Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Class 14.1 (5%): Elon spent a total of $5,000 on incorporation fees for his business. He plans to expense as much of these fees

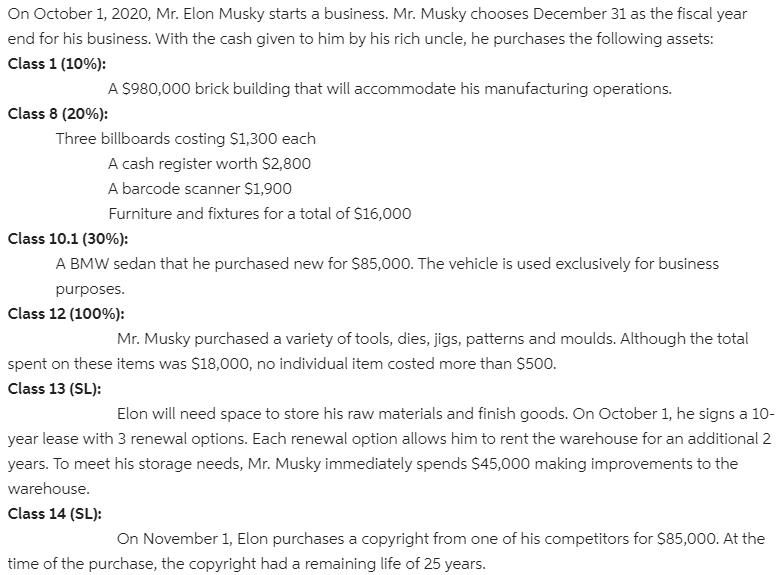

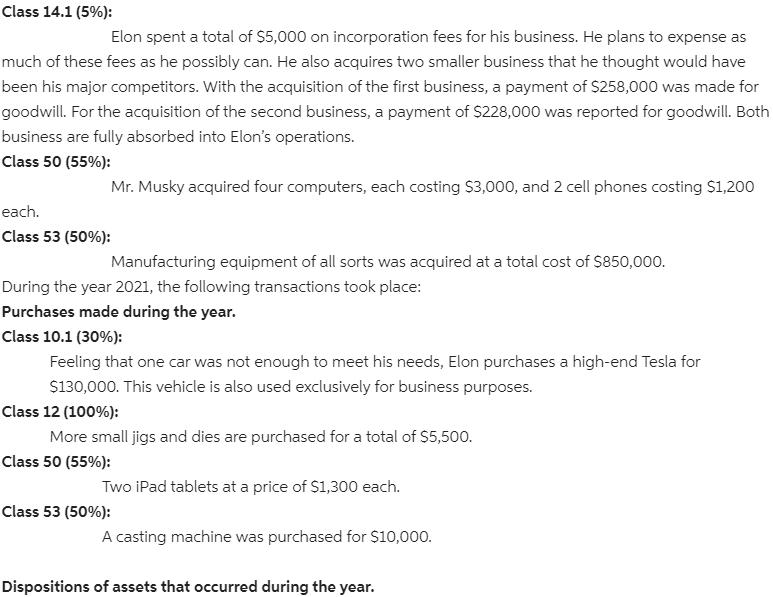

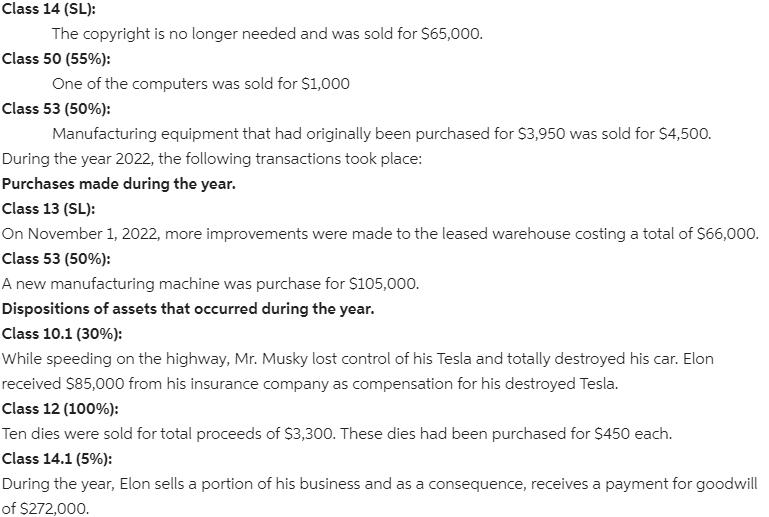

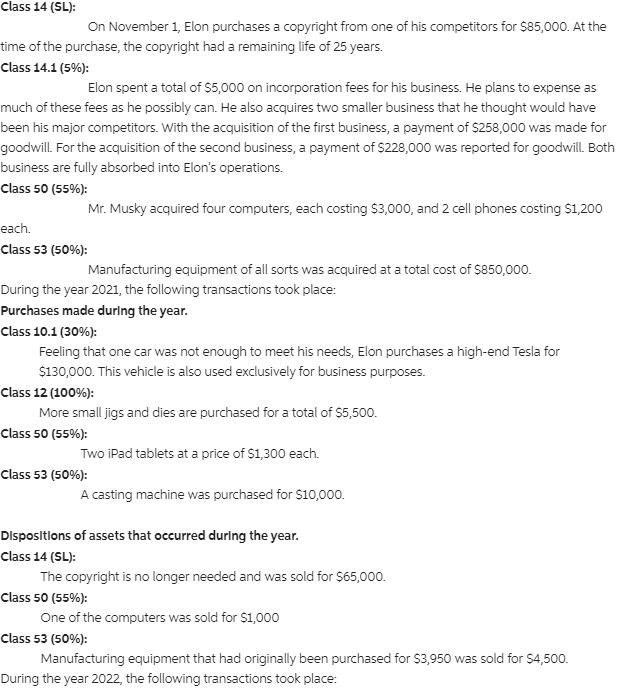

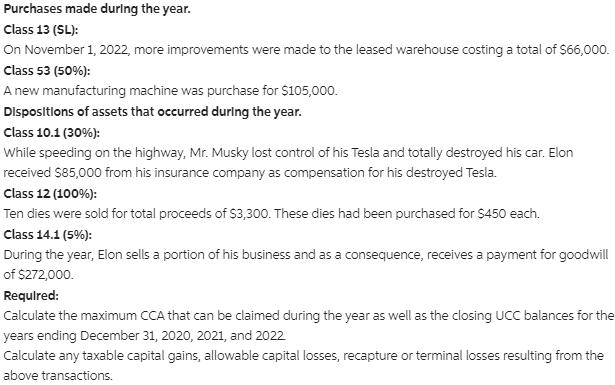

Class 14.1 (5%): Elon spent a total of $5,000 on incorporation fees for his business. He plans to expense as much of these fees as he possibly can. He also acquires two smaller business that he thought would have been his major competitors. With the acquisition of the first business, a payment of $258,000 was made for goodwill. For the acquisition of the second business, a payment of $228,000 was reported for goodwill. Both business are fully absorbed into Elon's operations. Class 50 (55%): Mr. Musky acquired four computers, each costing $3,000, and 2 cell phones costing $1,200o each. Class 53 (50%): Manufacturing equipment of all sorts was acquired at a total cost of $850,000. During the year 2021, the following transactions took place: Purchases made during the year. Class 10.1 (30%): Feeling that one car was not enough to meet his needs, Elon purchases a high-end Tesla for $130,000. This vehicle is also used exclusively for business purposes. Class 12 (100%): More small jigs and dies are purchased for a total of $5,500. Class 50 (55%): Two iPad tablets at a price of $1,300 each. Class 53 (50%): A casting machine was purchased for $10,000. Dispositions of assets that occurred during the year. Class 14 (SL): The copyright is no longer needed and was sold for S65,000. Class 50 (55%): One of the computers was sold for $1,000 Class 53 (50%): Manufacturing equipment that had originally been purchased for $3,950 was sold for $4,500. During the year 2022, the following transactions took place: Purchases made during the year. Class 13 (SL): On November 1, 2022, more improvements were made to the leased warehouse costing a total of $66,000. Class 53 (50%): A new manufacturing machine was purchase for S$105,000. Dispositions of assets that occurred during the year. Class 10.1 (30%): While speeding on the highway, Mr. Musky lost control of his Tesla and totally destroyed his car. Elon received $85,000 from his insurance company as compensation for his destroyed Tesla. Class 12 (100%): Ten dies were sold for total proceeds of $3,300. These dies had been purchased for $450 each. Class 14.1 (5%): During the year, Elon sells a portion of his business and as a consequence, receives a payment for goodwill of $272,000. Required: Calculate the maximum CCA that can be claimed during the year as well as the closing UCC balances for the years ending December 31, 2020, 2021, and 2022. Calculate any taxable capital gains, allowable capital losses, recapture or terminal losses resulting from the above transactions. On October 1, 2020, Mr. Elon Musky starts a business. Mr. Musky chooses December 31 as the fiscal year end for his business. With the cash given to him by his rich uncle, he purchases the following assets: Class 1 (10%): A S980,000 brick building that will accommodate his manufacturing operations. Class 8 (20%): Three billboards costing $1,300 each A cash register worth $2,800 A barcode scanner $1,900 Furniture and fixtures for a total of S16,000 Class 10.1 (30%): A BMW sedan that he purchased new for $85,000. The vehicle is used exclusively for business purposes. Class 12 (100%): Mr. Musky purchased a variety of tools, dies, jigs, patterns and moulds. Although the total spent on these items was $18,000, no individual item costed more than $500. Class 13 (SL): Elon will need space to store his raw materials and finish goods. On October 1, he signs a 10- year lease with 3 renewal options. Each renewal option allows him to rent the warehouse for an additional 2 years. To meet his storage needs, Mr. Musky immediately spends $45,000 making improvements to the warehouse. Class 14 (SL): On November 1, Elon purchases a copyright from one of his competitors for S85,000. At the time of the purchase, the copyright had a remaining life of 25 years. Class 14.1 (5%): Elon spent a total of $5,000 on incorporation fees for his business. He plans to expense as much of these fees as he possibly can. He also acquires two smaller business that he thought would have been his major competitors. With the acquisition of the first business, a payment of $258,000 was made for goodwill. For the acquisition of the second business, a payment of $228,000 was reported for goodwill. Both business are fully absorbed into Elon's operations. Class 50 (55%): Mr. Musky acquired four computers, each costing $3,000, and 2 cell phones costing S1,200 each. Class 53 (50%): Manufacturing equipment of all sorts was acquired at a total cost of $850,000. During the year 2021, the following transactions took place: Purchases made durlng the year. Class 10.1 (30%): Feeling that one car was not enough to meet his needs, Elon purchases a high-end Tesla for $130,000. This vehicle is also used exclusively for business purposes. Class 12 (100%): More small jigs and dies are purchased for a total of $5,500. Class 50 (55%): Two iPad tablets at a price of $1,300 each. Class 53 (50%): A casting machine was purchased for S10,000. DIspositlons of assets that occurred during the year. Class 14 (SL): The copyright is no longer needed and was sold for $65,000. Class 50 (55%): One of the computers was sold for $1,000 Class 53 (50%): Manufacturing equipment that had originally been purchased for $3,950 was sold for $4,500. During the year 2022, the following transactions took place: Purchases made during the year. Class 13 (SL): On November 1, 2022, more improvements were made to the leased warehouse costing a total of S66,000. Class 53 (50%): A new manufacturing machine was purchase for $105,000. Dispositlons of assets that occurred durlng the year. Class 10.1 (30%): While speeding on the highway, Mr. Musky lost control of his Tesla and totally destroyed his car. Elon received S85,000 from his insurance company as compensation for his destroyed Tesla. Class 12 (100%): Ten dies were sold for total proceeds of S3,300. These dies had been purchased for $450 each. Class 14.1 (5%): During the year, Elon sells a portion of his business and as a consequence, receives a payment for goodwill of $272,000. Requlred: Calculate the maximum CCA that can be claimed during the year as well as the closing UCC balances for the years ending December 31, 2020, 2021, and 2022 Calculate any taxable capital gains, allowable capital losses, recapture or terminal losses resulting from the above transactions.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started