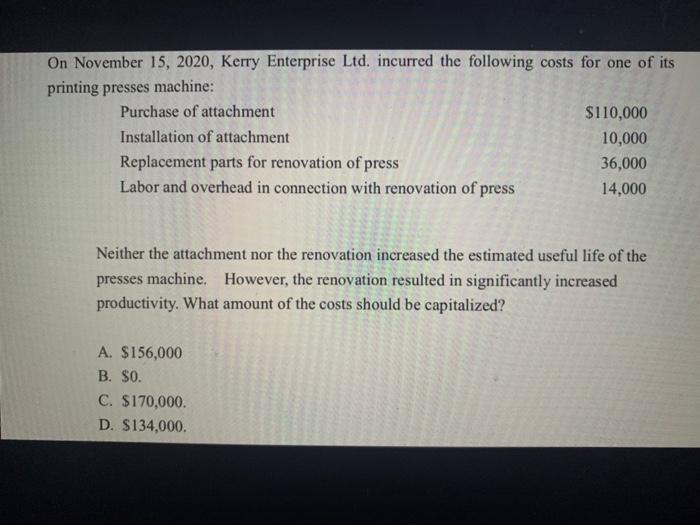

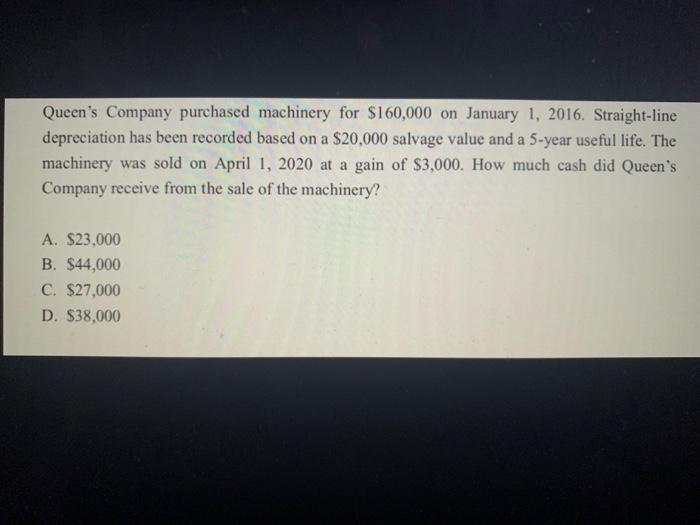

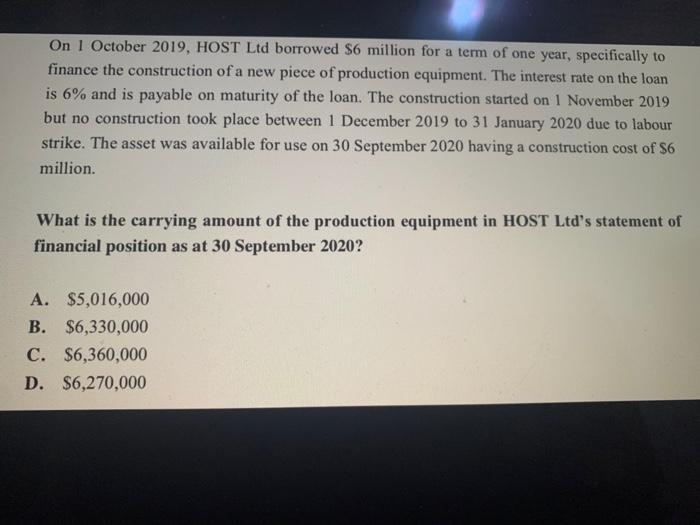

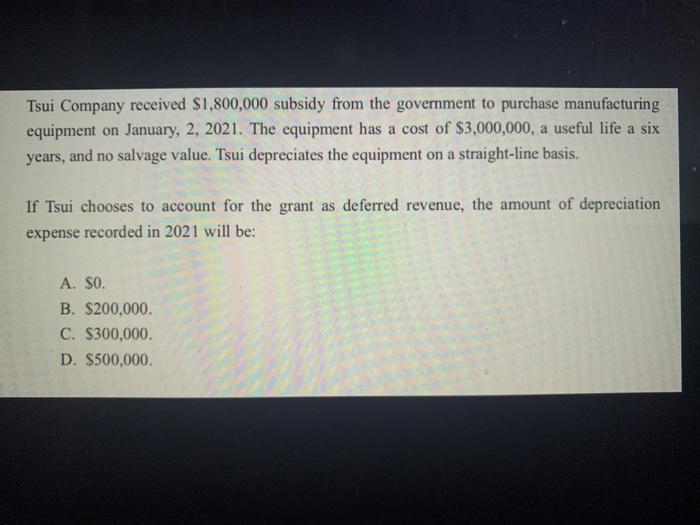

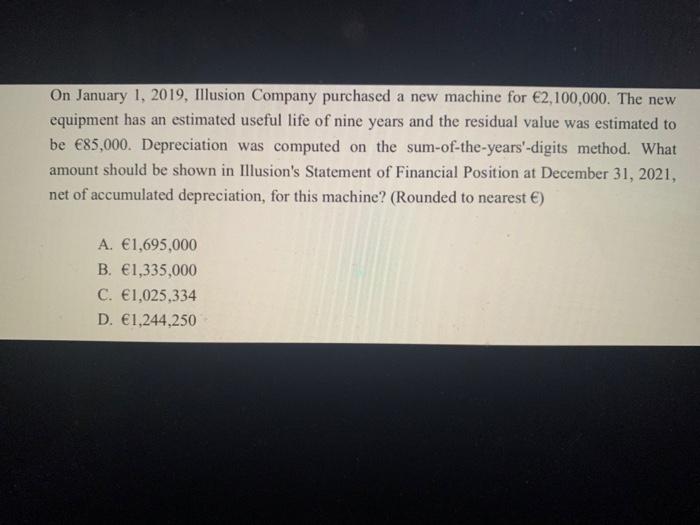

On November 15, 2020, Kerry Enterprise Ltd. incurred the following costs for one of its printing presses machine: Purchase of attachment $110,000 Installation of attachment 10,000 Replacement parts for renovation of press 36,000 Labor and overhead in connection with renovation of press 14,000 Neither the attachment nor the renovation increased the estimated useful life of the presses machine. However, the renovation resulted in significantly increased productivity. What amount of the costs should be capitalized? A. $156,000 B. SO. C. $170,000. D. $134,000. Queen's Company purchased machinery for $160,000 on January 1, 2016. Straight-line depreciation has been recorded based on a $20,000 salvage value and a 5-year useful life. The machinery was sold on April 1, 2020 at a gain of $3,000. How much cash did Queen's Company receive from the sale of the machinery? A. $23.000 B. $44,000 C. $27,000 D. $38,000 On 1 October 2019, HOST Ltd borrowed $6 million for a term of one year, specifically to finance the construction of a new piece of production equipment. The interest rate on the loan is 6% and is payable on maturity of the loan. The construction started on 1 November 2019 but no construction took place between 1 December 2019 to 31 January 2020 due to labour strike. The asset was available for use on 30 September 2020 having a construction cost of $6 million. What is the carrying amount of the production equipment in HOST Ltd's statement of financial position as at 30 September 2020? A. $5,016,000 B. $6,330,000 C. $6,360,000 D. $6,270,000 Tsui Company received $1,800,000 subsidy from the government to purchase manufacturing equipment on January, 2, 2021. The equipment has a cost of $3,000,000, a useful life a six years, and no salvage value. Tsui depreciates the equipment on a straight-line basis. If Tsui chooses to account for the grant as deferred revenue, the amount of depreciation expense recorded in 2021 will be: A. SO. B. $200,000 C. $300,000 D. $500,000 On January 1, 2019, Illusion Company purchased a new machine for 2,100,000. The new equipment has an estimated useful life of nine years and the residual value was estimated to be 85,000. Depreciation was computed on the sum-of-the-years'-digits method. What amount should be shown in Illusion's Statement of Financial Position at December 31, 2021, net of accumulated depreciation, for this machine? (Rounded to nearest ) A. 1,695,000 B. 1,335,000 C. 1,025,334 D. 1,244,250