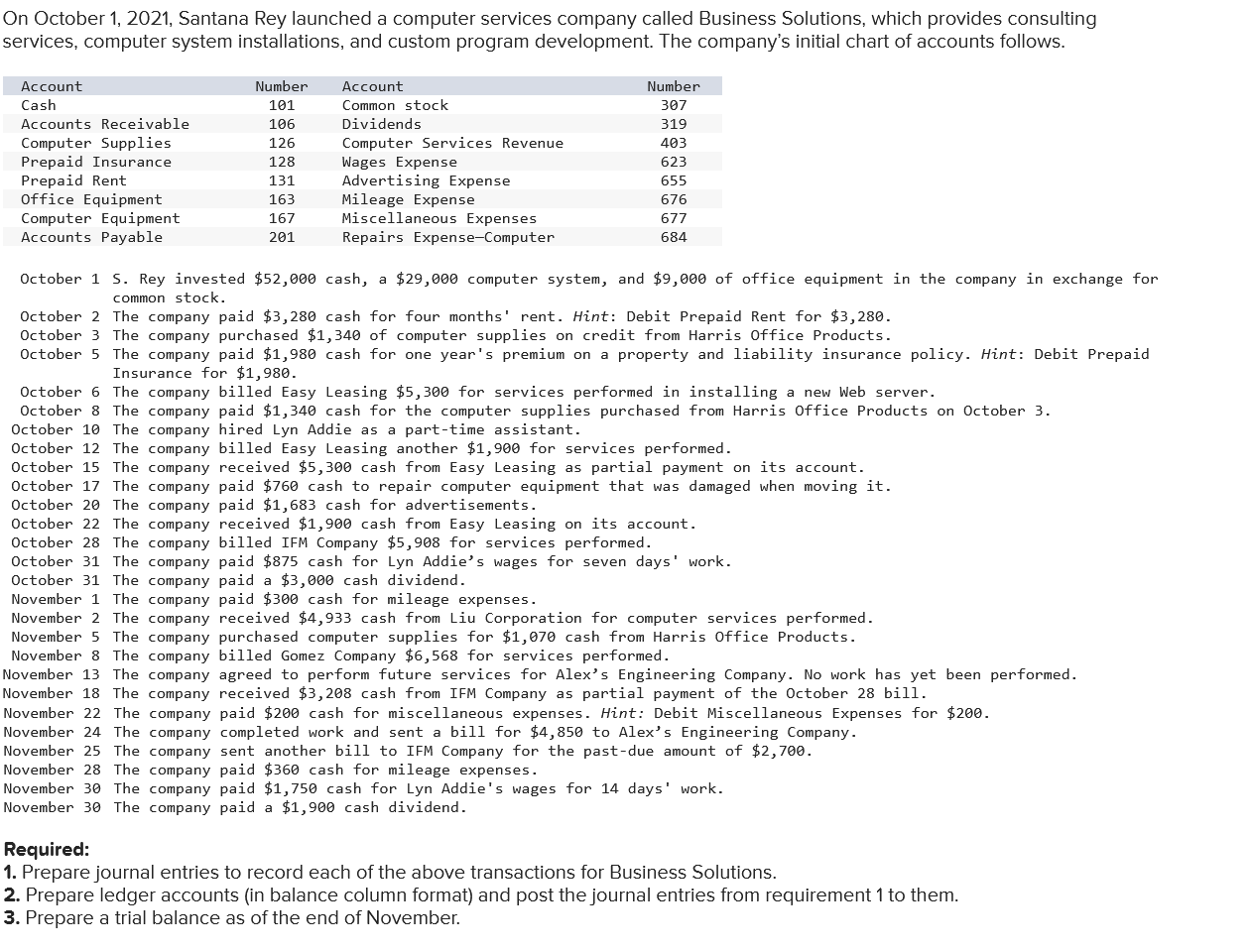

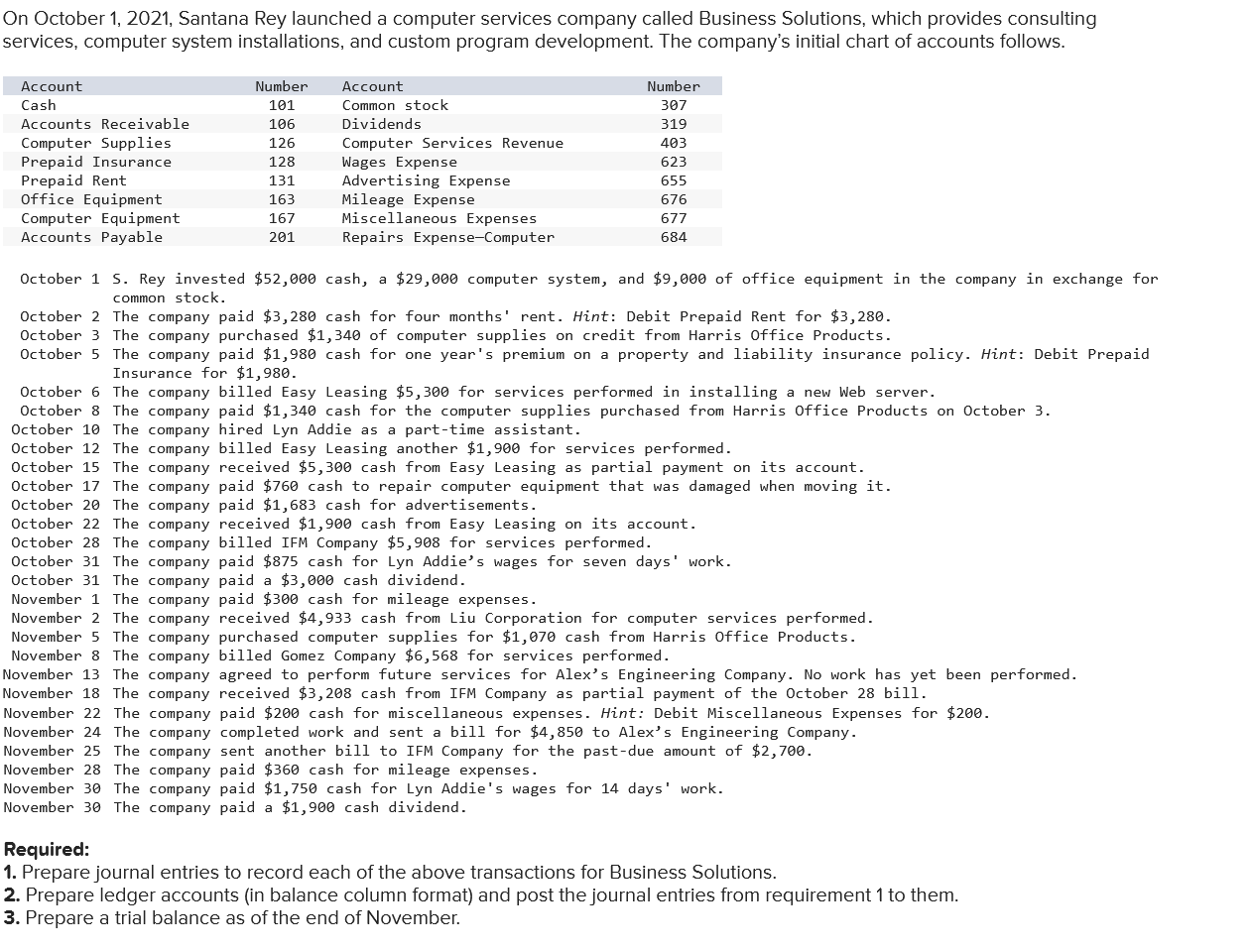

On October 1, 2021, Santana Rey launched a computer services company called Business Solutions, which provides consulting services, computer system installations, and custom program development. The company's initial chart of accounts follows. October 1 S. Rey invested $52,000 cash, a $29,000 computer system, and $9,000 of office equipment in the company in exchange for common stock. October 2 The company paid $3,280 cash for four months' rent. Hint: Debit Prepaid Rent for \$3,280. October 3 The company purchased $1,340 of computer supplies on credit from Harris Office Products. October 5 The company paid $1,980 cash for one year's premium on a property and liability insurance policy. Hint: Debit Prepaid Insurance for $1,980. October 6 The company billed Easy Leasing \$5,300 for services performed in installing a new Web server. October 8 The company paid $1,340 cash for the computer supplies purchased from Harris Office Products on October 3. October 10 The company hired Lyn Addie as a part-time assistant. October 12 The company billed Easy Leasing another $1,900 for services performed. October 15 The company received $5,300 cash from Easy Leasing as partial payment on its account. October 17 The company paid $760 cash to repair computer equipment that was damaged when moving it. October 20 The company paid $1,683 cash for advertisements. October 22 The company received $1,900 cash from Easy Leasing on its account. October 28 The company billed IFM Company $5,908 for services performed. October 31 The company paid \$875 cash for Lyn Addie's wages for seven days' work. October 31 The company paid a $3,000 cash dividend. November 1 The company paid $300 cash for mileage expenses. November 2 The company received $4,933 cash from Liu Corporation for computer services performed. November 5 The company purchased computer supplies for $1,070 cash from Harris 0ffice Products. November 8 The company billed Gomez Company \$6,568 for services performed. November 13 The company agreed to perform future services for Alex's Engineering Company. No work has yet been performed. November 18 The company received $3,208 cash from IFM Company as partial payment of the October 28 bill. November 22 The company paid $200 cash for miscellaneous expenses. Hint: Debit Miscellaneous Expenses for $200. November 24 The company completed work and sent a bill for $4,850 to Alex's Engineering Company. November 25 The company sent another bill to IFM Company for the past-due amount of $2,700. November 28 The company paid $360 cash for mileage expenses. November 30 The company paid $1,750 cash for Lyn Addie's wages for 14 days' work. November 30 The company paid a $1,900 cash dividend. Required: 1. Prepare journal entries to record each of the above transactions for Business Solutions. 2. Prepare ledger accounts (in balance column format) and post the journal entries from requirement 1 to them. 3. Prepare a trial balance as of the end of November