Answered step by step

Verified Expert Solution

Question

1 Approved Answer

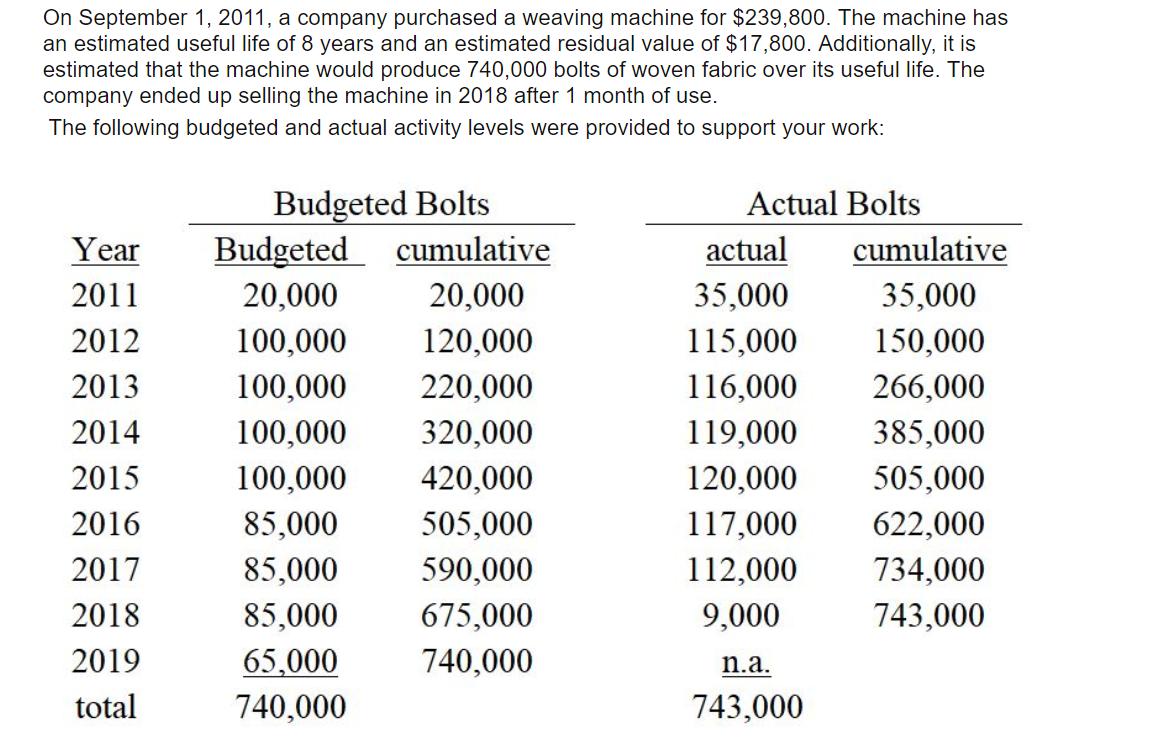

On September 1, 2011, a company purchased a weaving machine for $239,800. The machine has an estimated useful life of 8 years and an

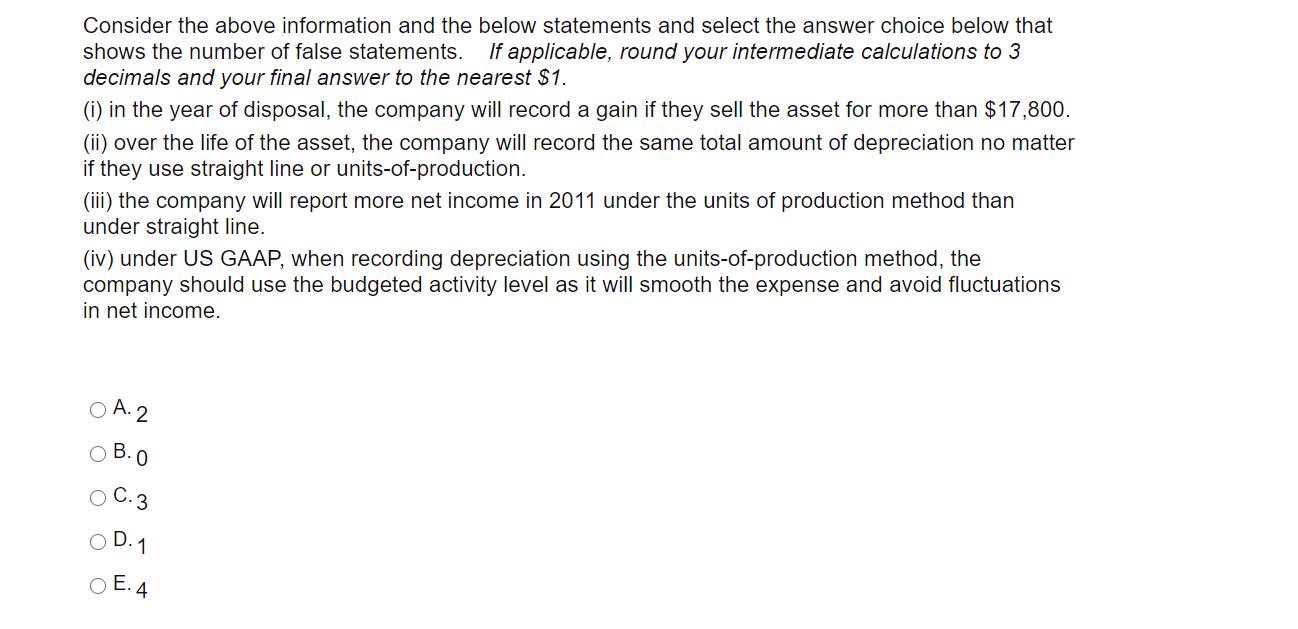

On September 1, 2011, a company purchased a weaving machine for $239,800. The machine has an estimated useful life of 8 years and an estimated residual value of $17,800. Additionally, it is estimated that the machine would produce 740,000 bolts of woven fabric over its useful life. The company ended up selling the machine in 2018 after 1 month of use. The following budgeted and actual activity levels were provided to support your work: Budgeted Bolts Budgeted cumulative Actual Bolts Year actual cumulative 2011 20,000 20,000 35,000 35,000 2012 100,000 120,000 115,000 150,000 2013 100,000 220,000 116,000 266,000 2014 100,000 320,000 119,000 385,000 2015 100,000 420,000 120,000 505,000 2016 85,000 505,000 117,000 622,000 2017 85,000 590,000 112,000 734,000 2018 85,000 675,000 9,000 743,000 2019 65,000 740,000 n.a. total 740,000 743,000 Consider the above information and the below statements and select the answer choice below that If applicable, round your intermediate calculations to 3 shows the number of false statements. decimals and your final answer to the nearest $1. (i) in the year of disposal, the company will record a gain if they sell the asset for more than $17,800. (ii) over the life of the asset, the company will record the same total amount of depreciation no matter if they use straight line or units-of-production. (iii) the company will report more net income in 2011 under the units of production method than under straight line. (iv) under US GAAP, when recording depreciation using the units-of-production method, the company should use the budgeted activity level as it will smooth the expense and avoid fluctuations in net income. O A. 2 B.0 1 O E. 4

Step by Step Solution

★★★★★

3.33 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Total Cost of Machine 239800 Estimated Life of Machine 8 years Residual Value 17800 Depreciation For ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started