Question

On November 30, 2020, the general ledger accounts of the Wyatt Consulting Corporation had the following balances: Cash $124,000 Accounts Receivable $167,000 Office Supplies Inventory

On November 30, 2020, the general ledger accounts of the Wyatt Consulting Corporation had the following balances:

On November 30, 2020, the general ledger accounts of the Wyatt Consulting Corporation had the following balances:

| Cash | $124,000 |

| Accounts Receivable | $167,000 |

| Office Supplies Inventory | $37,000 |

| Prepaid Insurance | $62,000 |

| Office Equipment | $480,000 |

| Wages Payable | $93,000 |

| Accounts Payable | $26,000 |

| Common Stock | $100,000 |

| Retained Earnings | $509,400 |

| Service Revenue | $715,000 |

| Rent Revenue | $39,000 |

| Interest Revenue | $2,100 |

| Rent Expense | $132,000 |

| Delivery Expense | $5,700 |

| Advertising Expense | $16,200 |

| Office Supplies Expense | $56,000 |

| Office Utilities Expense | $21,600 |

| Wages Expense | $383,000 |

Closing the Books Tasks

A) Record the opening account balances in "T" accounts. Key November 30th balances with a check mark ().

B) The transactions for the month of December are listed below. Record these transactions directly in the "T" accounts. Label each transaction, as you record it, by listing the number identifying the transaction at the left of each debit and the right of each credit.

- Cash was collected on accounts receivable, $96,000

- Office supplies were purchased on account, $27,000

- An account payable was settled by giving a note payable, $15,500

- Wages previously accrued were paid in the amount of $76,000

- The rent was paid for the months of December and January, totaling $24,000

- Delivery expenses paid in cash, $1,600

- The month's advertising bill was received (but not paid), $1,100

- Rent revenue for December was received from a sub-tenant, $3,000

- A dividend was declared and paid on December 30 in the amount of $40,000

- A past due account was collected, $800, plus interest of $17

- Insurance remaining unexpired at the end of December, $18,000

- A summary of transactions for the month: service sales on account, $68,000; cash sales, $41,000; cash received on accounts receivable, $103,000

- Wages accrued since last payday, $34,000

- Gas and electricity bills for the office for December were received but not paid, $4,500

- Supplies inventory as of December 31 was $9,000

- The office equipment was purchased on January 1, 2020. It was expected to last 8 years and have no residual value. Depreciation is recorded for the year 2020.

- Taxes for the current year totaling $28,000 will be paid on March 15th of the following year.

C) Close all temporary accounts. Key closing entries with letters C1, C2, C3, etc.

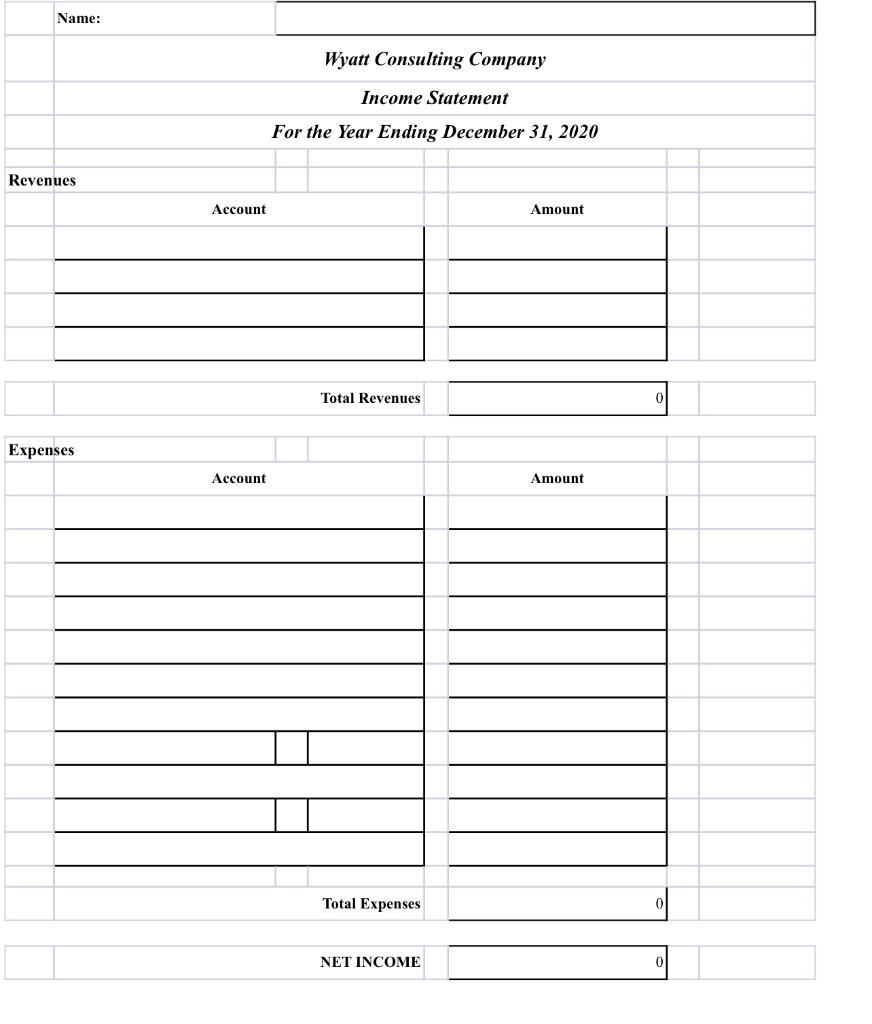

D) Prepare a balance sheet as of December 31, 2020, and an income statement for the year 2020.

Name: Wyatt Consulting Company Income Statement For the Year Ending December 31, 2020 Revenues Account Amount Total Revenues Expenses Account Amount Total Expenses NET INCOME 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started