Answered step by step

Verified Expert Solution

Question

1 Approved Answer

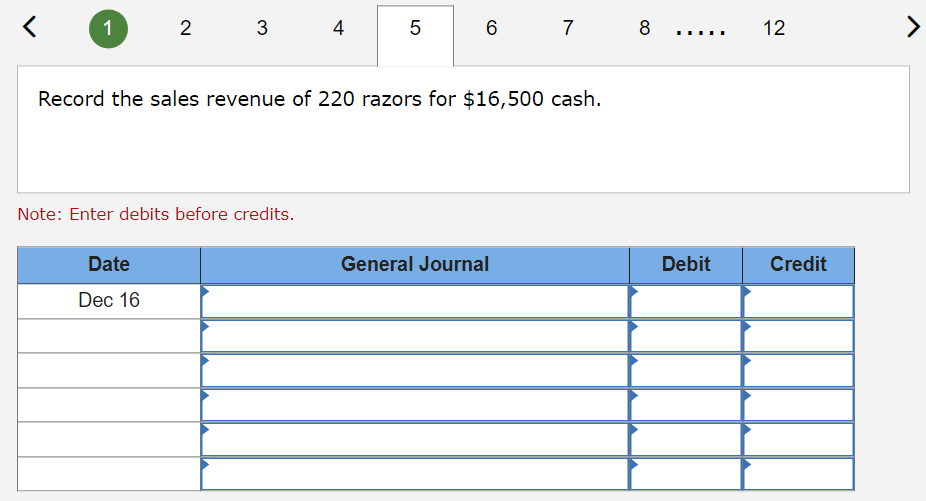

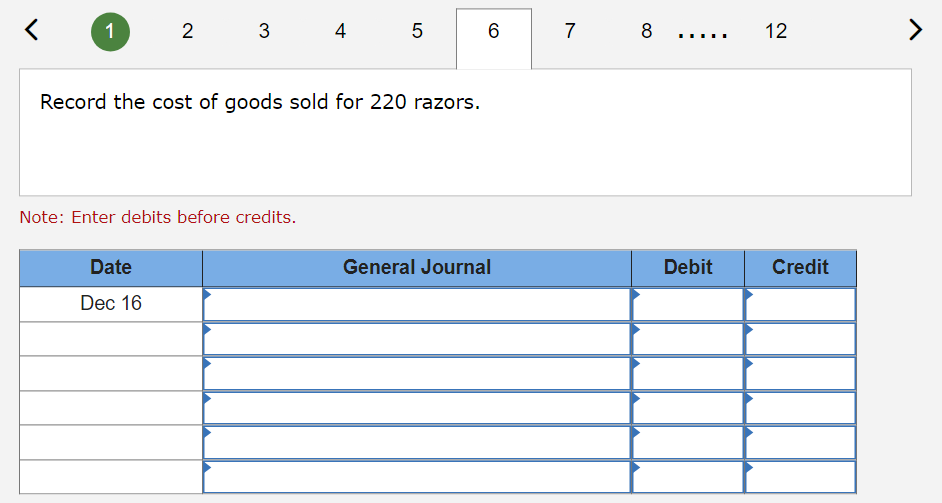

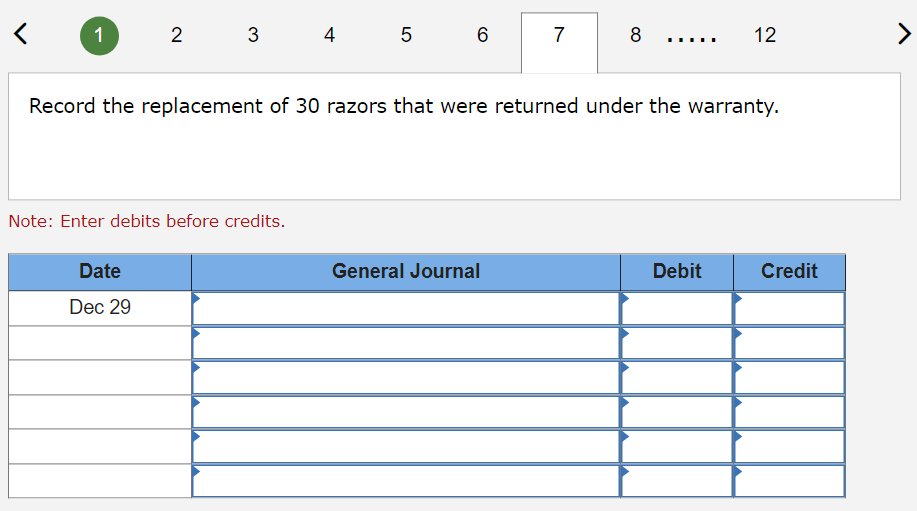

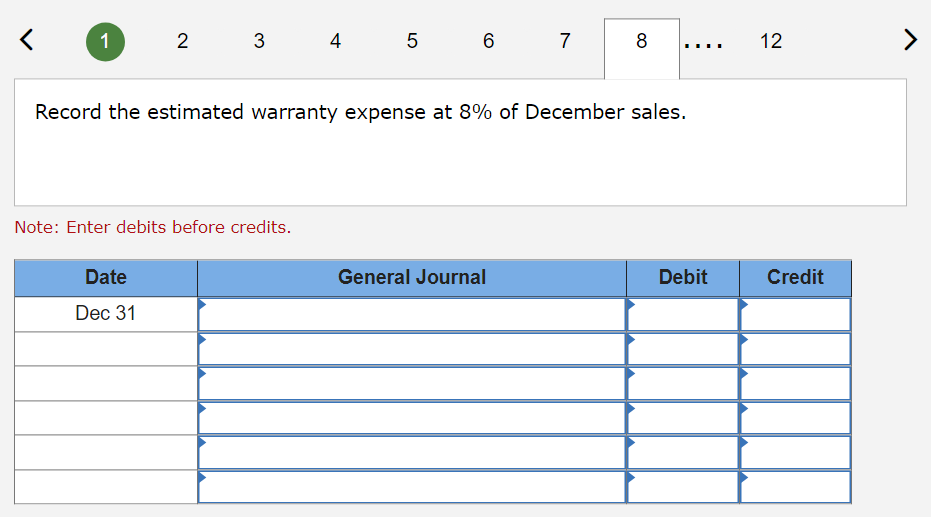

On October 29, Lobo Co. began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the

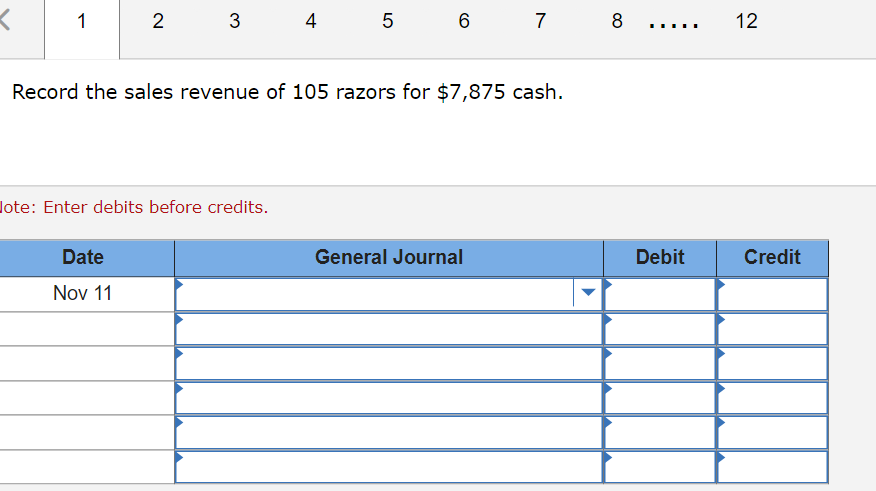

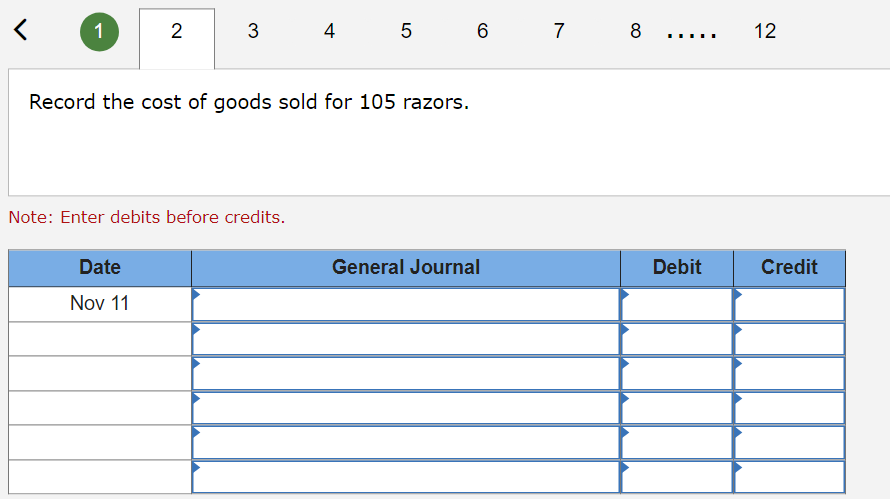

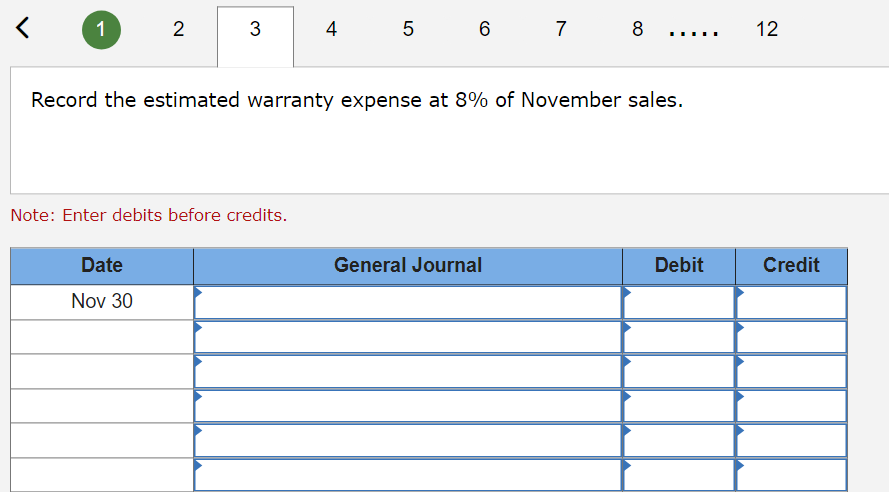

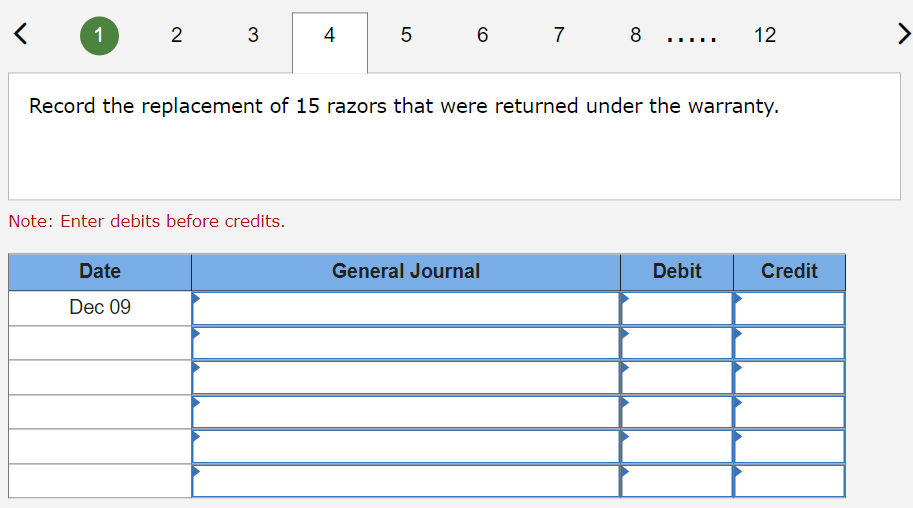

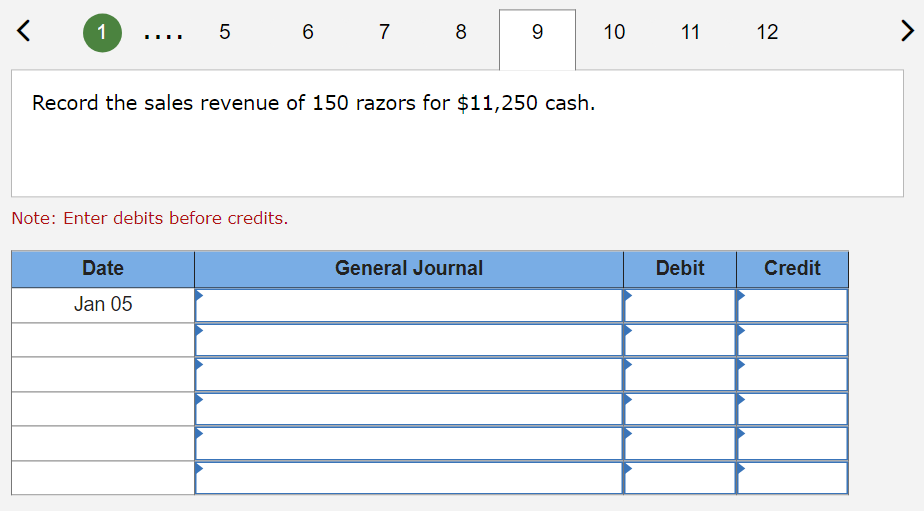

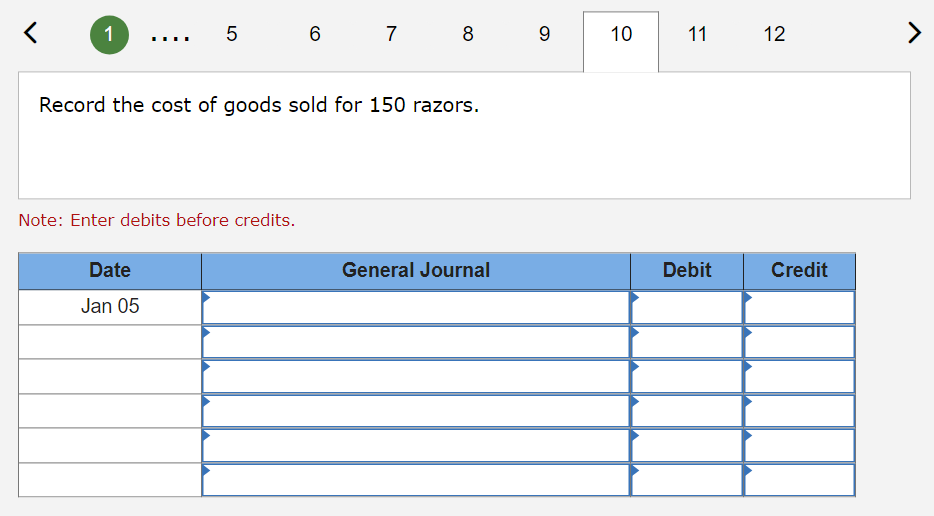

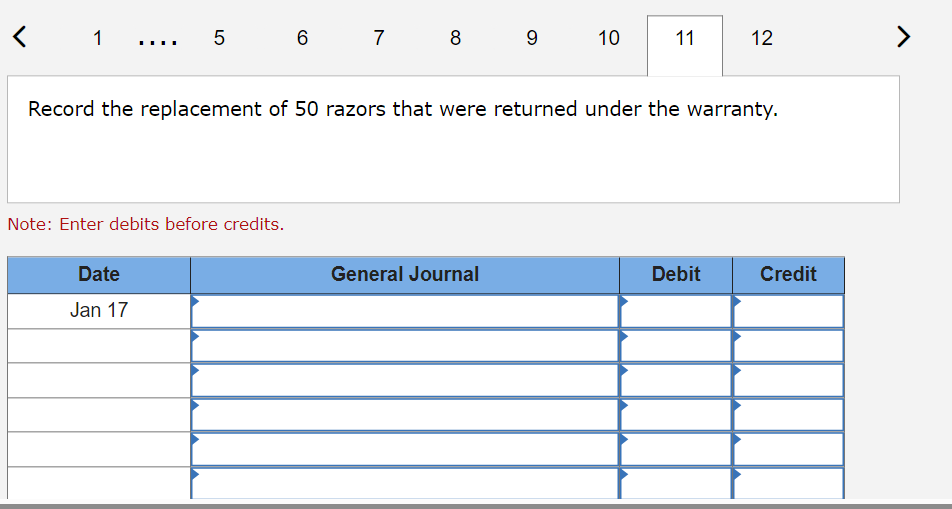

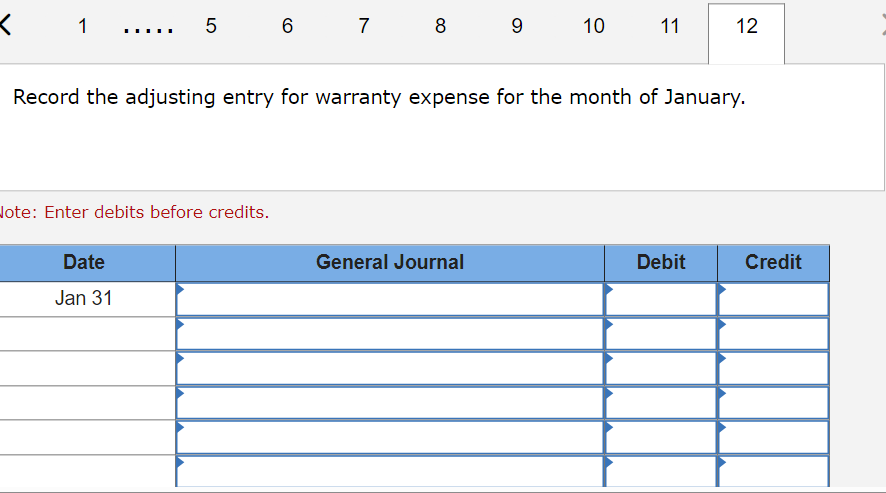

On October 29, Lobo Co. began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $20 and its retail selling price is $75. The company expects warranty costs to equal 8% of dollar sales. The following transactions occurred. Nov. 11 Sold 105 razors for $7,875 cash. Dec. 30 Recognized warranty expense related to November sales with an adjusting entry. 9 Replaced 15 razors that were returned under the warranty. 16 Sold 220 razors for $16,500 cash. 29 Replaced 30 razors that were returned under the warranty. 31 Recognized warranty expense related to December sales with an adjusting entry. Jan. 5 Sold 150 razors for $11,250 cash. 17 Replaced 50 razors that were returned under the warranty. 31 Recognized warranty expense related to January sales with an adjusting entry. < 1 2 3 4 LO 5 6 7 8 12 Record the sales revenue of 105 razors for $7,875 cash. lote: Enter debits before credits. Date Nov 11 General Journal Debit Credit 1 2 3 4 5 6 7 8 12 Record the cost of goods sold for 105 razors. Note: Enter debits before credits. Date Nov 11 General Journal Debit Credit 1 2 3 4 5 6 7 8 12 ----- Record the estimated warranty expense at 8% of November sales. Note: Enter debits before credits. Date Nov 30 General Journal Debit Credit 1 2 3 4 5 6 7 8 12 > Record the replacement of 15 razors that were returned under the warranty. Note: Enter debits before credits. Date Dec 09 General Journal Debit Credit 1 2 3 4 LO 5 6 7 8 12 > Record the sales revenue of 220 razors for $16,500 cash. Note: Enter debits before credits. Date Dec 16 General Journal Debit Credit 1 2 3 4 LO 5 6 7 8 12 Record the cost of goods sold for 220 razors. Note: Enter debits before credits. Date Dec 16 General Journal Debit Credit 1 2 3 4 5 CO 6 7 8 12 > Record the replacement of 30 razors that were returned under the warranty. Note: Enter debits before credits. Date Dec 29 General Journal Debit Credit 1 2 3 4 5 6 7 8 12 > Record the estimated warranty expense at 8% of December sales. Note: Enter debits before credits. Date Dec 31 General Journal Debit Credit 1 LO 5 6 7 8 9 10 11 12 7 Record the sales revenue of 150 razors for $11,250 cash. Note: Enter debits before credits. Date Jan 05 General Journal Debit Credit 1 5 6 7 8 9 10 11 12 Record the cost of goods sold for 150 razors. Note: Enter debits before credits. Date Jan 05 General Journal Debit Credit 1 LO 5 6 7 8 9 10 11 12 > Record the replacement of 50 razors that were returned under the warranty. Note: Enter debits before credits. Date Jan 17 General Journal Debit Credit 1 5 6 7 8 9 10 11 12 Record the adjusting entry for warranty expense for the month of January. Note: Enter debits before credits. Date Jan 31 General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started