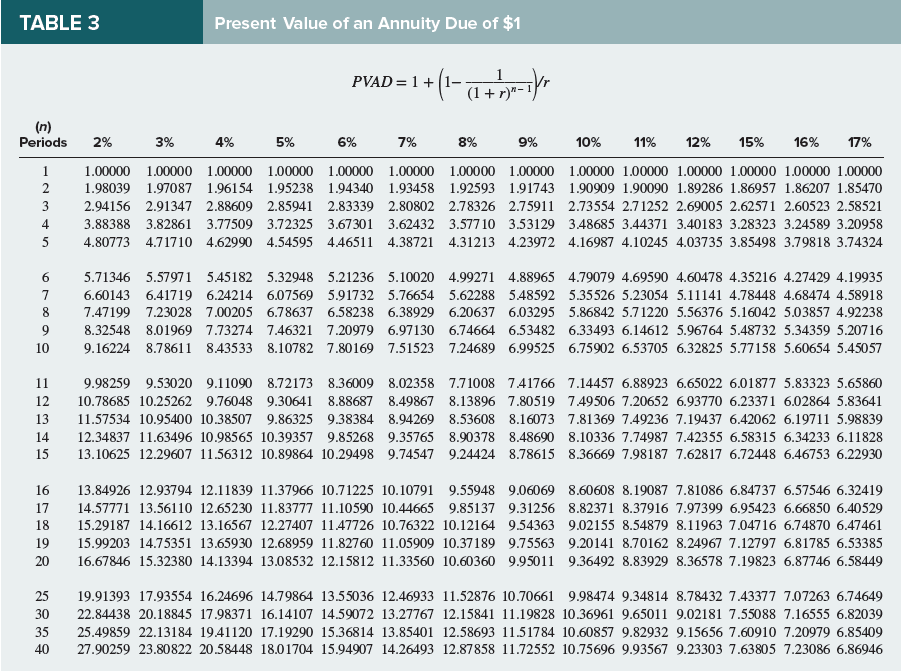

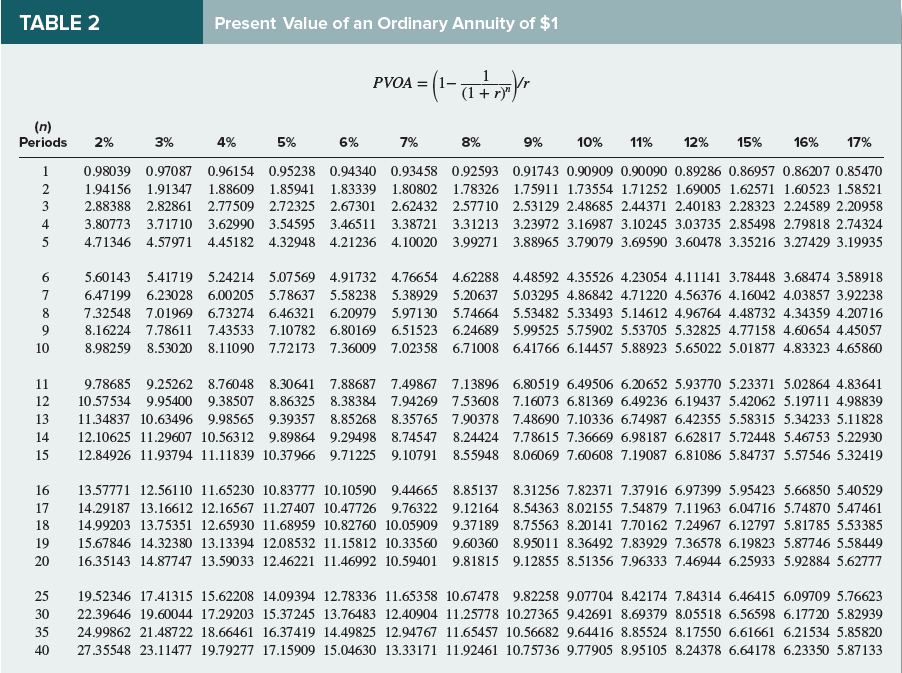

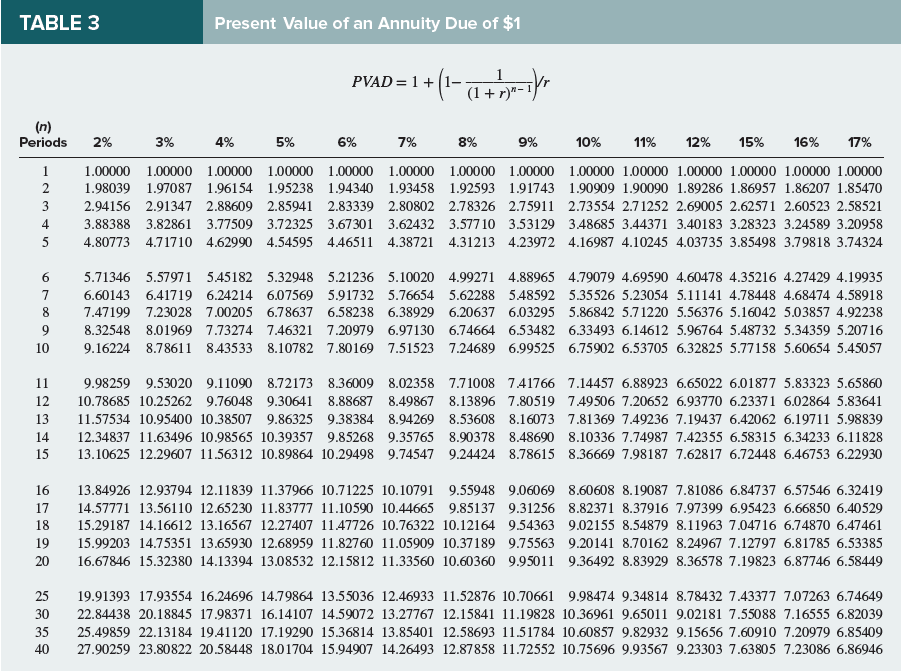

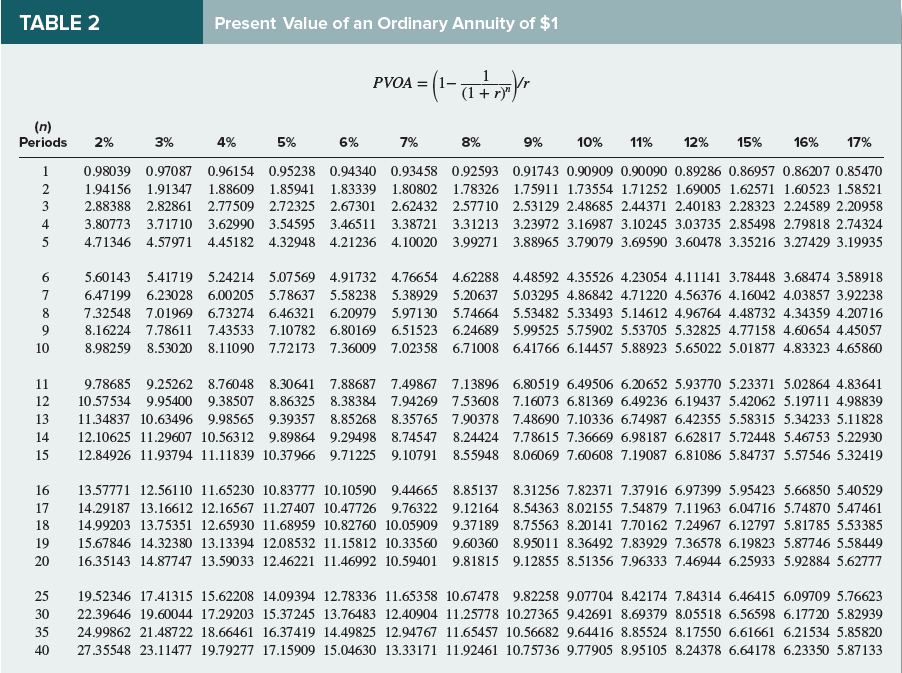

On October 1, 2017, Vaughn, Inc., leased a machine from Fell Leasing Company for five years. The lease requires five annual payments of $10,000 beginning September 30, 2018. Vaughns incremental borrowing rate is 11%, and it uses a calendar year for reporting purposes. The machine has a 12-year economic life with zero salvage value. Vaughn correctly classifies the lease as an operating lease under ASU 2016-02. Using (PV of 1, PVAD of 1, and PVOA of 1) (Use the appropriate factor(s) from the tables provided.)

Required:

1. At what amount should Vaughn record the leased equipment on October 1, 2017? (Round your answer to the nearest whole dollar.)

2. What is the amount of rent expense that Vaughn should record for the year ended December 31, 2017, and for the year ended December 31, 2018?

3. How much of the lease liability should be classified as current on December 31, 2017, and December 31, 2018? (Round your intermediate calculations and final answers to 2 decimal places.)

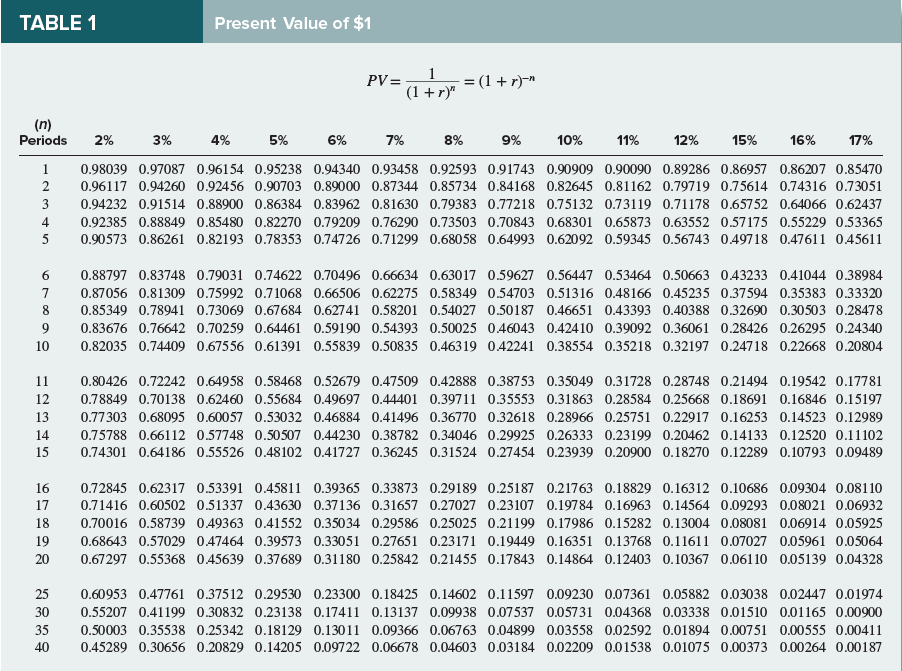

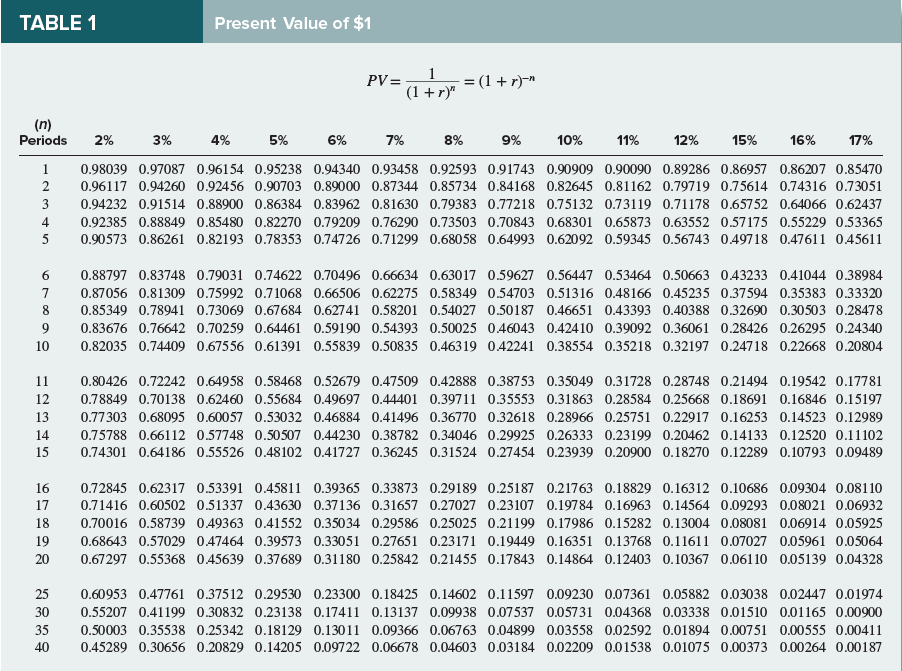

TABLE 1 Present Value of $1 Periods 2% 3% 5% 6% 7% 8% 9% 10% 11% 12% 15% 16% 17% 1 0.98039 0.97087 0.96154 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.86957 0.86207 0.85470 2 0.96117 0.94260 0.92456 0.90703 0.89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 0.75614 0.74316 0.73051 3 0.94232 0.91514 0.88900 0.86384 0.83962 0.81630 0.79383 0.77218 0.75132 0.73119 0.71178 0.65752 0.64066 0.62437 4 0.92385 0.88849 0.85480 0.82270 0.79209 0.76290 0.73503 0.70843 0.68301 0.65873 0.63552 057175 0.55229 0.53365 5 0.90573 0.86261 0.82193 0.78353 0.74726 0.71299 0.68058 0.64993 0.62092 0.59345 0.56743 049718 0.47611 045611 6 0.88797 0.83748 0.79031 0.74622 0.70496 0.66634 0.63017 0.59627 0.56447 0.534640.50663 043233 0.41044 0.38984 7 0.87056 0.81309 0.75992 0.71068 0.66506 0.62275 0.58349 0.54703 0.51316 0.48166 0.45235 0.37594 0.35383 0.33320 8 0.85349 0.78941 0.73069 0.67684 0.62741 0.58201 0.54027 0.50187 0.46651 0.43393 0.40388 0.32690 0.30503 0.28478 9 0.83676 0.76642 0.70259 0.64461 0.59190 0.54393 0.50025 046043 0.42410 0.39092 0.36061 0.28426 0.26295 0.24340 10 0.82035 0.74409 0.67556 0.61391 0.55839 0.50835 0.46319 042241 0.38554 0.35218 0.32197 0.24718 0.22668 0.20804 11 0.80426 0.72242 0.64958 0.58468 0.52679 0.47509 0.42888 0.38753 0.35049 0.31728 0.28748 0.21494 0.19542 0.17781 12 0.78849 0.70138 0.62460 0.55684 0.49697 0.44401 0.39711 0.35553 0.31863 0.28584 0.25668 0.18691 0.16846 0.15197 13 0.77303 0.680950.60057 0.53032 0.46884 0.41496 0.36770 0.32618 0.28966 0.25751 0.22917 0.16253 0.14523 0.12989 14 0.75788 0.66112 0.57748 0.50507 0.44230 0.38782 0.34046 0.29925 0.26333 0.23199 0.20462 0.14133 0.12520 0.11102 15 0.74301 0.64186 0.55526 0.48102 0.41727 0.36245 0.31524 0.27454 0.23939 0.20900 0.18270 0.12289 0.10793 0.09489 16 0.72845 0.623170.53391 0.45811 0.39365 0.33873 0.29189 0.25187 0.21763 0.18829 0.16312 0.10686 0.09304 0.08110 17 0.71416 0.60502 0.51337 0.43630 0.37136 0.31657 0.27027 0.23107 0.19784 0.16963 0.14564 0.09293 0.08021 0.06932 18 0.70016 0.58739 049363 0.41552 0.35034 0.29586 0.25025 0.21199 0.17986 0.15282 0.13004 0.08081 0.06914 0.05925 19 0.68643 0.57029 047464 0.39573 0.33051 0.27651 0.23171 0.19449 0.16351 0.13768 0.11611 0.07027 0.05961 0.05064 20 0.67297 0.55368 045639 0.37689 0.31180 0.25842 0.21455 0.17843 0.14864 0.12403 0.10367 0.06110 0.05139 0.04328 25 0.60953 0.47761 0.37512 0.29530 0.23300 0.18425 0.14602 0.11597 0.09230 0.07361 0.05882 0.03038 002447 0.01974 30 0.55207 0.41199 0.30832 0.23138 0.17411 0.13137 0.09938 0.07537 0.05731 0.04368 0.03338 0.01510 0.01165 0.00900 35 0.50003 0.35538 0.25342 0.18129 0.13011 0.09366 0.06763 0.04899 0.03558 0.02592 0.01894 0.00751 0.00555 0.00411 40 0.45289 0.30656 0.20829 0.14205 0.09722 0.06678 0.04603 0.03184 0.02209 0.01538 0.01075 0.00373 0.00264 0.00187