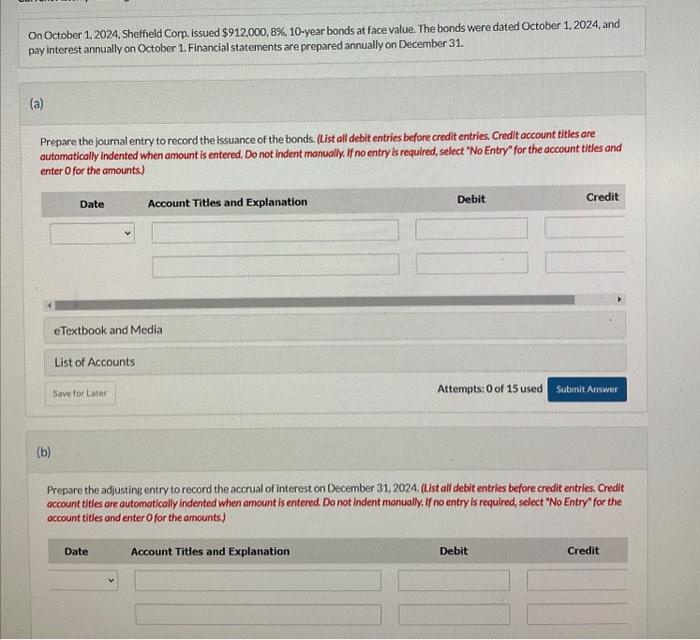

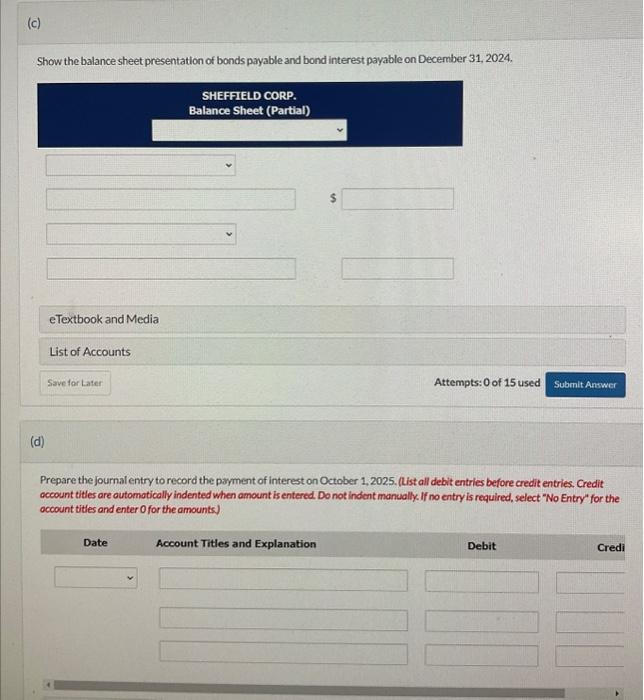

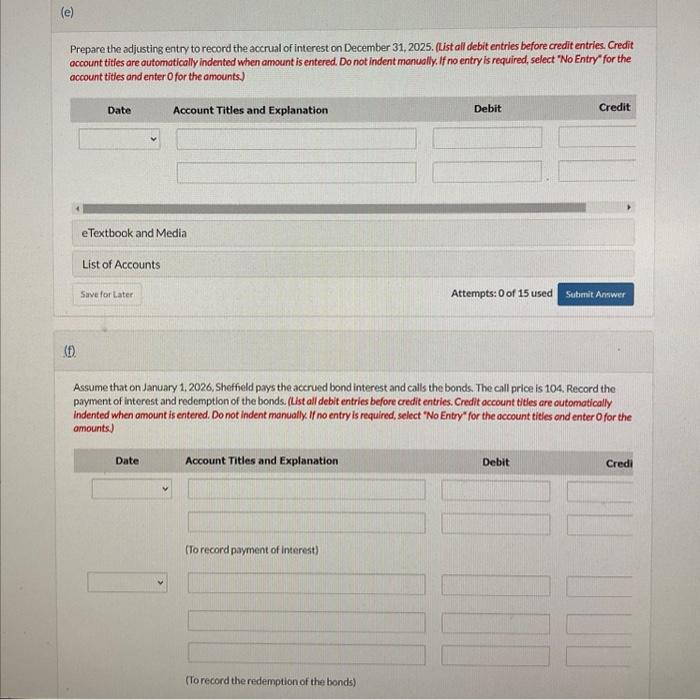

On October 1, 2024, Sheffield Corp. issued $912,000,8%,10-year bonds at face value. The bonds were dated October 1, 2024, and pay interest annually on October 1 . Financlal statements are prepared annually on December 31. (a) Prepare the joumal entry to record the issuance of the bonds. (List all debit entries before credit entries. Credit account titles are outomatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts) List of Accounts (b) Prepare the adjusting entry to record the accrual of Interest on December 31, 2024. (List all debit entries before credit entries. Credit occount titles are outomatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter 0 for the amounts.) Show the balance sheet presentation of bonds payable and bond interest payable on December 31, 2024. SHEFFIELD CORP. Balance Sheet (Partlal) eTextbook and Media List of Accounts Attempts: 0 of 15 used (d) Prepare the journal entry to record the payment of interest on October 1, 2025, (list all debit entries before credit entries. Credit account titles are outomatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter 0 for the amounts.) Prepare the adjusting entry to record the accrual of interest on December 31, 2025. (List all debit entries before credit entries. Credit account titles are outomatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) List of Accounts Attempts: 0 of 15 used (f). Assume that on January 1, 2026, Sheffield pays the accrued bond interest and calls the bonds. The call price is 104, Record the payment of interest and redemption of the bonds. (List all debit entries before credit entries. Credit account titles cre cutomatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount tities ond enter Of for the omounts)