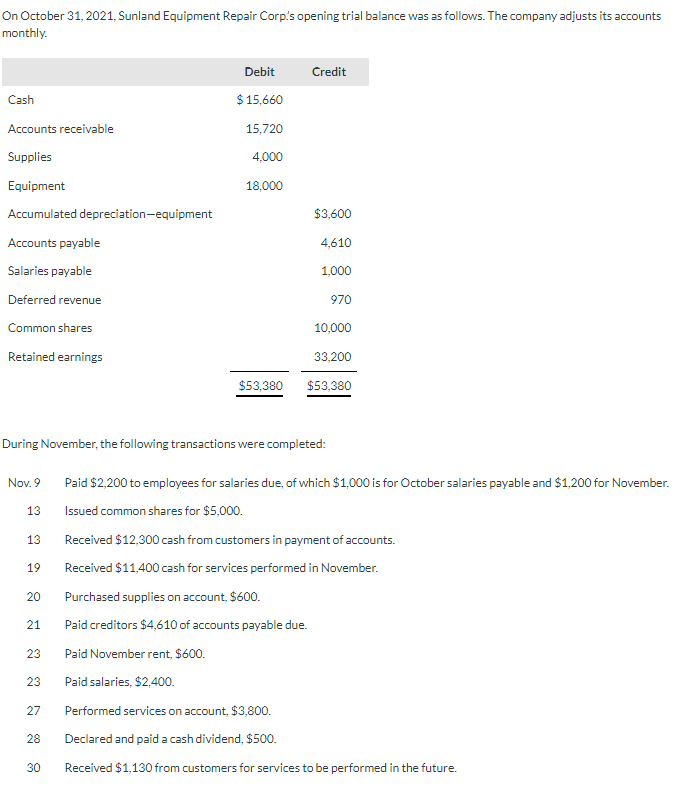

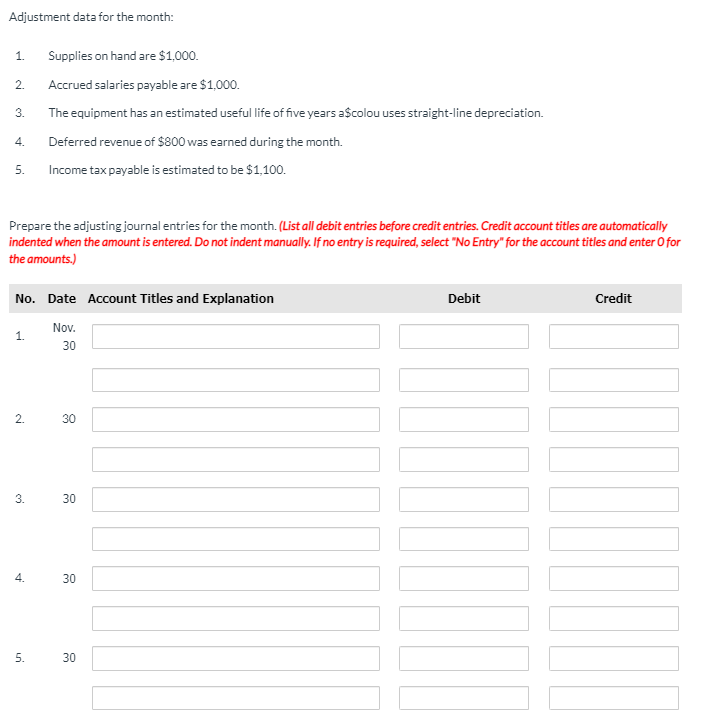

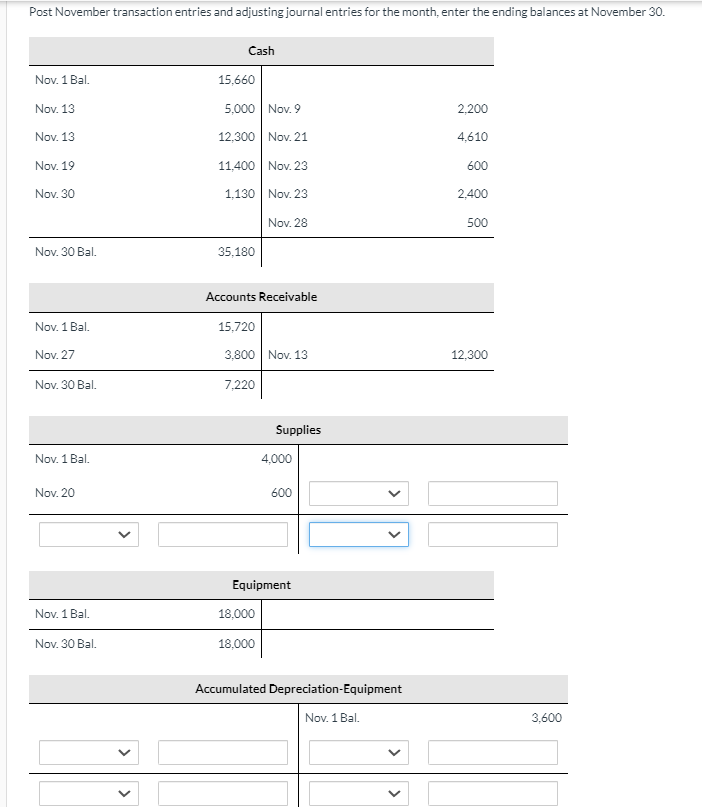

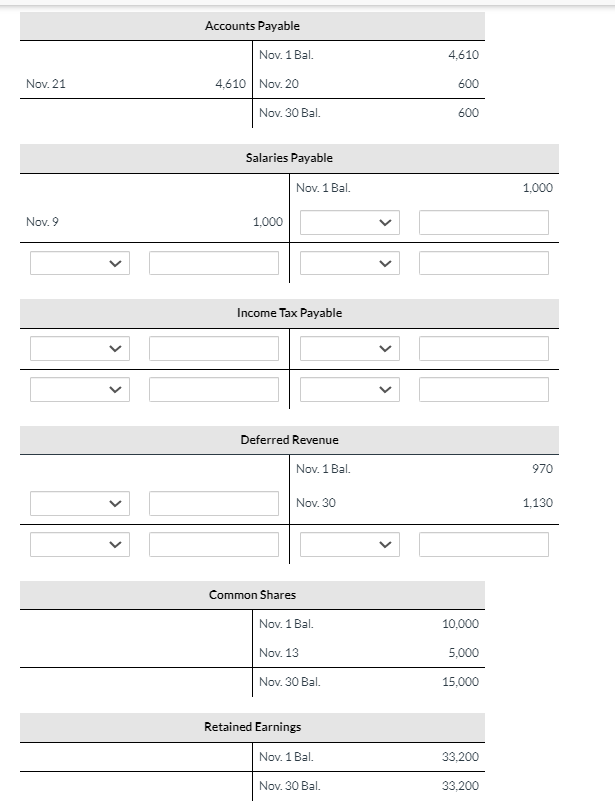

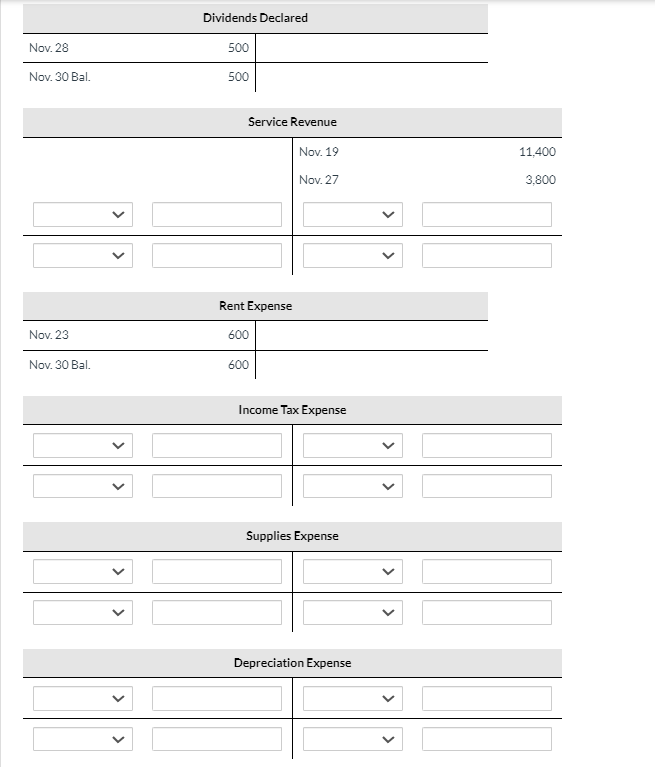

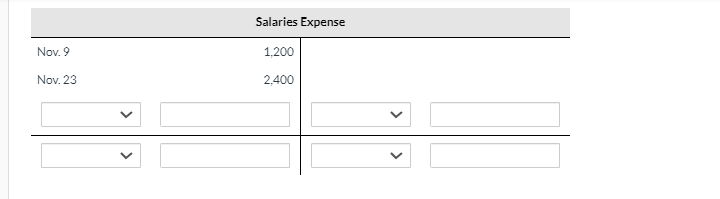

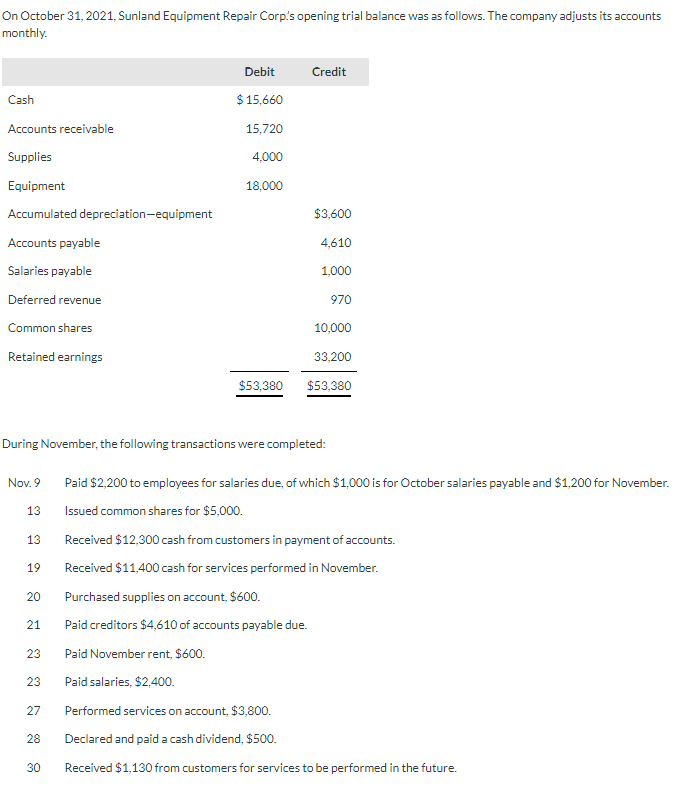

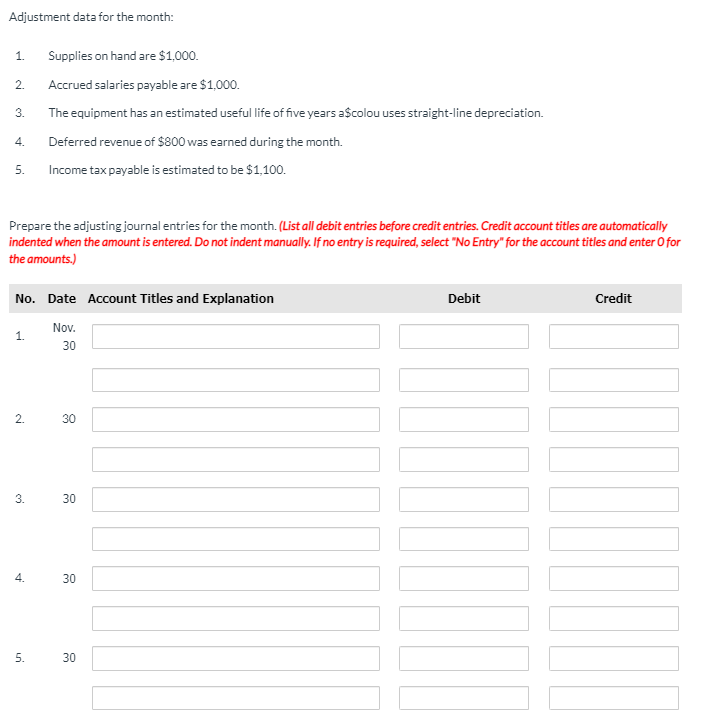

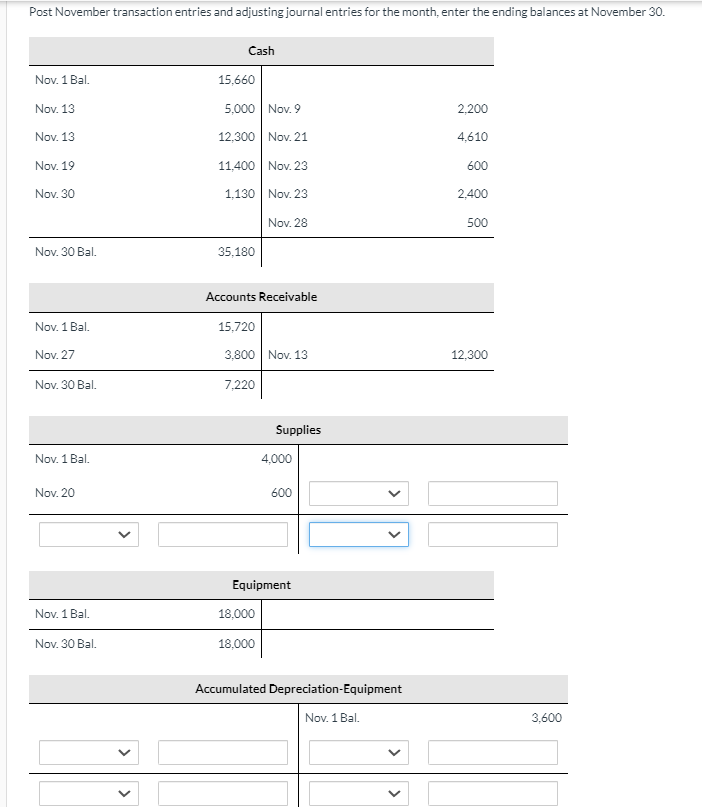

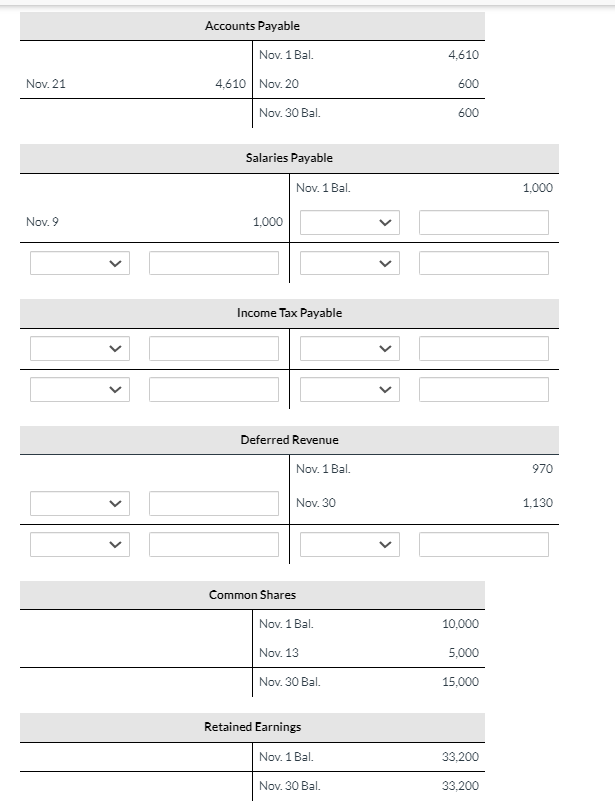

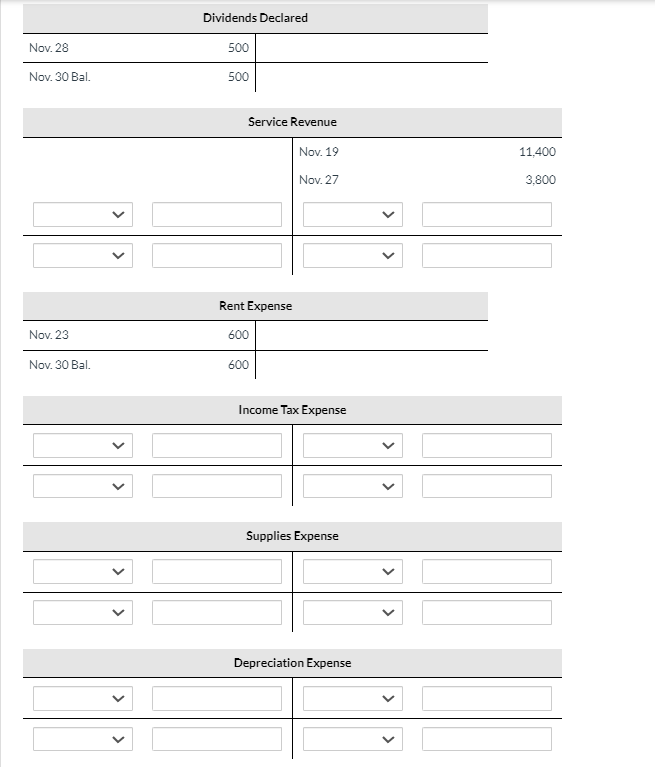

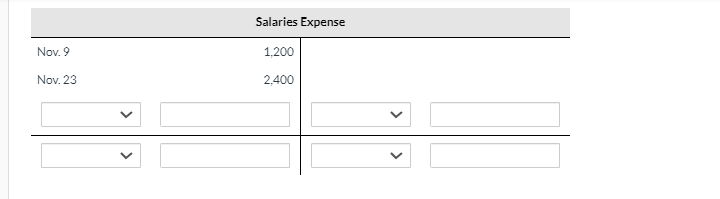

On October 31, 2021, Sunland Equipment Repair Corp.s opening trial balance was as follows. The company adjusts its accounts monthly. During November, the following transactions were completed: Nov. 9 Paid $2,200 to employees for salaries due, of which $1,000 is for October salaries payable and $1,200 for November. 13 Issued common shares for $5,000. 13 Received $12,300 cash from customers in payment of accounts. 19 Received $11,400 cash for services performed in November. 20 Purchased supplies on account, $600. 21 Paid creditors $4,610 of accounts payable due. 23 Paid November rent, $600. 23 Paid salaries, $2,400. 27 Performed services on account, $3,800. 28 Declared and paid a cash dividend, $500. 30 Received $1,130 from customers for services to be performed in the future. Adjustment data for the month: 1. Supplies on hand are $1,000. 2. Accrued salaries payable are $1,000. 3. The equipment has an estimated useful life of five years a\$colou uses straight-line depreciation. 4. Deferred revenue of $800 was earned during the month. 5. Income tax payable is estimated to be $1,100. Prepare the adjusting journal entries for the month. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Post November transaction entries and adjusting journal entries for the month, enter the ending balances at November 30 . Cash \begin{tabular}{lr|lr} \hline Nov. 1 Bal. & 15,660 & & \\ Nov. 13 & 5,000 & Nov. 9 & 2,200 \\ Nov. 13 & 12,300 & Nov. 21 & 4,610 \\ Nov. 19 & 11,400 & Nov. 23 & 600 \\ Nov. 30 & 1,130 & Nov. 23 & 2,400 \\ & & Nov. 28 & 500 \\ \hline Nov. 30 Bal. & 35,180 & & \end{tabular} Accounts Receivable \begin{tabular}{lr|lr} \hline Nov. 1 Bal. & 15,720 & & \\ Nov. 27 & 3,800 & Nov. 13 & 12,300 \\ \hline Nov. 30 Bal. & 7,220 & \end{tabular} Supplies Nov. 1 Bal. Nov. 20 Equipment \begin{tabular}{lr|l} \hline Nov. 1 Bal. & 18,000 & \\ \hline Nov. 30 Bal. & 18,000 & \end{tabular} Accumulated Depreciation-Equipment Accounts Payable \begin{tabular}{lllr} \hline & & Nov. 1 Bal. & 4,610 \\ Nov. 21 & 4,610 & Nov. 20 & 600 \\ \hline & & Nov. 30 Bal. & 600 \end{tabular} Income Tax Payable Deferred Revenue Common Shares \begin{tabular}{l|lr} \hline & Nov. 1 Bal. & 10,000 \\ & Nov. 13 & 5,000 \\ \hline & Nov. 30 Bal. & 15,000 \end{tabular} Retained Earnings \begin{tabular}{l|lr} \hline & Nov. 1 Bal. & 33,200 \\ \hline & Nov. 30 Bal. & 33,200 \end{tabular} Dividends Declared \begin{tabular}{ll|l} \hline Nov. 28 & 500 & \\ \hline Nov. 30 Bal. & 500 & \end{tabular} Service Revenue \begin{tabular}{lr|l} \multicolumn{2}{c}{ Rent Expense } \\ \hline Nov. 23 & 600 & \\ \hline Nov. 30 Bal. & 600 & \end{tabular} Income Tax Expense Supplies Expense Depreciation Expense Salaries Expense Nov. 9 Nov. 23 1,200 2,400