Question

On September 1, 2000, Company ABC had $10M of fixed-rate bonds outstanding. The bonds have a coupon rate of 9.25% (semi-annual coupons) and maturity of

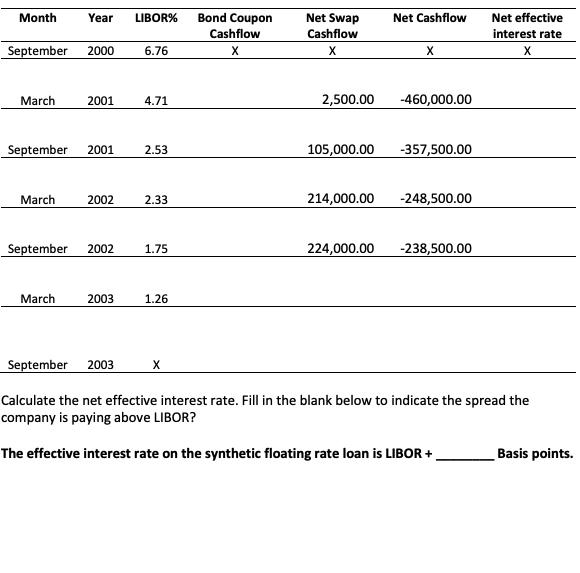

On September 1, 2000, Company ABC had $10M of fixed-rate bonds outstanding. The bonds have a coupon rate of 9.25% (semi-annual coupons) and maturity of September 1, 2003. ABC wishes to create a synthetic floating rate loan through the swap market. On September 1, 2000, 3-year swaps were offered at a rate of 6.81%/LIBOR. Assume ABC takes the floating-payer position in the 3-year swap (Semi-annual payments, and notional principal of $10M). Complete the following table to indicate the cashflows associated with the synthetic floating rate loan. Mark cash outflows as negative values.

Month Year LIBOR% Bond Coupon Net Swap Net Cashflow Net effective Cashflow Cashflow interest rate September 2000 6.76 X X March 2001 4.71 2,500.00 -460,000.00 September 2001 105,000.00 -357,500.00 2.53 March 2002 2.33 214,000.00 -248,500.00 September 2002 1.75 224,000.00 -238,500.00 March 2003 1.26 September 2003 X Calculate the net effective interest rate. Fill in the blank below to indicate the spread the company is paying above LIBOR? The effective interest rate on the synthetic floating rate loan is LIBOR +. Basis points.

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Bond coupon 925 Semiannual coupon payment 925210000000 462500 Net swap cash flow 6...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started