Answered step by step

Verified Expert Solution

Question

1 Approved Answer

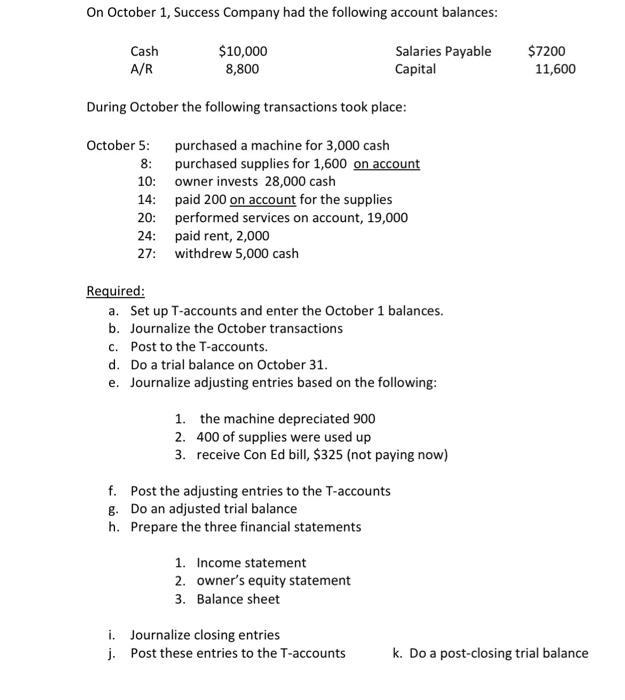

On October 1, Success Company had the following account balances: Salaries Payable $10,000 8,800 Capital Cash A/R During October the following transactions took place:

On October 1, Success Company had the following account balances: Salaries Payable $10,000 8,800 Capital Cash A/R During October the following transactions took place: purchased a machine for 3,000 cash purchased supplies for 1,600 on account owner invests 28,000 cash paid 200 on account for the supplies performed services on account, 19,000 October 5: 8: 10: 14: 20: 24: 27: paid rent, 2,000 withdrew 5,000 cash Required: a. Set up T-accounts and enter the October 1 balances. b. Journalize the October transactions c. Post to the T-accounts. d. Do a trial balance on October 31. e. Journalize adjusting entries based on the following: 1. the machine depreciated 900 2. 400 of supplies were used up 3. receive Con Ed bill, $325 (not paying now) f. Post the adjusting entries to the T-accounts g. Do an adjusted trial balance h. Prepare the three financial statements 1. Income statement 2. owner's equity statement 3. Balance sheet i. Journalize closing entries j. Post these entries to the T-accounts $7200 11,600 k. Do a post-closing trial balance

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

A Set up Taccounts and enter the October 1 balances CashAR DebitCredit 100008800 Salaries PayableCapital DebitCredit 720011600 B Journalize the October transactions October 5 Debit Cash 3000 Credit Ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started