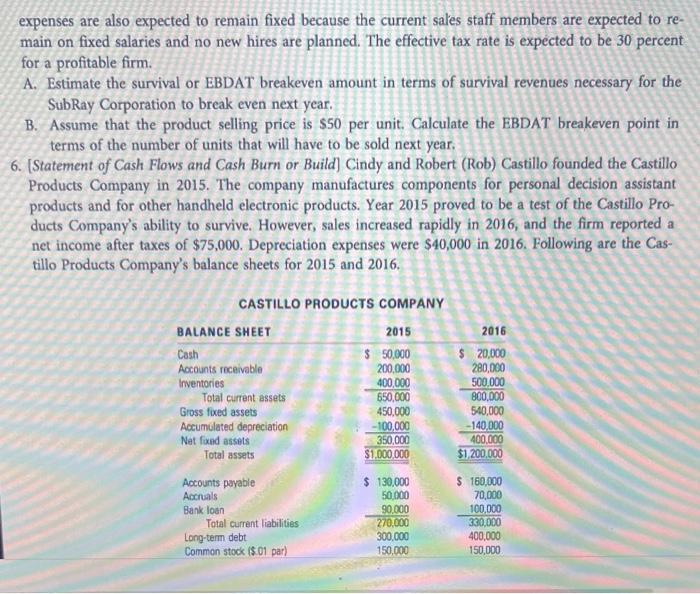

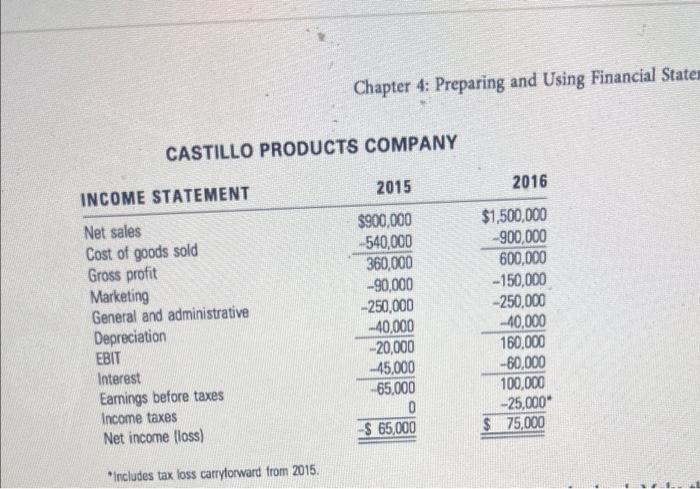

On pages 154 and 155 of our text, you will find financial statements for Castillo Products Company 1. Using the 2016 income statement and the balance sheets, prepare a statement of cash flows Here's a tip: Compare the 2016 net income to the change in retained earnings from 2015 to 2016. If the change in retained earnings is less than net profit, they paid dividends to the owners. 2. Using the 2016 income statement, calculate the EBDAT breakeven point. Show your math. 3. From your calculations, the financial statements provided, and the description in the text, what advice related your findings in questions one and two would you share with the owners? Show critical thinking here - more than the obvious. expenses are also expected to remain fixed because the current sales staff members are expected to re- main on fixed salaries and no new hires are planned. The effective tax rate is expected to be 30 percent for a profitable firm A. Estimate the survival or EBDAT breakeven amount in terms of survival revenues necessary for the SubRay Corporation to break even next year. B. Assume that the product selling price is $50 per unit. Calculate the EBDAT breakeven point in terms of the number of units that will have to be sold next year. 6. (Statement of Cash Flows and Cash Burn or Build) Cindy and Robert (Rob) Castillo founded the Castillo Products Company in 2015. The company manufactures components for personal decision assistant products and for other handheld electronic products. Year 2015 proved to be a test of the Castillo Pro- ducts Company's ability to survive. However, sales increased rapidly in 2016, and the firm reported a net income after taxes of $75,000. Depreciation expenses were $40,000 in 2016. Following are the Cas- tillo Products Company's balance sheets for 2015 and 2016. CASTILLO PRODUCTS COMPANY BALANCE SHEET 2015 Cash $ 50,000 $ 20,000 Accounts receivable 200,000 280,000 Inventories Total current assets 650,000 Gross fixed assets 450,000 540,000 Accumulated depreciation -100,000 Net fixed assets Total assets $1,200.000 Accounts payable Accruals 70,000 Bank loan 100,000 Total Current liabilities Long-term debt 300,000 Common stock (5 01 par) 2016 400,000 500,000 800,000 -140,000 400.000 350,000 $1.000.000 $ 160,000 $ 130,000 50.000 90.000 270.000 330.000 400,000 150,000 150,000 Chapter 4: Preparing and Using Financial Staten CASTILLO PRODUCTS COMPANY 2015 2016 INCOME STATEMENT Net sales Cost of goods sold Gross profit Marketing General and administrative Depreciation EBIT Interest Earnings before taxes Income taxes Net income floss) $900,000 --540,000 360,000 -90,000 - 250,000 -40,000 20,000 -45,000 65,000 0 -$ 65,000 $1,500,000 -900,000 600,000 - 150,000 - 250,000 - 40,000 160.000 -60,000 100,000 -- 25,000 $ 75,000 includes tax loss carryforward from 2015