Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On September 1, 2022, Finley Corp. sold inventory in exchange for a 2-year non-interest-bearing note having a face value of $30,000. The present value

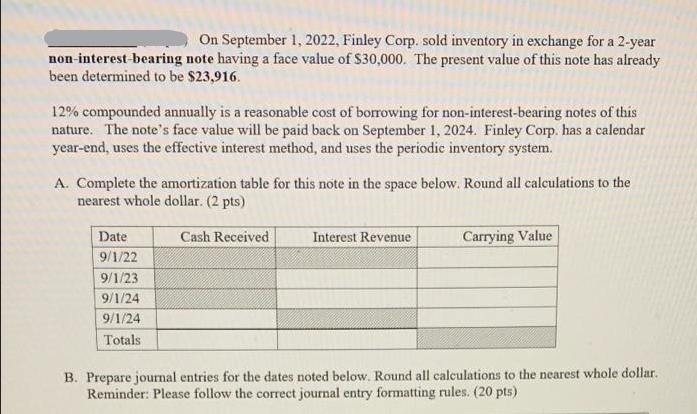

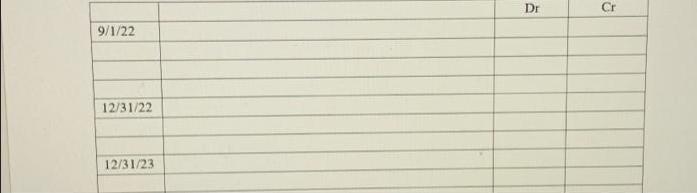

On September 1, 2022, Finley Corp. sold inventory in exchange for a 2-year non-interest-bearing note having a face value of $30,000. The present value of this note has already been determined to be $23,916. 12% compounded annually is a reasonable cost of borrowing for non-interest-bearing notes of this nature. The note's face value will be paid back on September 1, 2024. Finley Corp. has a calendar year-end, uses the effective interest method, and uses the periodic inventory system. A. Complete the amortization table for this note in the space below. Round all calculations to the nearest whole dollar. (2 pts) Cash Received Date 9/1/22 9/1/23 9/1/24 9/1/24 Totals Interest Revenue Carrying Value B. Prepare journal entries for the dates noted below. Round all calculations to the nearest whole dollar. Reminder: Please follow the correct journal entry formatting rules. (20 pts) 9/1/22 12/31/22 12/31/23 Dr Cr

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

A Amortization Table Date Cash Received Interest Revenue Car...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started