Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On October 31, 2015, Zeyn sold the property whose its cost of goods was 60,000 at a price of $75,000. he received a down

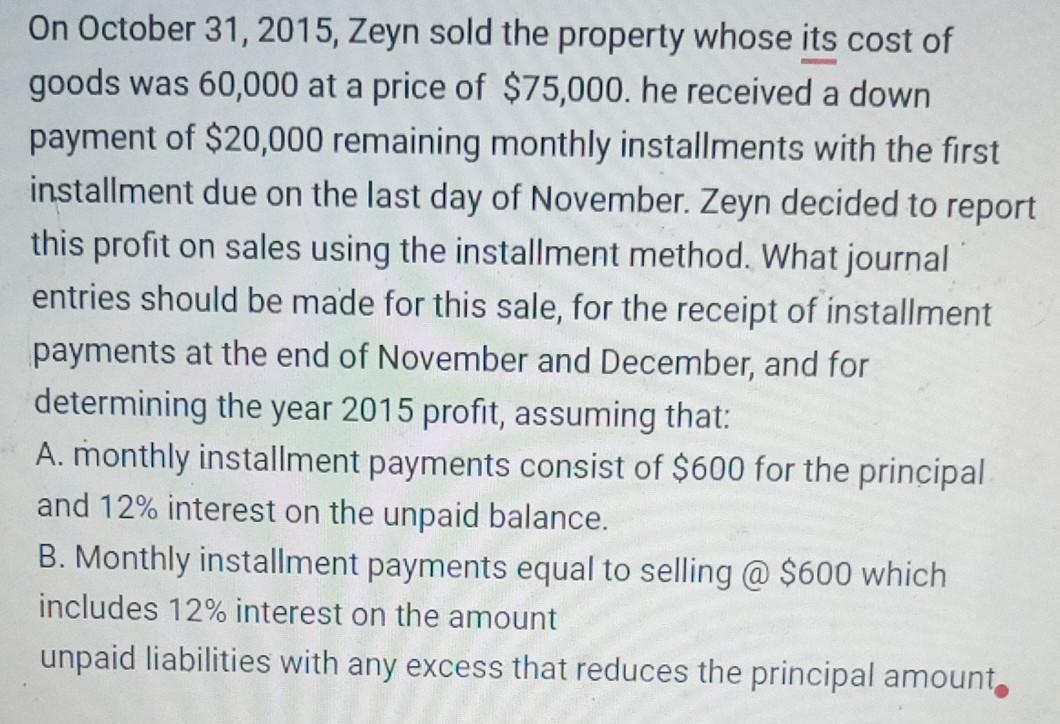

On October 31, 2015, Zeyn sold the property whose its cost of goods was 60,000 at a price of $75,000. he received a down payment of $20,000 remaining monthly installments with the first installment due on the last day of November. Zeyn decided to report this profit on sales using the installment method. What journal entries should be made for this sale, for the receipt of installment payments at the end of November and December, and for determining the year 2015 profit, assuming that: . A. monthly installment payments consist of $600 for the principal and 12% interest on the unpaid balance. B. Monthly installment payments equal to selling @ $600 which includes 12% interest on the amount unpaid liabilities with any excess that reduces the principal amount.

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

A Principal payment 600 pm Date Opening balance InstallmentDown payment Principal Interest Closing B...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started