Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On September 1, 2016, a new machine was acquired for P150,000. This machine replaced two other machines. One of the two replaced machines was

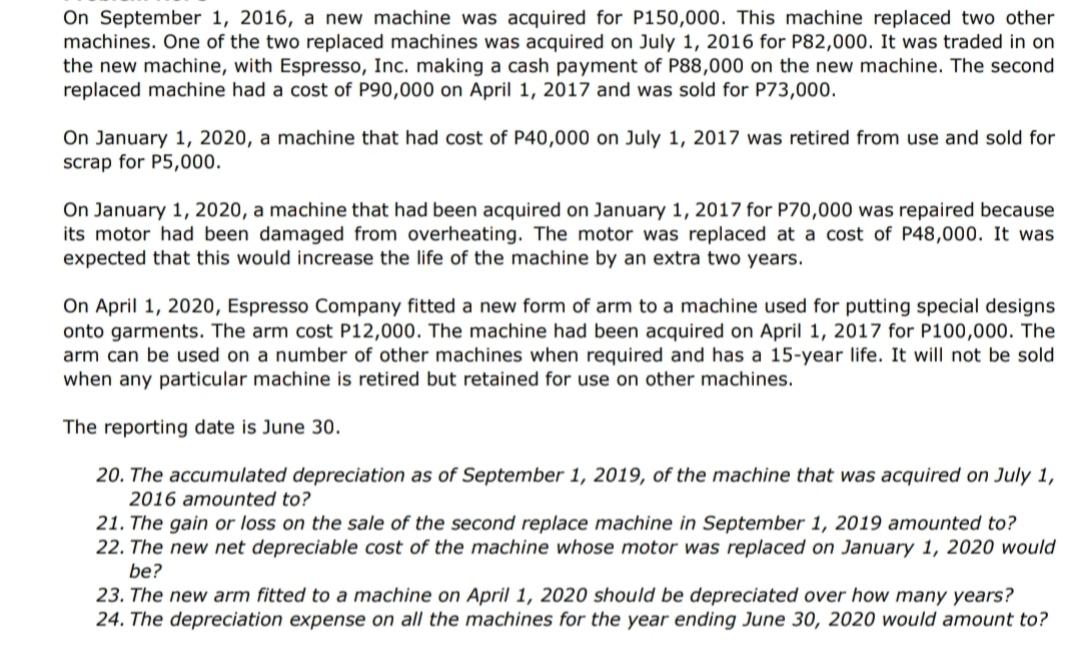

On September 1, 2016, a new machine was acquired for P150,000. This machine replaced two other machines. One of the two replaced machines was acquired on July 1, 2016 for P82,000. It was traded in on the new machine, with Espresso, Inc. making a cash payment of P88,000 on the new machine. The second replaced machine had a cost of P90,000 on April 1, 2017 and was sold for P73,000. On January 1, 2020, a machine that had cost of P40,000 on July 1, 2017 was retired from use and sold for scrap for P5,000. On January 1, 2020, a machine that had been acquired on January 1, 2017 for P70,000 was repaired because its motor had been damaged from overheating. The motor was replaced at a cost of P48,000. It was expected that this would increase the life of the machine by an extra two years. On April 1, 2020, Espresso Company fitted a new form of arm to a machine used for putting special designs onto garments. The arm cost P12,000. The machine had been acquired on April 1, 2017 for P100,000. The arm can be used on a number of other machines when required and has a 15-year life. It will not be sold when any particular machine is retired but retained for use on other machines. The reporting date is June 30. 20. The accumulated depreciation as of September 1, 2019, of the machine that was acquired on July 1, 2016 amounted to? 21. The gain or loss on the sale of the second replace machine in September 1, 2019 amounted to? 22. The new net depreciable cost of the machine whose motor was replaced on January 1, 2020 would be? 23. The new arm fitted to a machine on April 1, 2020 should be depreciated over how many years? 24. The depreciation expense on all the machines for the year ending June 30, 2020 would amount to?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate the accumulated depreciation as of September 1 2019 we need to determine the depreciation expense for the machine that was acquired on July 1 2016 from the date of acquisition to Septem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started