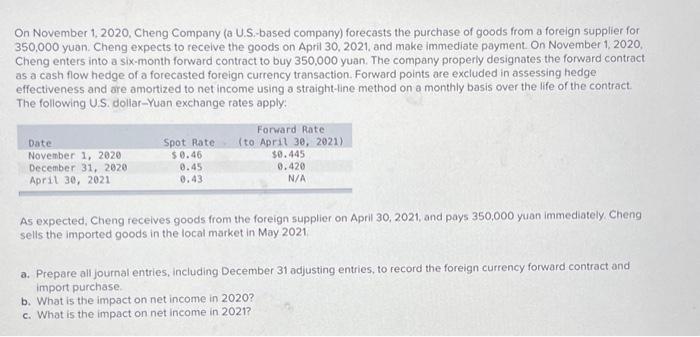

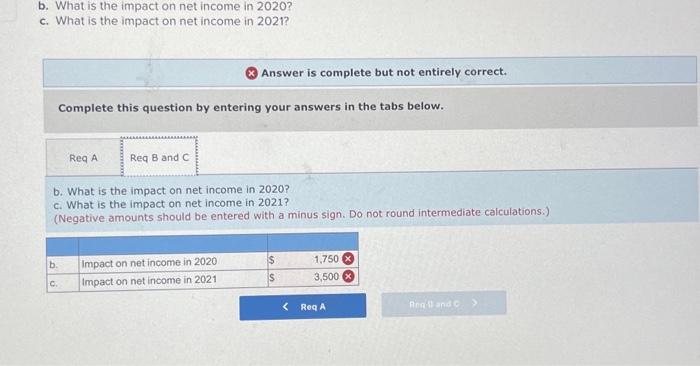

On November 1,2020, Cheng Company (a U.S.-based company) forecasts the purchase of goods from a foreign supplier for 350,000 yuan. Cheng expects to recelve the goods on April 30,2021, and make immediate payment. On November 1,2020, Cheng enters into a six-month forward contract to buy 350,000 yuan. The company properly designates the forward contract as a cash flow hedge of a forecasted foreign currency transaction. Forward points are excluded in assessing hedge effectiveness and are amortized to net income using a straight-line method on a monthly basis over the life of the contract. The following U.S. dollar-Yuan exchange rates apply: As expected, Cheng recelves goods from the foreign supplier on April 30, 2021, and pays 350,000 yuan immediately. Cheng sells the imported goods in the local market in May 2021 a. Prepare all journal entries, including December 31 adjusting entries, to record the foreign currency forward contract and import purchase. b. What is the impact on net income in 2020 ? c. What is the impact on net income in 2021? b. What is the impact on net income in 2020 ? c. What is the impact on net income in 2021? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. b. What is the impact on net income in 2020 ? c. What is the impact on net income in 2021? (Negative amounts should be entered with a minus sign. Do not round intermediate calculations.) On November 1,2020, Cheng Company (a U.S.-based company) forecasts the purchase of goods from a foreign supplier for 350,000 yuan. Cheng expects to recelve the goods on April 30,2021, and make immediate payment. On November 1,2020, Cheng enters into a six-month forward contract to buy 350,000 yuan. The company properly designates the forward contract as a cash flow hedge of a forecasted foreign currency transaction. Forward points are excluded in assessing hedge effectiveness and are amortized to net income using a straight-line method on a monthly basis over the life of the contract. The following U.S. dollar-Yuan exchange rates apply: As expected, Cheng recelves goods from the foreign supplier on April 30, 2021, and pays 350,000 yuan immediately. Cheng sells the imported goods in the local market in May 2021 a. Prepare all journal entries, including December 31 adjusting entries, to record the foreign currency forward contract and import purchase. b. What is the impact on net income in 2020 ? c. What is the impact on net income in 2021? b. What is the impact on net income in 2020 ? c. What is the impact on net income in 2021? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. b. What is the impact on net income in 2020 ? c. What is the impact on net income in 2021? (Negative amounts should be entered with a minus sign. Do not round intermediate calculations.)