Question

On November 16, 2019, a U.S. company makes a sale to a customer in Germany. Under the sale terms, the customer will pay the

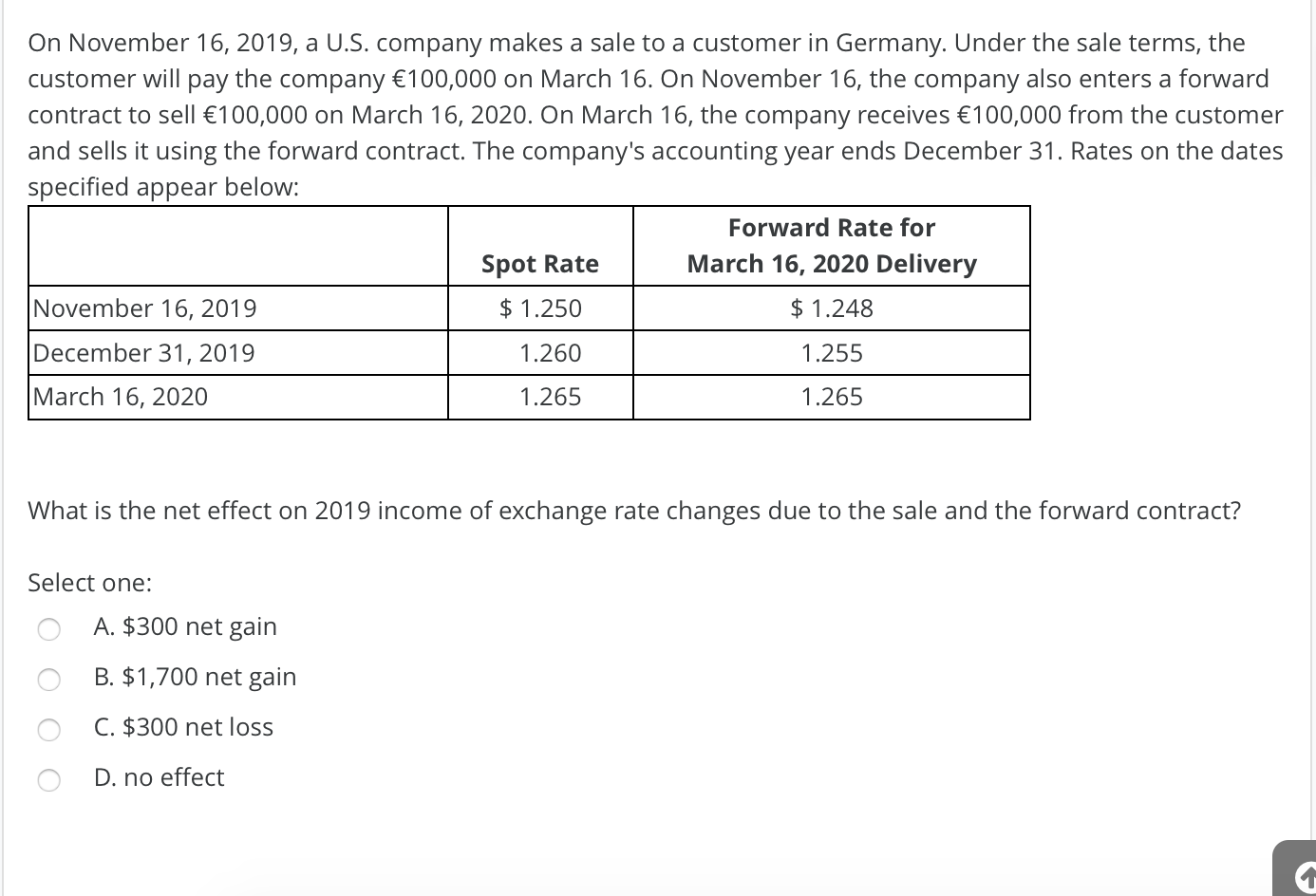

On November 16, 2019, a U.S. company makes a sale to a customer in Germany. Under the sale terms, the customer will pay the company 100,000 on March 16. On November 16, the company also enters a forward contract to sell 100,000 on March 16, 2020. On March 16, the company receives 100,000 from the customer and sells it using the forward contract. The company's accounting year ends December 31. Rates on the dates specified appear below: November 16, 2019 December 31, 2019 March 16, 2020 Select one: Spot Rate $ 1.250 1.260 1.265 What is the net effect on 2019 income of exchange rate changes due to the sale and the forward contract? A. $300 net gain B. $1,700 net gain C. $300 net loss D. no effect Forward Rate for March 16, 2020 Delivery $ 1.248 1.255 1.265 1

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Sol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Reporting and Analysis

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

3rd edition

9781337909402, 978-1337788281

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App