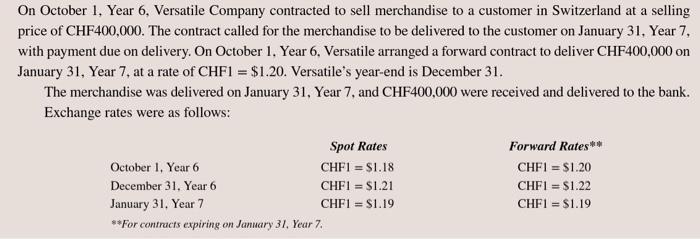

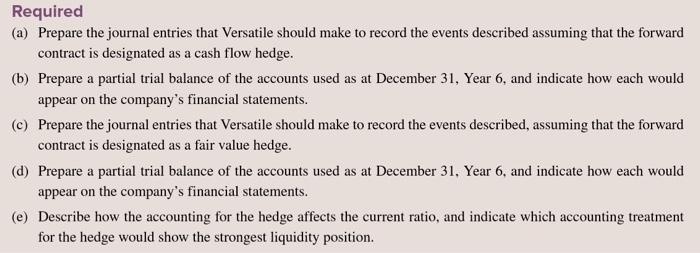

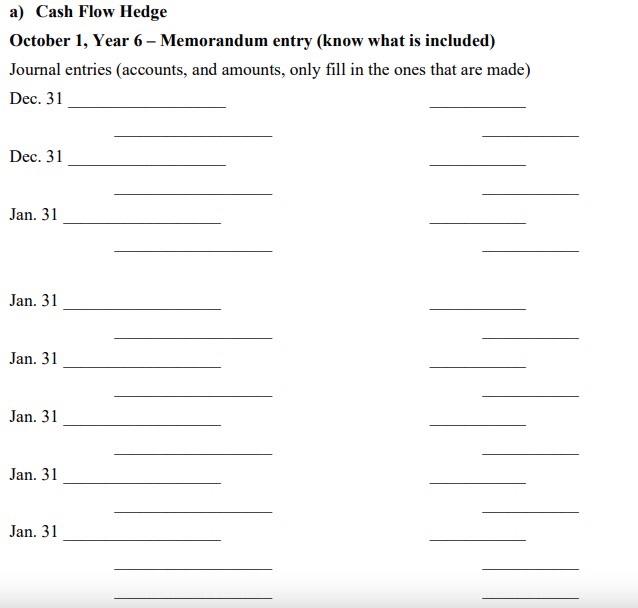

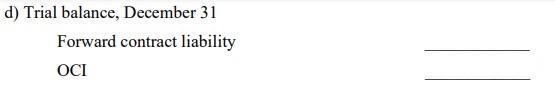

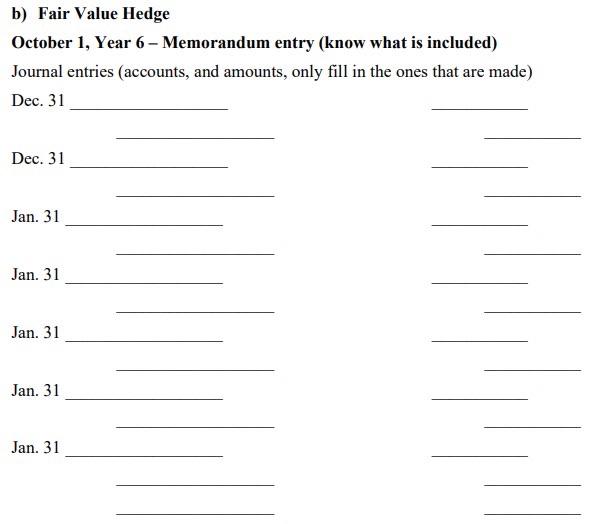

On October 1, Year 6. Versatile Company contracted to sell merchandise to a customer in Switzerland at a selling price of CHF400,000. The contract called for the merchandise to be delivered to the customer on January 31, Year 7, with payment due on delivery. On October 1, Year 6, Versatile arranged a forward contract to deliver CHF400,000 on January 31, Year 7, at a rate of CHF1 = $1.20. Versatile's year-end is December 31. The merchandise was delivered on January 31, Year 7, and CHF400,000 were received and delivered to the bank. Exchange rates were as follows: Spot Rates October 1, Year 6 CHF1 =$1.18 December 31, Year 6 CHF1 = $1.21 January 31, Year 7 CHF1 = $119 **For contracts expiring on January 31, Year 7. Forward Rates CHF1 =$1.20 CHF1 = $1.22 CHF1 = $119 Required (a) Prepare the journal entries that Versatile should make to record the events described assuming that the forward contract is designated as a cash flow hedge. (b) Prepare a partial trial balance of the accounts used as at December 31, Year 6, and indicate how each would appear on the company's financial statements. (c) Prepare the journal entries that Versatile should make to record the events described, assuming that the forward contract is designated as a fair value hedge. (d) Prepare a partial trial balance of the accounts used as at December 31, Year 6, and indicate how each would appear on the company's financial statements. (e) Describe how the accounting for the hedge affects the current ratio, and indicate which accounting treatment for the hedge would show the strongest liquidity position. a) Cash Flow Hedge October 1, Year 6 - Memorandum entry (know what is included) Journal entries (accounts, and amounts, only fill in the ones that are made) Dec. 31 Dec. 31 Jan. 31 Jan. 31 Jan. 31 Jan. 31 Jan. 31 Jan. 31 d) Trial balance, December 31 Forward contract liability OCI b) Fair Value Hedge October 1, Year 6 - Memorandum entry (know what is included) Journal entries (accounts, and amounts, only fill in the ones that are made) Dec. 31 Dec. 31 Jan. 31 Jan. 31 Jan. 31 Jan. 31 Jan. 31 d) Trial balance, December 31 Commitment receivable Exchange gains or losses