Answered step by step

Verified Expert Solution

Question

1 Approved Answer

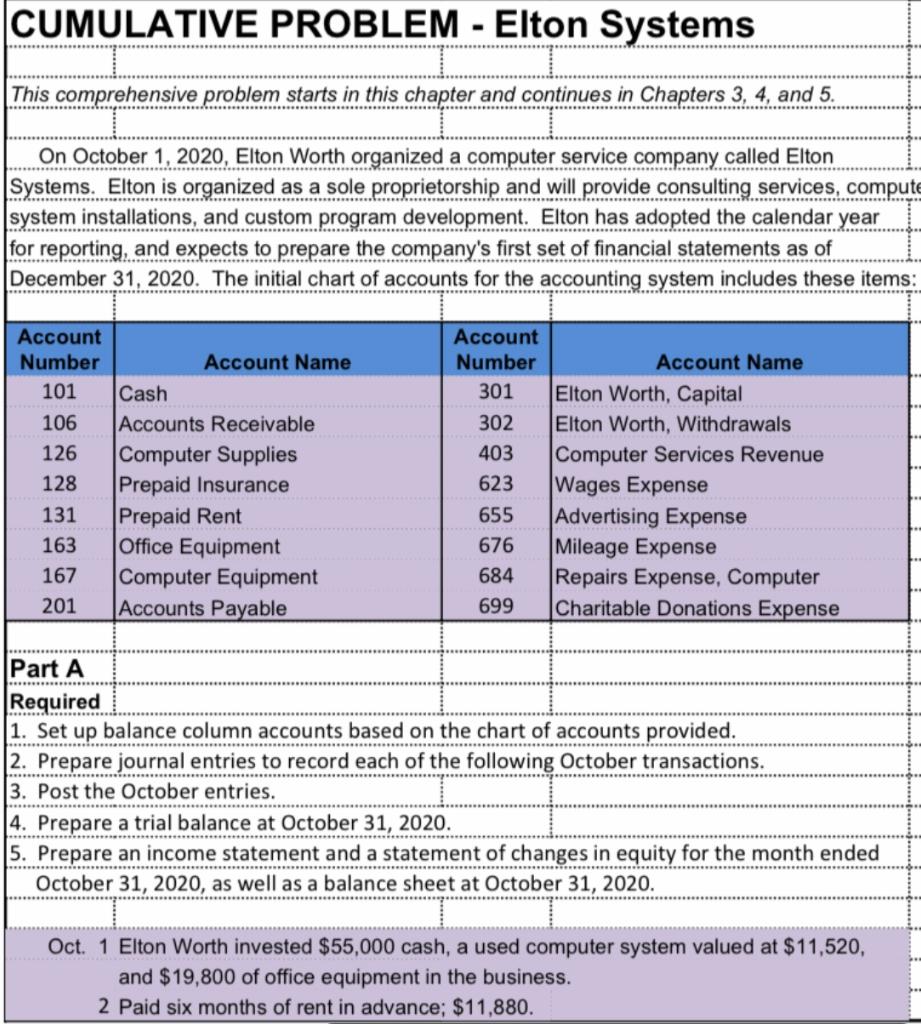

CUMULATIVE PROBLEM - Elton Systems This comprehensive problem starts in this chapter and continues in Chapters 3, 4, and 5. ************** ******** ********** H

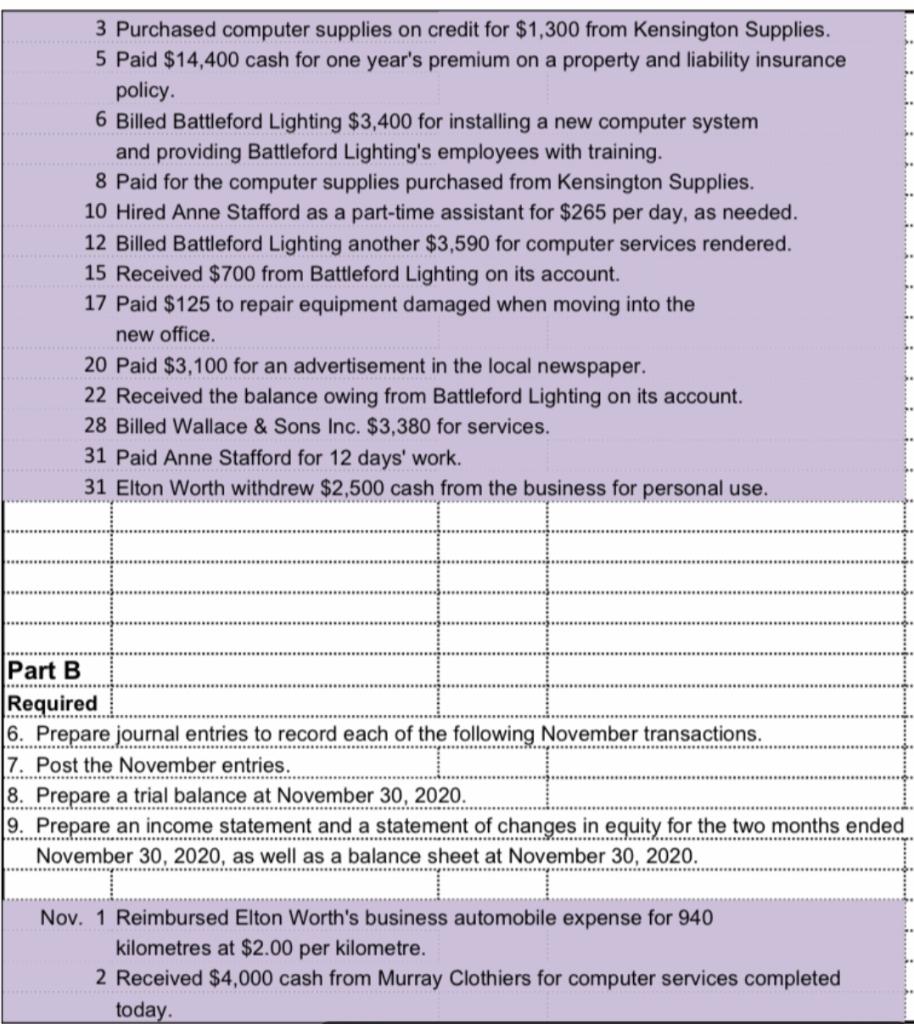

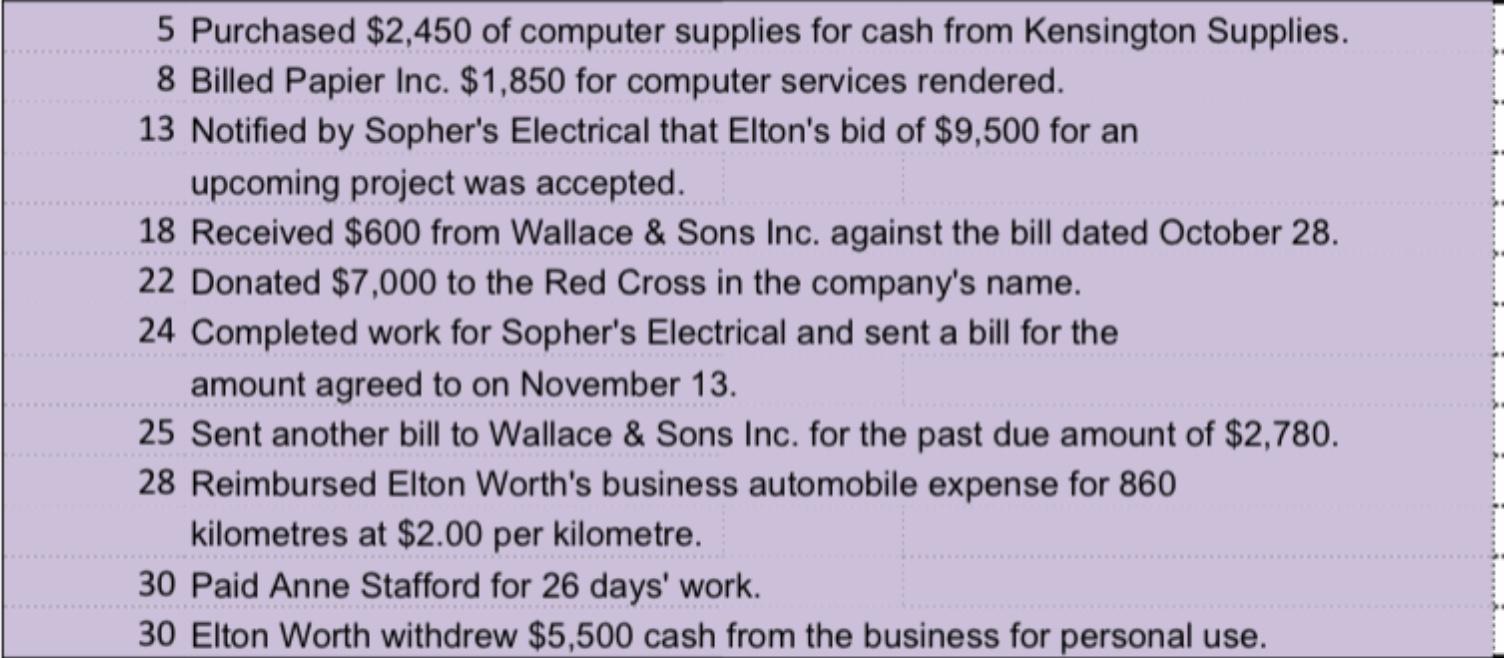

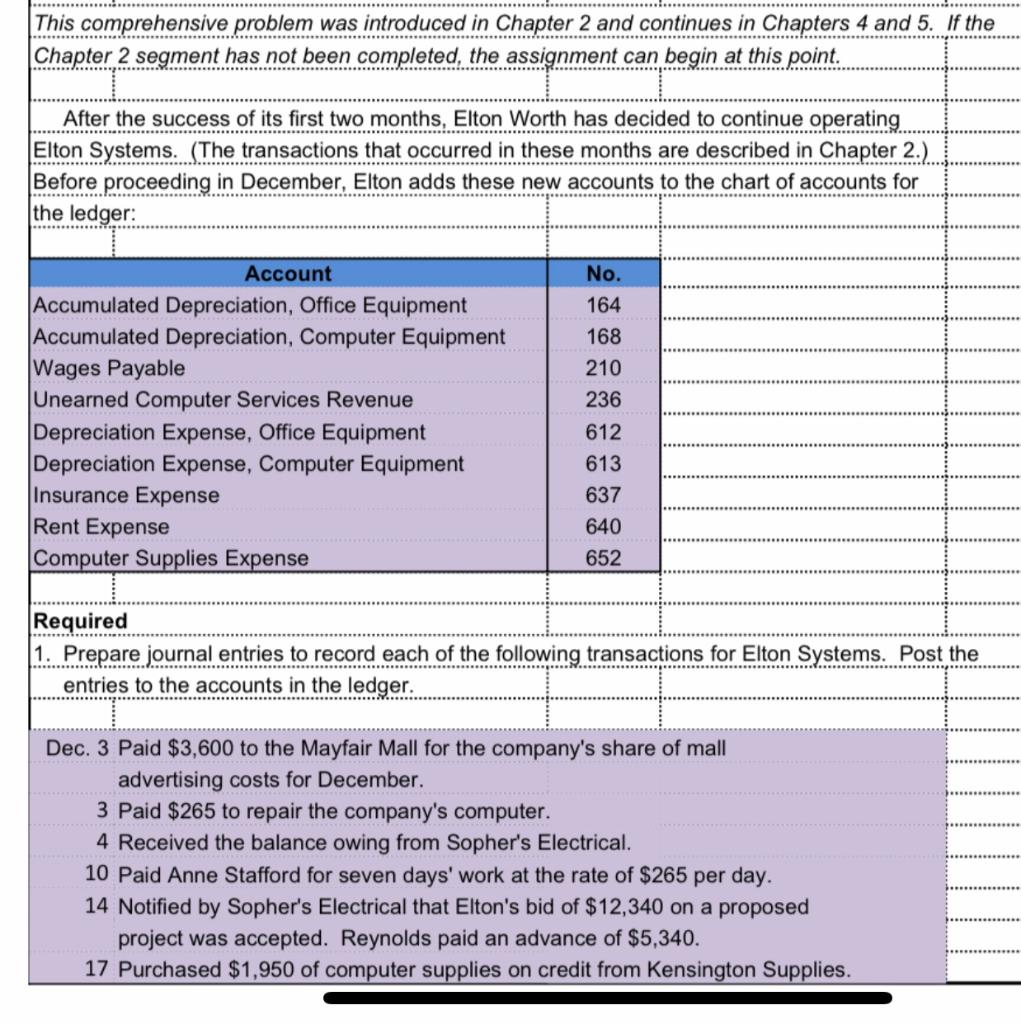

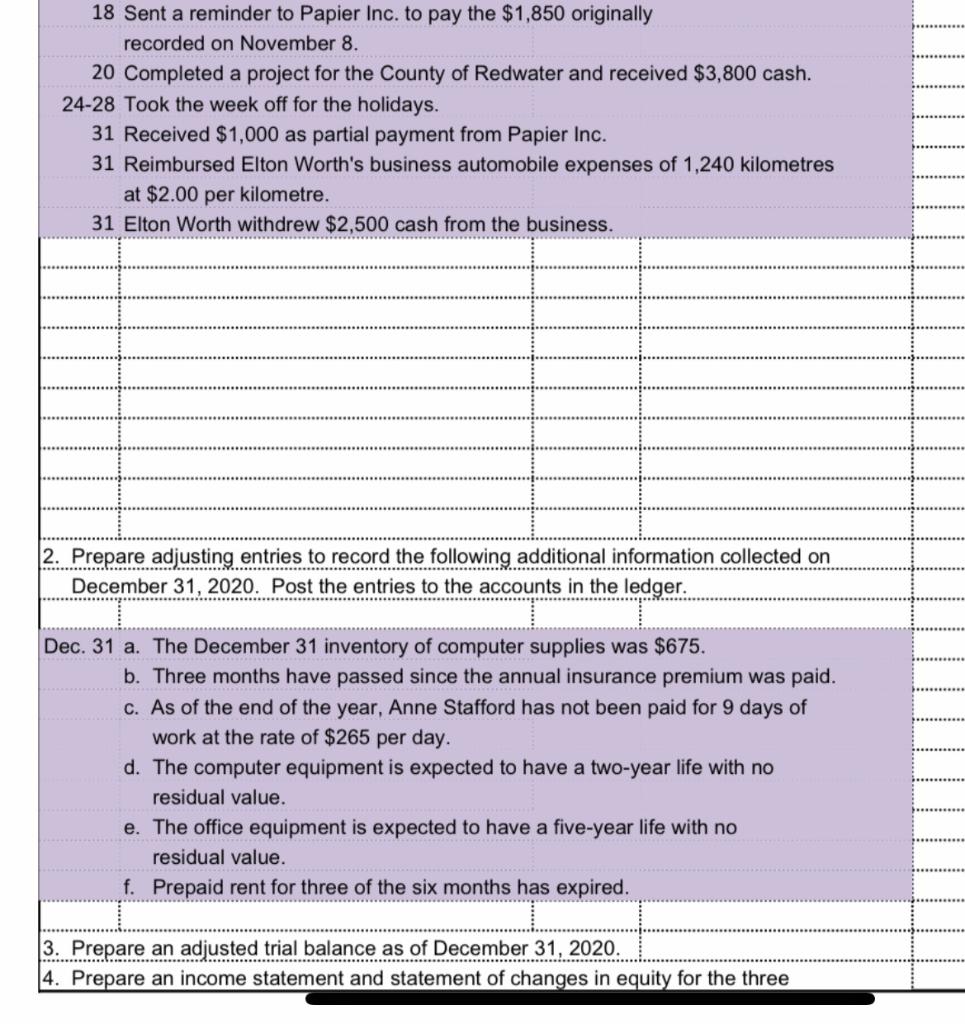

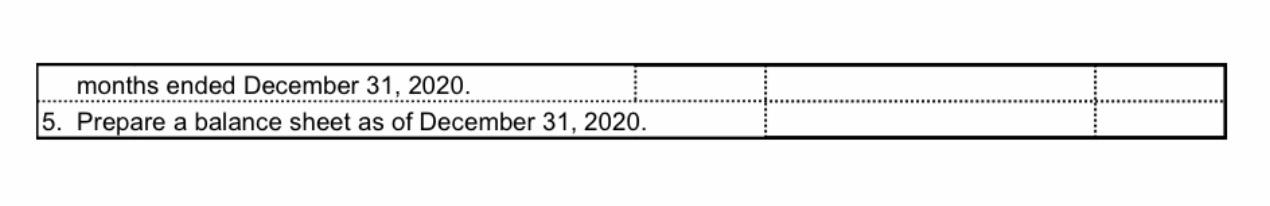

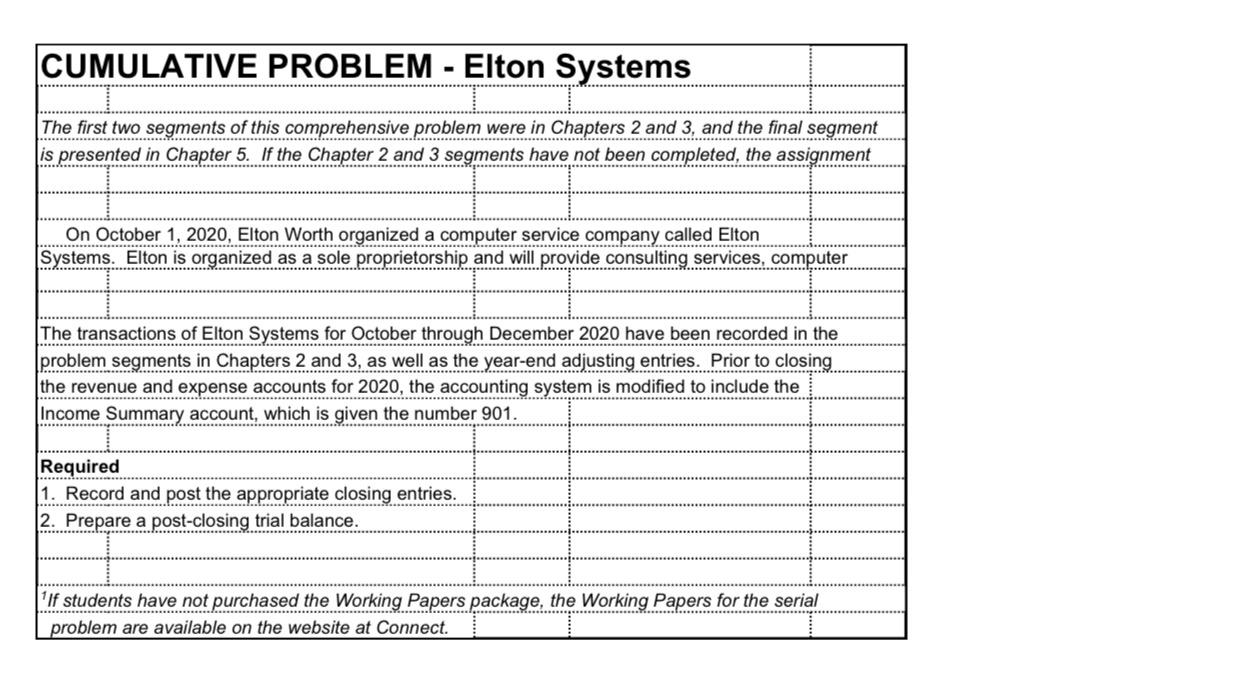

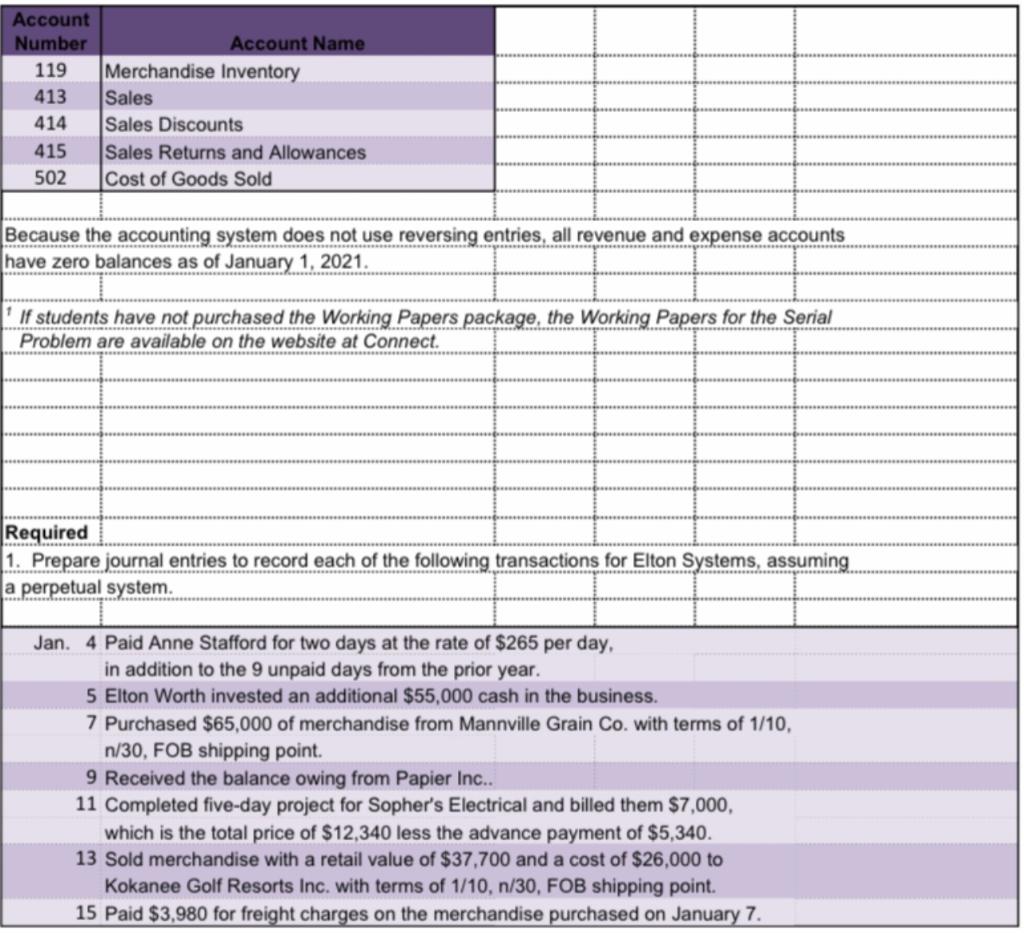

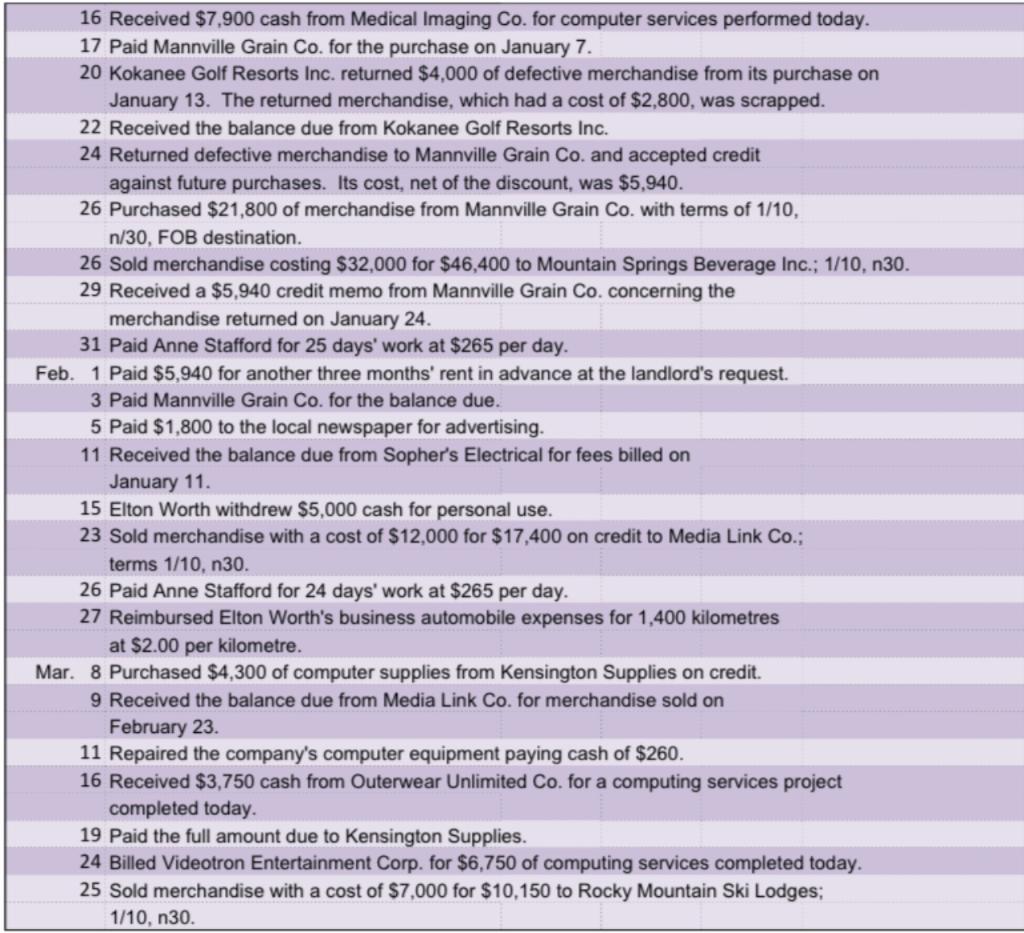

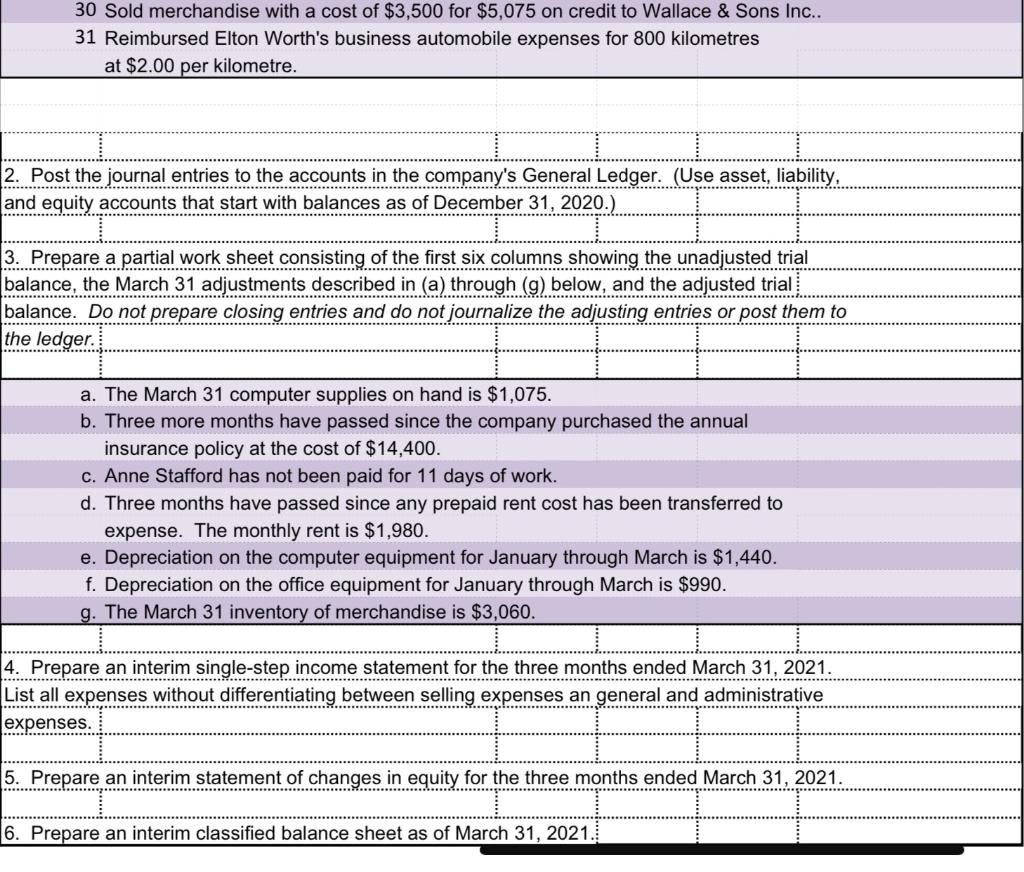

CUMULATIVE PROBLEM - Elton Systems This comprehensive problem starts in this chapter and continues in Chapters 3, 4, and 5. ************** ******** ********** H On October 1, 2020, Elton Worth organized a computer service company called Elton Systems. Elton is organized as a sole proprietorship and will provide consulting services, compute system installations, and custom program development. Elton has adopted the calendar year for reporting, and expects to prepare the company's first set of financial statements as of December 31, 2020. The initial chart of accounts for the accounting system includes these items: Account Number 101 106 126 128 131 163 167 201 Account Name Cash Accounts Receivable Computer Supplies Prepaid Insurance Prepaid Rent Office Equipment Computer Equipment Accounts Payable Account Number 301 302 403 623 655 676 684 699 Account Name Elton Worth, Capital Elton Worth, Withdrawals Computer Services Revenue Wages Expense Advertising Expense Mileage Expense Repairs Expense, Computer Charitable Donations Expense Part A Required 1. Set up balance column accounts based on the chart of accounts provided. 2. Prepare journal entries to record each of the following October transactions. 3. Post the October entries. 4. Prepare a trial balance at October 31, 2020. 5. Prepare an income statement and a statement of changes in equity for the month ended October 31, 2020, as well as a balance sheet at October 31, 2020. Oct. 1 Elton Worth invested $55,000 cash, a used computer system valued at $11,520, and $19,800 of office equipment in the business. 2 Paid six months of rent in advance; $11,880. 3 Purchased computer supplies on credit for $1,300 from Kensington Supplies. 5 Paid $14,400 cash for one year's premium on a property and liability insurance policy. 6 Billed Battleford Lighting $3,400 for installing a new computer system and providing Battleford Lighting's employees with training. 8 Paid for the computer supplies purchased from Kensington Supplies. 10 Hired Anne Stafford as a part-time assistant for $265 per day, as needed. 12 Billed Battleford Lighting another $3,590 for computer services rendered. 15 Received $700 from Battleford Lighting on its account. 17 Paid $125 to repair equipment damaged when moving into the new office. 20 Paid $3,100 for an advertisement in the local newspaper. 22 Received the balance owing from Battleford Lighting on its account. 28 Billed Wallace & Sons Inc. $3,380 for services. 31 Paid Anne Stafford for 12 days' work. 31 Elton Worth withdrew $2,500 cash from the business for personal use. Part B Required 6. Prepare journal entries to record each of the following November transactions. 7. Post the November entries. 8. Prepare a trial balance at November 30, 2020. 9. Prepare an income statement and a statement of changes in equity for the two months ended November 30, 2020, as well as a balance sheet at November 30, 2020. Nov. 1 Reimbursed Elton Worth's business automobile expense for 940 kilometres at $2.00 per kilometre. 2 Received $4,000 cash from Murray Clothiers for computer services completed today. 5 Purchased $2,450 of computer supplies for cash from Kensington Supplies. 8 Billed Papier Inc. $1,850 for computer services rendered. 13 Notified by Sopher's Electrical that Elton's bid of $9,500 for an upcoming project was accepted. 18 Received $600 from Wallace & Sons Inc. against the bill dated October 28. 22 Donated $7,000 to the Red Cross in the company's name. 24 Completed work for Sopher's Electrical and sent a bill for the amount agreed to on November 13. 25 Sent another bill to Wallace & Sons Inc. for the past due amount of $2,780. 28 Reimbursed Elton Worth's business automobile expense for 860 kilometres at $2.00 per kilometre. 30 Paid Anne Stafford for 26 days' work. 30 Elton Worth withdrew $5,500 cash from the business for personal use. This comprehensive problem was introduced in Chapter 2 and continues in Chapters 4 and 5. If the Chapter 2 segment has not been completed, the assignment can begin at this point. After the success of its first two months, Elton Worth has decided to continue operating Elton Systems. (The transactions that occurred in these months are described in Chapter 2.) Before proceeding in December, Elton adds these new accounts to the chart of accounts for the ledger: Account Accumulated Depreciation, Office Equipment Accumulated Depreciation, Computer Equipment Wages Payable Unearned Computer Services Revenue Depreciation Expense, Office Equipment Depreciation Expense, Computer Equipment Insurance Expense Rent Expense Computer Supplies Expense No. 164 168 210 236 612 613 637 640 652 Required 1. Prepare journal entries to record each of the following transactions for Elton Systems. Post the entries to the accounts in the ledger. Dec. 3 Paid $3,600 to the Mayfair Mall for the company's share of mall advertising costs for December. 3 Paid $265 to repair the company's computer. 4 Received the balance owing from Sopher's Electrical. 10 Anne Stafford for seven days' work at $265 per day. 14 Notified by Sopher's Electrical that Elton's bid of $12,340 on a proposed project was accepted. Reynolds paid an advance of $5,340. 17 Purchased $1,950 of computer supplies on credit from Kensington Supplies. 18 Sent a reminder to Papier Inc. to pay the $1,850 originally recorded on November 8. 20 Completed a project for the County of Redwater and received $3,800 cash. 24-28 Took the week off for the holidays. 31 Received $1,000 as partial payment from Papier Inc. 31 Reimbursed Elton Worth's business automobile expenses of 1,240 kilometres at $2.00 per kilometre. 31 Elton Worth withdrew $2,500 cash from the business. 2. Prepare adjusting entries to record the following additional information collected on December 31, 2020. Post the entries to the accounts in the ledger. Dec. 31 a. The December 31 inventory of computer supplies was $675. b. Three months have passed since the annual insurance premium was paid. c. As of the end of the year, Anne Stafford has not been paid for 9 days of work at the rate of $265 per day. d. The computer equipment is expected to have a two-year life with no residual value. e. The office equipment is expected to have a five-year life with no residual value. f. Prepaid rent for three of the six months has expired. 3. Prepare an adjusted trial balance as of December 31, 2020. 4. Prepare an income statement and statement of changes in equity for the three months ended December 31, 2020. 5. Prepare a balance sheet as of December 31, 2020. CUMULATIVE PROBLEM - Elton Systems The first two segments of this comprehensive problem were in Chapters 2 and 3, and the final segment is presented in Chapter 5. If the Chapter 2 and 3 segments have not been completed, the assignment On October 1, 2020, Elton Worth organized a computer service company called Elton Systems. Elton is organized as a sole proprietorship and will provide consulting services, computer ..... The transactions of Elton Systems for October through December 2020 have been recorded in the problem segments in Chapters 2 and 3, as well as the year-end adjusting entries. Prior to closing the revenue and expense accounts for 2020, the accounting system is modified to include the Income Summary account, which is given the number 901. *************. Required 1. Record and post the appropriate closing entries. ................ 2. Prepare a post-closing trial balance. If students have not purchased the Working Papers package, the Working Papers for the serial problem are available on the website at Connect. *********** CUMULATIVE PROBLEM - Elton Systems (Perpetual) The first three segments of this comprehensive problem were presented in Chapters 2, 3, and 4. If those segments have not been completed, the assignment can begin at this point. However, you should use the Working Papers that accompany this text because they reflect the account balances that resulted from posting the entries required in Chapters 2, 3, and 4. Earlier segments of this problem have described how Elton Worth created Elton Systems on October 1, 2020. The company has been successful, and its list of customers has started to grow. To accommodate the growth, the accounting system is ready to be modified to set up separate accounts for each customer. The following list of customers includes the account number used for each account and any balance as of the end of 2020. Elton decided to add a fourth digit with a decimal point to the 106 account number that had been used for the single Accounts Receivable account. This modification allows the existing chart of accounts to continue being used. The list also shows the balances that two customers owed as of December 31, 2020: Customer Account Sopher's Electrical Rocky Mountain Ski Lodges Videotron Entertainment Corp. Wallace & Sons Inc. Kokanee Golf Resorts Inc. Papier Inc. Media Link Co. Mountain Springs Beverage Inc. Outerwear Unlimited Co. No. 106.1 106.2 106.3 106.4 106.5 106.6 106.7 106.8 106.9 Dec. 31 Balance 0 0 0 2,780 0 850 0 0 0 In response to frequent requests from customers, Elton has decided to begin selling computer software. The company will extend credit terms of 1/10, n/30 to customers who purchase merchandise. No cash discount will be available on consulting fees. The following additional accounts were added to the General Ledger to allow the system to account for the company's new merchandising activities: Account Number 119 Merchandise Inventory 413 Sales 414 415 502 Account Name Sales Discounts Sales Returns and Allowances Cost of Goods Sold Because the accounting system does not use reversing entries, all revenue and expense accounts have zero balances as of January 1, 2021. If students have not purchased the Working Papers package, the Working Papers for the Serial Problem are available on the website at Connect. Required 1. Prepare journal entries to record each of the following transactions for Elton Systems, assuming a perpetual system. Jan. 4 Paid Anne Stafford for two days at the rate of $265 per day, in addition to the 9 unpaid days from the prior year. 5 Elton Worth invested an additional $55,000 cash in the business. 7 Purchased $65,000 of merchandise from Mannville Grain Co. with terms of 1/10, n/30, FOB shipping point. 9 Received the balance owing from Papier Inc.. 11 Completed five-day project for Sopher's Electrical and billed them $7,000, which is the total price of $12,340 less the advance payment of $5,340. 13 Sold merchandise with a retail value of $37,700 and a cost of $26,000 to Kokanee Golf Resorts Inc. with terms of 1/10, n/30, FOB shipping point. 15 Paid $3,980 for freight charges on the merchandise purchased on January 7. 16 Received $7,900 cash from Medical Imaging Co. for computer services performed today. 17 Paid Mannville Grain Co. for the purchase on January 7. 20 Kokanee Golf Resorts Inc. returned $4,000 of defective merchandise from its purchase on January 13. The returned merchandise, which had a cost of $2,800, was scrapped. 22 Received the balance due from Kokanee Golf Resorts Inc. 24 Returned defective merchandise to Mannville Grain Co. and accepted credit against future purchases. Its cost, net of the discount, was $5,940. 26 Purchased $21,800 of merchandise from Mannville Grain Co. with terms of 1/10, n/30, FOB destination. 26 Sold merchandise costing $32,000 for $46,400 to Mountain Springs Beverage Inc.; 1/10, n30. 29 Received a $5,940 credit memo from Mannville Grain Co. concerning the merchandise returned on January 24. 31 Paid Anne Stafford for 25 days' work at $265 per day. Feb. 1 Paid $5,940 for another three months' rent in advance at the landlord's request. 3 Paid Mannville Grain Co. for the balance due. 5 Paid $1,800 to the local newspaper for advertising. 11 Received the balance due from Sopher's Electrical for fees billed on January 11. 15 Elton Worth withdrew $5,000 cash for personal use. 23 Sold merchandise with a cost of $12,000 for $17,400 on credit to Media Link Co.; terms 1/10, n30. 26 Paid Anne Stafford for 24 days' work at $265 per day. 27 Reimbursed Elton Worth's business automobile expenses for 1,400 kilometres at $2.00 per kilometre. Mar. 8 Purchased $4,300 of computer supplies from Kensington Supplies on credit. 9 Received the balance due from Media Link Co. for merchandise sold on February 23. 11 Repaired the company's computer equipment paying cash of $260. 16 Received $3,750 cash from Outerwear Unlimited Co. for a computing services project completed today. 19 Paid the full amount due to Kensington Supplies. 24 Billed Videotron Entertainment Corp. for $6,750 of computing services completed today. 25 Sold merchandise with a cost of $7,000 for $10,150 to Rocky Mountain Ski Lodges; 1/10, n30. 30 Sold merchandise with a cost of $3,500 for $5,075 on credit to Wallace & Sons Inc.. 31 Reimbursed Elton Worth's business automobile expenses for 800 kilometres at $2.00 per kilometre. 2. Post the journal entries to the accounts in the company's General Ledger. (Use asset, liability, and equity accounts that start with balances as of December 31, 2020.) ****** 3. Prepare a partial work sheet consisting of the first six columns showing the unadjusted trial balance, the March 31 adjustments described in (a) through (g) below, and the adjusted trial ************ *********** balance. Do not prepare closing entries and do not journalize the adjusting entries or post them to the ledger. ..... a. The March 31 computer supplies on hand is $1,075. b. Three more months have passed since the company purchased the annual insurance policy at the cost of $14,400. c. Anne Stafford has not been paid for 11 days of work. d. Three months have passed since any prepaid rent cost has been transferred to expense. The monthly rent is $1,980. e. Depreciation on the computer equipment for January through March is $1,440. f. Depreciation on the office equipment for January through March is $990. g. The March 31 inventory of merchandise is $3,060. 4. Prepare an interim single-step income statement for the three months ended March 31, 2021. List all expenses without differentiating between selling expenses an general and administrative expenses. 5. Prepare an interim statement of changes in equity for the three months ended March 31, 2021. 6. Prepare an interim classified balance sheet as of March 31, 2021.

Step by Step Solution

★★★★★

3.48 Rating (181 Votes )

There are 3 Steps involved in it

Step: 1

To address the complex cumulative problem for Elton Systems lets break down the tasks step by step Part A 1 Setup of Balance Column Accounts Create ba...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started