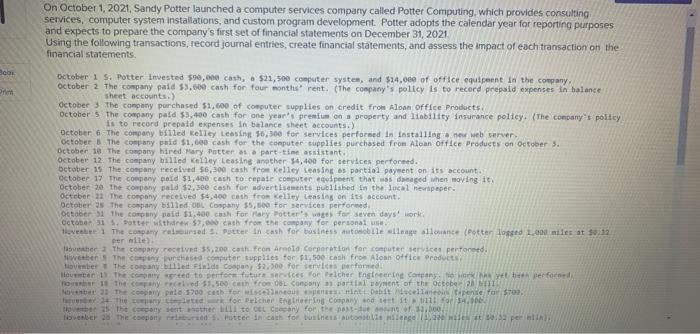

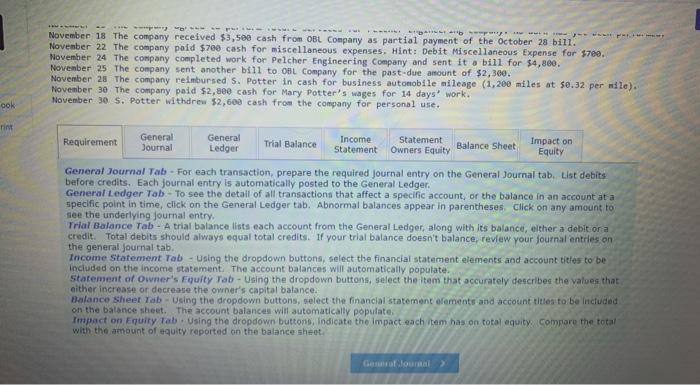

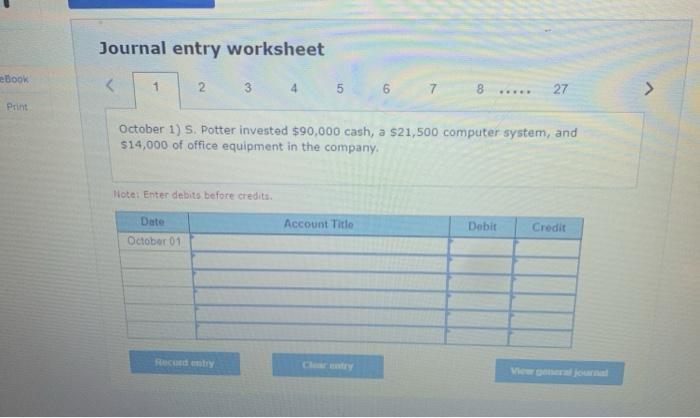

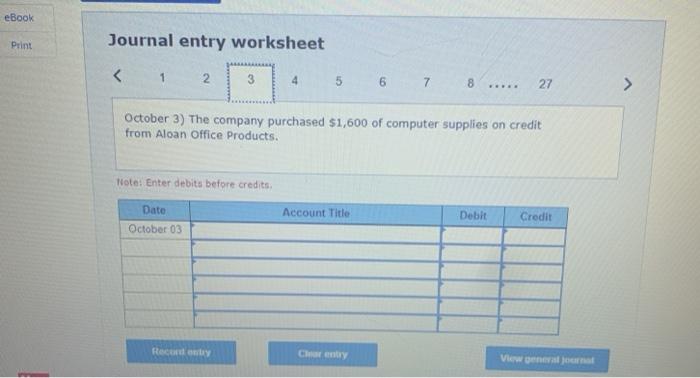

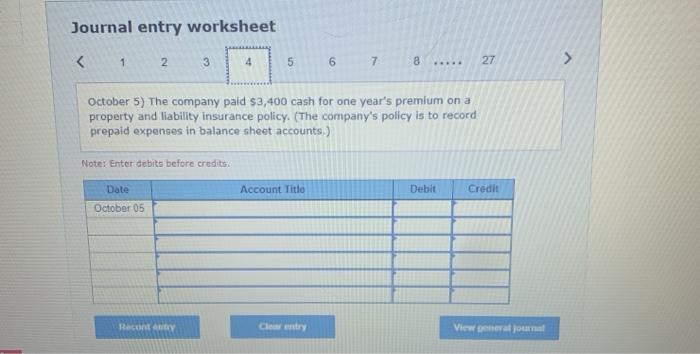

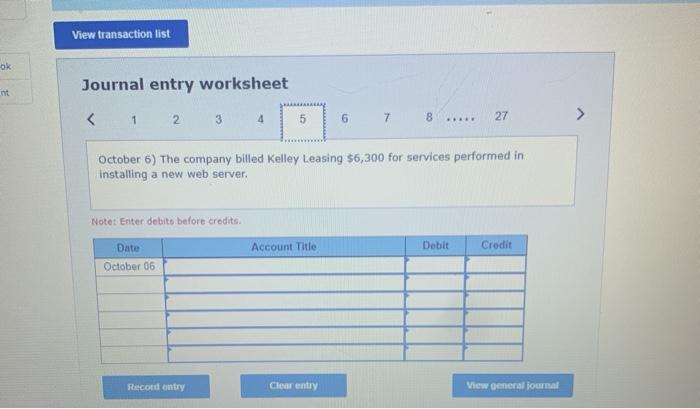

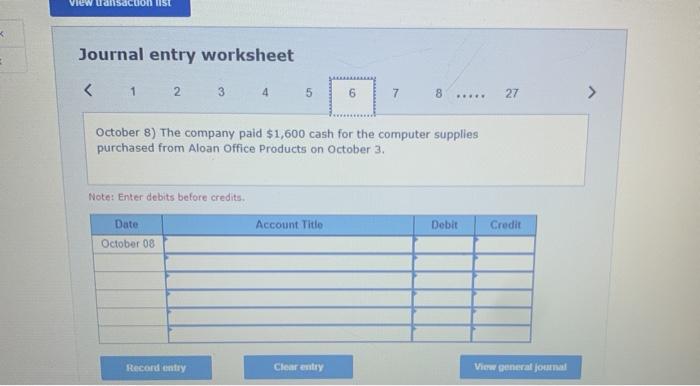

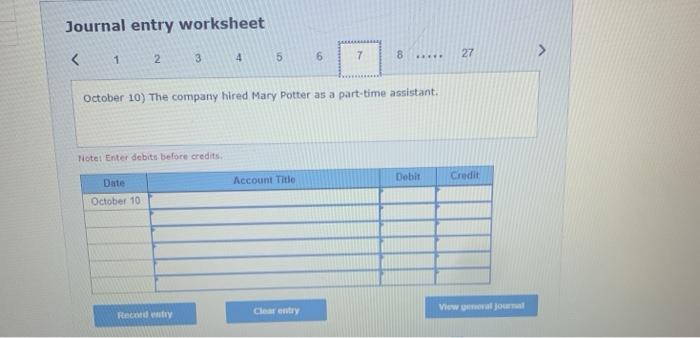

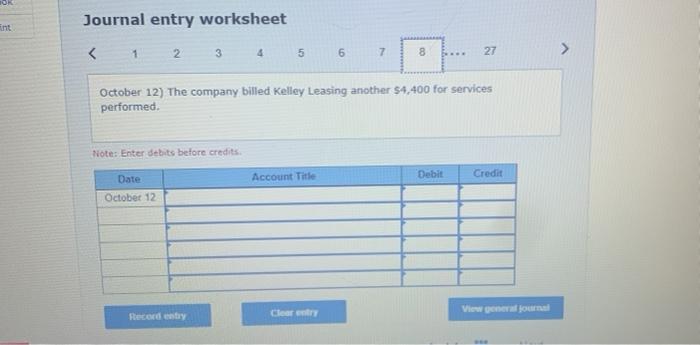

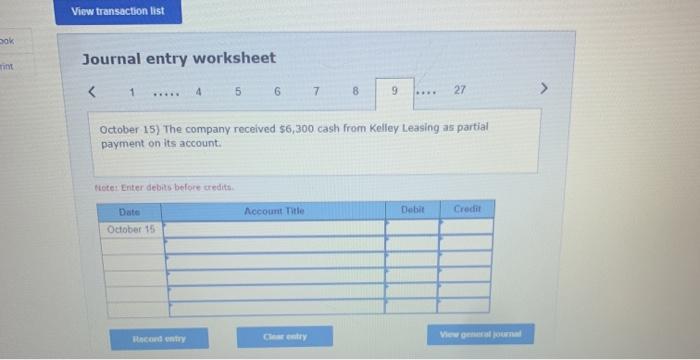

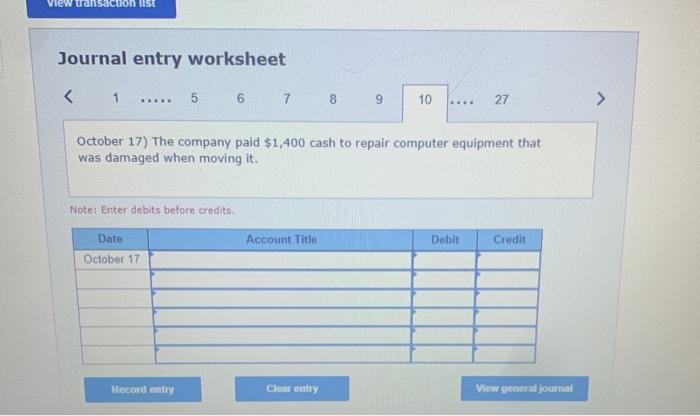

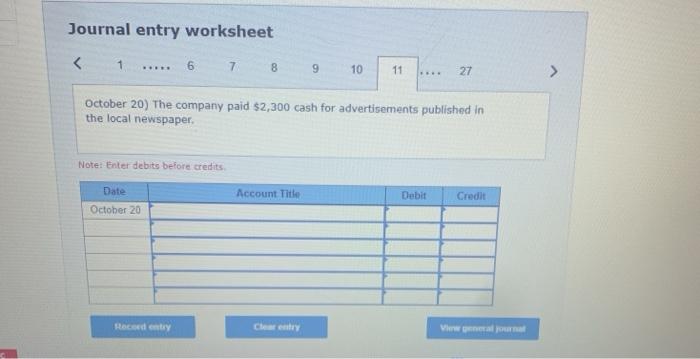

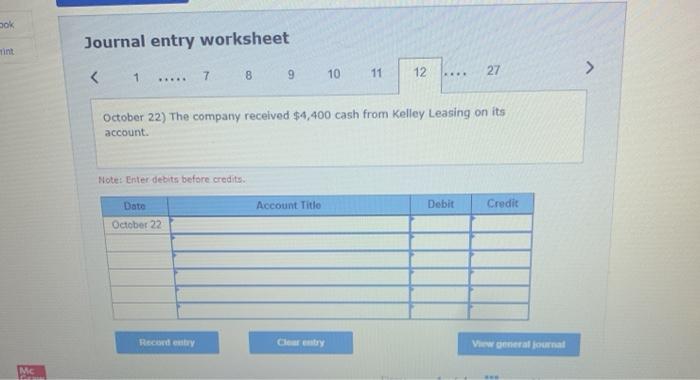

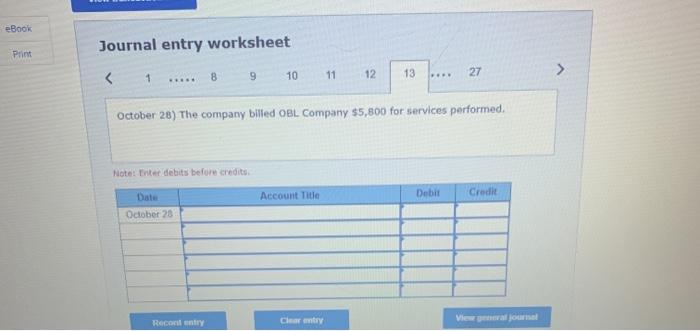

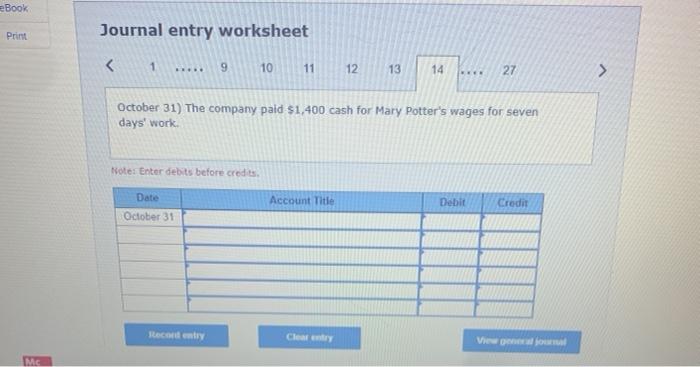

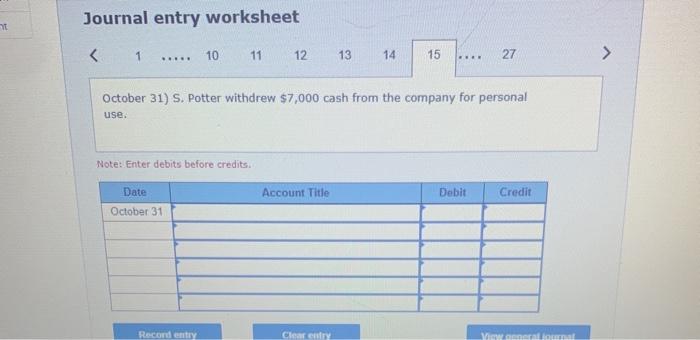

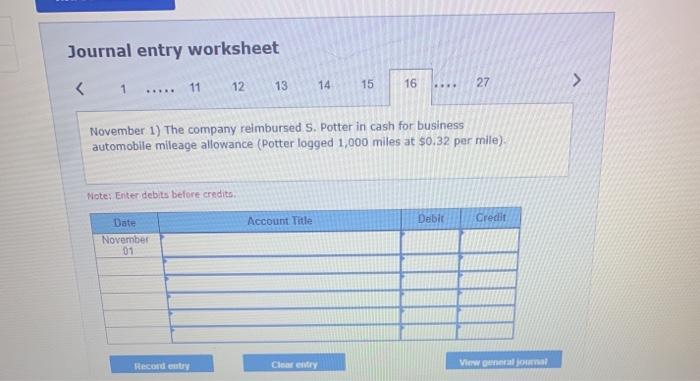

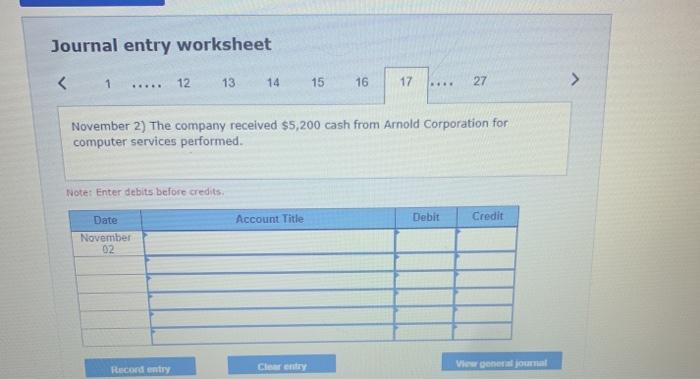

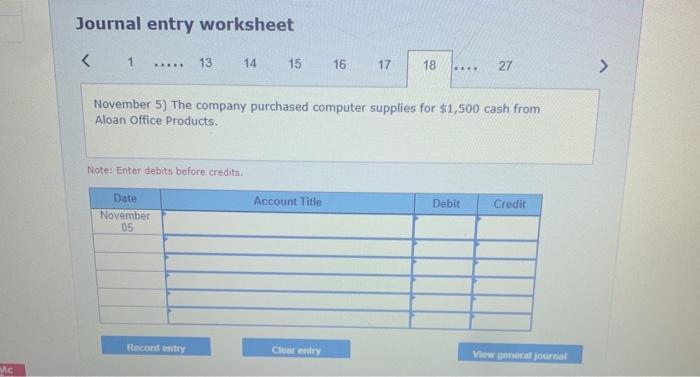

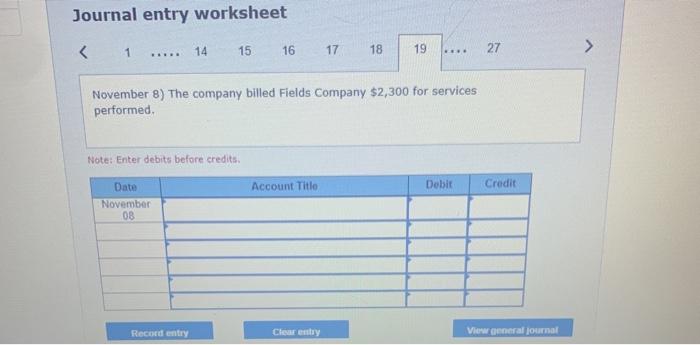

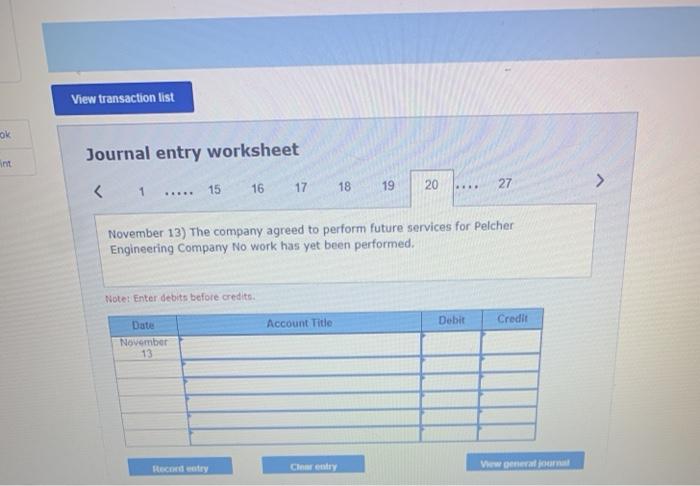

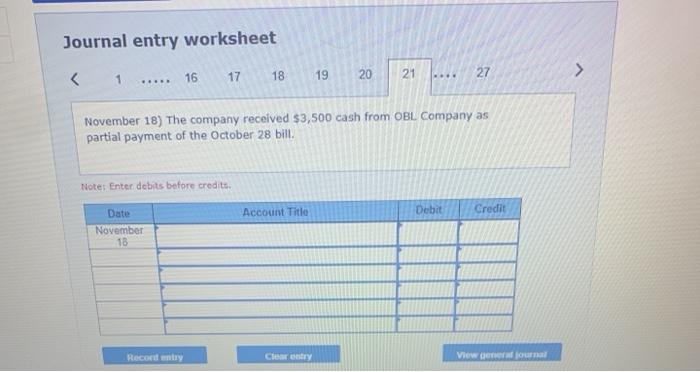

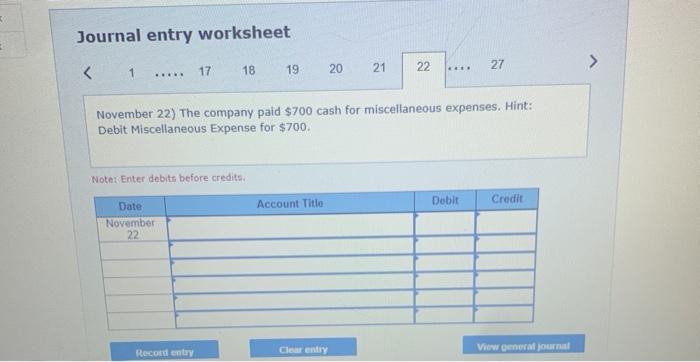

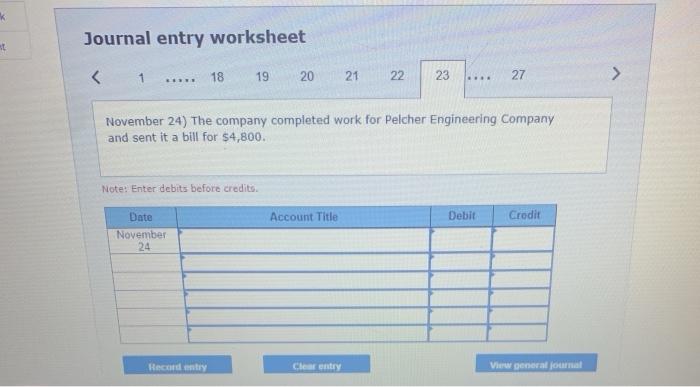

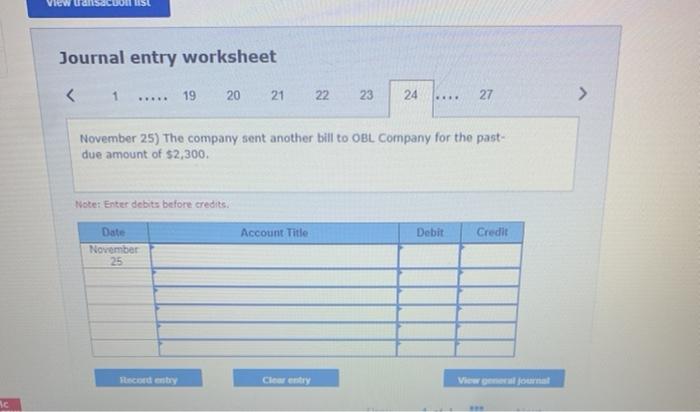

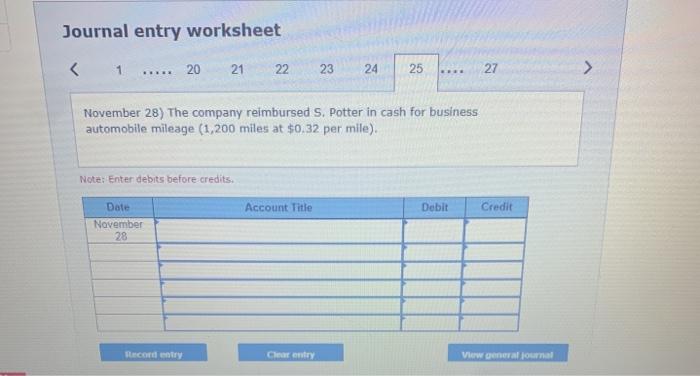

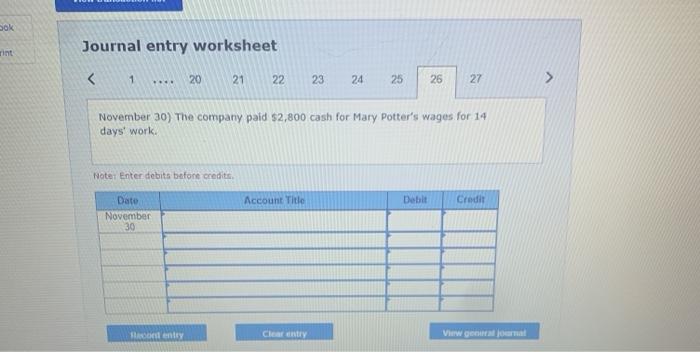

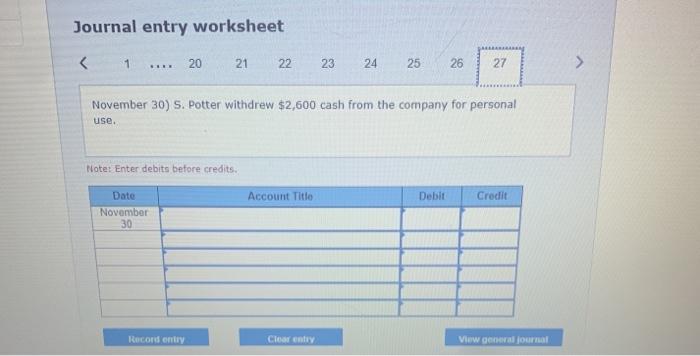

On October 1, 2021, Sandy Potter launched a computer services company called Potter Computing, which provides consulting services, computer system installations, and custom program development Potter adopts the calendar year for reporting purposes and expects to prepare the company's first set of financial statements on December 31, 2021 Using the following transactions, record journal entries, create financial statements, and assess the impact of each transaction on the financial statements B October 1 5. Potter invested 590,000 cash. $21,500 computer system, and $14,000 of office equipment in the company October 2 The company paid $3,600 cash for four months rent. The company's policy is to record prepaid expenses in balance sheet accounts.) October the company purchased 51,600 of computer supplies on credit from Aloon Office Products October 3 The company paid $3,400 cash for one year premium on property and liability insurance policy. (The company policy is to record prepaid expenses in balance sheet accounts.) October 6- The company billed Kelley Leasint 56.300 for services performed in installing a new web server October 8 The company paid $1,600 cash for the computer supplies purchased from Alean Office Products on October 3. October 10. The company hired Pury Potter as part-time assistant October 12. The company billed Kelley Leasing another 54,400 for services perforeed. October 15 The company received 56.300 cash from Kelley Leasing as partial payment on its account October 17 The company paid $1,400 cash to repair computer equipment that was damaged when moving it October 26 The company paid $2. see cash for advertisements publlibed in the local newspaper. October 22 The company received $4,400 cash from Kelley Leasing on its account. October 25 The company bledo Company 55,500 for services performed October 1 The company paid $1,400 cash for Mary Potter wages for seven days' work October 31 5. Potter withdrew $7,000 cash from the company for personal use love1 The company releases Potter for business auto llage allowance (Potter logo 1.000 miles at $3.12 permite vester 2 The company receive 35,200 cash from Arnold Corporation for computer services perford webers The Purchased computer supplies for $1.500 cash from Alean Office Products ovember The company in de company 53.500 for sent performed 1) the company pred to perfor future serces for Pelcher Internet Cant performed no 11 They received $3.500 chfro O Company as partial went of the October Note 3 con pada 1700 catherine Hint Debit cellent for so the foc alcher Entering Company and it for $4.00 to the consent the tooth any for the post of 3.000 over 20 The Copony rides Potter in cath for business at lege 22 ile 300 per min www. November 18 The company received $3,500 cash from OBL Company as partial payment of the October 28 bill. November 22 The company paid $700 cash for miscellaneous expenses. Hint: Debit Miscellaneous Expense for $700. November 24 The company completed work for Pelcher Engineering Company and sent it a bill for $4,800. November 25 The company sent another bill to OBL Company for the past-due amount of $2,300. November 28 The company reimbursed 5. Potter in cash for business automobile mileage (1,200 miles at $0.32 per wile). November 30 The company paid $2,300 cash for Mary Potter's wages for 14 days' work. November 30 s. Potter withdrew $2,600 cash from the company for personal use. ook rint Requirement General Journal General Ledger Trial Balance Income Statement Statement Owners Equity Balance Sheet Impact on Equity General Journal Tab - For each transaction, prepare the required journal entry on the General Journal tab. List debits before credits. Each journal entry is automatically posted to the General Ledger, General Ledger Tab - To see the detail of all transactions that affect a specific account, or the balance in an account at a specific point in time, click on the General Ledger tab. Abnormal balances appear in parentheses. Click on any amount to see the underlying Journal entry Trial Balance Tab - A trial balance lists each account from the General Ledger, along with its balance, either a debit or a credit. Total debits should always equal total credits. If your trial balance doesn't balance, review your journal entries on the general Journal tab. Income Statement Tab - Using the dropdown buttons, select the financial statement elements and account titles to be included on the income statement. The account balances will automatically populate. Statement of Owner's Equity Tab - Using the dropdown buttons, select the item that accurately describes the values that either increase or decrease the owner's capital balance. Balance Sheet Tab - Using the dropdown buttons, select the financial statement elements and account titles to be included on the balance sheet. The account balances will automatically populate. Impact on Equity Tab. Using the dropdown buttons, indicate the impact each item has on total equity, compare the total with the amount of equity reported on the balance sheet Journal entry worksheet eBook ht October 2) The company paid $3,600 cash for four months' rent. (The company's policy is to record prepaid expenses in balance sheet accounts.) Note: Enter debits before credits Date Account Title Debit Credit October 02 Recounty Clementy View general journal Journal entry worksheet 1 2 3 4 5 6 7 8 27 .. October 5) The company paid $3,400 cash for one year's premium on a property and liability insurance policy. (The company's policy is to record prepaid expenses in balance sheet accounts.) Note: Enter dobits before credits Account Title Debit Credit Date October 05 Recon Clear entry View all View transaction list Journal entry worksheet nt 2 3 4 5 6 7 8 ... 27 October 6) The company billed Kelley Leasing $6,300 for services performed in installing a new web server. Note: Enter debits before credits Account Title Debit Credit Date October 06 Recon entry Clear entry View general journal View uanscuon 1151 Journal entry worksheet October 15) The company received $6,300 cash from Kelley Leasing as partial payment on its account. Lote: Enter debits before credits Date Recount Title Debit Credit October 15 View Romy View uansacuon list Journal entry worksheet 1 ... 5 6 7 9 10 ... 27 October 17) The company paid $1,400 cash to repair computer equipment that was damaged when moving it. Note: Enter debits before credits Account Title Debit Credit Date October 17 Record entry Clear entry View general journal Journal entry worksheet October 20) The company paid $2,300 cash for advertisements published in the local newspaper Note: Enter debits before credits Date Account Title Debit Credit October 20 Rody Clearen Sok Journal entry worksheet int 1 7 8 12 27 9 10 11 October 22) The company received $4,400 cash from Kelley Leasing on its account Note: Enter debits before credits Account Title Debit Credit Date October 22 Recordenty Clear View all Me eBook Journal entry worksheet Print October 31) The company paid $1,400 cash for Mary Potter's wages for seven days' work Note: Enter debits before credits Account Title Date October 31 Debit Credit Key Clear View Journal entry worksheet October 31) S. Potter withdrew $7,000 cash from the company for personal use. Note: Enter debits before credits. Date Account Title Debit Credit October 31 Recondent Clearen You Journal entry worksheet 11 12 13 14 15 16 27 . B. November 1) The company reimbursed. S. Potter in cash for business automobile mileage allowance (Potter logged 1,000 miles at $0.32 per mile) Note: Enter debits before credits Account Title Debic Credit Date November 01 Record entry Cler View general al Journal entry worksheet November 2) The company received $5,200 cash from Arnold Corporation for computer services performed. Note: Enter debits before credits Account Title Debit Credit Date November 02 Record entry Clearn View general Journal entry worksheet November 5) The company purchased computer supplies for $1,500 cash from Aloan Office Products Note: Enter debits before credits Account Title Debit Credit Date November 05 Record entry Clementy Viewed journal MC Journal entry worksheet 1 14 15 16 17 18 19 27 > November 8) The company billed Fields Company $2,300 for services performed Note: Enter debits before credits Account Title Debit Credit Date November 08 Record entry Clementy View general Journal View transaction list OK Journal entry worksheet int 17 19 16 20 27 November 18) The company received $3,500 cash from OBL Company as partial payment of the October 28 bill. Notes Enter debits before credits Account Title Debit Credit Date November 18 Record entry Clementy Viewer Journal entry worksheet .... 17 .. November 24) The company completed work for Pelcher Engineering Company and sent it a bill for $4,800. Note: Enter debits before credito Account Title Debit Credit Date November 24 Recenty Clear entry View general journal Journal entry worksheet November 25) The company sent another bill to OBL Company for the past due amount of $2,300. Note: Enter debits before credits Account Title Debit Credit Date November 25 Hemby Clear en View journal SC Journal entry worksheet November 30) The company paid $2,800 cash for Mary Potter's wages for 14 days' work. Note: Enter debits before credits Account Title Debit Credit Date November 30 onenty Clear entry VW gara Journal entry worksheet ht October 2) The company paid $3,600 cash for four months' rent. (The company's policy is to record prepaid expenses in balance sheet accounts.) Note: Enter debits before credits Date Account Title Debit Credit October 02 Recounty Clementy View general journal Journal entry worksheet 1 2 3 4 5 6 7 8 27 .. October 5) The company paid $3,400 cash for one year's premium on a property and liability insurance policy. (The company's policy is to record prepaid expenses in balance sheet accounts.) Note: Enter dobits before credits Account Title Debit Credit Date October 05 Recon Clear entry View all View transaction list Journal entry worksheet nt 2 3 4 5 6 7 8 ... 27 October 6) The company billed Kelley Leasing $6,300 for services performed in installing a new web server. Note: Enter debits before credits Account Title Debit Credit Date October 06 Recon entry Clear entry View general journal View uanscuon 1151 Journal entry worksheet October 15) The company received $6,300 cash from Kelley Leasing as partial payment on its account. Lote: Enter debits before credits Date Recount Title Debit Credit October 15 View Romy View uansacuon list Journal entry worksheet 1 ... 5 6 7 9 10 ... 27 October 17) The company paid $1,400 cash to repair computer equipment that was damaged when moving it. Note: Enter debits before credits Account Title Debit Credit Date October 17 Record entry Clear entry View general journal Journal entry worksheet October 20) The company paid $2,300 cash for advertisements published in the local newspaper Note: Enter debits before credits Date Account Title Debit Credit October 20 Rody Clearen Sok Journal entry worksheet int 1 7 8 12 27 9 10 11 October 22) The company received $4,400 cash from Kelley Leasing on its account Note: Enter debits before credits Account Title Debit Credit Date October 22 Recordenty Clear View all Me eBook Journal entry worksheet Print October 31) The company paid $1,400 cash for Mary Potter's wages for seven days' work Note: Enter debits before credits Account Title Date October 31 Debit Credit Key Clear View Journal entry worksheet October 31) S. Potter withdrew $7,000 cash from the company for personal use. Note: Enter debits before credits. Date Account Title Debit Credit October 31 Recondent Clearen You Journal entry worksheet 11 12 13 14 15 16 27 . B. November 1) The company reimbursed. S. Potter in cash for business automobile mileage allowance (Potter logged 1,000 miles at $0.32 per mile) Note: Enter debits before credits Account Title Debic Credit Date November 01 Record entry Cler View general al Journal entry worksheet November 2) The company received $5,200 cash from Arnold Corporation for computer services performed. Note: Enter debits before credits Account Title Debit Credit Date November 02 Record entry Clearn View general Journal entry worksheet November 5) The company purchased computer supplies for $1,500 cash from Aloan Office Products Note: Enter debits before credits Account Title Debit Credit Date November 05 Record entry Clementy Viewed journal MC Journal entry worksheet 1 14 15 16 17 18 19 27 > November 8) The company billed Fields Company $2,300 for services performed Note: Enter debits before credits Account Title Debit Credit Date November 08 Record entry Clementy View general Journal View transaction list OK Journal entry worksheet int 17 19 16 20 27 November 18) The company received $3,500 cash from OBL Company as partial payment of the October 28 bill. Notes Enter debits before credits Account Title Debit Credit Date November 18 Record entry Clementy Viewer Journal entry worksheet .... 17 .. November 24) The company completed work for Pelcher Engineering Company and sent it a bill for $4,800. Note: Enter debits before credito Account Title Debit Credit Date November 24 Recenty Clear entry View general journal Journal entry worksheet November 25) The company sent another bill to OBL Company for the past due amount of $2,300. Note: Enter debits before credits Account Title Debit Credit Date November 25 Hemby Clear en View journal SC Journal entry worksheet November 30) The company paid $2,800 cash for Mary Potter's wages for 14 days' work. Note: Enter debits before credits Account Title Debit Credit Date November 30 onenty Clear entry VW gara Journal entry worksheet