Question

On November 1, the company issued 10,000 preferred shares to a private investor at a cost of $100 each. The shares have a mandatory

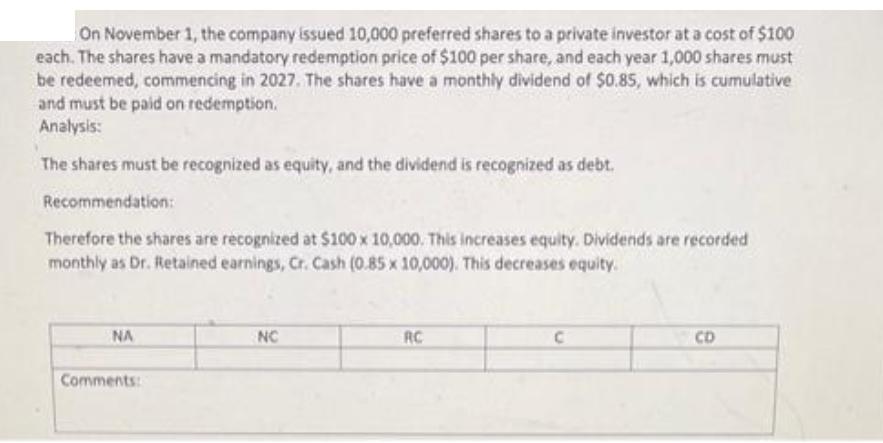

On November 1, the company issued 10,000 preferred shares to a private investor at a cost of $100 each. The shares have a mandatory redemption price of $100 per share, and each year 1,000 shares must be redeemed, commencing in 2027. The shares have a monthly dividend of $0.85, which is cumulative and must be paid on redemption. Analysis: The shares must be recognized as equity, and the dividend is recognized as debt. Recommendation: Therefore the shares are recognized at $100 x 10,000. This increases equity. Dividends are recorded monthly as Dr. Retained earnings, Cr. Cash (0.85 x 10,000). This decreases equity. NA Comments: NC RC C CD

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

NA The issuance of the 10000 preferred shares to a private investor at a cost of 100 each will incre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Loren A. Nikolai, John D. Bazley, Jefferson P. Jones

11th edition

978-0538467087, 9781111781262, 538467088, 1111781265, 978-0324659139

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App