Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On October 15, 2025, Crane Co. purchased 3,860 barrels of fuel oil with a cost of $208,440 ($54 per barrel). Crane is holding this

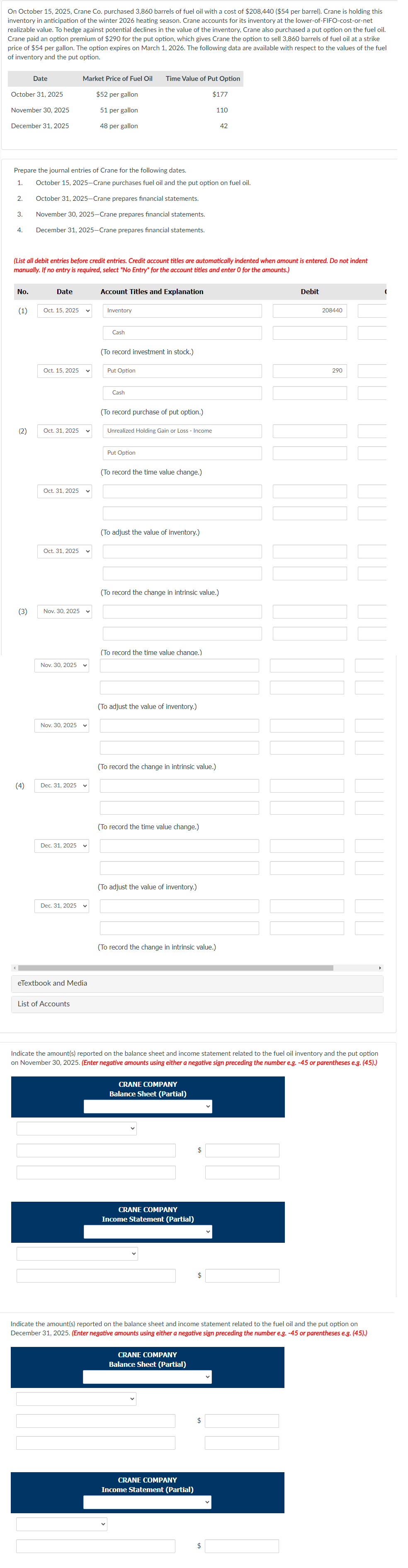

On October 15, 2025, Crane Co. purchased 3,860 barrels of fuel oil with a cost of $208,440 ($54 per barrel). Crane is holding this inventory in anticipation of the winter 2026 heating season. Crane accounts for its inventory at the lower-of-FIFO-cost-or-net realizable value. To hedge against potential declines in the value of the inventory, Crane also purchased a put option on the fuel oil. Crane paid an option premium of $290 for the put option, which gives Crane the option to sell 3,860 barrels of fuel oil at a strike price of $54 per gallon. The option expires on March 1, 2026. The following data are available with respect to the values of the fuel of inventory and the put option. Market Price of Fuel Oil Time Value of Put Option Date October 31, 2025 $52 per gallon November 30, 2025 51 per gallon December 31, 2025 48 per gallon Prepare the journal entries of Crane for the following dates. $177 110 42 1. October 15, 2025-Crane purchases fuel oil and the put option on fuel oil. 2. October 31, 2025-Crane prepares financial statements. 3. November 30, 2025-Crane prepares financial statements. 4. December 31, 2025-Crane prepares financial statements. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Date Account Titles and Explanation (1) Oct. 15, 2025 Inventory Cash (To record investment in stock.) Oct. 15, 2025 Put Option (2) Oct. 31, 2025 Oct. 31, 2025 Oct. 31, 2025 (3) Nov. 30, 2025 Cash (To record purchase of put option.) Unrealized Holding Gain or Loss - Income Put Option (To record the time value change.) (To adjust the value of inventory.) (To record the change in intrinsic value.) (To record the time value change.) Nov. 30, 2025 Nov. 30, 2025 (To adjust the value of inventory.) (To record the change in intrinsic value.) (4) Dec. 31, 2025 Dec. 31, 2025 Dec. 31, 2025 eTextbook and Media List of Accounts (To record the time value change.) (To adjust the value of inventory.) (To record the change in intrinsic value.) Debit 208440 290 Indicate the amount(s) reported on the balance sheet and income statement related to the fuel oil inventory and the put option on November 30, 2025. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) CRANE COMPANY Balance Sheet (Partial) CRANE COMPANY Income Statement (Partial) $ Indicate the amount(s) reported on the balance sheet and income statement related to the fuel oil and the put option on December 31, 2025. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) CRANE COMPANY Balance Sheet (Partial) CRANE COMPANY Income Statement (Partial) $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started