Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On September 1, 2022, Walloon purchased $100,000, 8% bonds at 102 plus accrued interest. The bonds mature on 1/1/25. Straight-line amortization is used. Annual

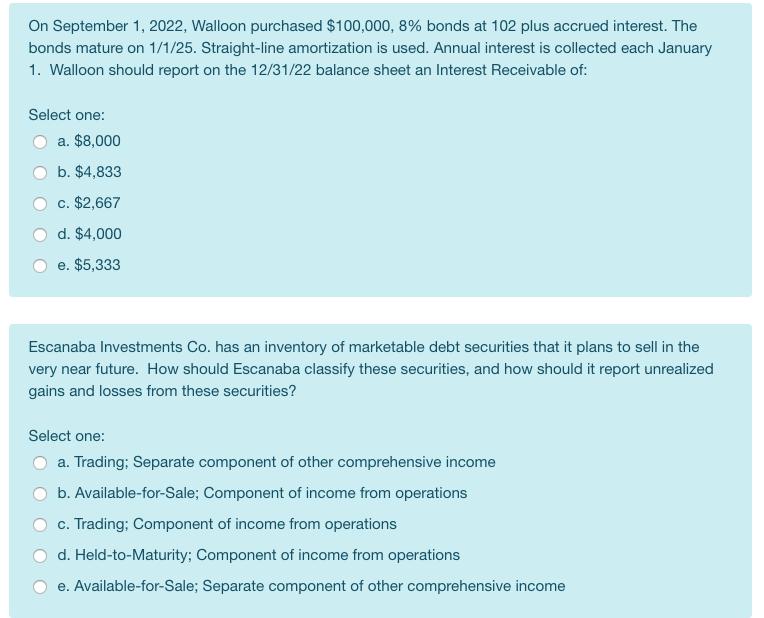

On September 1, 2022, Walloon purchased $100,000, 8% bonds at 102 plus accrued interest. The bonds mature on 1/1/25. Straight-line amortization is used. Annual interest is collected each January 1. Walloon should report on the 12/31/22 balance sheet an Interest Receivable of: Select one: a. $8,000 b. $4,833 c. $2,667 d. $4,000 e. $5,333 Escanaba Investments Co. has an inventory of marketable debt securities that it plans to sell in the very near future. How should Escanaba classify these securities, and how should it report unrealized gains and losses from these securities? Select one: a. Trading; Separate component of other comprehensive income b. Available-for-Sale; Component of income from operations c. Trading; Component of income from operations d. Held-to-Maturity; Component of income from operations e. Available-for-Sale; Separate component of other comprehensive income

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

ANS WER 8 000 WORK ING 100 000 8 2 4 000 4 000 3 12 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started