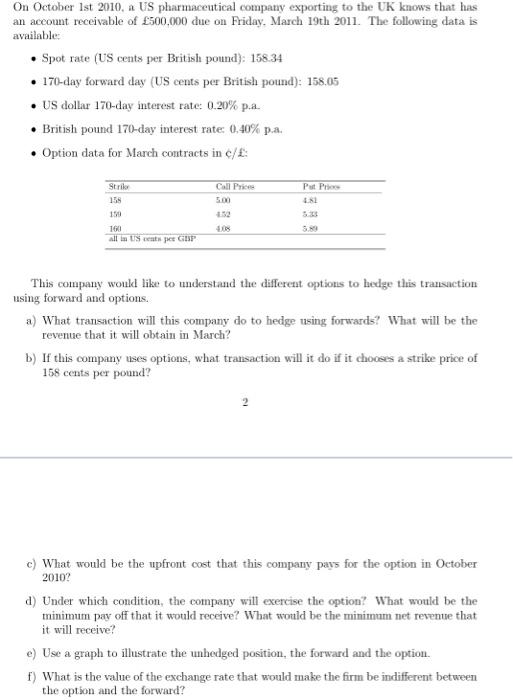

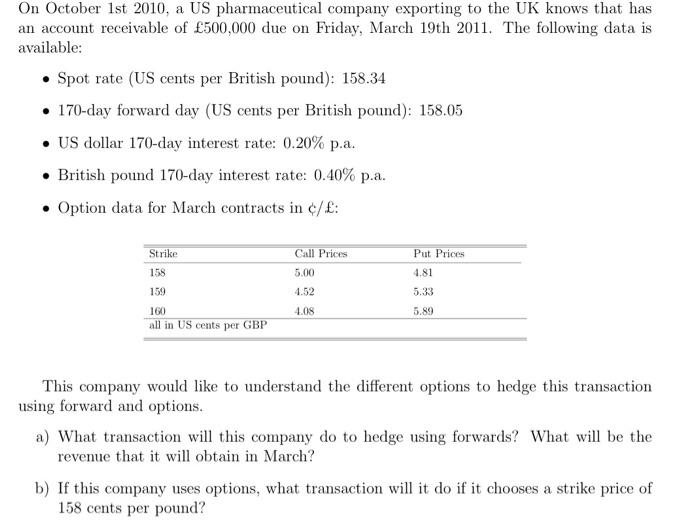

On October lst 2010, a US pharmaceutical company exporting to the UK knows that has an aceount receivable of 500,000 due on Friday. March 19th 2011. The following data is available: - Spot rate (US cents per British pound): 158.34 - 170-day forward day (US cents per British pound): 158.05 - US dollar 170-day interest rate: 0.20% p.a. - British pound 170-day interest rate: 0,40% p.a. - Option data for March contracts in c/E : This company woukd like to understand the different options to hedge this transaction using forward and options. a) What transaction will this company do to hedge using forwards? What will be the revenue that it will obtain in March? b) If this company uses options, what transaction will it do if it chooes a strike price of 158 cents per pound? c) What would be the upfront cost that this company pays for the option in October 2010? d) Under which condition, the company will exercise the option? What would be the tninimum pay off that it would receive? What would be the minimum net revenue that it will receive? e) Use a graph to illustrate the unhedged position, the forward and the option. f) What is the value of the exchange rate that would make the firm be indifferent between the option and the forward? On October 1st 2010, a US pharmaceutical company exporting to the UK knows that has an account receivable of 500,000 due on Friday, March 19th 2011. The following data is available: - Spot rate (US cents per British pound): 158.34 - 170-day forward day (US cents per British pound): 158.05 - US dollar 170-day interest rate: 0.20% p.a. - British pound 170-day interest rate: 0.40% p.a. - Option data for March contracts in c/ : This company would like to understand the different options to hedge this transaction using forward and options. a) What transaction will this company do to hedge using forwards? What will be the revenue that it will obtain in March? b) If this company uses options, what transaction will it do if it chooses a strike price of 158 cents per pound? c) What would be the upfront cost that this company pays for the option in October 2010 ? d) Under which condition, the company will exercise the option? What would be the minimum pay off that it would receive? What would be the minimum net revenue that it will receive? e) Use a graph to illustrate the unhedged position, the forward and the option. f) What is the value of the exchange rate that would make the firm be indifferent between the option and the forward? On October lst 2010, a US pharmaceutical company exporting to the UK knows that has an aceount receivable of 500,000 due on Friday. March 19th 2011. The following data is available: - Spot rate (US cents per British pound): 158.34 - 170-day forward day (US cents per British pound): 158.05 - US dollar 170-day interest rate: 0.20% p.a. - British pound 170-day interest rate: 0,40% p.a. - Option data for March contracts in c/E : This company woukd like to understand the different options to hedge this transaction using forward and options. a) What transaction will this company do to hedge using forwards? What will be the revenue that it will obtain in March? b) If this company uses options, what transaction will it do if it chooes a strike price of 158 cents per pound? c) What would be the upfront cost that this company pays for the option in October 2010? d) Under which condition, the company will exercise the option? What would be the tninimum pay off that it would receive? What would be the minimum net revenue that it will receive? e) Use a graph to illustrate the unhedged position, the forward and the option. f) What is the value of the exchange rate that would make the firm be indifferent between the option and the forward? On October 1st 2010, a US pharmaceutical company exporting to the UK knows that has an account receivable of 500,000 due on Friday, March 19th 2011. The following data is available: - Spot rate (US cents per British pound): 158.34 - 170-day forward day (US cents per British pound): 158.05 - US dollar 170-day interest rate: 0.20% p.a. - British pound 170-day interest rate: 0.40% p.a. - Option data for March contracts in c/ : This company would like to understand the different options to hedge this transaction using forward and options. a) What transaction will this company do to hedge using forwards? What will be the revenue that it will obtain in March? b) If this company uses options, what transaction will it do if it chooses a strike price of 158 cents per pound? c) What would be the upfront cost that this company pays for the option in October 2010 ? d) Under which condition, the company will exercise the option? What would be the minimum pay off that it would receive? What would be the minimum net revenue that it will receive? e) Use a graph to illustrate the unhedged position, the forward and the option. f) What is the value of the exchange rate that would make the firm be indifferent between the option and the forward