Answered step by step

Verified Expert Solution

Question

1 Approved Answer

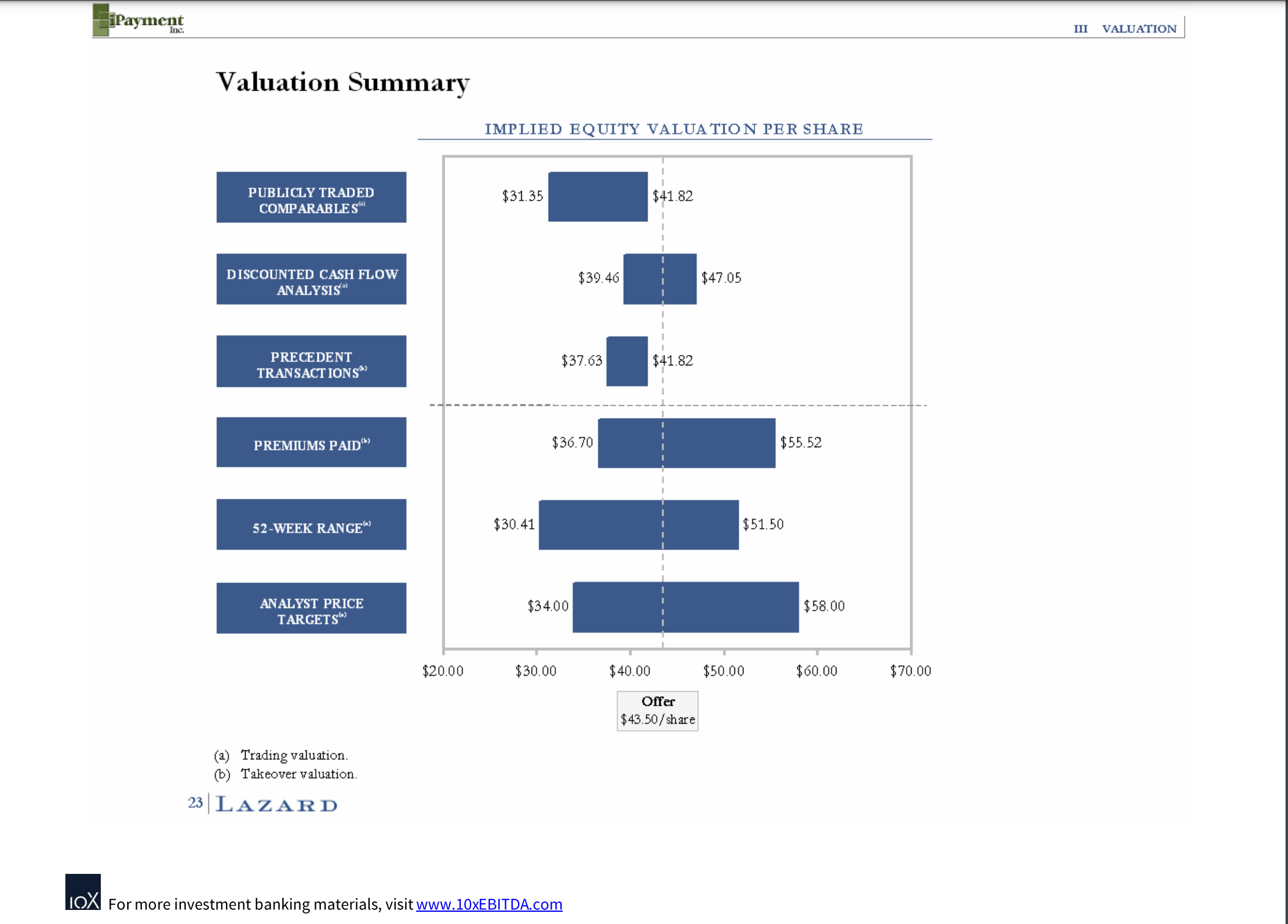

On page 23, the $43.50 transaction price is within the DCF range and higher than the publicly traded comparable companies and precedent transaction multiple implied

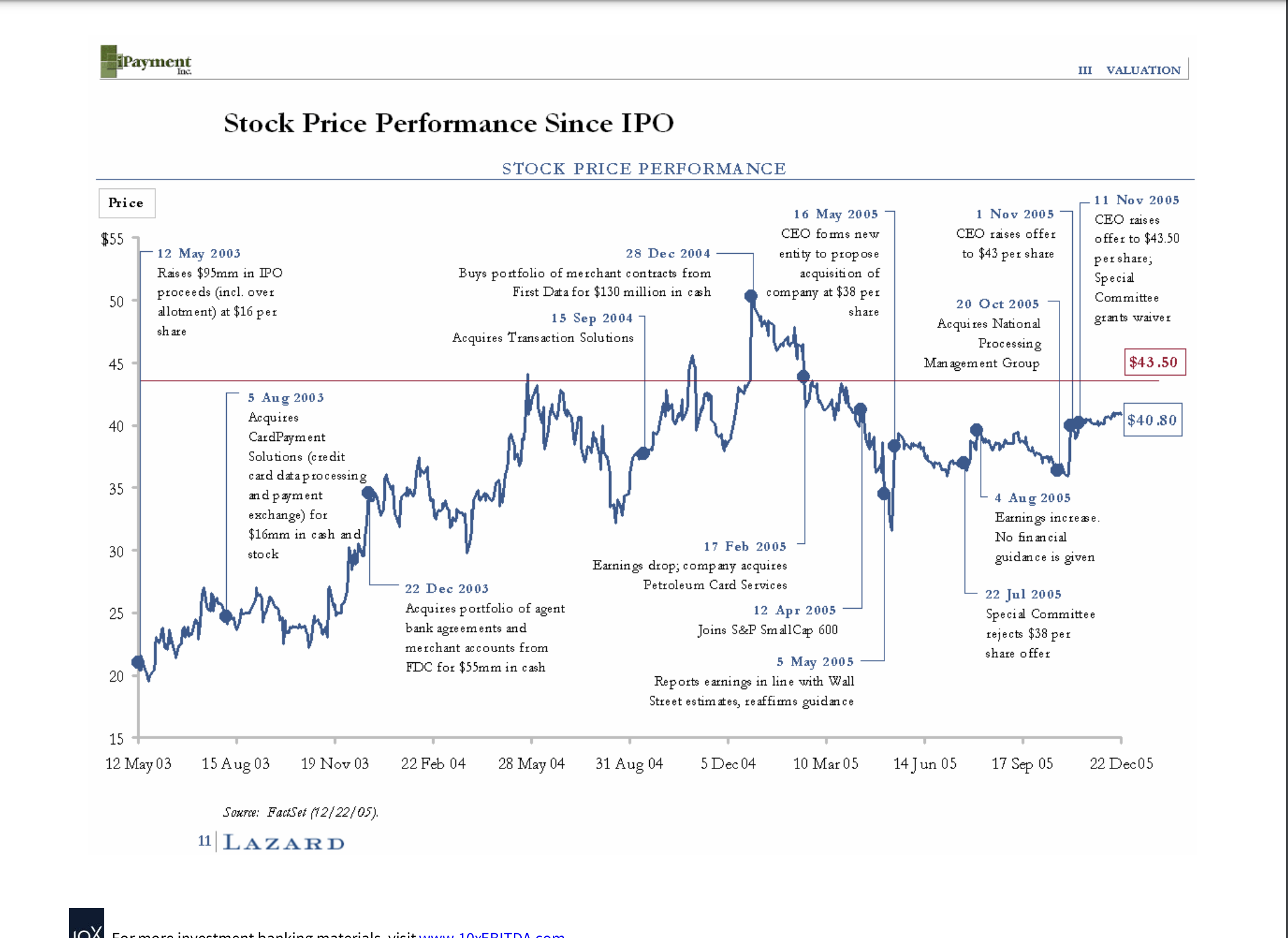

Valuation Summary (b) Takeover valuation. 23|LAZARD For more investment banking materials, visi1 iParment III VALUATION Stock Price Performance Since IPO STOCK PRICE PERFORMANCE Sonte: FactSet (12/22/05). 11 LAZARDOn page 23, the $43.50 transaction price is within the DCF range and higher than the publicly traded comparable companies and precedent transaction multiple implied valuations. However, the price is 15.5% lower than the 52 week high of the stand alone trading price. If you were the investment banker, why would you advise the Special Committee that this is not concerning in this fact pattern? Why might the stock be trading at $55.52 at the time but that is not a price that the Special Committee should demand in a transaction now? HINT: page 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started