Question

On November 1, 2023, Mick's Mostly Meat Inc. issues a short term note payable in exchange for $10,000 cash. The note is payable in

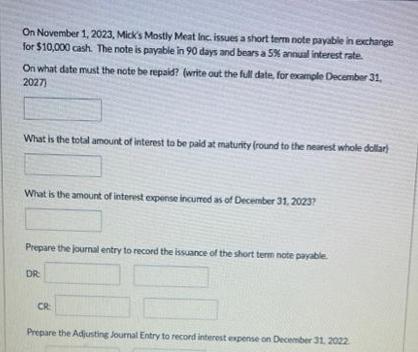

On November 1, 2023, Mick's Mostly Meat Inc. issues a short term note payable in exchange for $10,000 cash. The note is payable in 90 days and bears a 5% annual interest rate. On what date must the note be repaid? (write out the full date, for example December 31, 2027) What is the total amount of interest to be paid at maturity (round to the nearest whole dollar) What is the amount of interest expense incurred as of December 31, 2023? Prepare the journal entry to record the issuance of the short term note payable DR CR Prepare the Adjusting Journal Entry to record interest expense on December 31, 2022

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER I When we borrow any amount to someone then we issued a promissory note with t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Tools for Business Decision Making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine

7th Canadian edition

1119368456, 978-1119211587, 1119211581, 978-1119320623, 978-1119368458

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App