On October 1, 2018, Jarvis Co. sold widgets to a customer in a foreign country, denominated in 100,000 local currency units (LCU). Collection of the cash (in LCU) is expected in four months. The widgets cost $40,000 for Jarvis to make. On October 1, 2018, a forward exchange contract was acquired whereby Jarvis Co. was to pay 100,000 LCU in four months (on February 1, 2019) and receive $78,000 in U.S. dollars. The spot and forward rates for the LCU were as follows: Can you write each step clearly and step by step of how can you get the forward rate?

Can you write each step clearly and step by step of how can you get the forward rate?

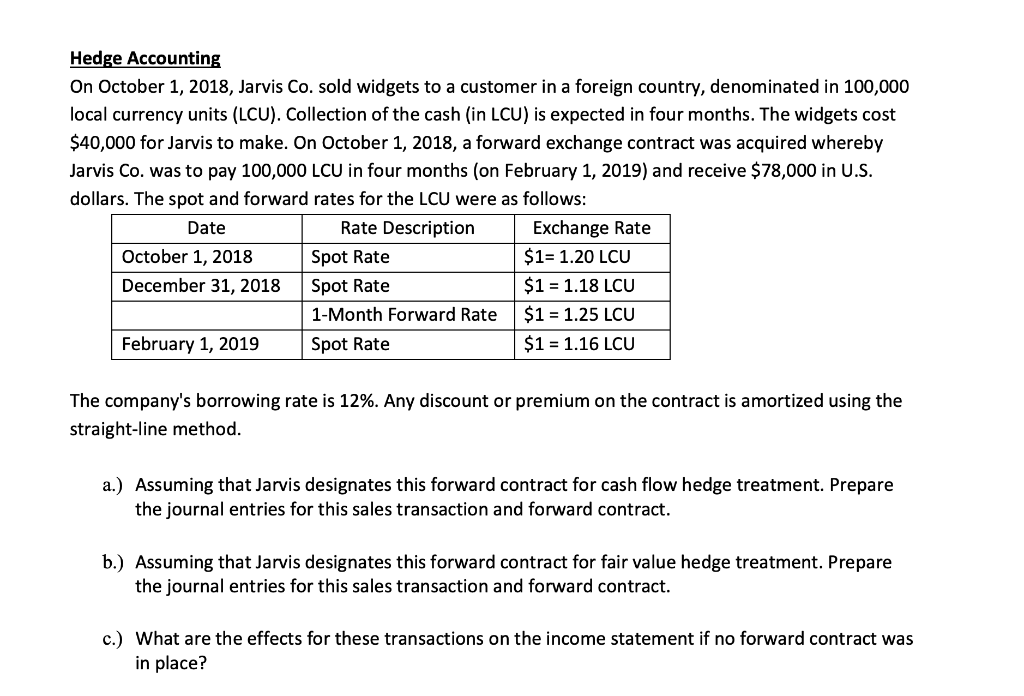

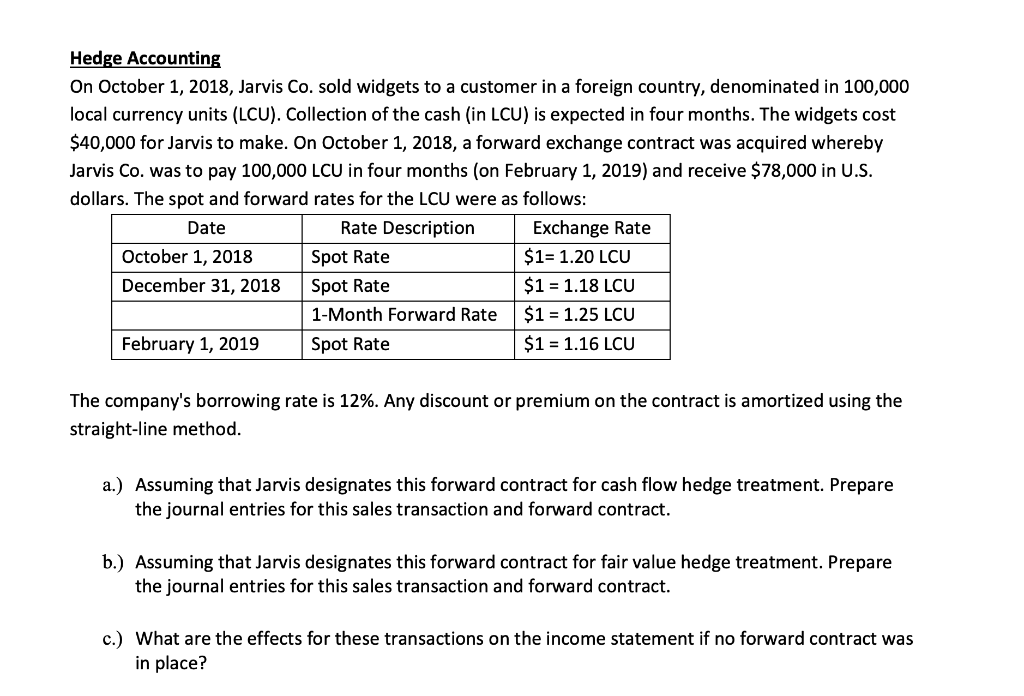

Hedge Accounting On October 1, 2018, Jarvis Co. sold widgets to a customer in a foreign country, denominated in 100,000 local currency units (LCU). Collection of the cash (in LCU) is expected in four months. The widgets cost $40,000 for Jarvis to make. On October 1, 2018, a forward exchange contract was acquired whereby Jarvis Co. was to pay 100,000 LCU in four months (on February 1, 2019) and receive $78,000 in U.S. dollars. The spot and forward rates for the LCU were as follows: Date Rate Description Exchange Rate $1= 1.20 LCU October 1, 2018 Spot Rate December 31, 2018 Spot Rate $1 = 1.18 LCU 1-Month Forward Rate $1 = 1.25 LCU February 1, 2019 Spot Rate $1 = 1.16 LCU The company's borrowing rate is 12%. Any discount or premium on the contract is amortized using the straight-line method. a.) Assuming that Jarvis designates this forward contract for cash flow hedge treatment. Prepare the journal entries for this sales transaction and forward contract. b.) Assuming that Jarvis designates this forward contract for fair value hedge treatment. Prepare the journal entries for this sales transaction and forward contract. c.) What are the effects for these transactions on the income statement if no forward contract was in place? Hedge Accounting On October 1, 2018, Jarvis Co. sold widgets to a customer in a foreign country, denominated in 100,000 local currency units (LCU). Collection of the cash (in LCU) is expected in four months. The widgets cost $40,000 for Jarvis to make. On October 1, 2018, a forward exchange contract was acquired whereby Jarvis Co. was to pay 100,000 LCU in four months (on February 1, 2019) and receive $78,000 in U.S. dollars. The spot and forward rates for the LCU were as follows: Date Rate Description Exchange Rate $1= 1.20 LCU October 1, 2018 Spot Rate December 31, 2018 Spot Rate $1 = 1.18 LCU 1-Month Forward Rate $1 = 1.25 LCU February 1, 2019 Spot Rate $1 = 1.16 LCU The company's borrowing rate is 12%. Any discount or premium on the contract is amortized using the straight-line method. a.) Assuming that Jarvis designates this forward contract for cash flow hedge treatment. Prepare the journal entries for this sales transaction and forward contract. b.) Assuming that Jarvis designates this forward contract for fair value hedge treatment. Prepare the journal entries for this sales transaction and forward contract. c.) What are the effects for these transactions on the income statement if no forward contract was in place

Can you write each step clearly and step by step of how can you get the forward rate?

Can you write each step clearly and step by step of how can you get the forward rate?