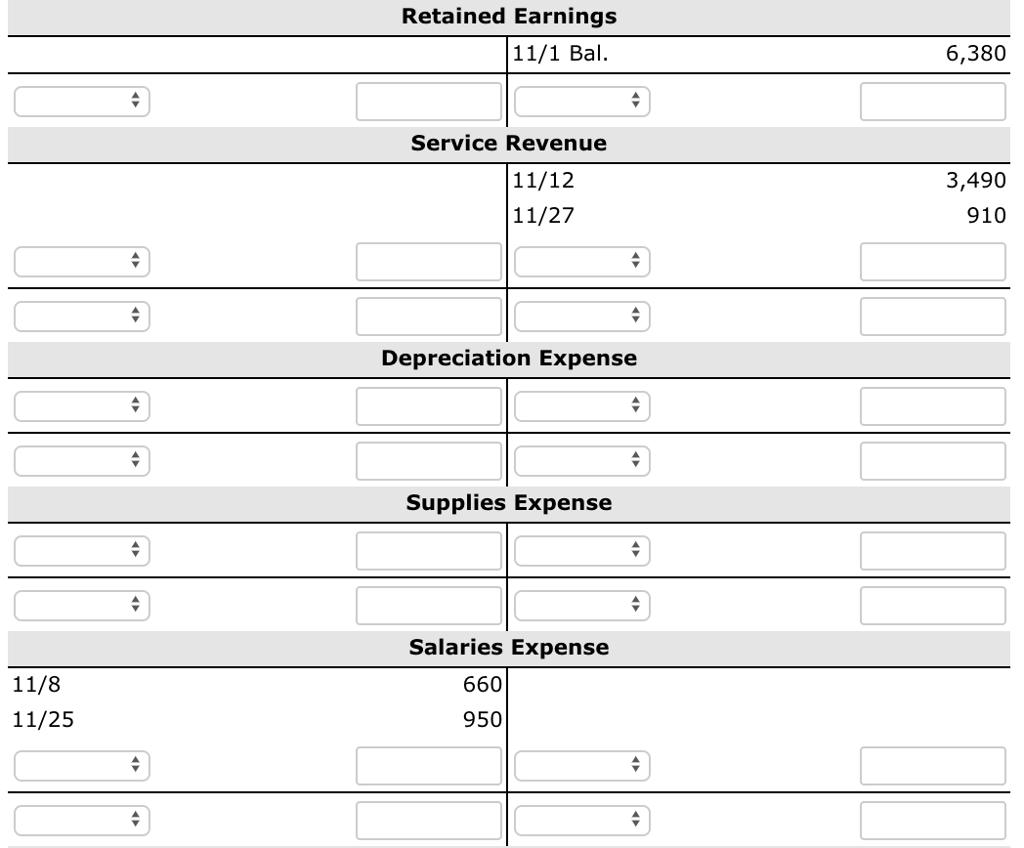

Enter the November 1 balances in the ledger accounts.

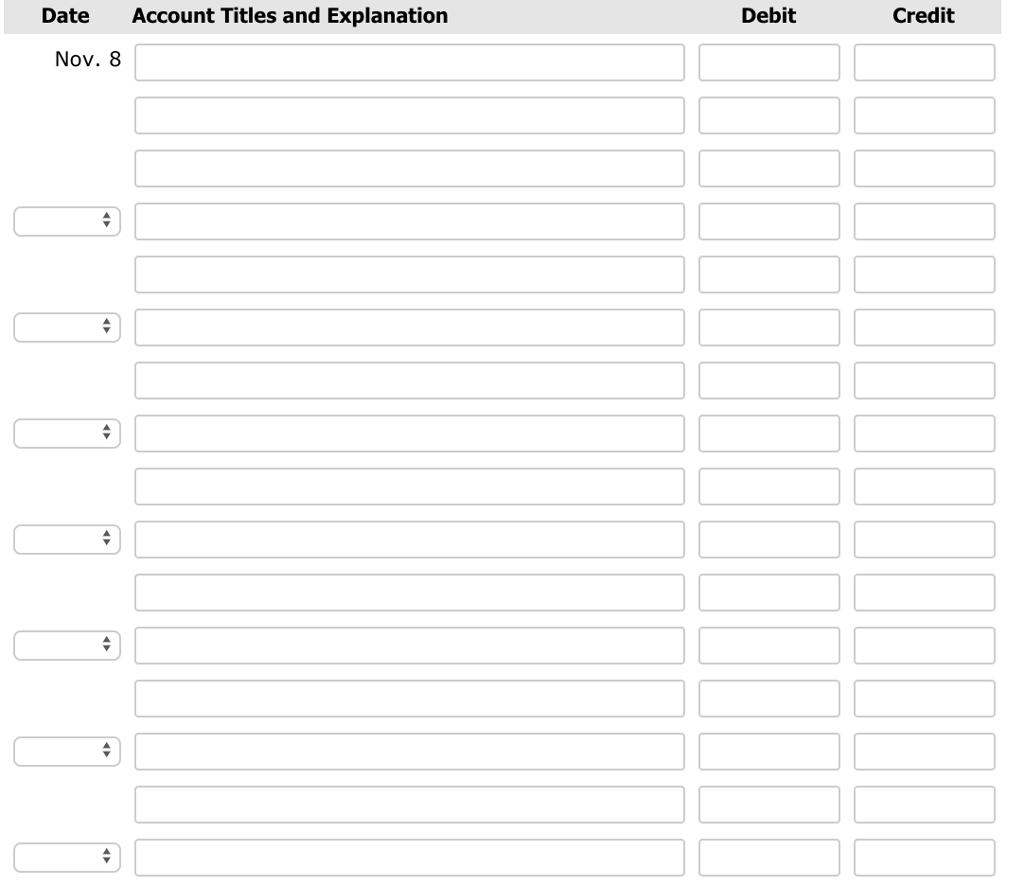

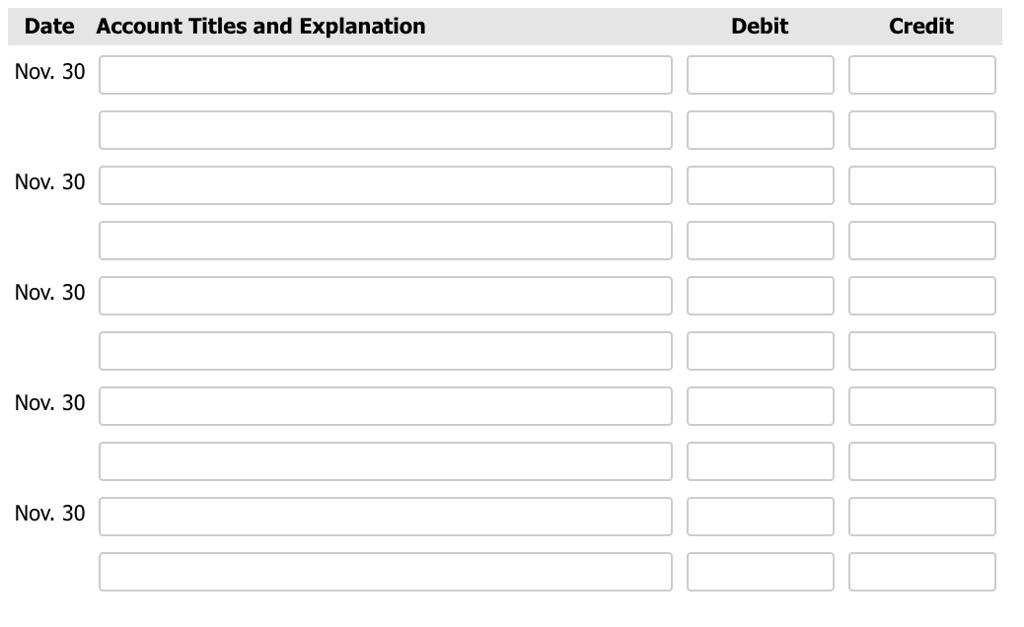

Journalize the November transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Post to the ledger accounts. (Post entries in the order of journal entries presented in the previous part.)

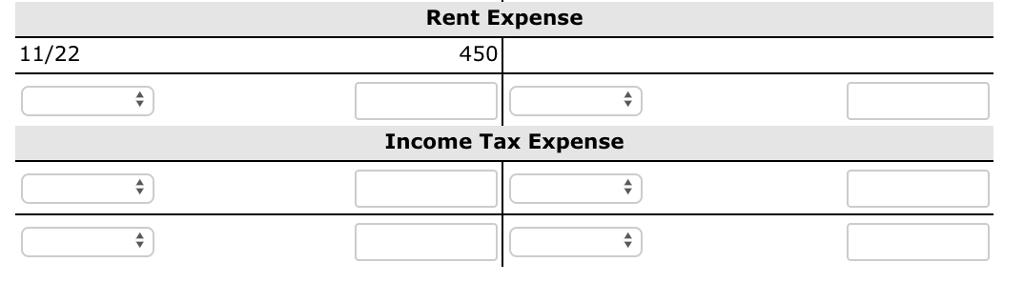

Journalize and post adjusting entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.)

Post adjusting journal entries. (Post entries in the order of journal entries presented in the previous part.)

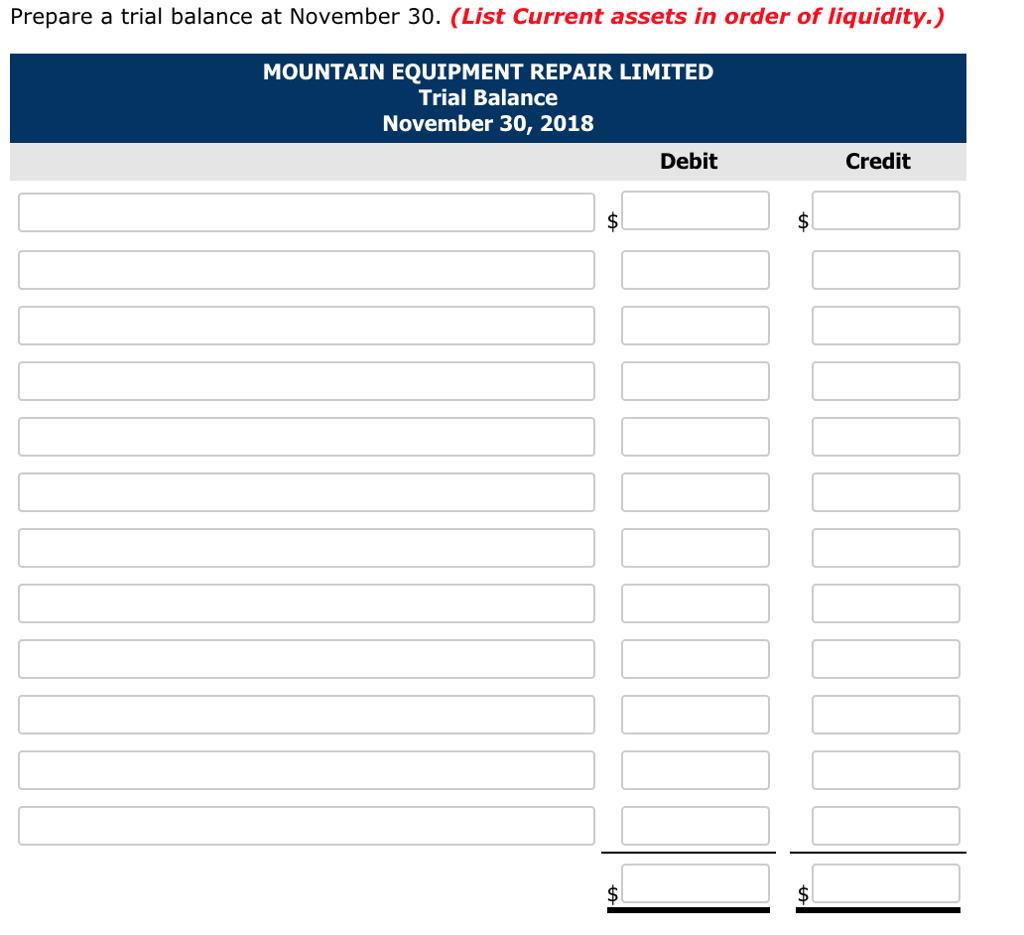

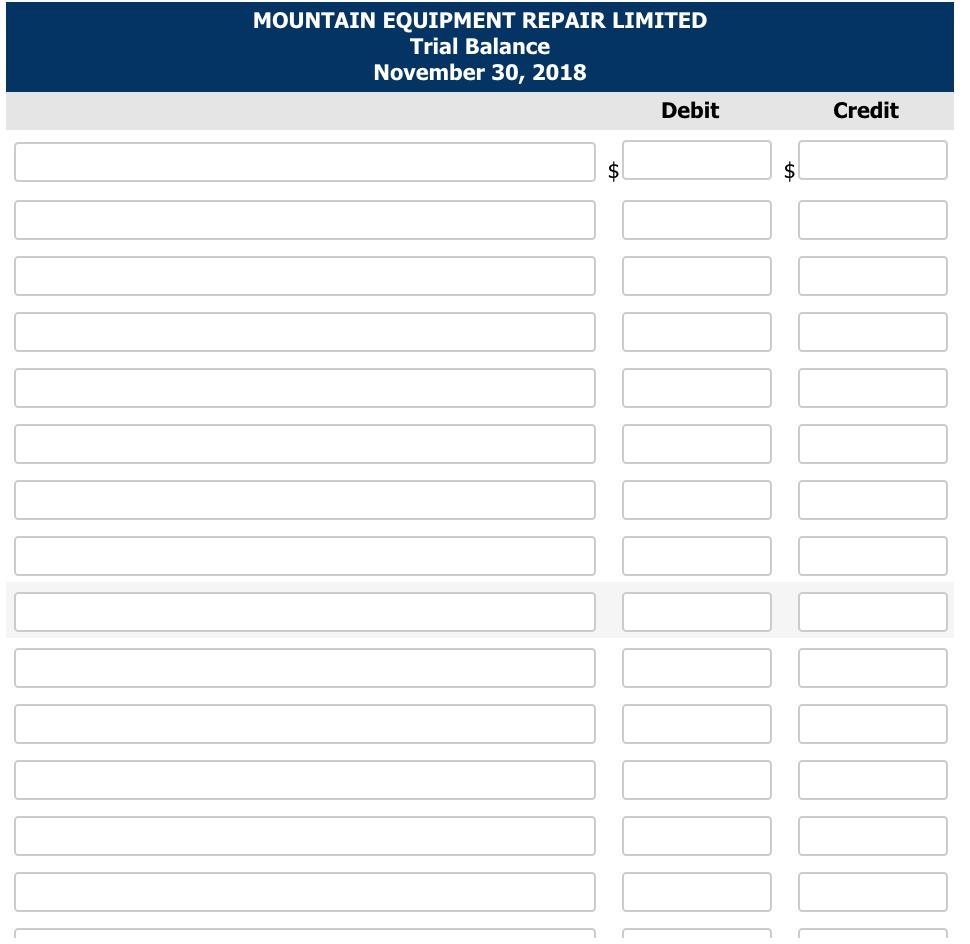

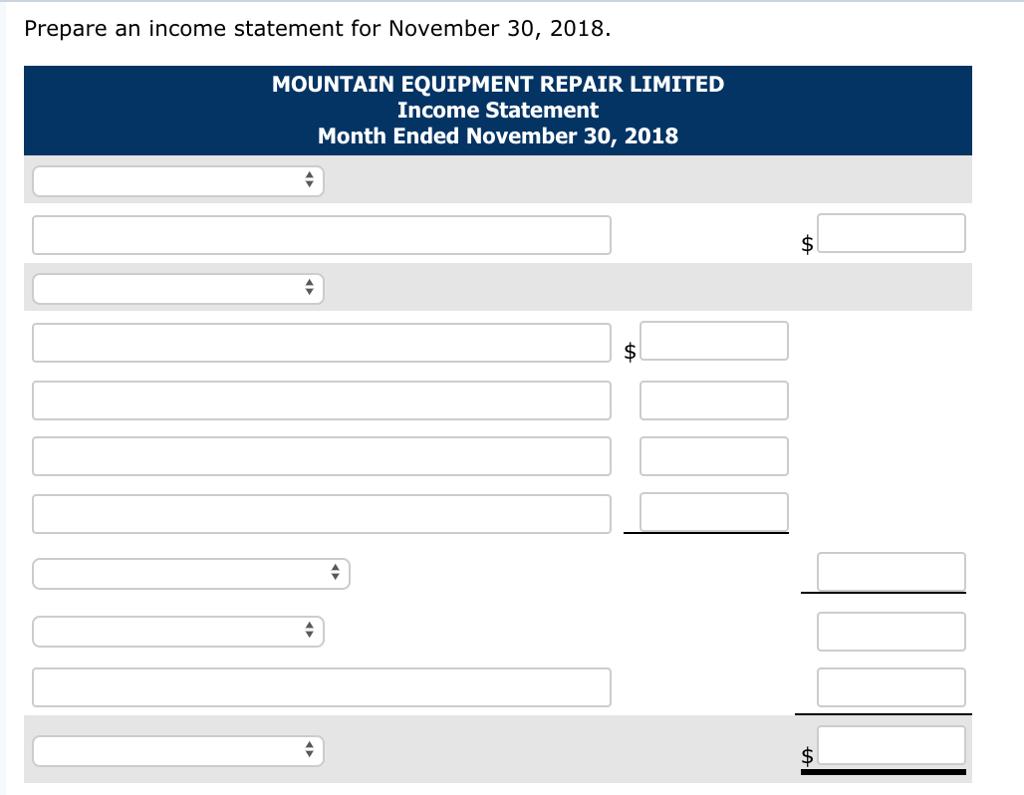

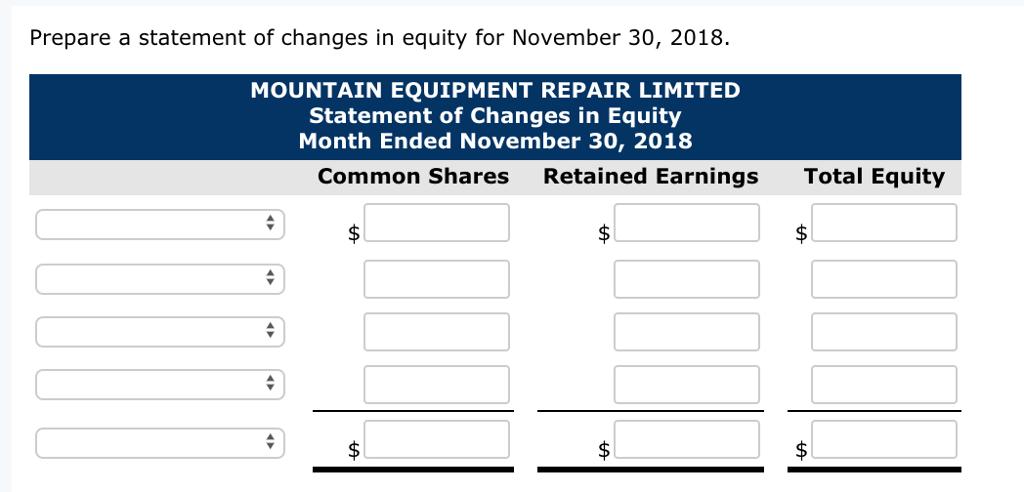

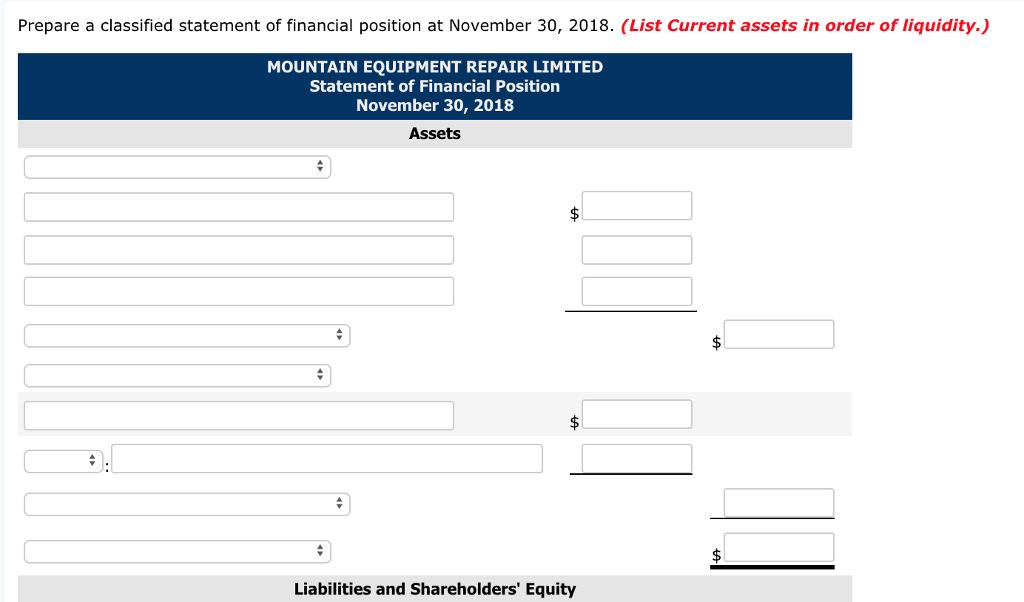

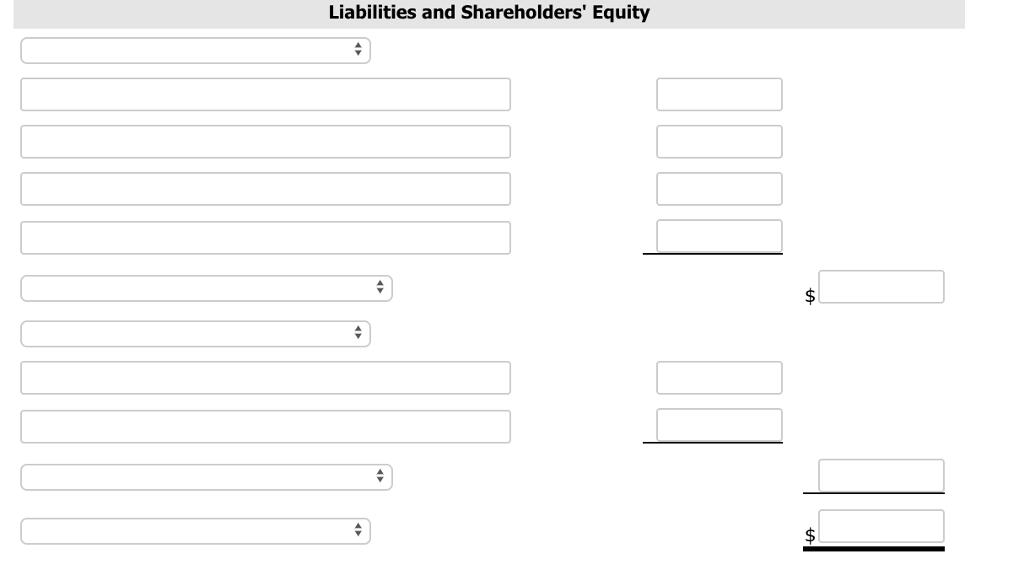

Prepare an adjusted trial balance. (List Current assets in order of liquidity.)

MOUNTAIN EQUIPMENT REPAIR LIMITED Post-Closing Trial Balance November 1, 2018 Debit Credit Cash $2,790 Accounts receivable 2,970 Supplies 1,120 Equipment 9,600 Accumulated depreciation - Equipment $5,760 Accounts payable 2,330 Salaries payable 610 Unearned revenue 400 Common shares 1,000 Retained earnings 6,380 $16,480 $16,480

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Cash 111 Bal 2790 118 1270 1110 1580 1120 2250 1112 3490 1122 450 1129 530 1125 950 1130 Bal 3470 Accounts Receivable 111 Bal 2970 1110 1580 1127 910 1130 Bal 2300 Supplies 111 Bal 1120 1130 1420 1117 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started