Question

) On November 13, 2017, Costco Wholesale Co. had 436,990,000 shares of stock outstanding at a price of $172.29. The beta for Costco was 0.99

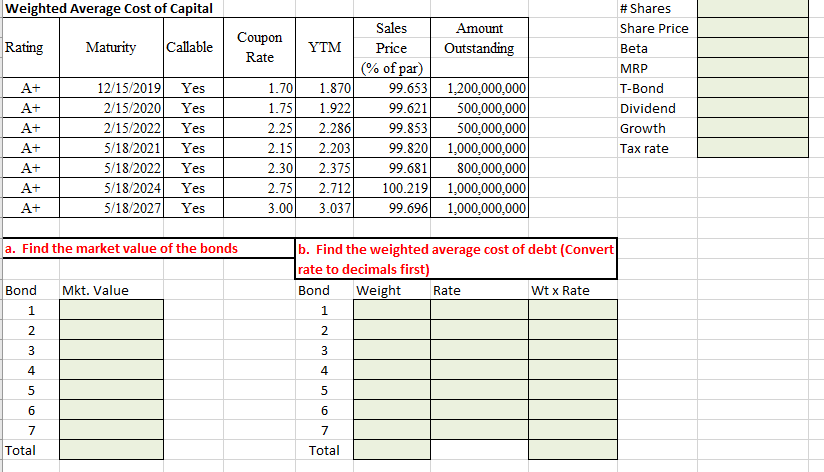

) On November 13, 2017, Costco Wholesale Co. had 436,990,000 shares of stock outstanding at a price of $172.29. The beta for Costco was 0.99 and the market risk premium was estimated at 5 percent. The 30-year T-Bond rate was 2.88 percent. The company currently pays an annual dividend of $2.00 and analysts expect earnings growth of 9.51 percent. The company has a tax rate of 33%. The company also had the following bonds outstanding (all bonds pay interest semi-annually):

a. Find the market value of the bonds.

b. Find the weighted average cost of debt.

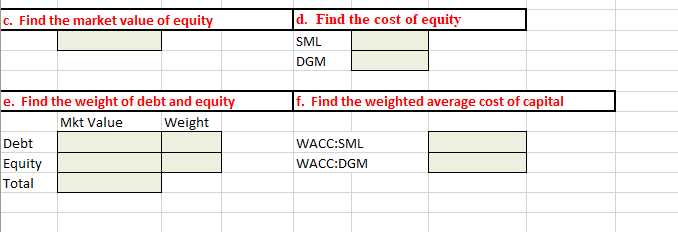

c. Find the market value of equity.

d. Find the cost of equity using the Security Market Line and the Dividend Growth Model.

e. Find the weight of debt and equity.

f. Find the WACC using the SML estimate for equity and the DGM estimate for equity.

# Shares Share Price Beta MRP T-Bond Dividend Growth Tax rate Weighted Average Cost of Capital Sales Maturity CallableCoupon Rate Rating YTM Price Outstanding o of par 12/15/2019Yes 2/15/2020Yes 2/15/2022Yes 5/18/202 Yes 5/18/2022Yes 5/18/2024Yes 5/18/2027Yes 1.70 1.870 1.751.922 2.25 2.286 2.152.203 2.30 2.375 2.75 2.712 3.00 3.037 99.653 1,200,000,000 500,000,000 99.853500,000,000 99.8201.000.000,000 800,000,000 100.219 1000,000,000 99.6961.000.000,000 99.621 99.681 a. Find the market value of the bonds b. Find the weighted average cost of debt (Convert rate to decimals first) Bond Weight Bond Mkt. Value Rate Wt x Rate 2 2 4 4 Total Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started