Answered step by step

Verified Expert Solution

Question

1 Approved Answer

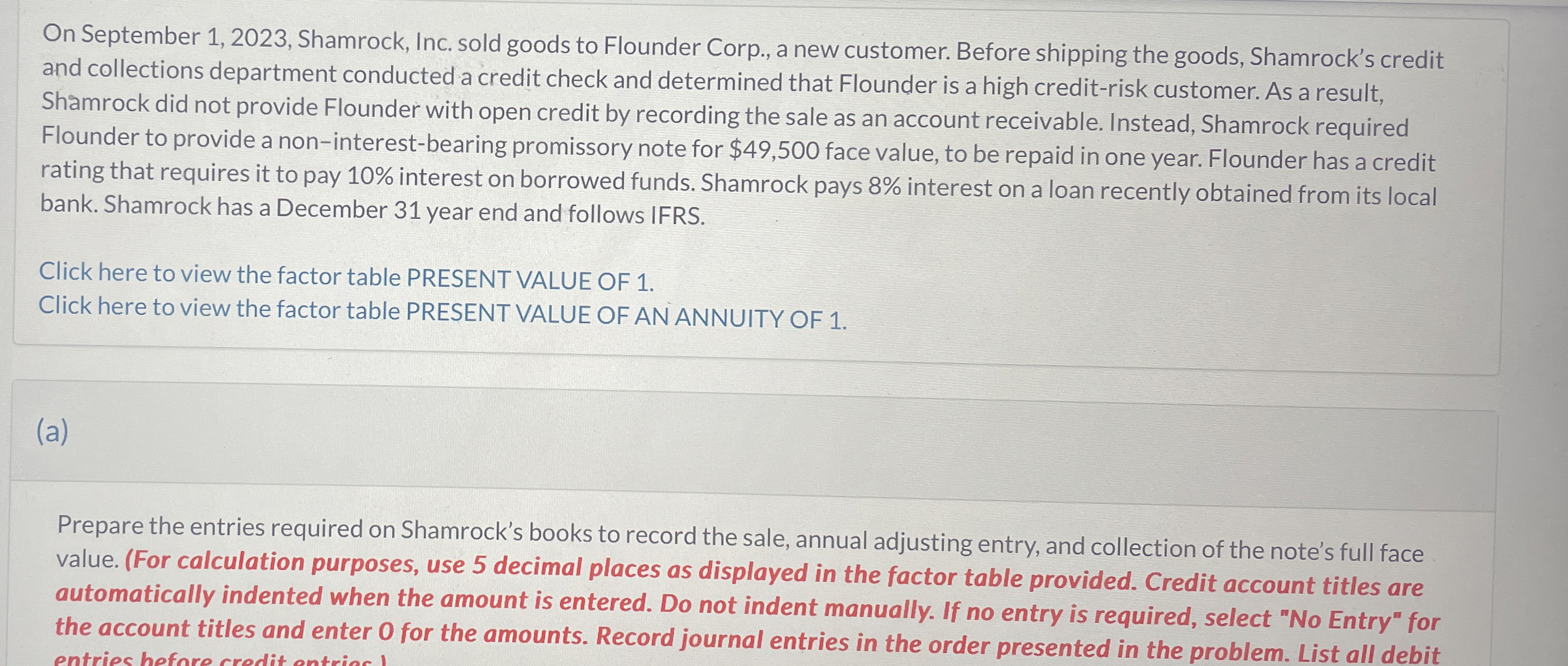

On September 1 , 2 0 2 3 , Shamrock, Inc. sold goods to Flounder Corp., a new customer. Before shipping the goods, Shamrock's credit

On September Shamrock, Inc. sold goods to Flounder Corp., a new customer. Before shipping the goods, Shamrock's credit and collections department conducted a credit check and determined that Flounder is a high creditrisk customer. As a result, Shamrock did not provide Flounder with open credit by recording the sale as an account receivable. Instead, Shamrock required Flounder to provide a noninterestbearing promissory note for $ face value, to be repaid in one year. Flounder has a credit rating that requires it to pay interest on borrowed funds. Shamrock pays interest on a loan recently obtained from its local bank. Shamrock has a December year end and follows IFRS.

ick here to view the factor table PRESENT VALUE OF

ick here to view the factor table PRESENT VALUE OF AN ANNUITY OF

a

Prepare the entries required on Shamrock's books to record the sale, annual adjusting entry, and collection of the note's full face value. For calculation purposes, use decimal places as displayed in the factor table provided. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter for the amounts. Record journal entries in the order presented in the problem. List all debit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started