Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On September 1, 2021, Woodmark Inc. paid $1,200 for six months' rent in advance. The bookkeeper who recorded this transaction used rent expense. No other

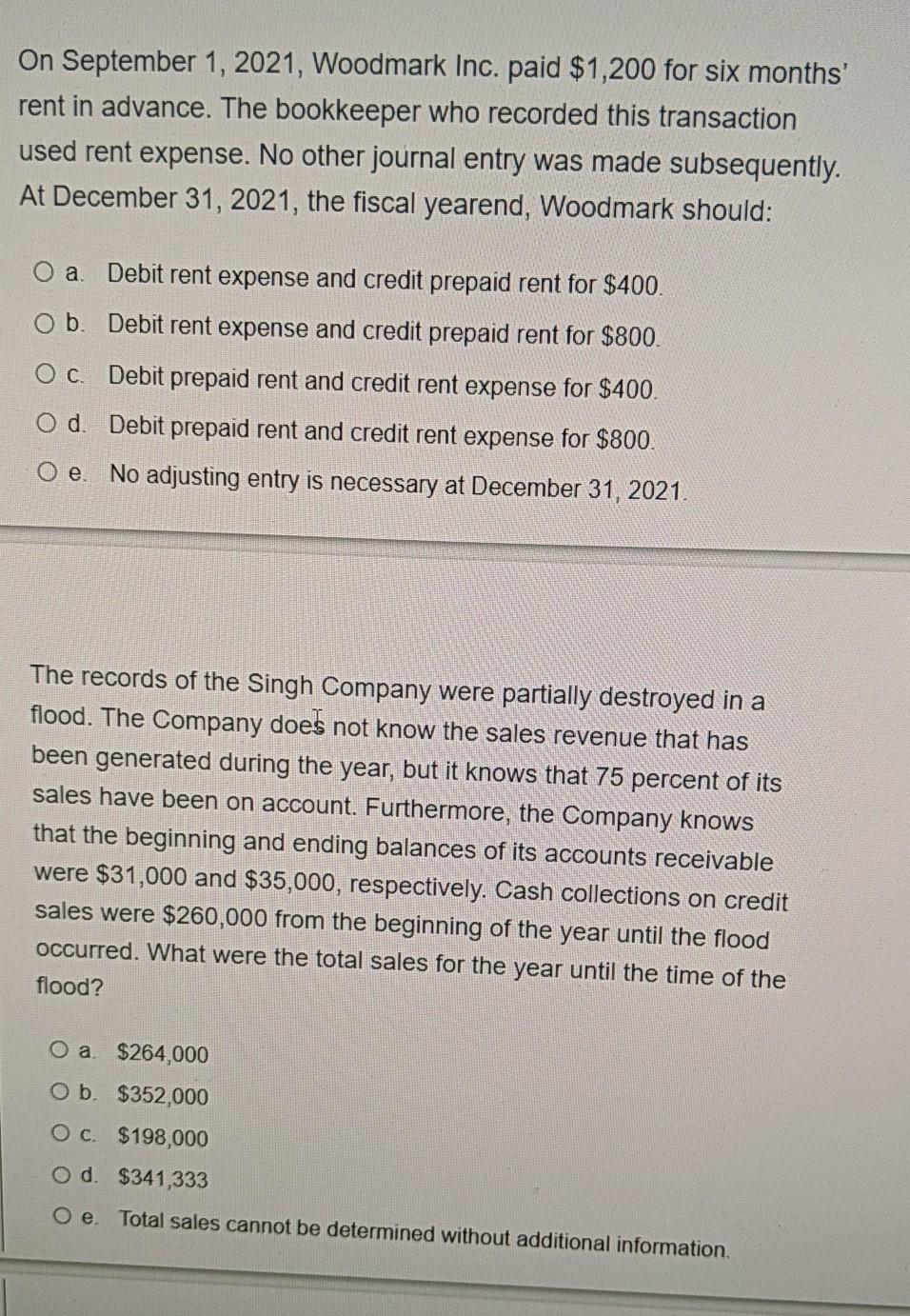

On September 1, 2021, Woodmark Inc. paid $1,200 for six months' rent in advance. The bookkeeper who recorded this transaction used rent expense. No other journal entry was made subsequently. At December 31, 2021, the fiscal yearend, Woodmark should: Oa Debit rent expense and credit prepaid rent for $400. O b. Debit rent expense and credit prepaid rent for $800. OC. Debit prepaid rent and credit rent expense for $400. od Debit prepaid rent and credit rent expense for $800 O e. No adjusting entry is necessary at December 31, 2021. The records of the Singh Company were partially destroyed in a flood. The Company does not know the sales revenue that has been generated during the year, but it knows that 75 percent of its sales have been on account. Furthermore, the Company knows that the beginning and ending balances of its accounts receivable were $31,000 and $35,000, respectively. Cash collections on credit sales were $260,000 from the beginning of the year until the flood occurred. What were the total sales for the year until the time of the flood? O a. $264,000 O b. $352,000 Oc. $198,000 O d. $341,333 O. Total sales cannot be determined without additional information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started