Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On September 1, Indigo Corporation had the following investments classified as held for trading purposes: $71,000,6% FMC Co, bond, purchased previously by indigo at

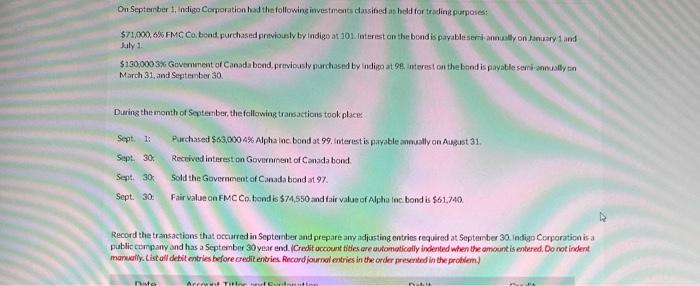

On September 1, Indigo Corporation had the following investments classified as held for trading purposes: $71,000,6% FMC Co, bond, purchased previously by indigo at 101. Interest on the bond is payable semi-annually on January 1 and July 13 $130,000 3% Government of Canada bond, previously purchased by indigo at 98. interest on the bond is payable semi-annually on March 31, and September 30. During the month of September, the following transactions took places Sept. 1: Sept. 30 Sept. 30 Sept. 30 Purchased $63,000 4% Alpha inc. bond at 99. Interest is payable annually on August 31. Received interest on Government of Canada bond. Data Sold the Government of Canada bond at 97. Fair value on FMC Co. bond is $74,550 and fair value of Alpha Inc. bond is $61,740. Record the transactions that occurred in September and prepare any adjusting entries required at September 30. indigo Corporation is a public company and has a September 30 year end. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries Record journal entries in the order presented in the problem) Account Ti natt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the journal entries for the transactions and adjusting entri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started