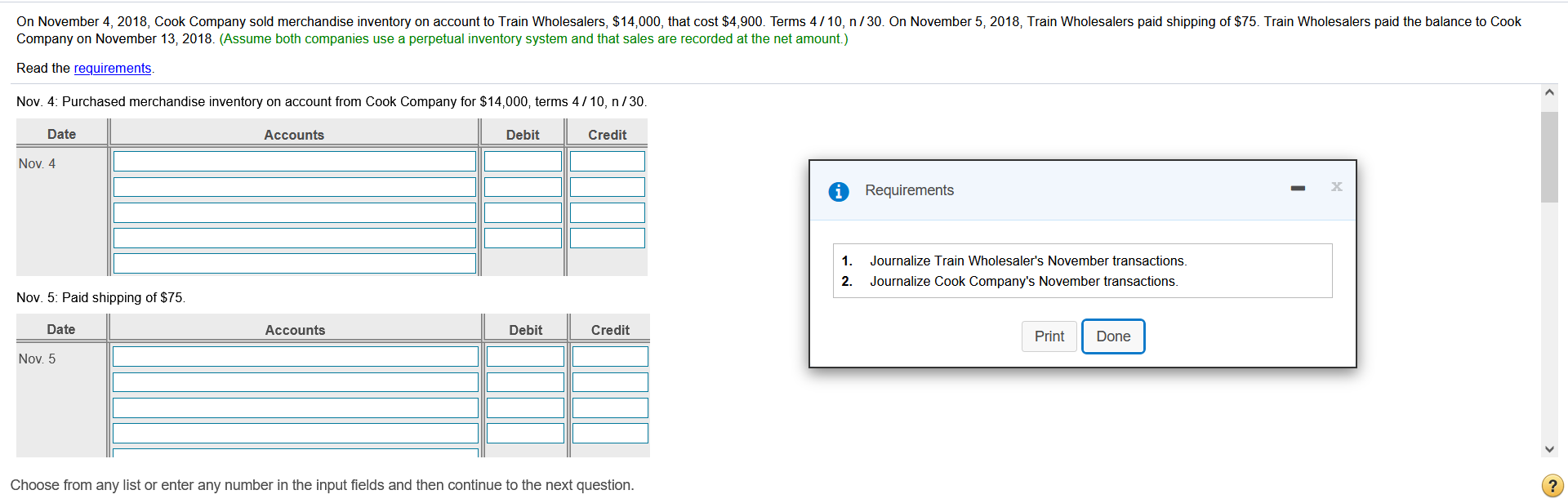

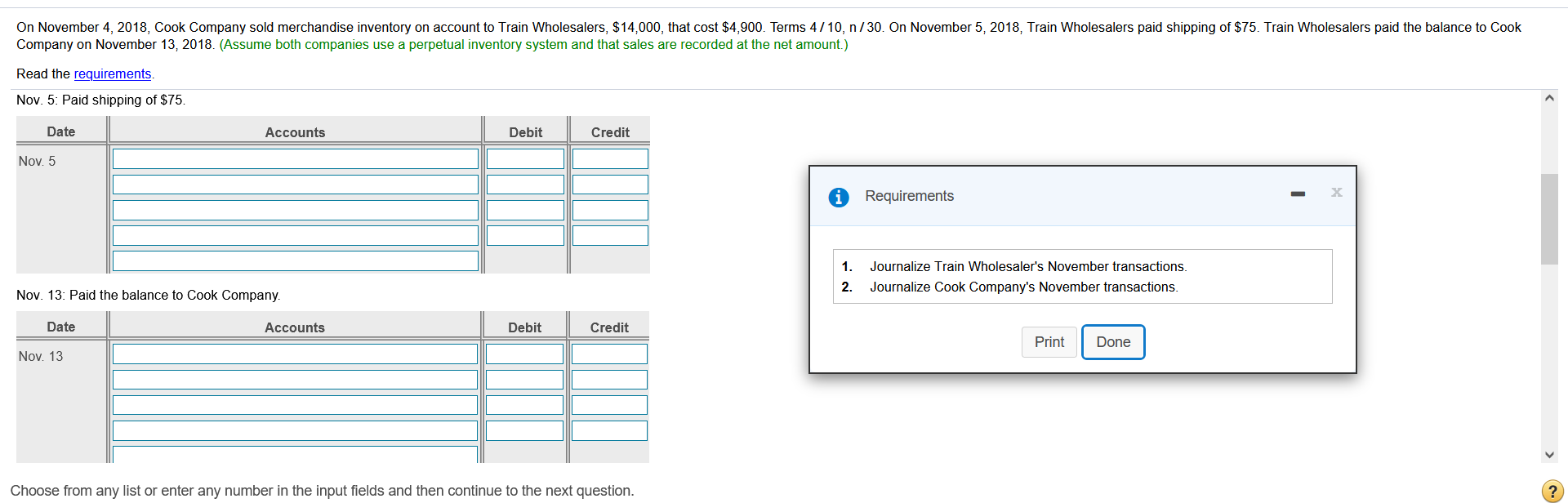

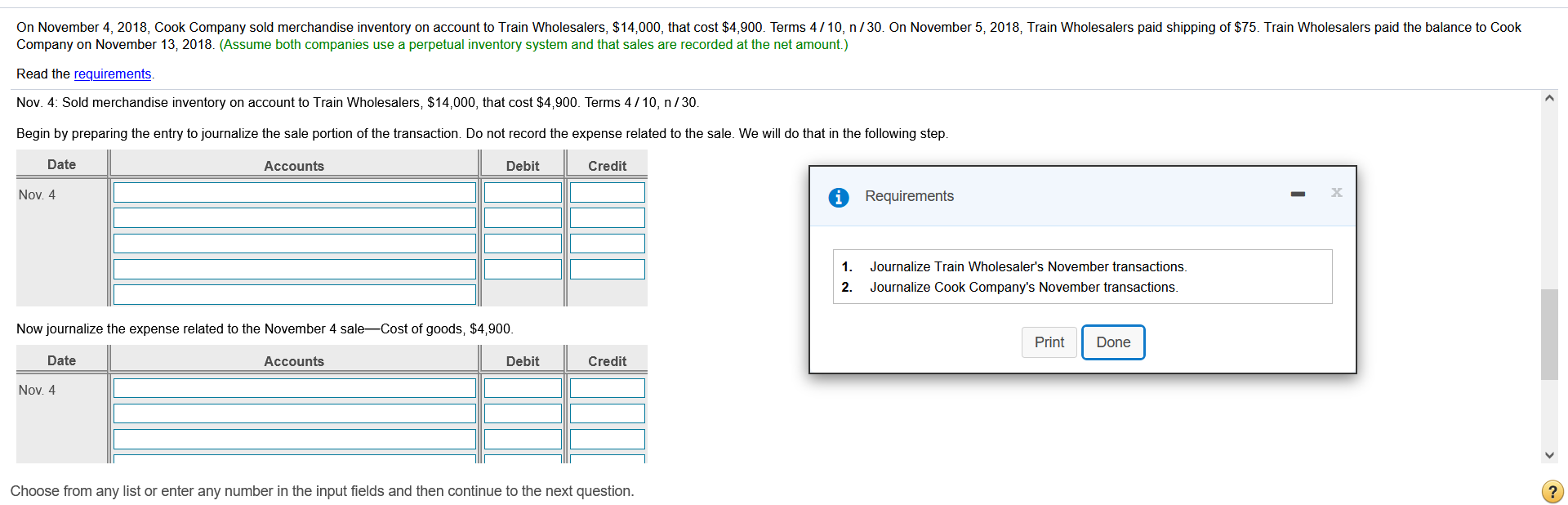

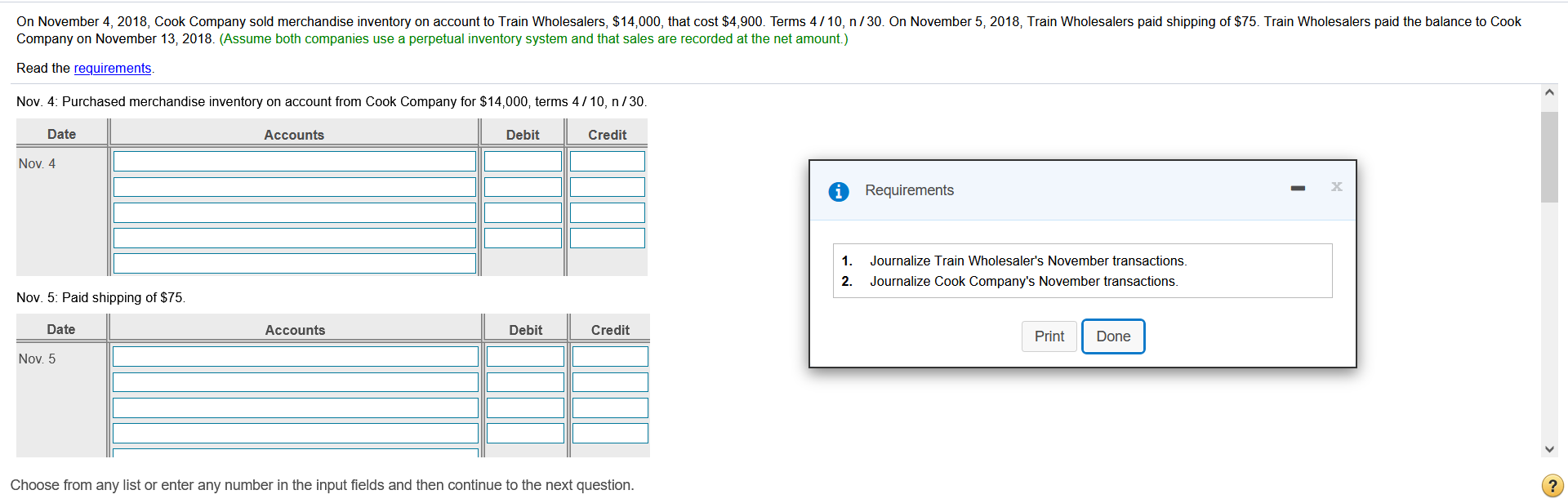

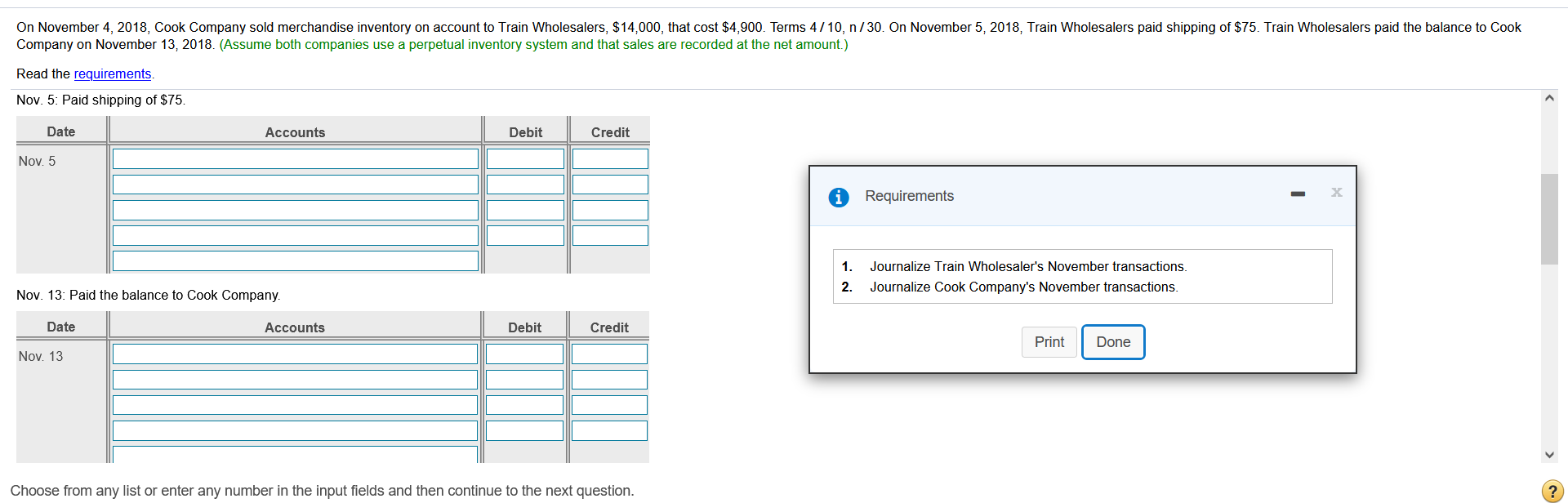

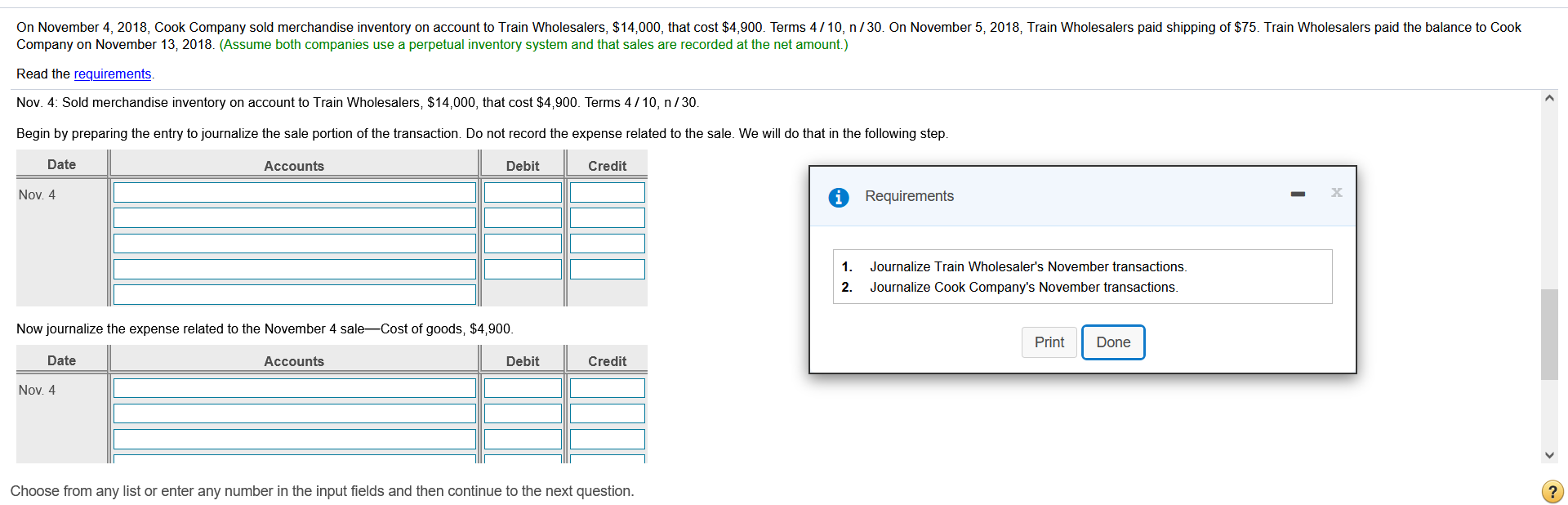

On November 4, 2018, Cook Company sold merchandise inventory on account to Train Wholesalers, $14,000, that cost $4,900. Terms 4/10, n/30. On November 5, 2018, Train Wholesalers paid shipping of $75. Train Wholesalers paid the balance to Cook Company on November 13, 2018. (Assume both companies use a perpetual inventory system and that sales are recorded at the net amount.) Read the requirements. Nov. 4: Purchased merchandise inventory on account from Cook Company for $14,000, terms 4/10, n/30 Date Accounts Debit Credit Nov. 4 Requirements 1. Journalize Train Wholesaler's November transactions Journalize Cook Company's November transactions. 2. Nov. 5: Paid shipping of $75. Date Accounts Debit Credit Print Done Nov. 5 Choose from any list or enter any number in the input fields and then continue to the next question. ? On November 4, 2018, Cook Company sold merchandise inventory on account to Train Wholesalers, $14,000, that cost $4,900. Terms 4/10, n/30. On November 5, 2018, Train Wholesalers paid shipping of $75. Train Wholesalers paid the balance to Cook Company on November 13, 2018. (Assume both companies use a perpetual inventory system and that sales are recorded at the net amount.) Read the requirements Nov. 5: Paid shipping of $75. Date Accounts Debit Credit Nov. 5 Requirements 1. Journalize Train Wholesaler's November transactions Journalize Cook Company's November transactions. 2. Nov. 13: Paid the balance to Cook Company. Date Accounts Debit Credit Print Done Nov. 13 > Choose from any list or enter any number in the input fields and then continue to the next question. On November 4, 2018, Cook Company sold merchandise inventory on account to Train Wholesalers, $14,000, that cost $4,900. Terms 4/10, n/30. On November 5, 2018, Train Wholesalers paid shipping of $75. Train Wholesalers paid the balance to Cook Company on November 13, 2018. (Assume both companies use a perpetual inventory system and that sales are recorded at the net amount.) Read the requirements Nov. 4: Sold merchandise inventory on account to Train Wholesalers, $14,000, that cost $4,900. Terms 4/10, n/30. Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. Date Accounts Debit Credit Nov. 4 Requirements 1. Journalize Train Wholesaler's November transactions Journalize Cook Company's November transactions. 2. Now journalize the expense related to the November 4 saleCost of goods, $4,900. Print Done Date Accounts Debit Credit Nov. 4 > Choose from any list or enter any number in the input fields and then continue to the next question. ? On November 4, 2018, Cook Company sold merchandise inventory on account to Train Wholesalers, $14,000, that cost $4,900. Terms 4/10, n/30. On November 5, 2018, Train Wholesalers paid shipping of $75. Train Wholesalers paid the balance to Cook Company on November 13, 2018. (Assume both companies use a perpetual inventory system and that sales are recorded at the net amount.) Read the requirements. Now journalize the expense related to the November 4 sale-Cost of goods, $4,900. Date Accounts Debit Credit Nov. 4 Requirements 1. Journalize Train Wholesaler's November transactions. Journalize Cook Company's November transactions. 2. Nov. 13: Train Wholesalers paid the balance to Cook Company. Date Accounts Debit Credit Print Done Nov. 13 Choose from any list or enter any number in the input fields and then continue to the next