Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On October 1, 2024, Putney, Inc., purchased a computer system for $115,000 from AIT Systems. The computer system had an estimated life of five

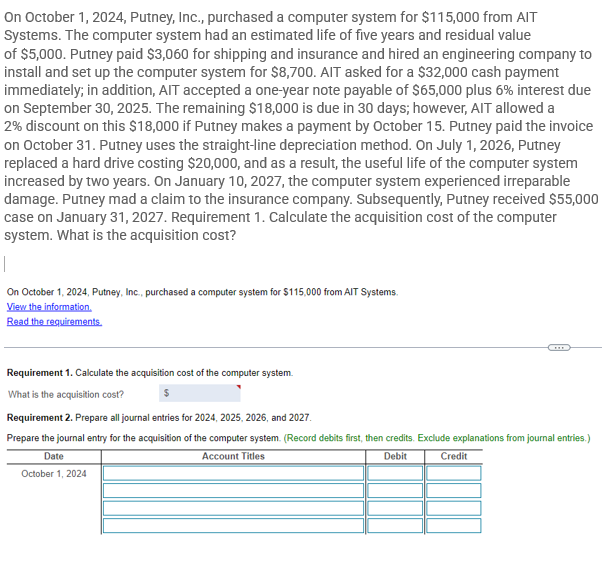

On October 1, 2024, Putney, Inc., purchased a computer system for $115,000 from AIT Systems. The computer system had an estimated life of five years and residual value of $5,000. Putney paid $3,060 for shipping and insurance and hired an engineering company to install and set up the computer system for $8,700. AIT asked for a $32,000 cash payment immediately; in addition, AIT accepted a one-year note payable of $65,000 plus 6% interest due on September 30, 2025. The remaining $18,000 is due in 30 days; however, AIT allowed a 2% discount on this $18,000 if Putney makes a payment by October 15. Putney paid the invoice on October 31. Putney uses the straight-line depreciation method. On July 1, 2026, Putney replaced a hard drive costing $20,000, and as a result, the useful life of the computer system increased by two years. On January 10, 2027, the computer system experienced irreparable damage. Putney mad a claim to the insurance company. Subsequently, Putney received $55,000 case on January 31, 2027. Requirement 1. Calculate the acquisition cost of the computer system. What is the acquisition cost? On October 1, 2024, Putney, Inc., purchased a computer system for $115,000 from AIT Systems. View the information. Read the requirements. Requirement 1. Calculate the acquisition cost of the computer system. What is the acquisition cost? (... Requirement 2. Prepare all journal entries for 2024, 2025, 2026, and 2027. Prepare the journal entry for the acquisition of the computer system. (Record debits first, then credits. Exclude explanations from journal entries.) Date October 1, 2024 Account Titles Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started